For those interested in the currency impact. Here's the reply from SAMY

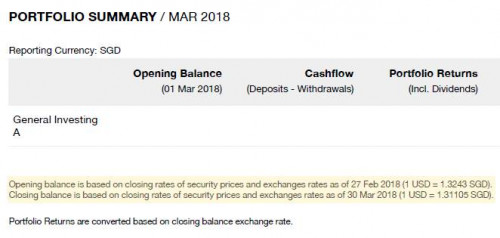

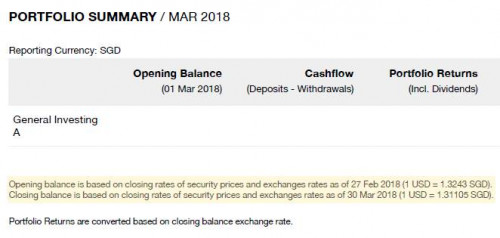

You can calculate your monthly currency impact, with details in the monthly statement. Under "Portfolio Summary", you can view the opening and closing exchange rates for USD/MYR, which can be used to calculate your currency impact.

In the example attached: (In your case MYR per USD)

Currency Impact = (1.31105 - 1.3243 SGD per USD) * (Total opening USD value of assets)

Please note that this calculation is only approximate, and may differ from the stated value if there were cash inflows (e.g. deposits, dividends) or outflows (e.g. withdrawals) over the month. Hope this helps!

Edit: not sure why SGD is used here. Anyway, here it is.

This post has been edited by neverfap: Jan 16 2020, 03:46 PM

Jan 16 2020, 10:55 AM

Jan 16 2020, 10:55 AM

Quote

Quote

0.3692sec

0.3692sec

1.09

1.09

7 queries

7 queries

GZIP Disabled

GZIP Disabled