Outline ·

[ Standard ] ·

Linear+

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

|

Jitty

|

Jan 27 2021, 01:42 PM Jan 27 2021, 01:42 PM

|

|

QUOTE(Silfer @ Jan 27 2021, 01:32 PM) What is mwr twr? I set auto rm50 monthly. Maybe will increase to 100 soon.  at the top of the portfolio (PCversion) or apps version (bottom left) got show you the MWR and TWR. https://www.stashaway.my/faq/900000952746-w...weighted-returnyou can learn what it means technical via the article above  |

|

|

|

|

|

Jitty

|

Jan 27 2021, 01:49 PM Jan 27 2021, 01:49 PM

|

|

QUOTE(Silfer @ Jan 27 2021, 01:46 PM) Oo.. my MWR stands at 33 while TWR stands at 31. Ok eh? What's yours? TWR = 48.40 % MWR = 60 %  |

|

|

|

|

|

Jitty

|

Jan 28 2021, 11:09 PM Jan 28 2021, 11:09 PM

|

|

QUOTE(xander83 @ Jan 28 2021, 10:46 PM) ARK will said that because they have been long terms holdersvbut I can foreseen that if Tesla fell below 800 which happening soon a lot of funds will cut their position and take profits If buying early before split then by all means keep because it’s like the same story like Apple between 2012 and 2014 when the boom is inconsistent any source or prediction from any expert tesla will fall soon? i know tesla right now RSI is overbought kao kao. and when tesla drop, I think the entire market will follow to crash down too |

|

|

|

|

|

Jitty

|

Feb 3 2021, 05:02 PM Feb 3 2021, 05:02 PM

|

|

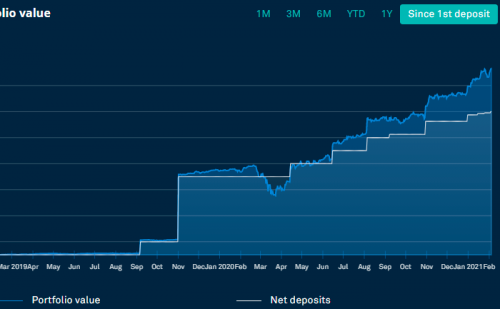

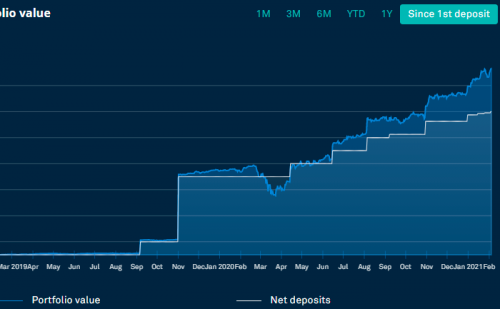

mine SAMY updated already.

Profit going back to previous high after stupid GME frenzy

|

|

|

|

|

|

Jitty

|

Feb 4 2021, 11:36 PM Feb 4 2021, 11:36 PM

|

|

QUOTE(stormseeker92 @ Feb 4 2021, 10:49 PM) GLD is dropping like it's hot yeah, and this will definitely affect us too.  next support at 1775. let see whether It break or not. |

|

|

|

|

|

Jitty

|

Feb 5 2021, 11:01 AM Feb 5 2021, 11:01 AM

|

|

QUOTE(GrumpyNooby @ Feb 5 2021, 07:26 AM) stormseeker92 Are you one of them? T20 withdraw savings via i-Sinar to invest in gold, stockshttps://www.theedgemarkets.com/article/t20-...est-gold-stocks i tot t20 cannot take isinar? i applied isinar, BPN, BSN, BPH or whatever. end up all fail and tidak lulus. i called them and ask why, they say I am T20. but I know I am not T20.      |

|

|

|

|

|

Jitty

|

Feb 5 2021, 11:06 AM Feb 5 2021, 11:06 AM

|

|

QUOTE(ali00 @ Feb 4 2021, 08:28 PM) 2 years with SA and I'm still jealous of everybody returns. ☹️ Equals to ASB but ASB safer 22% risk at 3.5% roi 36% risk at 5% roi can see see some screenshot? cant be that low. My MWR and TWR is Money-weighted return 59.47% Time-weighted return 48.48% I start investing to SAMY September 2019. About 1yr and 4 months ago  |

|

|

|

|

|

Jitty

|

Feb 6 2021, 02:37 PM Feb 6 2021, 02:37 PM

|

|

QUOTE(Xenopher @ Feb 5 2021, 12:32 PM) Either one or more of the below: 1. Panic withdraw during market dip 2. Fear of missing out and pump a lot more during market raise 3. Switch to lower risk index during market dip 4. Switch to higher risk index during market raise Easy method that works for almost everyone: Consistently 'stash away' a portion of active income and ignore for 10-30 years. agree with sifus here. DCA nia. no matter is Rm 10 per week or Rm 100 per week or Rm 1000 per week. sedikit sedikit, lama lama jadi bukit. |

|

|

|

|

|

Jitty

|

Feb 6 2021, 02:51 PM Feb 6 2021, 02:51 PM

|

|

QUOTE(JLean @ Feb 6 2021, 02:42 PM) Agree with your statement. DCA (Dollar cost averaging) is the way for long term investment even its 3/5/7/10 or more years. yeah. Time IN the market is more important than TIMING the market. |

|

|

|

|

|

Jitty

|

Feb 8 2021, 06:24 PM Feb 8 2021, 06:24 PM

|

|

QUOTE(Seth Ho @ Feb 6 2021, 11:21 PM)  My one not performing quite while compare to others, maybe due to risk lower i guess what is your risk level bro? |

|

|

|

|

|

Jitty

|

Feb 15 2021, 04:51 PM Feb 15 2021, 04:51 PM

|

|

QUOTE(naranjero @ Feb 15 2021, 04:09 PM) For any investor who would like to find out how other robo advisor world wide performing in order to have a better understanding what can we expect from robo-advisor, you could download the pdf report as below:- https://www.backendbenchmarking.com/the-robo-report/thanks for the helpful link bro  |

|

|

|

|

|

Jitty

|

Feb 15 2021, 06:06 PM Feb 15 2021, 06:06 PM

|

|

QUOTE(Noob Boy 1996 @ Feb 15 2021, 05:32 PM) How long does it takes for stashaway to deposit money in the app? I manual deposite rm100 11 days ago but still in process. Though it only takes about 3 to 5 days. general rule of thumb. usually 3-4 working days. impossible it tooks 11 days. does it deduct from your account already? |

|

|

|

|

|

Jitty

|

Feb 16 2021, 10:27 AM Feb 16 2021, 10:27 AM

|

|

QUOTE(Noob Boy 1996 @ Feb 16 2021, 01:40 AM) yes the money has been deducted from my bank account. I even received an email about they received my funds and will take 2-3 working days to invest...but stiill no money in the app. Will whatsapp them about it. Maybe because of CNY their progress are quite slow... maybe you can whatappps SAMY and ask for more info. this is the first time I heard such incident.  |

|

|

|

|

|

Jitty

|

Feb 17 2021, 12:56 PM Feb 17 2021, 12:56 PM

|

|

QUOTE(prophetjul @ Feb 16 2021, 10:43 AM) Question: Do you people invest monthly, quarterly or other frequency? DCA bro. Hardly anyone can time the market, unless you are pro and full time. time in the market > timing the market  |

|

|

|

|

|

Jitty

|

Feb 17 2021, 12:57 PM Feb 17 2021, 12:57 PM

|

|

QUOTE(prophetjul @ Feb 17 2021, 08:03 AM) KraneShares CSI China Internet ETF An ETF that invest heavily on China A stock A 股 mostly on the internet sector |

|

|

|

|

|

Jitty

|

Feb 19 2021, 10:04 AM Feb 19 2021, 10:04 AM

|

|

QUOTE(DragonReine @ Feb 19 2021, 08:51 AM) It's not bad considering its a platform that's targeted at Millenial retail investors with low capital and deals primarily in ETFs which are low cost and easy to buy with AI. A lot of their human resources seem to be concentrated in IT, marketing and customer service since it's mostly online-based, so theoretically speaking it's a lot cheaper to run than a standard mutual funds wealth management company. At only 150+ employees (based on owler site report) it's not very high number of people to pay. SAMY have 150 employees in Malaysia? that a lot.  |

|

|

|

|

|

Jitty

|

Feb 22 2021, 11:12 AM Feb 22 2021, 11:12 AM

|

|

for the past week, SAMY and global market consolidate.

|

|

|

|

|

|

Jitty

|

Feb 22 2021, 02:57 PM Feb 22 2021, 02:57 PM

|

|

QUOTE(zstan @ Feb 22 2021, 02:33 PM) woots welcome. gonna be red red this few weeks so hang on tight why this few weeks will red red ya ? |

|

|

|

|

|

Jitty

|

Feb 22 2021, 04:54 PM Feb 22 2021, 04:54 PM

|

|

QUOTE(zstan @ Feb 22 2021, 03:10 PM) US treasury bonds increasing as of late. oic, I tot it was due to recently BTC pump. all cash move from stock market to crypto market. |

|

|

|

|

|

Jitty

|

Feb 23 2021, 10:24 AM Feb 23 2021, 10:24 AM

|

|

market drop quite abit.

can DCA more now.

|

|

|

|

|

Jan 27 2021, 01:42 PM

Jan 27 2021, 01:42 PM

Quote

Quote

0.0483sec

0.0483sec

0.43

0.43

7 queries

7 queries

GZIP Disabled

GZIP Disabled