QUOTE(littlegamer @ Aug 11 2021, 11:52 AM)

I'm not going to complain for another 2009, I will be dead happy to dump in more, sp500 that is. in fact if I wanna complain, with kweb dropped over 50% , like u said all portfolio has kweb, aren't we already in a '' 2009'' but China style?

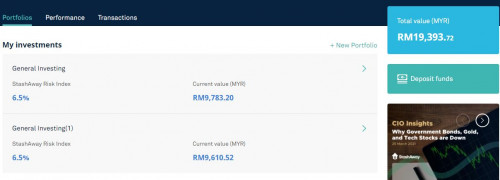

We are on the recover run, yet my returns are same as putting in FD or perhaps lowers.

I don't mind they want to re opt this that, whatever they buy this year, last year and even previous years, if they have just not do anything it will grow better than they buy sell buy sell now.

Happened to vgk, spem, gld, ijr and more. Look at the new xle as an example, if they set to buy beginning of the year, it will have decent growth.

As of all investment the power comes from compound, doing this just kills off the tail end of exponential returns.

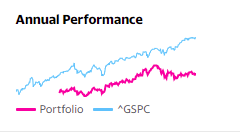

I know people is not going to agree with me, and will continue to lick off SA boots just to feel better. My Sp500 portfolio dosent lie

If being a Bogle heads get me better returns, glad to be one.

I also should stay away from this thread , starts to feel like a cult than proper discussion.

You can't blame SA for being a managed portfolio that is geared towards very conservative bias even at 36%. Think of SA like a volvo. One can't purchase a volvo and expect it to accelerate and speed like Porsche 911 Turbo S. SA is meant for a group of people like unker here (earliest SA investor) who got no time to DIY and want to KISS (just in case this unker passed away my family have easy way to claim my money).

SA is not meant for everyone. If you are young or want to max outcome, then go the Porche way i.e. DIY on ETF route (there is a thread in this sub forum - low fees, passive investing philosophy and max your returns). If I am much younger, I would do exactly that. Alternatively, go for Akrunow (the alternative roboadvisor that invests in S&P500 and if I am not wrong, no re-optimisation).

There are many types of portfolios;

(golden butterfly)

https://youtu.be/N4IYiTZcRNo(100% equity)

https://youtu.be/l64AguVOmZUAnd many more. Each portfolio are set up for different objectives. So what unker is saying is that when one invest make sure what one is investing is align to one's goal and portfolio.

Apr 17 2021, 11:05 AM

Apr 17 2021, 11:05 AM

Quote

Quote

0.0464sec

0.0464sec

0.58

0.58

7 queries

7 queries

GZIP Disabled

GZIP Disabled