Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

|

|

Nov 19 2020, 10:05 AM Nov 19 2020, 10:05 AM

Return to original view | Post

#21

|

Senior Member

4,139 posts Joined: May 2005 |

Wah lau all the technical talk here. Can sum up for layman ar?

|

|

|

|

|

|

Feb 6 2021, 10:48 PM Feb 6 2021, 10:48 PM

Return to original view | Post

#22

|

Senior Member

4,139 posts Joined: May 2005 |

QUOTE(littlegamer @ Feb 6 2021, 06:22 PM) Say I have 1 lumpsum I know for the next 5 years I confirm won't use it. https://ofdollarsanddata.com/dollar-cost-av...ng-vs-lump-sum/Should I just dump in all in once? If DCA, the amount the come in later in the DCA strategy seem to frogo the returns in the market. Dumping in 1 shot ensure the full amount of lumpsum get to stick in there market longest time Kinda begs the question should I DCA over 5 years or dump all and forget, come back to see after 5 years |

|

|

Feb 7 2021, 04:31 PM Feb 7 2021, 04:31 PM

Return to original view | Post

#23

|

Senior Member

4,139 posts Joined: May 2005 |

QUOTE(Pewufod @ Feb 7 2021, 04:16 PM) Funny he go and censor the value when we know how much it is from the bar |

|

|

Feb 12 2021, 12:09 PM Feb 12 2021, 12:09 PM

Return to original view | Post

#24

|

Senior Member

4,139 posts Joined: May 2005 |

|

|

|

Feb 23 2021, 03:40 PM Feb 23 2021, 03:40 PM

Return to original view | Post

#25

|

Senior Member

4,139 posts Joined: May 2005 |

|

|

|

Feb 25 2021, 01:33 PM Feb 25 2021, 01:33 PM

Return to original view | Post

#26

|

Senior Member

4,139 posts Joined: May 2005 |

QUOTE(DragonReine @ Feb 25 2021, 12:55 PM) Middle range about 12% to 22% SRI is the most "balanced" for the average person, who have some money able to invest and already have a solid savings and insurance plan Yeah that's why my 36% is bleeding red now and my 18% still positive. I just put 15k into each portfolio earlier this month.That's a reason why SAMY locks away risk indices higher than 22% unless you've got high savings and/or study the investing modules in SA. higher risk doesn't necessarily mean higher returns https://www.stashaway.my/r/debunking-high-risk-high-return DragonReine liked this post

|

|

|

|

|

|

Mar 24 2021, 08:07 AM Mar 24 2021, 08:07 AM

Return to original view | Post

#27

|

Senior Member

4,139 posts Joined: May 2005 |

|

|

|

Apr 3 2021, 09:45 PM Apr 3 2021, 09:45 PM

Return to original view | Post

#28

|

Senior Member

4,139 posts Joined: May 2005 |

SA is also my 2nd best investment. First is crypto. The gain is crazy and I cannot imagine any investment can even get near my gain.

|

|

|

Apr 8 2021, 09:15 PM Apr 8 2021, 09:15 PM

Return to original view | Post

#29

|

Senior Member

4,139 posts Joined: May 2005 |

QUOTE(magicang @ Apr 8 2021, 12:08 PM) That’s why I never bother to put into simple. Not as liquid as SSPN and interest way lower than SSPN. All my FD matured this year transfer to SSPN. Then I DCA weekly into SA. |

|

|

Apr 27 2021, 01:06 PM Apr 27 2021, 01:06 PM

Return to original view | Post

#30

|

Senior Member

4,139 posts Joined: May 2005 |

QUOTE(xander83 @ Apr 27 2021, 12:07 PM) Depends on the market value when the sell order is executed it might be higher or lower on the the day when the sell order is executed You talk so much for what? Show your numbers la!Like I said go check this week rate and you will know because you are investing small sum hence you are not exposed for conversion losses Yes this after deducting 1% in cash and the missing 0.5% is because forex conversion on the volatility of exchange rate If you check on your MYR and USD and you will realise the difference in the % of the performance which accounts for it as the range will be 0.12 to 0.5% on depending on the time horizon preducer liked this post

|

|

|

May 7 2021, 09:51 PM May 7 2021, 09:51 PM

Return to original view | Post

#31

|

Senior Member

4,139 posts Joined: May 2005 |

|

|

|

May 8 2021, 12:08 PM May 8 2021, 12:08 PM

Return to original view | Post

#32

|

Senior Member

4,139 posts Joined: May 2005 |

QUOTE(Kagekiyo @ May 8 2021, 11:36 AM) Checking in with you folks. I can guarantee it's because of KWEB. When you dump in 10k in Feb 2021 KWEB price is at the highest. And KWEB takes up 20% of your portfolio. That's why you're seeing negative right now. Keep dumping in RM1k per month and by year end you might see some difference. Background: - I started Stashaway with an initial capital investment of RM10k in Feb 2021 and every month, i allocate RM1k to be deposited into my investment portfolio. To date, i have deposited a total of RM13k as of May 2021 - My risk setting is set to the highest at 36% Question: - I noticed that over the past 4 months since my initial capital investment, i have never break even or seen any positive returns when evaluating my portfolio every month - Are any of you folks in the same boat as i am whereby in the past 6 months or so, you have noticed negative returns month on month? When comparing Stashaway's robo advisor performance against my Public Mutual's portfolio performance, i'm quite embaressed to say that my Public Mutual porfolio out performs it by quite a large margin month on month. BTW..... you just invested for 3 months..... StashAway is for long term. Keep DCA 1k per month and compare with your mutual fund again in another year time shall we? |

|

|

May 8 2021, 12:26 PM May 8 2021, 12:26 PM

Return to original view | Post

#33

|

Senior Member

4,139 posts Joined: May 2005 |

QUOTE(DragonReine @ May 8 2021, 12:19 PM) Basically these two things put together is giving you an underperforming portfolio right now. Nobody knows KWEB will tank in Feb. Me too, put in significant amount in Feb. But I DCA more frequently and aggressively during the tank, so it's not too bad now.36%SRI invests heavily in KWEB which was overvalued and at ATH (all time high) during February at easily 80+ USD per unit. Subsequently it has dropped down to a more logical amount of 72-ish per unit. that 10 usd reduction will impact your portfolio seriously at least for short term Gotta stick around for at least a year or two 😅😅 you entered at the wrong time really. |

|

|

|

|

|

May 10 2021, 06:12 PM May 10 2021, 06:12 PM

Return to original view | Post

#34

|

Senior Member

4,139 posts Joined: May 2005 |

QUOTE(mickeysew814 @ May 10 2021, 05:32 PM) Do it. I’m investing I-sinar to 36% SRI mickeysew814 liked this post

|

|

|

May 23 2021, 08:16 PM May 23 2021, 08:16 PM

Return to original view | Post

#35

|

Senior Member

4,139 posts Joined: May 2005 |

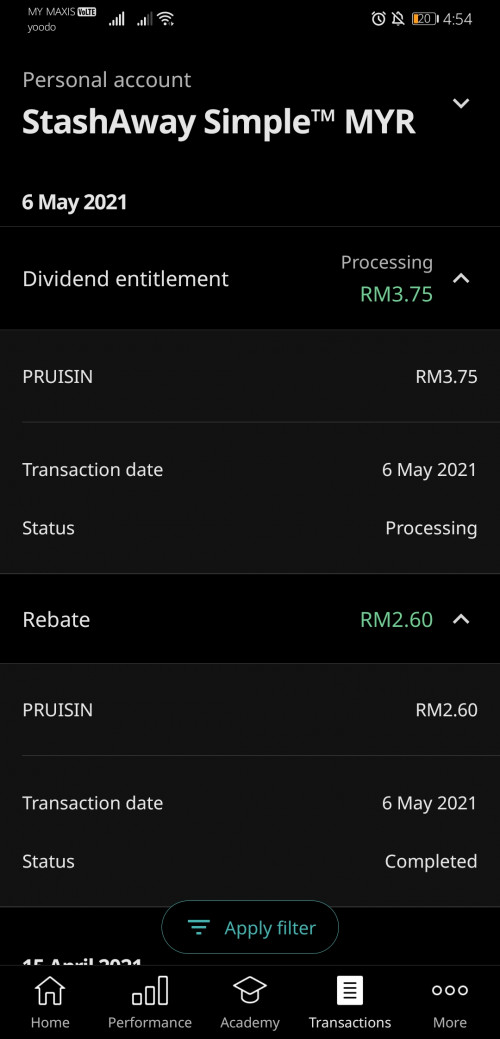

Hey guys, I'm on 36% SRI. Some of the invested ETF will give dividend right? Is there any way we can know when dividend will be declared and the percentage?

|

|

|

May 26 2021, 11:43 PM May 26 2021, 11:43 PM

Return to original view | Post

#36

|

Senior Member

4,139 posts Joined: May 2005 |

QUOTE(jonoave @ May 26 2021, 09:03 PM) how though? Shouldn't single account vs several accounts should have the same total return if the incoming funds and profit rates are identical? Obviously he is wrong.E.g. 1 account of RM10 k with RM100/month, vs 2 accounts of RM5k with RM50/month to both accounts Assuming the same profit rate, wouldn't the final returns be identical? wKkaY liked this post

|

|

|

May 29 2021, 09:54 AM May 29 2021, 09:54 AM

Return to original view | Post

#37

|

Senior Member

4,139 posts Joined: May 2005 |

What a waste of time calculating all those numbers just for a petty amount! yellowpika, tehoice, and 12 others liked this post

|

|

|

Jun 1 2021, 07:00 PM Jun 1 2021, 07:00 PM

Return to original view | Post

#38

|

Senior Member

4,139 posts Joined: May 2005 |

Is it just me? My StashAway portfolio numbers not updated for few days already since last week

|

|

|

Jun 18 2021, 11:34 AM Jun 18 2021, 11:34 AM

Return to original view | Post

#39

|

Senior Member

4,139 posts Joined: May 2005 |

QUOTE(Medufsaid @ Jun 18 2021, 09:42 AM) if you can actively manage your SA, switch into 6% SA during bear market and switch back to 36% during bull market Stupid adviceif you are young (means you can afford to keep for 10-20 years) and want to do it passively, you can pick a high ratio like 30%-36% as it'll go up in the long run Quazacolt, wongmunkeong, and 1 other liked this post

|

|

|

Jun 26 2021, 09:39 AM Jun 26 2021, 09:39 AM

Return to original view | Post

#40

|

Senior Member

4,139 posts Joined: May 2005 |

Thanks!!! That code saved me RM300++ of management fees

|

| Change to: |  0.0511sec 0.0511sec

0.51 0.51

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 25th November 2025 - 09:29 PM |

All Rights Reserved © 2002- 2025 Vijandren Ramadass (~unite against racism~)

Powered by Invision Power Board © 2025 IPS, Inc.

Quote

Quote