Warchest ready..... foresee there will be another round of drop in June.

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

|

|

May 31 2022, 07:49 PM May 31 2022, 07:49 PM

Return to original view | Post

#61

|

Senior Member

4,141 posts Joined: May 2005 |

Warchest ready..... foresee there will be another round of drop in June.

|

|

|

|

|

|

Jun 21 2022, 11:05 AM Jun 21 2022, 11:05 AM

Return to original view | Post

#62

|

Senior Member

4,141 posts Joined: May 2005 |

Flexible Portfolio also charge annual fee? What exactly did they contribute? I invest via Syfe Invest is free!

|

|

|

Jun 21 2022, 09:37 PM Jun 21 2022, 09:37 PM

Return to original view | IPv6 | Post

#63

|

Senior Member

4,141 posts Joined: May 2005 |

QUOTE(sgh @ Jun 21 2022, 04:54 PM) Sorry do you mean Syfe Trade? I thought there is only Syfe Wealth and Syfe Trade? Syfe Trade is your DIY ETF from the market directly whereas Syfe Wealth comes with some portfolios already pre-planned and Syfe Custom which is equivalent to SA Flexible Portfolio. Even with Syfe Trade it is free as in no annual fee but at the point of buy/sell transaction you pay fees isn't it? So far Syfe trade is 2 free trades each month after which is chargeable. So to DIY ETF best is Webull Spore 0 comm fees if you manage to open the account. Yeah Syfe Trade. One time charge to buy/sell is better than annual fee right? Especially for those who holding long term. Do you know if the 2 free trade each month is temp? |

|

|

Jul 1 2022, 10:30 PM Jul 1 2022, 10:30 PM

Return to original view | Post

#64

|

Senior Member

4,141 posts Joined: May 2005 |

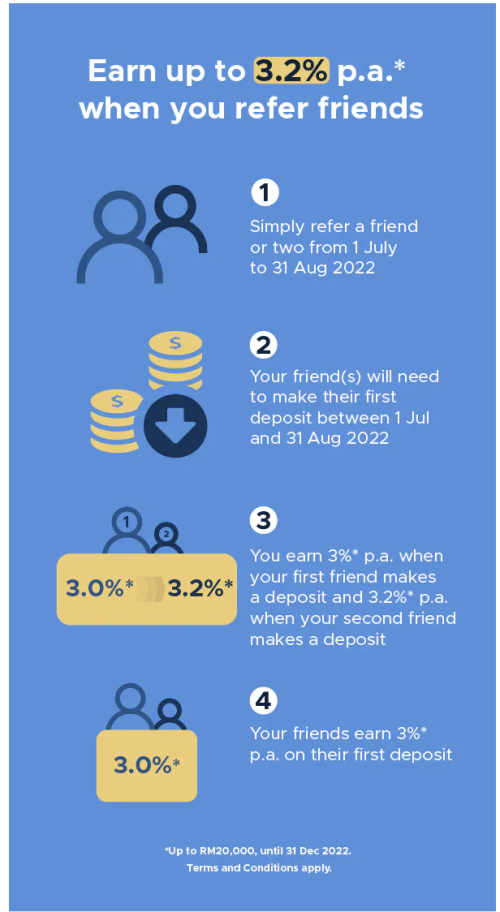

QUOTE(money_tree888 @ Jul 1 2022, 05:09 PM) just received this email from stashaway about a Simple promo. the rate is good. Hong Leong bank have that promo as well. 3%.anyone here not a stashaway user yet? this is so much better than my FD and savings account, no lock up also so nothing to lose  This one only 20k. Lame. |

|

|

Jul 2 2022, 10:10 AM Jul 2 2022, 10:10 AM

Return to original view | IPv6 | Post

#65

|

Senior Member

4,141 posts Joined: May 2005 |

QUOTE(bcombat @ Jul 1 2022, 11:40 PM) Hong Leong one is FD. Cannot withdraw prematurely. For me withdrawal is never a concern. I just want to maximise the return for my cash in hand during this volatile market. 20k limit is really a dealbreaker. Guess I’ll be going for FD or KDISA simple can withdraw anytime we want to without the concern that interest be forfeited |

|

|

Mar 22 2024, 01:19 PM Mar 22 2024, 01:19 PM

Return to original view | Post

#66

|

Senior Member

4,141 posts Joined: May 2005 |

This company should just close down for good. Majority of the investors already left. Cannot trust them anymore since the KWEB fiasco. Buy high sell low is their motto. Better learn to DIY and save from fees. This post has been edited by Barricade: Mar 22 2024, 02:02 PM imforumer, langstrasse, and 1 other liked this post

|

|

|

|

|

|

Mar 26 2024, 04:22 PM Mar 26 2024, 04:22 PM

Return to original view | Post

#67

|

Senior Member

4,141 posts Joined: May 2005 |

QUOTE(besiegetank @ Mar 25 2024, 08:37 PM) Despite their flaws in the past, my SA still gets around 7% annualized return (based on MYR) from past two years. Not sure if it is due to the current market uptrend in general and also I did conveniently disregard the bad record beyond the two years ago. If it can still consistently give me higher return compared to EPF then I will still stay put. 7% is pathetic for the past two years especially when SA invest in US market - considering S&P 500 went up so much. If you DCA into S&P 500 for the past two years definitely you'll get near to 20% TOS liked this post

|

|

|

Mar 28 2024, 01:49 PM Mar 28 2024, 01:49 PM

Return to original view | IPv6 | Post

#68

|

Senior Member

4,141 posts Joined: May 2005 |

QUOTE(Macam Yes @ Mar 28 2024, 09:15 AM) You all are newbie la. Those who are with SA from the beginning majority already left and DIY. Newbie don’t know and haven’t experience the fiasco behind SA yet. Even the co-founder of SA already left the company because of buy at highest and sell at lowest (KWEB)U think 20% is something to be proud of when market is up more than that? Any DIY investor easily get more than that, especially those invested in NVDA. |

|

|

Mar 28 2024, 03:32 PM Mar 28 2024, 03:32 PM

Return to original view | IPv6 | Post

#69

|

Senior Member

4,141 posts Joined: May 2005 |

QUOTE(Natsukashii @ Mar 28 2024, 03:21 PM) Please don't ask SA to close. Why you talk like only SA can buy fraction? Didn’t you know IBKR and plenty of other brokers can also buy fraction? Why pay SA maintenance fee for nothing?You must be rich. I'm happy for you. But not everyone can afford the way you invest. If you want to buy QQQ, you can buy right now it cost USD444, or Nvidia at 900USD (or few units at 250USD a year back) If me, or people who are less rich than you, we can only buy fractions, DCA little by little. That is the part where SA excels, I can invest into QQQ or SP500 with as low as RM20 or RM100 right now |

|

|

Mar 28 2024, 03:36 PM Mar 28 2024, 03:36 PM

Return to original view | IPv6 | Post

#70

|

Senior Member

4,141 posts Joined: May 2005 |

QUOTE(Macam Yes @ Mar 28 2024, 02:58 PM) Can you show your DIY? I think you try to act pro but earn lesser than robo. Is ok bro, u still can invest again Don’t triggered la newbie. See your name also know already, only appear recently. Browse back 2020 post and see how many of those investors still around. When bear comes or stock market crash don’t cry to your mama when lose money, SA won’t help you to mitigate that. Sell also need few days to execute, you can only see the market plummet without able to do anything |

|

|

Mar 28 2024, 03:41 PM Mar 28 2024, 03:41 PM

Return to original view | IPv6 | Post

#71

|

Senior Member

4,141 posts Joined: May 2005 |

QUOTE(Natsukashii @ Mar 28 2024, 03:37 PM) I didn't know IBKR can buy fraction Plenty of ways to fund, bottom line is we don’t want to pay SA maintenance fee for nothing. Why pay them maintenance fee if you’re customising buying QQQ or other shares.Anyway, even if can, I think I can't directly put in MYR via card/FPX, can I? Unlike SA, I just jompay. So it's more like convenience fee, than maintenance fee. Unless if I'm wrong, there is easy way to deposit/withdraw IBKR. Plenty of useful tutorial on YouTube like ziet invest. No convenience is worth that maintenance fee that SA charge you. This post has been edited by Barricade: Mar 28 2024, 03:48 PM TOS liked this post

|

|

|

Apr 1 2024, 02:29 PM Apr 1 2024, 02:29 PM

Return to original view | Post

#72

|

Senior Member

4,141 posts Joined: May 2005 |

QUOTE(dattebayo @ Apr 1 2024, 02:05 PM) today I checked SA balance it suddenly have over 8k of dividends from PRIMMAM? Whereas the fund size is just over 30k only It's either they are that low - joke about dividend on April fools day or they farked up on declaration of dividend which shouldn't be happening. Both is unacceptable.April fool joke or what? StashAway can't be that low rite |

| Change to: |  0.4883sec 0.4883sec

0.23 0.23

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 26th November 2025 - 03:11 AM |