QUOTE(47100 @ Apr 23 2021, 09:15 PM)

Like this, you mean?

never gotten call, but they sent me emails la

This post has been edited by DragonReine: Apr 23 2021, 09:22 PM

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

|

|

Apr 23 2021, 09:18 PM Apr 23 2021, 09:18 PM

Return to original view | Post

#201

|

Senior Member

2,610 posts Joined: Aug 2011 |

|

|

|

|

|

|

Apr 24 2021, 01:57 AM Apr 24 2021, 01:57 AM

Return to original view | IPv6 | Post

#202

|

Senior Member

2,610 posts Joined: Aug 2011 |

QUOTE(honsiong @ Apr 23 2021, 10:38 PM) With cheap brokers like Tiger and Moomoo, I am not sure if we even need StashAway anymore. You gonna exit StashAway and realise those sweet earnings? Doing Bogleheads' VTI + VXUS portfolios become affordable and feasible now. Of course those brokers probably cannot get back 30% dividend tax for bond ETFs lah, hence I never say 3 funds portfolio. I think it's less "do we need StashAway" and more "does StashAway meet our needs". The passive investor who rather put their trust in robo rather than studying the funds out there for themselves will still go for robo. StashAway is for the ultimate lazy who just wants to save and stash, and trusts SA's management of the portfolio |

|

|

Apr 24 2021, 01:59 AM Apr 24 2021, 01:59 AM

Return to original view | IPv6 | Post

#203

|

Senior Member

2,610 posts Joined: Aug 2011 |

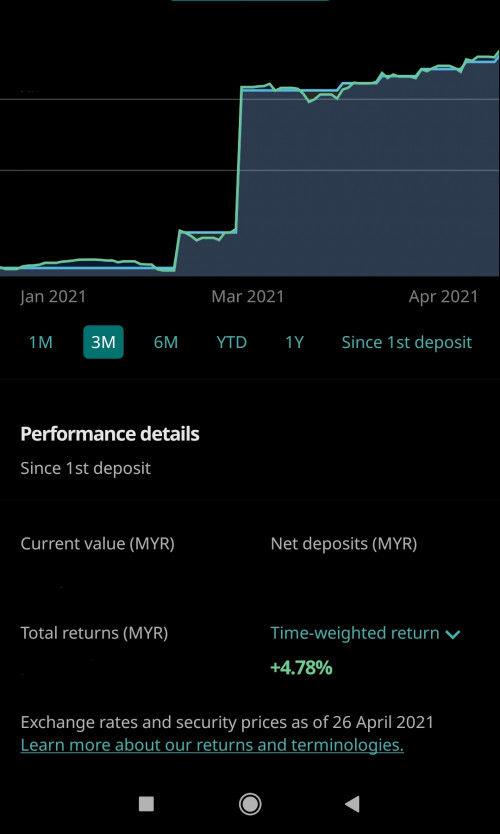

QUOTE(47100 @ Apr 23 2021, 09:22 PM) 🤔🤔 so far no, but my withdrawal is small, only a few Ks, and I didn't do a full withdrawal, only a bit to realise some of my earnings from KWEB ATH |

|

|

Apr 24 2021, 09:20 AM Apr 24 2021, 09:20 AM

Return to original view | IPv6 | Post

#204

|

Senior Member

2,610 posts Joined: Aug 2011 |

|

|

|

Apr 25 2021, 02:34 AM Apr 25 2021, 02:34 AM

Return to original view | IPv6 | Post

#205

|

Senior Member

2,610 posts Joined: Aug 2011 |

QUOTE(ChipZ @ Apr 25 2021, 12:43 AM) Depending on when you invested, most likely because MYR strengthened against USD from crash in March 2020 + bonds have been weakening because of US stimulus.This post has been edited by DragonReine: Apr 25 2021, 02:35 AM |

|

|

Apr 25 2021, 11:44 AM Apr 25 2021, 11:44 AM

Return to original view | IPv6 | Post

#206

|

Senior Member

2,610 posts Joined: Aug 2011 |

QUOTE(JeffreyYap @ Apr 25 2021, 10:08 AM) The current value showing in portfolio is reflecting forex loss/gain too(My SA is in USD)? Other than capital loss/gain. There will always be forex risk because we're investing/withdrawing in MYR, but the ETFs themselves are trading in USD (or GBP for those with domestic ringgit borrowing). So depending on our currency's strength, it can either be to our advantage or disadvantage. |

|

|

|

|

|

Apr 25 2021, 11:53 AM Apr 25 2021, 11:53 AM

Return to original view | IPv6 | Post

#207

|

Senior Member

2,610 posts Joined: Aug 2011 |

QUOTE(X_hunter @ Apr 25 2021, 11:10 AM) Just a thought, how come stock/investment account cannot have nominee? Like EPF and ASNB got nominee, but all these investment accounts don’t have. Just curious. The short of it is that it's incredibly complicated and expensive to setup nominees for death. EPF and ASNB because they're government managed and meant to be "safe" investments for rakyat where dividends and gains are mostly guaranteed, so they're functionally more like savings, which means there's always money.For investing if you wish to pass the accounts to your heirs after death, you'll need a will so your executor/ administrator will have to produce a grant of probate or letters of administration to the investing fund house before the account can be liquidated to a designated account as instructed to your nominees. |

|

|

Apr 25 2021, 11:54 AM Apr 25 2021, 11:54 AM

Return to original view | IPv6 | Post

#208

|

Senior Member

2,610 posts Joined: Aug 2011 |

QUOTE(yklooi @ Apr 25 2021, 11:45 AM) Direct or Nominee CDS Account? post meant "nominee" as in those who inherit/benefit after death beginner, Stock investment https://malaysiayounginvestor.blogspot.com/...cdsaccount.html |

|

|

Apr 25 2021, 02:00 PM Apr 25 2021, 02:00 PM

Return to original view | IPv6 | Post

#209

|

Senior Member

2,610 posts Joined: Aug 2011 |

QUOTE(ChipZ @ Apr 25 2021, 12:21 PM) I remember during the first 2 months I was making some gain. Then I tried not to monitor it (trusting whoever managing it). For StashAway you should be investing for at least 3 years, it's not designed for short term gains.Should I stay put and be hopeful it will go up in the long term? |

|

|

Apr 26 2021, 08:13 AM Apr 26 2021, 08:13 AM

Return to original view | IPv6 | Post

#210

|

Senior Member

2,610 posts Joined: Aug 2011 |

Looks like StashAway has more investment funding:

https://techcrunch.com/2021/04/25/robo-advi...-capital-india/ |

|

|

Apr 27 2021, 10:32 AM Apr 27 2021, 10:32 AM

Return to original view | IPv6 | Post

#211

|

Senior Member

2,610 posts Joined: Aug 2011 |

QUOTE(xander83 @ Apr 27 2021, 02:54 AM) Spot rate minus -0.1% is correct but however buy order purchase in USD and convert back to MYR you will notice the missing 0.3% to 0.5% You do realise that some of the money goes to portfolios' cash allocation, right? A very good example if this week someone deposit rm411 they will only get usd99.28 to purchase the ETF this week All the portfolios have 1% held in cash. That's why buy order amount is always less than the amount converted. That might account for the missing amount that isn't used to buy ETF units in your calculations, on top of MYR's volatility in forex rate. This post has been edited by DragonReine: Apr 27 2021, 10:41 AM |

|

|

Apr 27 2021, 03:19 PM Apr 27 2021, 03:19 PM

Return to original view | IPv6 | Post

#212

|

Senior Member

2,610 posts Joined: Aug 2011 |

Actually

|

|

|

Apr 27 2021, 05:56 PM Apr 27 2021, 05:56 PM

Return to original view | IPv6 | Post

#213

|

Senior Member

2,610 posts Joined: Aug 2011 |

QUOTE(X_hunter @ Apr 27 2021, 05:40 PM) I just started joining SA, and my money finally just appeared in my SA account. I transferred 1k, and now it’s showing Rm998.94. Means the Rm1.06 is for? There's forex exchange fee when SA convert to USD, and forex fluctuations, and units themselves fluctuates in price.SA isn't guaranteed nett positive gains unless you wait at least 3 to 4 years. Even then if market kaput you might dip below your nett deposit amount anyway, as it happened during 2018 trade war crash and March 2020 pandemic crash. This post has been edited by DragonReine: Apr 27 2021, 06:03 PM |

|

|

|

|

|

Apr 27 2021, 06:53 PM Apr 27 2021, 06:53 PM

Return to original view | IPv6 | Post

#214

|

Senior Member

2,610 posts Joined: Aug 2011 |

QUOTE(christ14 @ Apr 27 2021, 06:32 PM) man took some time to reflect in the SA account but out of nowhere drop lol Takes time la, and market conditions.i guess need to be in there for 1 yearr to see any actual gain See here one of my newer portfolios bouncing up and down the first 3 months of this year 🤣 For higher SRIs especially need to get used to seeing the green line do rollercoaster haha  Gains are never guaranteed. SA's main strength if anything is that you are simply not likely to lose very much. For investments like these, none of us can see the future. This post has been edited by DragonReine: Apr 27 2021, 06:56 PM |

|

|

Apr 28 2021, 07:57 AM Apr 28 2021, 07:57 AM

Return to original view | IPv6 | Post

#215

|

Senior Member

2,610 posts Joined: Aug 2011 |

QUOTE(tiramisu83 @ Apr 28 2021, 12:54 AM) just curious..do you guys feel the return from SA (36%) is consider low compare to Wahed or other platform? my return is like only 5% out of my total deposit (since 2020 Jul). I did DCA quite frequent. There are people here who invested long enough to get 74%+ money weighted return honsiong liked this post

|

|

|

Apr 30 2021, 01:34 PM Apr 30 2021, 01:34 PM

Return to original view | IPv6 | Post

#216

|

Senior Member

2,610 posts Joined: Aug 2011 |

KingArthurVI, SwarmTroll, and 4 others liked this post

|

|

|

Apr 30 2021, 03:02 PM Apr 30 2021, 03:02 PM

Return to original view | IPv6 | Post

#217

|

Senior Member

2,610 posts Joined: Aug 2011 |

QUOTE(thecurious @ Apr 30 2021, 01:43 PM) Basically explanation of proof why SAMY decided it was good idea to implement the 20% gold ETF into all portfolios, and showed how especially for portfolios heavily weighted with KWEB, gold allocation managed to reduce the impact of KWEB volatility. KingArthurVI and thecurious liked this post

|

|

|

Apr 30 2021, 03:15 PM Apr 30 2021, 03:15 PM

Return to original view | IPv6 | Post

#218

|

Senior Member

2,610 posts Joined: Aug 2011 |

QUOTE(necrox77 @ Apr 30 2021, 02:13 PM) Hi all, I just want to get your guys opinion about if me, and I'm less than 35 years old, I'll take 20k ASB and 5k SAMYwhich investment I should withdraw for my marriage expenses. Currently I have 57k in Asb (no loans) and around 24k in stash away portfolio. My original plan is to use stashaway portfolio, or better use ASB due to lower return ? I need around 25k maybe. Thank you in advance. if more than 35, 10k ASB and 15k SAMY one extra factor: Am I on ASB financing and I'm relying on dividends from ASB to service the financing? Then I won't take more than the minimum to allow ASB dividends to cover the financing instalment This post has been edited by DragonReine: Apr 30 2021, 03:17 PM |

|

|

Apr 30 2021, 04:58 PM Apr 30 2021, 04:58 PM

Return to original view | IPv6 | Post

#219

|

Senior Member

2,610 posts Joined: Aug 2011 |

QUOTE(lee82gx @ Apr 30 2021, 04:07 PM) Thanks for showing this.It proves what I was blabbering on about bond and low risk portfolio mixes. But I bet you there will still be folks diworseifying with low risk funds after seeing this chart. Many think it's low meaning its cheap. Well it's cheap for a reason. IMO the low SRI of less than 10% SRI are somewhat pointless in Malaysian context because of two main things:In the short term its hard to see the bond heavy portfolio getting any better but I will not bet against a bear market appearing at any time, and it will, and there will little warning of this. Its only really up to the investor to choose his poison and drink it. I'm always bullish and there is always a bull market somewhere. As long as my epf and other FI instruments stay steady (sspn, mmf) I see no reason to tilt towards debt investing. 1) Malaysians already have access to low risk passive investment instruments locally (EPF, SSPN, ASB/ASM) 2) Malaysia having a weak and unstable currency. In SASG probably different because low interest rate environment there and a stable currency. But unless EPF ASNB SSPN all fail sekali, no reason to invest in those low SRIs unless you REALLY dislike giving money to government-controlled investment fund houses Gwynbleidd and Takudan liked this post

|

|

|

Apr 30 2021, 06:06 PM Apr 30 2021, 06:06 PM

Return to original view | IPv6 | Post

#220

|

Senior Member

2,610 posts Joined: Aug 2011 |

|

| Change to: |  0.0418sec 0.0418sec

0.61 0.61

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 1st December 2025 - 12:35 PM |