QUOTE(shawnme @ Apr 19 2021, 01:20 PM)

I see. Thank you.

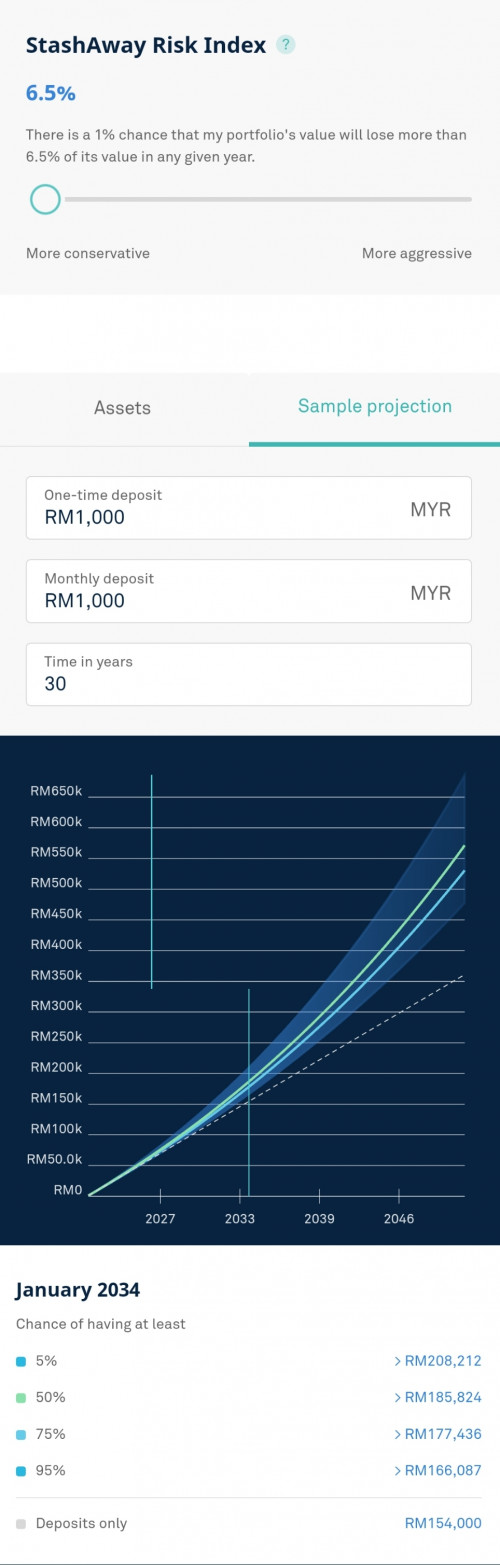

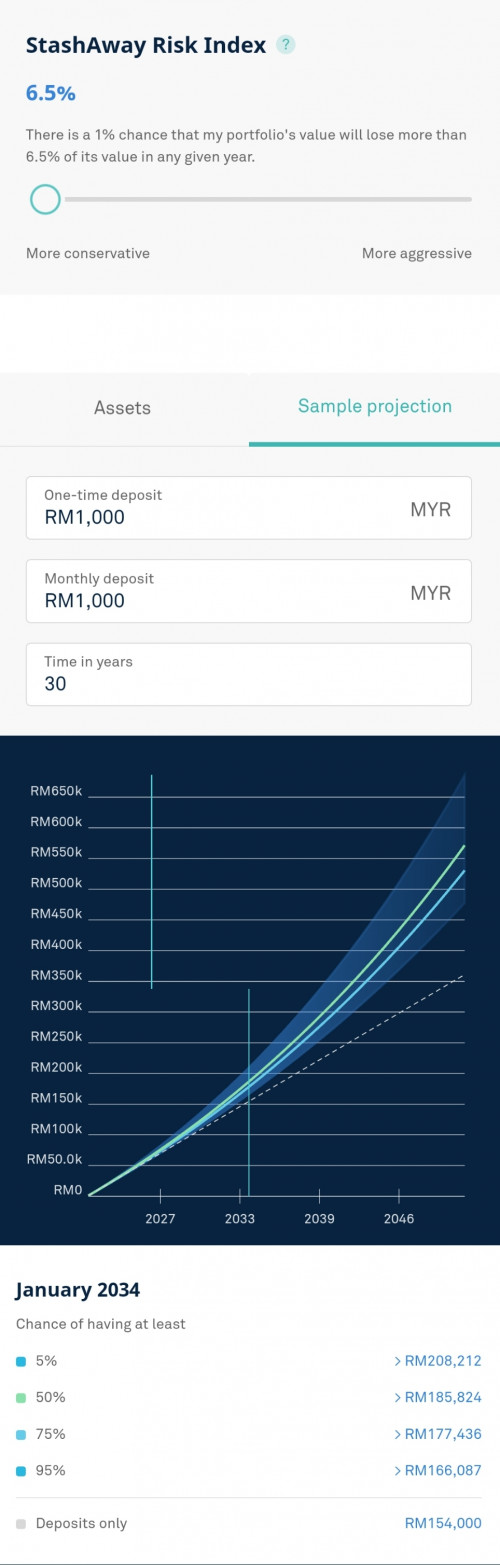

However, despite entering the lowest SRI, it's still showing 5 years of loss prior to any gains. As shown below.

Is the whole Stashaway investment considered as high risk in general? I understand that it's higher risk compared to MMF etc, but despite sliding from 6.5% - 36%, it still projects roughly 5 years of loss.

I understand these are projections, but would like to understand what or why.

To understand what SRI and projected gains means.

SRI: Refers to the Value-At-Risk (https://www.investopedia.com/articles/04/092904.asp). The number you see is a benchmark of how low a given portfolio can dip in value. Example: an SRI of 36% means that there is a 1% chance during any year year where the value can drop to lose more than 36% unrealised loss. 99% of the time, however, it would stay above -36% of the amount invested.

Projected gains:

I'll use the numbers you gave in the above slider chart:

At RM1k initial deposit, if I continue to deposit RM1k monthly, and I keep depositing that amount for 30 years non-stop without changing amount:

I have 95% chance of having more than RM166,087.00 in investment for that portfolio

I have 75% chance of having more than RM177,436.00

I have 50% chance of having more than RM185,834.00

I have 5% chance of having more than RM208,212.00

that's how the projection calculate.

For what you call the "losses" for first few years, it's to account for the volatility of the underlying portfolio. Usually first few years the volatility means that gains can be very minimal unless you get lucky and deposit right before a bull run in the market. It takes time for assets to gain value + for dividends to accrue properly.

Apr 15 2021, 03:15 PM

Apr 15 2021, 03:15 PM

Quote

Quote

0.4541sec

0.4541sec

0.66

0.66

7 queries

7 queries

GZIP Disabled

GZIP Disabled