QUOTE(gooroojee @ Jan 29 2023, 11:48 PM)

Thanks u r right, failed at 40k but 30k accepted. Instead of issuing msg amount too big it hanged/spinning at the FPX page.EPF - self contribution, need advise

EPF - self contribution, need advise

|

|

Jan 29 2023, 11:59 PM Jan 29 2023, 11:59 PM

Return to original view | Post

#21

|

All Stars

18,446 posts Joined: Oct 2010 |

QUOTE(gooroojee @ Jan 29 2023, 11:48 PM) Thanks u r right, failed at 40k but 30k accepted. Instead of issuing msg amount too big it hanged/spinning at the FPX page. gooroojee liked this post

|

|

|

|

|

|

Jan 30 2023, 09:07 AM Jan 30 2023, 09:07 AM

Return to original view | Post

#22

|

All Stars

18,446 posts Joined: Oct 2010 |

QUOTE(MGM @ Jan 29 2023, 11:59 PM) Thanks u r right, failed at 40k but 30k accepted. Instead of issuing msg amount too big it hanged/spinning at the FPX page. QUOTE(FinalHistory @ Jan 30 2023, 01:19 AM) How do you find out that it hanged/spinning at the FPX page? I self contributed RM 20k on Friday and until today still not inside my EPF account. Those I use FPX at IAkaun on 27(Fri), 28(Sat) have been credited n shown in balance and trans history. But the one via M2U on 27(Fri) is still nowhere in sight. |

|

|

Feb 14 2023, 09:40 AM Feb 14 2023, 09:40 AM

Return to original view | IPv6 | Post

#23

|

All Stars

18,446 posts Joined: Oct 2010 |

QUOTE(ronnie @ Feb 14 2023, 09:01 AM) Answer from KWSP enquiry:- So after resignation n while not employed can go for isaraan (if available)? Please be informed that a salaried employee who receives a monthly/mandatory contribution from their employer is not eligible to receive the government incentives under the i-Saraan scheme. Additionally, please be advised that the government incentives for the i-Saraan scheme contributions have been postponed until further notice and will be confirmed once the Budget 2023 has been finalized. If you wish to voluntarily contribute to your EPF account, you may opt to make your own voluntary payment under self-contribution scheme at any time until the age of 75 with any minimum amount but not more than RM60,000.00 in a year. |

|

|

Feb 23 2023, 08:16 PM Feb 23 2023, 08:16 PM

Return to original view | Post

#24

|

All Stars

18,446 posts Joined: Oct 2010 |

QUOTE(CommodoreAmiga @ Feb 23 2023, 07:39 PM) Today top up max...let see which date it masuk later. App says 3 working days. Now i have 4 working days till 28th Feb. Should be credited tomorrow Friday, reflected by Saturday. beLIEve liked this post

|

|

|

Mar 11 2023, 10:56 AM Mar 11 2023, 10:56 AM

Return to original view | Post

#25

|

All Stars

18,446 posts Joined: Oct 2010 |

QUOTE(Danhost @ Mar 11 2023, 10:02 AM) If you hv cimb Malaysia, you can open cimb singapore online ! Just sit at home to do it. But upfront you would need $ 1000 SGD deposit to your Sing account. So can open an CIMB SG account via cimbclick with 0 balance first. How to deposit the SGD1000 upfront, convert MYR-to-SGD via cimbclick too? |

|

|

Mar 19 2023, 07:30 PM Mar 19 2023, 07:30 PM

Return to original view | Post

#26

|

All Stars

18,446 posts Joined: Oct 2010 |

|

|

|

|

|

|

Mar 20 2023, 03:21 AM Mar 20 2023, 03:21 AM

Return to original view | Post

#27

|

All Stars

18,446 posts Joined: Oct 2010 |

Rm250 i-saraan credited on 3Feb2023.

|

|

|

Mar 20 2023, 06:18 PM Mar 20 2023, 06:18 PM

Return to original view | Post

#28

|

All Stars

18,446 posts Joined: Oct 2010 |

wongmunkeong, CommodoreAmiga, and 1 other liked this post

|

|

|

Mar 20 2023, 08:23 PM Mar 20 2023, 08:23 PM

Return to original view | Post

#29

|

All Stars

18,446 posts Joined: Oct 2010 |

|

|

|

Apr 11 2023, 08:44 AM Apr 11 2023, 08:44 AM

Return to original view | IPv6 | Post

#30

|

All Stars

18,446 posts Joined: Oct 2010 |

This increase of self contribution to 100k is for this year only?

|

|

|

Apr 11 2023, 09:08 AM Apr 11 2023, 09:08 AM

Return to original view | Post

#31

|

All Stars

18,446 posts Joined: Oct 2010 |

QUOTE(nexona88 @ Apr 11 2023, 08:56 AM) Should be permanent type For the time being probably the easiest n best place to park money n giving a consistent 5 to 6% returns. Now MY EPF > ASMx. Will stop once ratio is 2:1.Where can simply change to 100k then back to 60k Also DSAI or EPF CEO previously didn't mention only for 1 year @ 2023.... Unlike the i-saraa/i-suri thingy |

|

|

Apr 11 2023, 05:04 PM Apr 11 2023, 05:04 PM

Return to original view | Post

#32

|

All Stars

18,446 posts Joined: Oct 2010 |

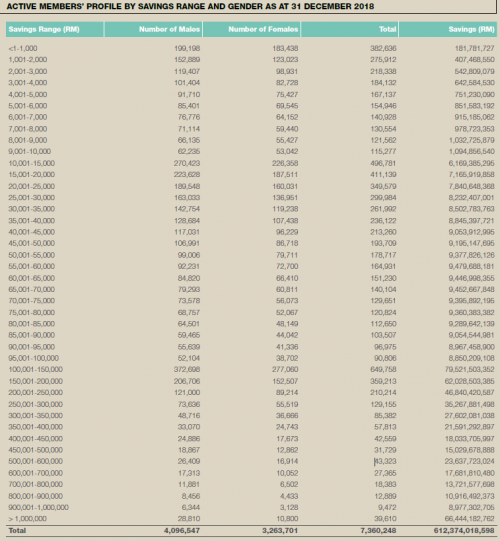

QUOTE(cute_boboi @ Apr 11 2023, 04:40 PM)  Dec 2018 there are 39k individuals >1M with a total of RM66B+  Dec 2020 increase to 68k individuals >1M (total up last two rows) with a total of RM116B By Dec 2022, projected 2 years growth at nearly double the individuals and double the amount. Dec 2020 assume 68k individuals withdraw everything >1M and leaving a base of 1M = 116 - 68 = Outflow of 48B Assume Dec 2022 projected double = 2x 48B = 96 billion withdrawal, it won't be insignificant if tiered dividend happens. Even more than the total i-series ? |

|

|

Apr 12 2023, 06:06 PM Apr 12 2023, 06:06 PM

Return to original view | Post

#33

|

All Stars

18,446 posts Joined: Oct 2010 |

QUOTE(nexona88 @ Apr 12 2023, 05:24 PM) Hehehe I think the 1st couple of years when self contribution started there was no limit.I think EPF knows got this kind of people That's why limit 60k previously... Now increase to 100k People abuse / make it as CASA 😁. Like some in ASB funds ongth60 liked this post

|

|

|

|

|

|

Apr 23 2023, 01:15 PM Apr 23 2023, 01:15 PM

Return to original view | Post

#34

|

All Stars

18,446 posts Joined: Oct 2010 |

QUOTE(batman1172 @ Apr 23 2023, 12:56 PM) U can withdraw any amount per year. But can only put in 60k (100k new quota) per year as self-contribution unlike bank where u can deposit any amount. sg8989 liked this post

|

|

|

Apr 26 2023, 01:06 AM Apr 26 2023, 01:06 AM

Return to original view | Post

#35

|

All Stars

18,446 posts Joined: Oct 2010 |

|

|

|

Apr 26 2023, 08:42 AM Apr 26 2023, 08:42 AM

Return to original view | Post

#36

|

All Stars

18,446 posts Joined: Oct 2010 |

QUOTE(strawsticks @ Apr 26 2023, 08:40 AM) Let's say April, which has 30 days. I self contributed rm10k on 1st April but this money isn't earning me any additional EPF dividend since i only need to make sure i have that rm10k on 29th April. Meaning from 1st to 29th April, I could have put that money in TNG Go+ or stashaway simple to earn some additional interest right? Yes. Use Epf i-Akaun for deposit, eventhough my such deposits were credited the next day(even on weekend), safer to do it on 27/28th instead of 29th which is Saturday, and Monday 1May is a holiday.This post has been edited by MGM: Apr 26 2023, 08:49 AM |

|

|

Apr 28 2023, 11:44 AM Apr 28 2023, 11:44 AM

Return to original view | Post

#37

|

All Stars

18,446 posts Joined: Oct 2010 |

QUOTE(nexona88 @ Apr 28 2023, 10:41 AM) Sometimes it's delayed.... So u kinda taking risk... Since they also mentioned maximum 3 days to reflect in your account 🙏 QUOTE(ronnie @ Apr 28 2023, 10:46 AM) So far what i have tested with iAkaun, it always posted next day whether deposited on weekday or weekend. |

|

|

Apr 28 2023, 04:59 PM Apr 28 2023, 04:59 PM

Return to original view | Post

#38

|

All Stars

18,446 posts Joined: Oct 2010 |

|

|

|

Apr 28 2023, 06:05 PM Apr 28 2023, 06:05 PM

Return to original view | Post

#39

|

All Stars

18,446 posts Joined: Oct 2010 |

QUOTE(nexona88 @ Apr 28 2023, 05:52 PM) yes. Ya, i know that to be safe it should be posted few days b4 last day.something like that... that's why to be safe... always deposit at least 3 to 5 days before end of the month But last day is still last day of the month like 30April, 31May etc, not 1 day b4. |

|

|

Apr 30 2023, 07:14 AM Apr 30 2023, 07:14 AM

Return to original view | IPv6 | Post

#40

|

All Stars

18,446 posts Joined: Oct 2010 |

QUOTE(nxtpg @ Apr 29 2023, 10:13 PM) got some 400k.available from hse loan account.. interest is 3.97% pa If u can withdraw from epf at anytime n it gives better than the mortgage rate, why not? When it is no longer so can always put them back. 1% diff is like 4k gains.bettter to withdraw and dump into epf and asm? nxtpg liked this post

|

| Change to: |  0.0932sec 0.0932sec

0.77 0.77

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 13th December 2025 - 12:59 PM |