Outline ·

[ Standard ] ·

Linear+

EPF - self contribution, need advise

|

MGM

|

Jul 18 2025, 09:46 AM Jul 18 2025, 09:46 AM

|

|

QUOTE(dwRK @ Jul 18 2025, 09:34 AM) if wanna open broker account overseas... suggest joint account with your kids, this way one less worry about fund access, estate taxes, etc... Didnt know that, thanks. Once major factor that I am holding back on oversea investment is estate planning. Where to get more info on this? |

|

|

|

|

|

MGM

|

Oct 28 2025, 05:55 PM Oct 28 2025, 05:55 PM

|

|

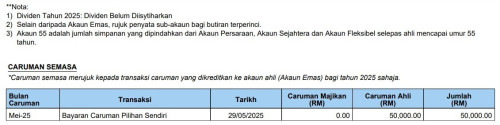

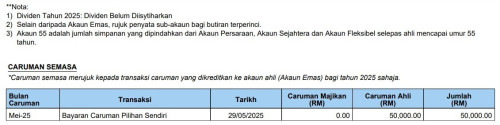

QUOTE(nexona88 @ Oct 28 2025, 12:12 PM) You need to download the statement... Then you can see the real thing.... I meant the i-saraan contribution listed... So far, only those deposit in January & February already gotten their $$$.... March to rest of the year is anyone guess... Normally January to June contribution would be getting their $$$ same time.... But this year it's little different.... U mean under TRANSAKSI description must be "i-SARAAN" not "Bayaran Caruman Pilihan Sendiri"?  This post has been edited by MGM: Oct 28 2025, 05:59 PM This post has been edited by MGM: Oct 28 2025, 05:59 PM |

|

|

|

|

|

MGM

|

Oct 30 2025, 04:05 PM Oct 30 2025, 04:05 PM

|

|

QUOTE(nexona88 @ Oct 28 2025, 07:51 PM) Something like this below (this one is old i-akaun, but the description is written like that)... New i-akaun also need to have like the wording in the transaction statement....  What is the sure way to pay epf n get i-saraan? |

|

|

|

|

|

MGM

|

Oct 30 2025, 05:34 PM Oct 30 2025, 05:34 PM

|

|

QUOTE(nexona88 @ Oct 30 2025, 05:28 PM) First thing first... Need to make sure you qualify first... All in website for details.... To get "i-saraan" in your deposit details.... We need to use the banking apps / website method.... Where can pick i-saraan category.... Using i-akaun kwsp method cannot pick.... Ohh before I forget.... Your profile page in i-akaun kwsp also need to write "i-saraan".... Profile stated i-saraan, previously use KWSP iAkaun to pay 97k. Luckily leave 3k balance unpaid, will use Maybank2u for this. Thanks |

|

|

|

|

|

MGM

|

Today, 10:42 AM Today, 10:42 AM

|

|

QUOTE(doremon @ Dec 13 2025, 09:31 AM) The way I look at it, EPF is the safest option to treat as a pension scheme, aside from the government pension scheme. Seventeen of my close personal friends whom I personally know are living on passive income from EPF dividends alone. Youngest is 38 and is getting RM20k monthly from dividends only. I am almost reaching RM1 million now but I need a few more bonuses to exceed RM1 million. I don’t care what people say about going for gold, unit trusts, insurance or Bitcoin. I’m going all out with EPF now. Because if EPF collapses, Malaysia will collapse as well. The 38yo one will not be abled to use 20k/month dividend Which also mean he/she has 4mil in EPF n should have other source + some from acc3. |

|

|

|

|

|

MGM

|

Today, 11:09 AM Today, 11:09 AM

|

|

QUOTE(virtualgay @ Dec 13 2025, 10:44 AM) can la... over 1.1M can withdraw ma.. Oops overlook that option. |

|

|

|

|

Jul 18 2025, 09:46 AM

Jul 18 2025, 09:46 AM

Quote

Quote

0.0203sec

0.0203sec

0.50

0.50

7 queries

7 queries

GZIP Disabled

GZIP Disabled