QUOTE(Yggdrasil @ Oct 10 2019, 02:27 AM)

Ya, unless u found a better one[DIY] S&P 500 Index w/ 0.07% Annual Fee, Buy the best companies in the world

[DIY] S&P 500 Index w/ 0.07% Annual Fee, Buy the best companies in the world

|

|

Oct 13 2019, 11:42 PM Oct 13 2019, 11:42 PM

Return to original view | IPv6 | Post

#21

|

Senior Member

2,106 posts Joined: Jul 2018 |

|

|

|

|

|

|

Oct 15 2019, 03:54 PM Oct 15 2019, 03:54 PM

Return to original view | Post

#22

|

Senior Member

2,106 posts Joined: Jul 2018 |

|

|

|

Oct 23 2019, 11:13 PM Oct 23 2019, 11:13 PM

Return to original view | IPv6 | Post

#23

|

Senior Member

2,106 posts Joined: Jul 2018 |

QUOTE(Yggdrasil @ Oct 23 2019, 03:24 AM) Errr. Guys. How to open Singaporean bank account in Malaysia again? I remember reading it somewhere but can't find. Opening a Bank Account in SGI remember got Maybank and CIMB options. Anyone know which post? but summary -> CIMB Fast Saver Maybank iSavvy |

|

|

Nov 20 2019, 01:57 PM Nov 20 2019, 01:57 PM

Return to original view | Post

#24

|

Senior Member

2,106 posts Joined: Jul 2018 |

It seems now Firstrade now accept Malaysian registration?

but i think they only have major US ETF, and it is not easy to fund the account like Tradestation/IB, whereby we need to fund to their US account |

|

|

Dec 4 2019, 10:44 PM Dec 4 2019, 10:44 PM

Return to original view | IPv6 | Post

#25

|

Senior Member

2,106 posts Joined: Jul 2018 |

Does anyone know how to check on TradeStation / IB client portal - dividend payout for accumulating type ETF bought?

|

|

|

Jan 7 2020, 10:15 PM Jan 7 2020, 10:15 PM

Return to original view | IPv6 | Post

#26

|

Senior Member

2,106 posts Joined: Jul 2018 |

|

|

|

|

|

|

Mar 1 2020, 10:57 AM Mar 1 2020, 10:57 AM

Return to original view | Post

#27

|

Senior Member

2,106 posts Joined: Jul 2018 |

|

|

|

Mar 3 2020, 11:56 PM Mar 3 2020, 11:56 PM

Return to original view | Post

#28

|

Senior Member

2,106 posts Joined: Jul 2018 |

Anyone invest in one pure sector ETF instead of all sector e.g. SPY?

e.g. XLK technology sector ETF is a boom these few years. e.g. in 2019 XLK return is around 49.97% SPY return is around 31.29% |

|

|

Mar 6 2020, 11:45 AM Mar 6 2020, 11:45 AM

Return to original view | Post

#29

|

Senior Member

2,106 posts Joined: Jul 2018 |

QUOTE(roarus @ Mar 6 2020, 11:35 AM) Not in specific S&P sector, but I have small holding in a disruptive theme ETF. Ballooned a little when Tesla skyrocketed. might share which ETF is that? sound interesting, can do some weekend research Interestingly it pays out dividend as "short term capital gain" which is tax exempt. |

|

|

Mar 11 2020, 11:30 AM Mar 11 2020, 11:30 AM

Return to original view | Post

#30

|

Senior Member

2,106 posts Joined: Jul 2018 |

QUOTE(alexkos @ Jul 16 2019, 04:24 PM) QUOTE(whizguy @ Mar 11 2020, 10:44 AM) Hi all, I'm new to ETF investment (sorry for the noob questions I'm going to ask). Thank you to TS and all for sharing your knowledge. it seems our brother alexkos here used to take 16 days for such remit of (myr -> instarem -> USD/EUR tradestation global)?I have recently opened an Instarem account and Tradestation Global. For Instarem I opted for whatsapp video call and did not need to meet them face to face. My Instarem account was activated the next day itself. For Tradestation Global I only submitted my bank statement with my house address and the account was ready for funding in 6 days. I hope you can help me with some questions below: 1) I tried to fund my Tradestation Global account directly using Instarem to transfer Euro (from MYR) since 5th March, going into 1 week soon yet the status is still "processing". How long does it usually take for funds to be transferred? I attached screenshot below, did I fill anything wrongly? because I cant stand my money in remit and no news for two weeks+ , my anxiety will drive me crazy haha This post has been edited by tadashi987: Mar 11 2020, 11:31 AM |

|

|

Mar 11 2020, 11:40 AM Mar 11 2020, 11:40 AM

Return to original view | Post

#31

|

Senior Member

2,106 posts Joined: Jul 2018 |

QUOTE(whizguy @ Mar 11 2020, 10:44 AM) 2) I'm interested to buy either SXR8 or CSP1. Did I choose the correct tickers below? Since I'm funding in Euro (so that can Instarem directly), maybe SXR8 is a better option. 3) I understand that SXR8 and CSP1 are accumulating dividend. Do I still need to sign this dividend reinvestment agreement in the IB website? i saw CSP1 is crazy high price 21,453.00 GBX but basically if u look from justetf website they are same etf  and you're funding in EUR, i think just do as alexkos hoot SXR8 for your question 3: ya should be not essential in this case so just agree and proceed |

|

|

Mar 13 2020, 01:40 PM Mar 13 2020, 01:40 PM

Return to original view | Post

#32

|

Senior Member

2,106 posts Joined: Jul 2018 |

QUOTE(Syncing @ Mar 12 2020, 10:16 PM) Hi guys, am new to this S&P 500 investing but already invested in SA. 1) instarem to trastation global as per others experience should be two weeks ore more. your transfer amount should be alright.I have a few questions, if some have been asked before, please do give me the link to the post/page and I'll go read it. 1) How long does it take to transfer from instarem to tradestation global? Also, how much should I transfer since minimum is 1k USD (I'm planning to get 7-8k worth in one go, should I transfer - cost per ETF * 6/7 + 1.5 euro + extra to be safe ? 2) If I buy it outside EU's market hours, what price will I get? Also, when would be the best time to buy then? 3) As I understand, 15% tax from Ireland-domiciled ETF is only on the dividends and not capital gain, correct? 4) Instarem can only transfer in EUR to TS, and not USD, as I read from previous posts. So I'm only able to get SXR8 and CSPX:NA ? 5) I would like to invest in tech sector but the options are limited for European listed ETF's on US tech sector. Can I purchase this : https://www.bloomberg.com/quote/IUIT:LN and it would be similar to getting SXR8? Sorry I have lots of questions, am new to this! 2) it depend on your set buy price? just like u purchase stock. 3) correct. 4) correct, in a way. 5) ya can. Cant say it is similar to SXR8. SXR8 is holdings from cross sector. IUIT is holdings on tech sector. |

|

|

Mar 14 2020, 07:15 PM Mar 14 2020, 07:15 PM

Return to original view | Post

#33

|

Senior Member

2,106 posts Joined: Jul 2018 |

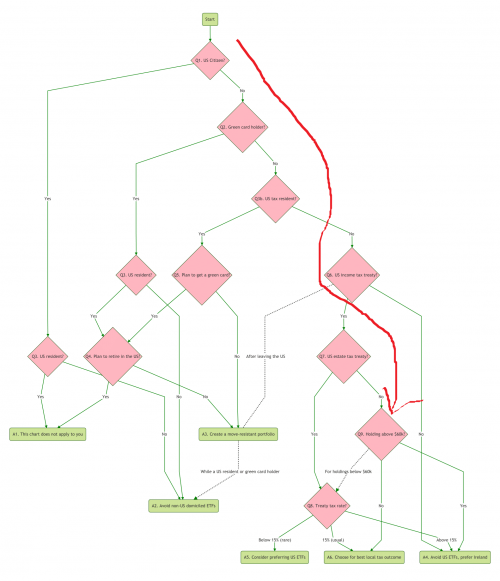

Found something useful for those who is holding US ETF / Stocks directly, google keyterm = US ETF estate duties

with US complicated tax system e.g. estate duties, capital gain tax It's basically asking Malaysian to avoid US ETF / Stocks if possibble. Non-US investor's guide to navigating US tax traps Estate Duty for Non-US Resident  This post has been edited by tadashi987: Mar 14 2020, 07:21 PM |

|

|

|

|

|

Mar 15 2020, 11:52 PM Mar 15 2020, 11:52 PM

Return to original view | Post

#34

|

Senior Member

2,106 posts Joined: Jul 2018 |

QUOTE(Syncing @ Mar 15 2020, 10:54 PM) Hi, just got my IB and instarem account approved. Thanks tadashi for answering my enquiries! 1) dont quite understand your meaning of "move my account to 3rd party broker", but indeed you need to fund the minimum deposit to IB (Tradestation) first, they received then only you can proceed with subsequent fundingI'm trying to transfer funds through instarem and linking my IB account to tradestation. But I'm facing an issue. 1) I can't seem to find the option to Move my account to 3rd party broker (Tradestation), is it because I have no funds yet in my IB account? 2) What phone number and email should I put for the recipient in the transfer details? Other details like IBAN are provided after creating my fund transfer notice. Sorry for spamming the thread with questions, but I did try googling and searching the thread but to no avail 2) phone number / email on instarem or IB? |

|

|

Mar 26 2020, 11:08 AM Mar 26 2020, 11:08 AM

Return to original view | Post

#35

|

Senior Member

2,106 posts Joined: Jul 2018 |

Hi sifu wanna enquire, can I entire rely on the online web client portal to convert SGD > USD, and buy ETF, instead of having to install the TWS?

What are their differences? |

|

|

Apr 9 2020, 06:16 PM Apr 9 2020, 06:16 PM

Return to original view | Post

#36

|

Senior Member

2,106 posts Joined: Jul 2018 |

QUOTE(findingdory @ Apr 9 2020, 10:45 AM) I'm new to foreign ETF. After reading the first post, a question on taxation. If we need to be taxed for 15%, is the investment still worth the hassle? Not too sure how to calculate a more realistic return scanario, that why asking here whether it worth of not is up to you to define i guesstake a simulation of you having 500k so 500k * average annual dividend yield of SPY which is 2%, so each year you will get 10k, 15% out of your dividend is 1,500. So this 1,500 is given to tax with no return back. the thinking is that, in your evaluation, SPY will give you better return so this 1,500 is nothing compared to your return. so I guess your question can be summarized as: 1) Is there a better investment that giving you a better return compare to ETF (deduct off the 15% from 2% dividend rate)? 2) if yes, then definitely you wouldn't opt for ETF 3) if no, then you mind consider opt for ETF despite there is a little hassle? well for evaluation of return, I always take past 10 or N years average annual return. Thou past performance shouldn't be used as in indicator for future performance, just a standard disclaimer. |

|

|

Apr 13 2020, 10:15 PM Apr 13 2020, 10:15 PM

Return to original view | Post

#37

|

Senior Member

2,106 posts Joined: Jul 2018 |

QUOTE(findingdory @ Apr 10 2020, 11:31 PM) Plan to give it a try because I think in long term it will be worthwhile. 1) as far as i known, correctI have been reading this thread but there are too much info. Questions: 1) Instarem transfers to tradestation only accept EUR? Cant fund tradestation account in USD? 2) SXR8 price is quite high and I found this VUAA on London stock exchange, Ireland domiciled, accumulating and it trades in USD. Is SXR8 having more advantage comparing with this? 3) LSE still charge stamp duty for ETF? I checked, they dont charge for ETF starting February 2007: https://www.lseg.com/areas-expertise/our-ma...d-products/etfs Thank you if you can enlighten me. 2) nope, both track S&P500, worth giving it a shot 3) nope stamp duty dont applied to us. |

|

|

Apr 13 2020, 11:12 PM Apr 13 2020, 11:12 PM

Return to original view | Post

#38

|

Senior Member

2,106 posts Joined: Jul 2018 |

Hi guys, wanna enquire if I am seeing an ETF which has no accumulating class but only distributing.

1) since everyone is recommending accumulating, any drawback to go for distributing? I try researched online that for accumulating, it saves the hassle as before reinvestment, fund manager will pay the withholding tax for you. 2) Does that means, for distributing there'll be cumbersome that investor would have to pay the witholdings tax on your own? 3) Also, any ones here who bought distributing ETF, can advise dividend will be straight credit into IBKR account? or it will be bank? |

|

|

Apr 13 2020, 11:50 PM Apr 13 2020, 11:50 PM

Return to original view | Post

#39

|

Senior Member

2,106 posts Joined: Jul 2018 |

QUOTE(Ramjade @ Apr 13 2020, 11:46 PM) 1. None. You received cash and up to you when to buy back. With accumulating even when it's expensive you will be buying. Thanks, IMHO in that case i would feel that distributing is way better than accumulating thou majority promote accumulating maybe it saves the commission of said straight reinvesting once getting the dividend2. IB automatically minus the tax for you. What you get is already nett tax. 3. IB account. |

|

|

Apr 14 2020, 12:01 AM Apr 14 2020, 12:01 AM

Return to original view | Post

#40

|

Senior Member

2,106 posts Joined: Jul 2018 |

|

| Change to: |  0.0462sec 0.0462sec

0.52 0.52

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 10th December 2025 - 08:51 AM |