QUOTE(Ramjade @ Apr 14 2020, 12:03 AM)

Thanks [DIY] S&P 500 Index w/ 0.07% Annual Fee, Buy the best companies in the world

[DIY] S&P 500 Index w/ 0.07% Annual Fee, Buy the best companies in the world

|

|

Apr 14 2020, 12:05 AM Apr 14 2020, 12:05 AM

Return to original view | Post

#41

|

Senior Member

2,106 posts Joined: Jul 2018 |

|

|

|

|

|

|

Apr 16 2020, 03:04 PM Apr 16 2020, 03:04 PM

Return to original view | Post

#42

|

Senior Member

2,106 posts Joined: Jul 2018 |

Hi guys would like to enquire, i found out that some ETF are available in an exchange (checking through IB ETF list in the exchange), but through TradeStation Global, i can't find the ETF in that exchange but it is only available in another exchange, why is this so?

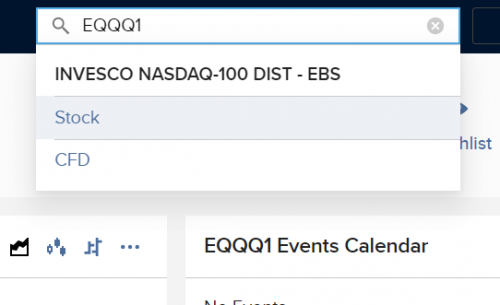

Is it because TradeStation Global doesn't offer to trade that ETF in that particular exchange, even though it is offered by IB? Example: EQQQ1 is shown to be available through LSE ETF LIST, checking through IB website https://ndcdyn.interactivebrokers.com/en/in...567&exch=lseetf  However, when search through TradeStation Global web client portal, it is not available but only offered through another exchange which is SIX SWISSS EBS  |

|

|

Apr 22 2020, 12:21 AM Apr 22 2020, 12:21 AM

Return to original view | Post

#43

|

Senior Member

2,106 posts Joined: Jul 2018 |

QUOTE(moosset @ Apr 21 2020, 01:55 PM) QUOTE(Ramjade @ Apr 21 2020, 02:22 PM) QUOTE(kart @ Apr 21 2020, 10:08 PM) Ramjade Do we submit our W8-BEN form when opening tradestation global account, I have forgotten about thatTo whom should we submit the scanned W8 form (with our signature)? Interactive Brokers, or Tradestation Global? Thank you for your clarification. I tried to search on my client portal > sidebar > Report / Tax Docs or Account Setting but can't find anything about W-8 Ben form, nor there is any information if I have submitted ones before |

|

|

Apr 22 2020, 12:33 AM Apr 22 2020, 12:33 AM

Return to original view | Post

#44

|

Senior Member

2,106 posts Joined: Jul 2018 |

|

|

|

May 6 2020, 05:44 AM May 6 2020, 05:44 AM

Return to original view | Post

#45

|

Senior Member

2,106 posts Joined: Jul 2018 |

QUOTE(dwRK @ May 5 2020, 02:09 PM) QUOTE(Julian2103 @ May 5 2020, 06:28 PM) Seems a lot less troublesome to use Etoro to buy s&P500 though. Ive been researching and cant find much info on this. Sifus can enlighten? QUOTE(Ramjade @ May 6 2020, 12:13 AM) Didn't know that. I always assumed they are cfd broker. Somehow I trust trading 212 more than Etoro. etoro is somehow still fishy for me 1) etoro is defaulted to CFD and you need to REQUEST afaik, in default, all malaysia account opened through etoro is parked under regulation of Australian Securities and Investments Commission (ASIC). in such, all trade are default in CFD, you can know that when u try to place order, there is no option at all  so there are netizen from etoro group mentioned, if you dont want to trade in CFD, you need to talk to their CS to SWITCH 2) etoro spread is crazily high looking at the same pic, QQQ last price is 217.66, but the spread is so high that you need to buy it with price of 217.93. it means that once your order is matched, you are already losing (217.93-271.66) per share. I am not sure is this because of CFD trade can try 1) open account and request etoro CS to switch your account to non CFD account 2) then you try check again if the order book price spread is still crazily high, if yes, better stay away from this I done all these research previously and finally switch to tradestation global thou more troublesome, but at least make me feel much safer This post has been edited by tadashi987: May 6 2020, 05:47 AM |

|

|

May 6 2020, 04:30 PM May 6 2020, 04:30 PM

Return to original view | Post

#46

|

Senior Member

2,106 posts Joined: Jul 2018 |

QUOTE(dwRK @ May 6 2020, 04:17 PM) no fishy smell lah...lol I quick scan last time it's all mentioned in their account, restrictions etc... understood, my concern is that usual investor e.g. Julian2103 wont know the bid spread is to high that contribute to their commission, also normal investor account opening first intention is to trade normal investment with closest bid spread according to market.regulated under Australia and UK should be quite safe all cfd brokers have higher spread... it's there they park their commission...so it's normal cfd brokers also served a different market... e.g., you can buy 0.01 lot of qqq... long on 500:1 leverage... get wiped out like 80% of ppl... lol anyways... all brokers got pros and cons... find one that match your own requirements ah... That's why every time people talk about etoro, they never knew they are trading CFD, let alone the high bid spread. also a lot etoro paid "influencer" like to promote etoro can be used to trade normal share but they never bother to further elaborate that 1) you need to write to CS to switch your account regulation 2) never tell your account is default opened as CFD enabled only account 3) never bother to explain the bid spread logic behind so a lot people fall for it and that's why i felt such marketing is very fishy and a bit unethical in my sense, personal two cents |

|

|

|

|

|

May 16 2020, 12:18 PM May 16 2020, 12:18 PM

Return to original view | Post

#47

|

Senior Member

2,106 posts Joined: Jul 2018 |

|

|

|

May 31 2020, 01:09 PM May 31 2020, 01:09 PM

Return to original view | Post

#48

|

Senior Member

2,106 posts Joined: Jul 2018 |

QUOTE(scriptkiddie44 @ May 31 2020, 09:26 AM) How do I find the QQQ ETF without the high withholding tax? Correct, EQQQ is domiciled in Ireland so WTH is 15% compared to QQQ 30%I only see EQQQ BVME / LSE on IBKR for EQQQ is this 2 having lesser withholding tax? Anyone can advise? https://www.justetf.com/en/find-etf.html?qu...&sortOrder=desc |

|

|

Jun 1 2020, 10:33 PM Jun 1 2020, 10:33 PM

Return to original view | Post

#49

|

Senior Member

2,106 posts Joined: Jul 2018 |

QUOTE(scriptkiddie44 @ May 31 2020, 08:12 PM) Is is EQQQ:LSEETF ticker? or which ticker symbol you go for? u see the ETF EQQQ naming is same so they are same ETF, just they're listed in different exchangesEQQQ only having EQQQ:BVME and EQQQ:LSEETF on IBKR Borsa Italiana (BVME) LSE (London Stock Exchange) for question of which exchange to go for, up to you, factoring in commission charge of TradeStation is different for different exchange. i remember BVME is cheaper QUOTE(zenquix @ May 31 2020, 11:04 PM) Can't comment as i didn't go for it. the price of EQQQ:LSEETF looks weird on IBKR though so i won't touch it. EQQQ:LSEETF is priced in GBx pence steering (British decimal coins)so the pricing figure is big 18,800.00 GBx = 188 GBP if u were to buy EQQQ:LSEETF, just convert to GBP and buy, TradeStation aka IBKR will handle the GBx:GBP hassle without any charge thou I dont like pricing in GBx, personal preference This post has been edited by tadashi987: Jun 1 2020, 10:34 PM |

|

|

Jun 10 2020, 11:56 PM Jun 10 2020, 11:56 PM

Return to original view | Post

#50

|

Senior Member

2,106 posts Joined: Jul 2018 |

curious to know, do we receive any email or acknowledgement from TSG when the dividend amount is debited into our TSG account?

|

|

|

Jul 28 2020, 09:46 PM Jul 28 2020, 09:46 PM

Return to original view | Post

#51

|

Senior Member

2,106 posts Joined: Jul 2018 |

|

|

|

Aug 6 2020, 12:21 AM Aug 6 2020, 12:21 AM

Return to original view | Post

#52

|

Senior Member

2,106 posts Joined: Jul 2018 |

not sure if anyone here opened TradeStation Global (TSG) joint account after personal account?

|

|

|

Aug 9 2020, 11:59 PM Aug 9 2020, 11:59 PM

Return to original view | Post

#53

|

Senior Member

2,106 posts Joined: Jul 2018 |

QUOTE(pigscanfly @ Aug 9 2020, 11:52 PM) Which stock exchange charges lower clearing fees? Any advantage to purchase ETF on XETRA vs LSE? I heard LSE charges stamp duty. not sure on clearing fee, i dont think i paid any clearing fee on US stocks, just brokerage fee, through TradeStation Globalbrokerage fee is different charging from TradeStation Global on different exchange u can check the charging from their website https://www.tradestation-international.com/...0-6ebf4fb9-d1f9 This post has been edited by tadashi987: Aug 10 2020, 12:11 AM |

|

|

|

|

|

Aug 24 2020, 08:00 PM Aug 24 2020, 08:00 PM

Return to original view | IPv6 | Post

#54

|

Senior Member

2,106 posts Joined: Jul 2018 |

|

|

|

Nov 28 2020, 06:25 PM Nov 28 2020, 06:25 PM

Return to original view | IPv6 | Post

#55

|

Senior Member

2,106 posts Joined: Jul 2018 |

|

|

|

Nov 28 2020, 07:40 PM Nov 28 2020, 07:40 PM

Return to original view | IPv6 | Post

#56

|

Senior Member

2,106 posts Joined: Jul 2018 |

QUOTE(alexkos @ Nov 28 2020, 07:07 PM) if fund A give u 8% percent return, management fee 0.25%fund B give u 20% percent return, management fee 0.75% u do the math Ramjade liked this post

|

|

|

Nov 29 2020, 09:58 AM Nov 29 2020, 09:58 AM

Return to original view | IPv6 | Post

#57

|

Senior Member

2,106 posts Joined: Jul 2018 |

QUOTE(alexkos @ Nov 29 2020, 05:42 AM) https://www.fsmone.com.my/funds/tools/facts...c=global-searchmerely for ur reading |

|

|

Nov 30 2020, 12:40 AM Nov 30 2020, 12:40 AM

Return to original view | IPv6 | Post

#58

|

Senior Member

2,106 posts Joined: Jul 2018 |

QUOTE(rozack @ Nov 29 2020, 11:13 PM) Hmm but the news are prompting that Cathie may face hardship next year due to the current takeover battle, a bit uncertain, however, I lean towards the positive side of Cathie staying but not guarantee though. Let see how market react to it, i think i would just keep holdings |

|

|

Jan 5 2021, 09:03 AM Jan 5 2021, 09:03 AM

Return to original view | Post

#59

|

Senior Member

2,106 posts Joined: Jul 2018 |

QUOTE(dattebayo @ Jan 4 2021, 03:21 PM) what's the difference of trading via foreign platform vs local brokerage houses? I think is the cost issue? trading or transacting using local brokerage house the fx convert and transactional charge is much higher?currently using AffinHwang CQ trading platform for foreign counters |

|

|

Mar 8 2021, 11:42 PM Mar 8 2021, 11:42 PM

Return to original view | IPv6 | Post

#60

|

Senior Member

2,106 posts Joined: Jul 2018 |

|

| Change to: |  0.0413sec 0.0413sec

1.07 1.07

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 9th December 2025 - 01:08 PM |