QUOTE(scriptkiddie44 @ Apr 1 2019, 05:17 PM)

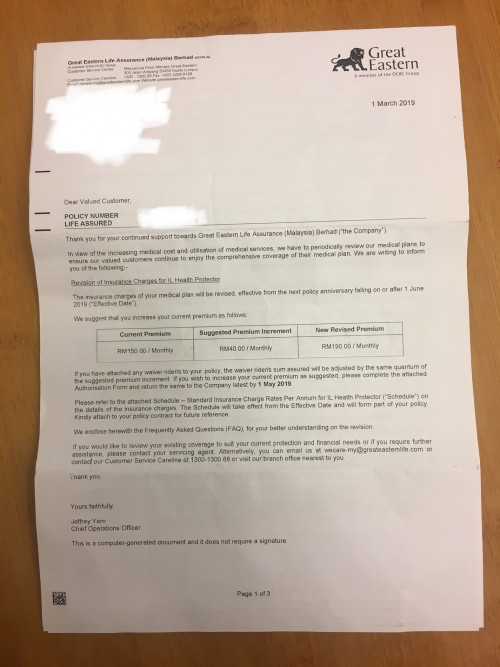

The only different I noticed is the cash value. I clarified with the agent to see if my assumption was correct (only cash value is difference, everything else is the same), and the agent say yes. After that, the agent keep saying that my policy will not sustain for long term.

I don't think it's reasonable to pay so much higher premium just for the sustainability. We pay premium for insurance, not cash value.

Some more, my policy started in 2012, and my friend's policy was from 2013. After 6 years, her total cash value only worth 2k more than my cash value. Considering the difference paid in the past 6 years (mine was RM135 at first, hers is RM250++). If she saved the differece only in FD (not any higher yield investment), she would have few thousand more. Now, her few thousand just disappeared from thin air. Kinda pity her.

sorry to revive old topic, but i think it's quite impressive your friend's total cash value is more than yours at all.

assuming both of you are around the same age, same medical condition, etc etc. your friend's higher premium indicates that she has much higher coverage in terms of life, medical, maybe critical illness etc.

there is a break off point of cash value, or fund invesment where you will see a sudden acceleration of the value/amount.

it's some sort of simulation that the insurance company feel that your balance's interest/earning can cover the rising costs every year

after that break off point, 95%? (maybe, example) of your premium will go into cash value/ funds invested

to cover higher coverage, you will reach the break off point later. but after the break off point, it will increase much faster.

for research purpose only, we can look at the difference again after 2 or 3 years.

i'm not proper insurance guy, but i think there's some relation between these stuff

Apr 5 2019, 02:32 PM

Apr 5 2019, 02:32 PM

Quote

Quote

0.0298sec

0.0298sec

0.69

0.69

6 queries

6 queries

GZIP Disabled

GZIP Disabled