Outline ·

[ Standard ] ·

Linear+

Insurance Talk V5!, Anything and everything about Insurance

|

simonhtz

|

Apr 5 2019, 03:51 PM Apr 5 2019, 03:51 PM

|

|

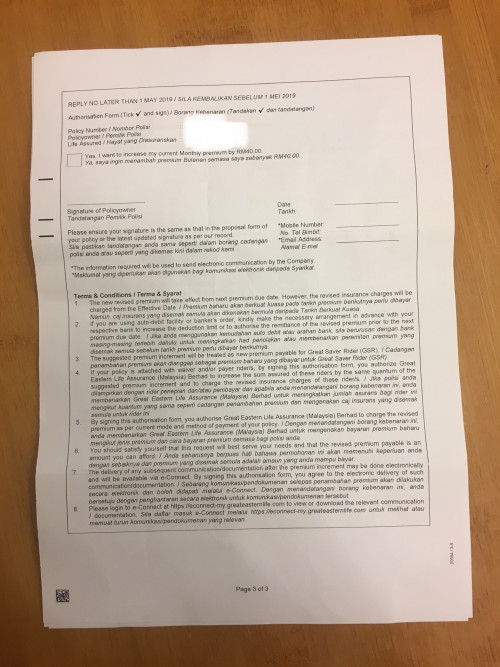

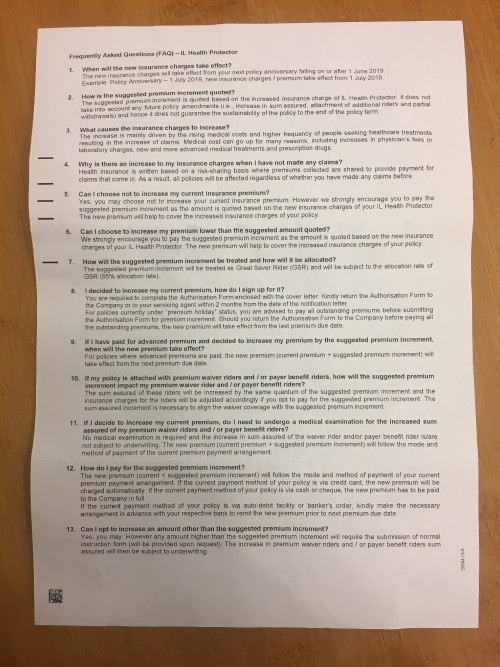

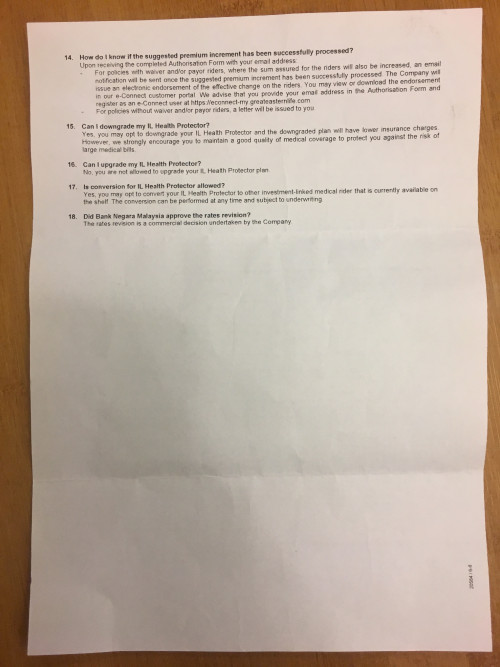

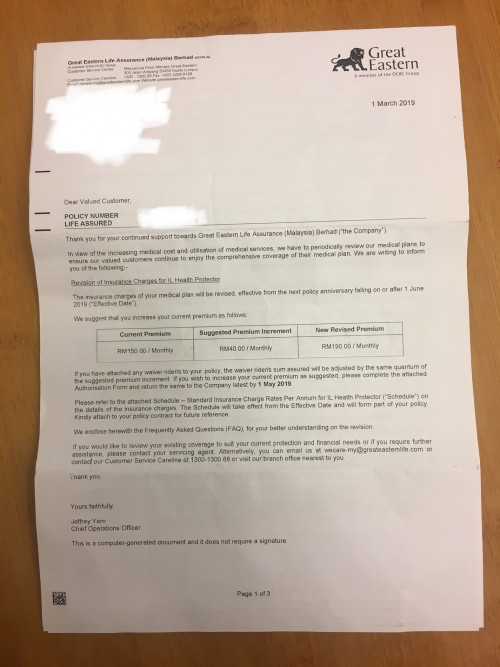

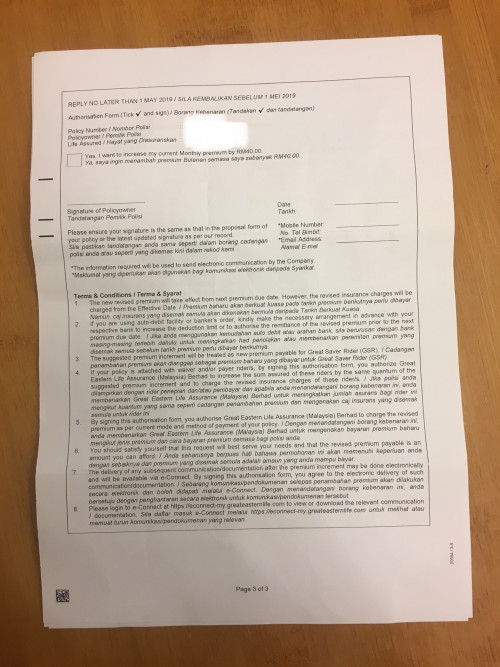

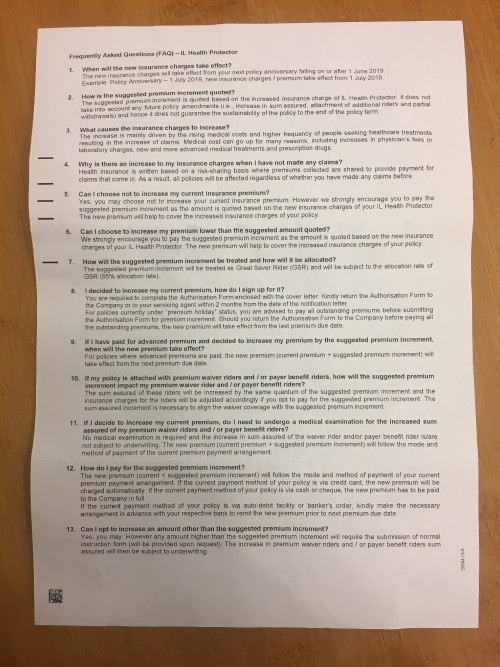

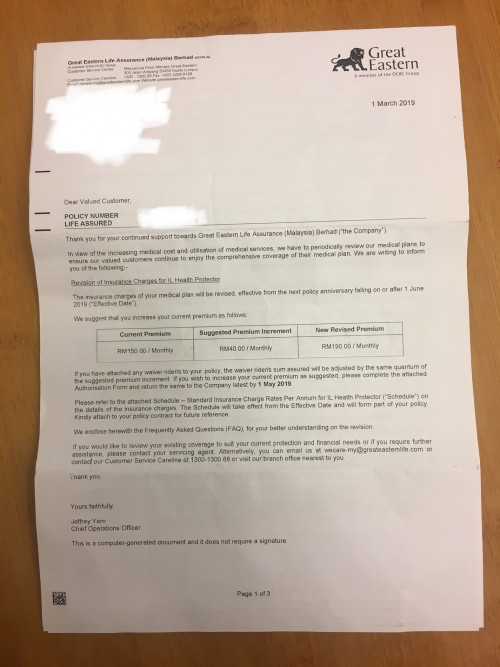

Guys, I got the following from GE for my medical card policy:     The other FAQ page didn’t seem to say that my policy will lapse if I don’t pay. Some background on the policy: - started 2007, paying RM150 per month - have been paying for 12 years - protection I’m paying for: RM100,000 med card and 100,000. I think the amount is shared. I do not want to increase the premium, am I still eligible from protection? Owing to the fact that I have already paid well over 20k for the pass 12 years. |

|

|

|

|

|

simonhtz

|

Apr 5 2019, 04:06 PM Apr 5 2019, 04:06 PM

|

|

QUOTE(lifebalance @ Apr 5 2019, 03:57 PM) PA not considered It's just a suggestion, if you don't follow then it will slowly deplete until it lapse. You're still covered until the policy lapse Thank you, much appreciated. Funny, I kept reading the FAQ and GE did not highlight the consequences. It’s a whopping 26% increase of premium to the same amount of protection. Either my maths fail or this does not make any sense at all. |

|

|

|

|

|

simonhtz

|

Apr 5 2019, 04:22 PM Apr 5 2019, 04:22 PM

|

|

QUOTE(HoNeYdEwBoY @ Apr 5 2019, 04:14 PM) hi bro, do you need help? I can help you check with this policy. The product name that I acquired is not listed in the letter. Did some digging through my old GE statement, this is the product name: Great ProtectLink Insurance IL-health protector Critical Illness Benefit |

|

|

|

|

|

simonhtz

|

Apr 8 2019, 12:02 PM Apr 8 2019, 12:02 PM

|

|

QUOTE(YH1234 @ Apr 7 2019, 09:42 AM) may I know why the co want to increase price knowing that the benefit is much less compare to later gen? what is their justification? I may miss the details in the letter, but I echo your sentiment. Upgrade to RM190 per month - to maintain the same 100k New policies RM200 per month - 1 million dollar coverage Given that even if I go for the revised product. I will most likely go through the same predicament in years to come. “Continue rise of insurance cost, recommend to increase premium to main the same coverage, etc...BUT hold-up we got another 2 million dollar infinite claim, next gen insurance product here!” |

|

|

|

|

|

simonhtz

|

Apr 18 2019, 02:20 PM Apr 18 2019, 02:20 PM

|

|

QUOTE(stevencjh @ Apr 18 2019, 12:49 PM) May i ask for AIA A-Enrich Gold is we can get the money guaranteed for the next 20 years? My agent quotes me by paying RM3700++ per month for the next 6 years, i will get RM5000 guaranteed for every 2 years and the amount increases after 10 years. Is it worth than place FD since i am not a ppl who knows how to invest? 3.7k is quite a high amount. For a month. I’m going to be crude here and straight up say you’re gonna get chop “carrot head”. Hope you get the joke. I’m sorry. |

|

|

|

|

|

simonhtz

|

Apr 23 2019, 10:45 AM Apr 23 2019, 10:45 AM

|

|

QUOTE(life27 @ Apr 22 2019, 09:41 PM) Hmm, Max budget for purely medicine card insurance .. any idea which insurance company I should buy ? ? Imho, there’s no such thing as max budget for insurance. The so-called budget is just a guideline. The idea here is to get the highest amount of protection at the lowest cost possible. It’s advisable to get a few quotes and compare the benefits. |

|

|

|

|

|

simonhtz

|

Apr 23 2019, 12:01 PM Apr 23 2019, 12:01 PM

|

|

QUOTE(lifebalance @ Apr 23 2019, 11:52 AM) As what cherroy pointed out. These 2 variable will make it hard to determine the future COI as well as how much premium you should contribute now in order to make sure that it 100% can last through >80 yrs old. You may always try to stand by some extra buffer on top of what you’re paying for your insurance premium at the moment for the future if you are worried that your cash value within your insurance policy may not sustain until the age that you’re targeting to last until. This is precisely the reason why, for me, after 10+ years paying for an ILP, GE advised me to up my premium payment for a whopping 26%. Had I understand this earlier, I could have gone for a term medical insurance. |

|

|

|

|

|

simonhtz

|

Apr 23 2019, 03:10 PM Apr 23 2019, 03:10 PM

|

|

QUOTE(cherroy @ Apr 23 2019, 02:50 PM) That's why medical insurance premium is cheap when you are 18, and become expensive when 60. Insurance companies have done statistics extensively and employ sophisticated computer algorithm to calculate those probability in the first place. Insurance companies exist as same as bank, or private companies, they exist because of profit. But policy owners are not at a loss as well, as joining in the pool of fund of insurance, means if unfortunate strike, then they get the compensation from insurance. As mentioned, insurance is consumable, please do not have a mindset that try to "win" against insurance, nor try to calculate whether it is "worth" or not. Heh. Consumers should go in with the mindset of buying an insurance with the hopes of not wanting to use it at all. Hopefully. |

|

|

|

|

|

simonhtz

|

Jan 14 2020, 01:28 PM Jan 14 2020, 01:28 PM

|

|

QUOTE(jack2 @ Jan 10 2020, 08:31 PM) My plan is GREATJUNIOR ADVANTAGE SERIES 2 / GREAT INCOME ADVANTAGE SERIES 2 I dunno if I shall surrender it... Damn it. Same here, the return are abysmal. |

|

|

|

|

Apr 5 2019, 03:51 PM

Apr 5 2019, 03:51 PM

Quote

Quote

0.1116sec

0.1116sec

1.00

1.00

7 queries

7 queries

GZIP Disabled

GZIP Disabled