QUOTE(kbandito @ Jan 23 2019, 10:18 AM)

You can check out Allianz Diabetic Essential (ADE) and subsequently post your questions here if you have any. ADE is a medical card for Diabetes type 2.

Best,

Jiansheng

Insurance Talk V5!, Anything and everything about Insurance

|

|

Jan 23 2019, 09:43 PM Jan 23 2019, 09:43 PM

Return to original view | Post

#21

|

Senior Member

945 posts Joined: Jun 2012 |

QUOTE(kbandito @ Jan 23 2019, 10:18 AM) You can check out Allianz Diabetic Essential (ADE) and subsequently post your questions here if you have any. ADE is a medical card for Diabetes type 2. Best, Jiansheng |

|

|

|

|

|

Jan 24 2019, 11:44 AM Jan 24 2019, 11:44 AM

Return to original view | IPv6 | Post

#22

|

Senior Member

945 posts Joined: Jun 2012 |

QUOTE(Jdite @ Jan 24 2019, 11:24 AM) Hi, Is Critical illness important? There are different kind of CI coverage. It could be late stage coverage or early to late stage coverage.A GE agent quoted me a Life Insurance with a rider for CI, which costs ~90 per month extra. As far as I understand, CI only pays out when the illness is at advance stage, and for GE, CI is part of the Life's SA. Isit worthwhile to pay RM90 extra per month just for that 'early payout'? As IMO, when your illness is at advance stage, the survival rate is also relatively low.. Also, your age, occupation, smoker/nonsmoker, sex and amount of coverage will determine your premium. So whether it is worthwhile or not depends on these factors. Not discounting the fact that you will be getting the coverage. Best, Jiansheng |

|

|

Jan 24 2019, 08:46 PM Jan 24 2019, 08:46 PM

Return to original view | Post

#23

|

Senior Member

945 posts Joined: Jun 2012 |

|

|

|

Jan 25 2019, 09:01 AM Jan 25 2019, 09:01 AM

Return to original view | Post

#24

|

Senior Member

945 posts Joined: Jun 2012 |

QUOTE(nakedtruth @ Jan 25 2019, 08:54 AM) Hi, Start with these in mind.There are so many insurance out therr. What are the criterias we should look in choosing the right insurance? Maybe looking for ILP with medical card coverage. Thank you. Protection: - Life/TPD: For family and TPD income replacement - Medical card: Medical bills - Critical illness: Income replacement - Personal Accident Best, Jiansheng |

|

|

Jan 26 2019, 08:50 PM Jan 26 2019, 08:50 PM

Return to original view | Post

#25

|

Senior Member

945 posts Joined: Jun 2012 |

QUOTE(jutamind @ Jan 26 2019, 08:27 PM) I'm looking at specific term until my kid reach a certain age for trust purpose. I have other life insurance policies that cover until 80 at least. Apart from term or ILP, any other tool can be used for trust for kids which is cost effective? Given that you already know how long you would like the term insurance to be, it is just mathematics now.Just compare the cost for term Vs ILP. Here's the formula: y = No. Of years until your kid reach a certain age (Term annual premium X y) Vs [(ILP annual premium X y) - average cash value at y] If term proves to be cheaper get term, otherwise ILP. Best, Jiansheng This post has been edited by Holocene: Jan 26 2019, 09:05 PM |

|

|

Jan 28 2019, 02:46 PM Jan 28 2019, 02:46 PM

Return to original view | IPv6 | Post

#26

|

Senior Member

945 posts Joined: Jun 2012 |

QUOTE(nakedtruth @ Jan 28 2019, 11:07 AM) Yeah this is the general... all insurance provider offer similar what distinguish among the insurance provider? Actually it all depends on what your needs are and the plan that you and your insurance agent come up with. With the rapid changing in the insurance industry partly due to competition and also Bank Negara's encouragement we do see quite a bit of difference between Companies' offering.The following are some of the differences (the list is not exhaustive) Life/TPD: - Investment linked or non-investment linked - Payout: Sum assured + cash value or Sum assured or cash value, whichever is higher Medical card - With XXX annual limit and no lifetime limit or with XXX lifetime limit only Critical illness coverage - 36 CI or 70 CI or 157 + 7 CI - Survival period: 7 days or 30 days - Coverage: Until 90 years old or 100 years old The best case scenario for you is to arrange a day, meet 2 - 3 agents from different insurance companies and get them to formulate an insurance plan to manage your life risk. You may then choose the best proposal. Remember, the best insurance plan is the one that is currently actively protecting you. So my advise is, don't wait. Best, Jiansheng This post has been edited by Holocene: Jan 28 2019, 02:47 PM |

|

|

|

|

|

Feb 1 2019, 10:04 AM Feb 1 2019, 10:04 AM

Return to original view | Post

#27

|

Senior Member

945 posts Joined: Jun 2012 |

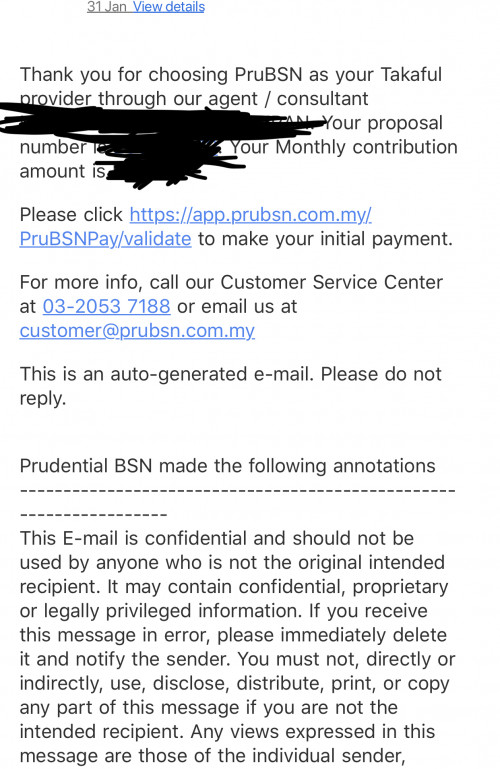

QUOTE(cucikaki @ Feb 1 2019, 09:20 AM) Hi. I applied for PruBSN Anugerah Plus insurance on 30/1. Request for a receipt of the said payment made, he will have a receipt from PruBSN.Receive email on 31/1 from prudential on the confirmation. Agent say the coverage start 1 february. But he said my february contribution is free. Will only deduct from credit card march onwards. However he say need to pay application fee one time which is equivalent to my monthly contribution. Is this true? Need transfer to his personal account as he paid the fee upfront for me yesterday upon registration. Best, Jiansheng |

|

|

Feb 1 2019, 06:37 PM Feb 1 2019, 06:37 PM

Return to original view | Post

#28

|

Senior Member

945 posts Joined: Jun 2012 |

QUOTE(cucikaki @ Feb 1 2019, 03:12 PM) Ya, he did pass me the insurance receipt for RM200 payment. He paid in advance. (Just that the receipt has no indication that the payment is for registration or monthly premium for feb) You mentioned that you received a confirmation email on 31/1/2019, what does the email say? However, for february, i need to pay rm200 (registration/application fee) + rm200 (monthly premium). He said monthly premium will be covered by him for february, but i need to pay registration/application fee. Is there such thing? My family members were under great eastern, and they never encountered such thing as application fee. For an insurance policy to be issued/confirmed, premiums have to be paid first (cash before cover). If the policy has been issued/confirmed, then your agent might have paid the January premium for you. Ask for the "registration fee" receipt. No receipt no pay. Easy. Best, Jiansheng |

|

|

Feb 2 2019, 07:23 AM Feb 2 2019, 07:23 AM

Return to original view | Post

#29

|

Senior Member

945 posts Joined: Jun 2012 |

QUOTE(cucikaki @ Feb 2 2019, 01:24 AM) Email of 31/1 is To make first payment. However, agent said he paid for me already. Today i receive email saying that my policy is enforce on 1/2/2019. So let me get this straight:So actually im paying my february policy myself? I asked a friend who took insurance recently with prudential, there no ‘registration fee’. And no cashback from agent also. So i feel like this so called ‘cashback’ for february actually doesnt even exist?  1) Premium paid by agent with receipt : RM200 (Need to pay back agent) 2) Registration Fee: RM200 (Need to pay back agent) 3) February premium: RM200 (To be paid by agent/cashback) You can text the following to your agent to clarify: "Can I double confirm what this registration fee is? Because my friend recently also gotten an insurance policy from Prudential and there is no such thing as a registration fee. Also, since you're giving me a cashback for February can we just contra the current amount I owe you and I'll just make payment to Prudential for March myself?" Share with us his reply. Best, Jiansheng |

|

|

Feb 14 2019, 03:04 PM Feb 14 2019, 03:04 PM

Return to original view | Post

#30

|

Senior Member

945 posts Joined: Jun 2012 |

QUOTE(wilson1149 @ Feb 14 2019, 02:44 PM) Here's an analogy for you. When you go to a mixed rice/nasi kandar shop, Investment linked plans (ILP) are basically the plate and a medical insurance/card is the dishes/kuah you order with the dish. But if you mean what's the difference between a medical card attached to an ILP vs a standalone medical card, then biggest difference is as per below: Cost: - ILP more expensive - standalone cheaper Coverage: - depends as ILP has high and low coverage options That's a straight forward way to look at it. Best, Jiansheng |

|

|

Feb 15 2019, 11:08 AM Feb 15 2019, 11:08 AM

Return to original view | Post

#31

|

Senior Member

945 posts Joined: Jun 2012 |

|

|

|

Feb 15 2019, 11:47 AM Feb 15 2019, 11:47 AM

Return to original view | Post

#32

|

Senior Member

945 posts Joined: Jun 2012 |

QUOTE(alexkos @ Feb 15 2019, 10:25 AM) ic, so even if i pay lesser in first 2 years, and then payback subsequent premium later, my agent will still get his full distribution cost, betul? I suppose you'd feel that way is because you don't feel any value from your insurance agent? That's on him/her to show his/her value.wah like that....confirm eat... I like how Lifebalance used the nasi lemaka example but here's another way to look at it. There are a lot of nasi lemak seller/cook out there but we all have our own favourite because every nasi lemak seller/cook is different due to their recipe. Purchasing the raw materials to make a nasi lemak is easy, we can Google the recipe, putting it together for an awesome nasi lemak is another story. Same case for insurance agents, we all carry protection products but it all boils down to how we design a plan and add value to our clients. If you are looking for a product that has the lowest cost, you can request for a standalone medical card. Best, Jiansheng This post has been edited by Holocene: Feb 15 2019, 11:48 AM |

|

|

Feb 19 2019, 06:46 PM Feb 19 2019, 06:46 PM

Return to original view | Post

#33

|

Senior Member

945 posts Joined: Jun 2012 |

QUOTE(wiind @ Feb 18 2019, 09:02 PM) 1) Life/TPD: RM1,000,000Premium starts from RM1,905 2) Life/TPD/36CI: RM1,000,000 Premium starts from RM4,300 Do use the information you've found here as a benchmark. Understand what you're signing up for then you'll be alright Best, Jiansheng |

|

|

|

|

|

Feb 21 2019, 01:18 PM Feb 21 2019, 01:18 PM

Return to original view | Post

#34

|

Senior Member

945 posts Joined: Jun 2012 |

QUOTE(shahrul09 @ Feb 21 2019, 11:31 AM) Just to clarify, now I know it is a investment linked life insurance. “No clue on the investment linked things” means the details of which fund they gonna go for. There are lot funds etiqa go for such as -Premier Global Equity Fund, Dana Pendapatan Prima, Dana Equity Prima etc. Hi shahrul09,I need the deeper things. So I can at least check their Fund fact sheet. Hence I asked here if anyone know better with the sales illustration etc, would love to give it a read on my own time whenever I can instead of spend my fixed limited time waiting and que in the bank. (Which I can, but not prefer to go, I think everyone understand ) If no one got that, yes I will go to that guy and listen there. Great to know that you are taking the initiative to do your homework. SmartWealth is basically an investment linked life insurance plan. Based on the brochure, they are selling the concept of legacy planning with life insurance as a tool. Let's break it down what the brochure is trying to convey. 1) You have RM3,000,000 in total assets = networth 2) You wish to leave RM2,000,000 to his kids and set aside RM1,000,000 for his retirement. Simple, but the brochure suggest that you do this instead 1) Set aside RM800,360 for life insurance premium payable over 5 years. This will provide you with a life insurance coverage of RM2,000,000 hence freeing up RM2,199,640 (RM3,000,000 - RM800,360) as your retirement fund instead of RM1,000,000 2) Your new networth is as follow: Life Insurance Coverage: RM2,000,000 Retirement Fund: RM2,199,640 Total Networth: RM4,199,640 As to which fund they go for, it is an option that you can choose and your banker should be able to generate the Sales illustration accordingly. However do take note that Sales illustration projections are merely that, projections. It does not take into account their actual past performance and the projection rates are fixed between 2 - 3% (low scenario) to 8 - 9% (high scenario). If you are concerned about time, you can always let us know the total sum assured you would like, follow with your Date of Birth, Sex, Occupation, Smoker/nonsmoker and we can all easily provide you with the detailed SI. These kind of investment linked insurance plan is not special to Etiqa P/S: Here's the link to their fund fact sheet if you're wondering: https://etiqa.com.my/v2/investment-linked-funds Best, Jiansheng This post has been edited by Holocene: Feb 21 2019, 01:20 PM |

|

|

Feb 21 2019, 02:29 PM Feb 21 2019, 02:29 PM

Return to original view | Post

#35

|

Senior Member

945 posts Joined: Jun 2012 |

QUOTE(basSist @ Feb 19 2019, 09:42 PM) Bear in mind, the higher amount you pay for ILP the bigger the administration fee (the commission) you have to give. That is partially true, it really depends on the type of plan too.For example: Life Insurance: RM1,000,000 Full pay: Premium RM1,907/year = total commision RM1,716.30 over 6 years 6 pay: Premium RM5,573/year = total commision RM1,504.71 over 6 years. As you can see the difference in commission is only RM211.59. If you are savvy with your finances/money then the question of Time Value of Money comes into play and lets just say chances are you will opt for the Full pay option. Best, Jiansheng |

|

|

Feb 22 2019, 01:09 PM Feb 22 2019, 01:09 PM

Return to original view | Post

#36

|

Senior Member

945 posts Joined: Jun 2012 |

QUOTE(wizardofoz @ Feb 22 2019, 12:18 PM) Hi all, It would seem you have the option to choose from the following:I am looking for deductible medical insurance with conversion option to 0 deductible upon retirement. Which insurance companies are offering this option?

You can read more at the following link: https://howtofinancemoney.com/2016/03/best-...d-malaysia.html Best, Jiansheng |

|

|

Feb 23 2019, 08:28 AM Feb 23 2019, 08:28 AM

Return to original view | Post

#37

|

Senior Member

945 posts Joined: Jun 2012 |

QUOTE(NosaJC @ Feb 22 2019, 11:49 PM) QUOTE(yklooi @ Feb 22 2019, 11:53 PM) while waiting for responses on the undefined criteria for "BEST"......try this? Hi NosaJC,Best Critical Illness Insurance in Malaysia https://ringgitplus.com/en/health-insurance...itical-illness/ It's like how yklooi has mentioned, what does the BEST really mean as there are all kinds of critical illness coverage in the market right now, from straight forward CI coverage to products that allows "refresh" of the coverage. It's a good thing as it forces insurance companies to be innovative and competitive with the design of the products. BUT If you are looking for a simple CI coverage that covers the Early - Advance stages of Critical Illnesses you can check out PrimeCare+ which was launched this month. The first and only of its kind. - Extensive coverage of over 150 critical illness conditions such as heart attack, cancer, Parkinson’s Disease, and stroke from Early to Advanced stages - Protection against 7 additional critical illnesses for those below the age of 19 - Diabetes and Cancer Recovery Benefit to help you recuperate and regain your ability to move on with your life planning - Catastrophic CI Benefit should you be diagnosed with these 6 catastrophic illnesses i.e. cancer with metastasis, extensive heart attack, severe stroke, transplantation of both heart and lungs, total quadriplegia as a result of spinal cord injury and the loss of your limbs to help you through those difficult moments - Critical illness coverage up to age 100

You can find the full brochure here: https://www.allianz.com.my/prime-care-plus Everybody is welcome to ask question about this product on this forum. Best, Jiansheng This post has been edited by Holocene: Feb 23 2019, 08:30 AM |

|

|

Feb 26 2019, 01:32 PM Feb 26 2019, 01:32 PM

Return to original view | Post

#38

|

Senior Member

945 posts Joined: Jun 2012 |

QUOTE(55665566 @ Feb 26 2019, 12:54 PM) hi, wan to get suggestion. Not necessarily it's expensive.my dad is 54 this year. i want to get him a medical card but i believe it will be very expensive by now. the previous medical card he have have very low annual limit. do you suggest me to get one for him (around ~4-5k annually) medical card or ask him to go to government hospital in case of emergency? Depending on your comfortable budget, an agent will be able to provide you with options from RM2k - RM10k in premium. But realistically you can consider the following 1) Option 1 - Life/TPD: RM25k - R&B200 -- Annual limit: RM100k -- Lifetime limit: RM1mil -- Deductible: RM2k Premium: RM3,060/annual 2) Option 2 - Life/TPD: RM25k - R&B200 -- Annual limit: RM100k -- Lifetime limit: RM1mil -- Deductible: RM300 Premium: RM3,660/annual 3) Option 3 - Life/TPD: RM25k - R&B200 -- Annual limit: RM1mil -- Lifetime limit: No limit -- Deductible: none Premium: RM4,860/annual So depending on the coverage you're getting for your dad the premium will be charged accordingly. Above is just a sample of what you could get for your dad. Do check with the insurance agent that you're meeting on your options 🤓 Unfortunately for my dad, he's 13 years older than yours so you can imagine the premium I'm paying on behalf 😥 Best, Jiansheng This post has been edited by Holocene: Feb 26 2019, 03:49 PM |

|

|

Feb 26 2019, 03:14 PM Feb 26 2019, 03:14 PM

Return to original view | Post

#39

|

Senior Member

945 posts Joined: Jun 2012 |

QUOTE(55665566 @ Feb 26 2019, 02:43 PM) Hi , thank you 2 sifus for your advice. When a medical card comes attached with a Life/TPD it's an indication that's it's an Investment Linked Plan (ILP). As to the benefits of life/today/36ci, a death payout will definitely benefit the nominee however a TPD and 36CI will benefit the life assured. Just 1 thing I don't understand. Why insurance usually comes with life/tpd? I suppose life/tpd/36ci only benefits your next of kin instead of yourselves. so i personally do not think it worth the money as you wont be able to use it. i also dont understand why usually people opt for private instead of gov hospital. i heard some of the case where the equipment in private hospital is less than gov hospital. in the end need private reference to gov hosp? as for the option1,2,3. what is the main different? i suppose this one is 1.1mil per year by A*A. the only different i see is the deductible? is that important and justifiable for the huge difference in premium? Private vs Government hospital is a matter of choice and convenience. There's quite a bit of difference between Option 1 and Option 2 for example: ICU days, outpatient treatment coverage. Option 1 is usually used as a complement to an existing medical coverage or in the case of limited budget the primary medical card. I encourage you to check their differences out. Option 1: Allianz MediAide https://www.allianz.com.my/mediaide Option 2: Allianz MediEssential https://www.allianz.com.my/medisafeessential Option 3: Allianz MediSafe Infinite https://www.allianz.com.my/medisafe-infinite-infinite-xtra To put it in a simple manner here, the more you pay the better the coverage is. Best, Jiansheng |

|

|

Feb 26 2019, 03:54 PM Feb 26 2019, 03:54 PM

Return to original view | Post

#40

|

Senior Member

945 posts Joined: Jun 2012 |

|

|

Topic ClosedOptions

|

| Change to: |  0.0207sec 0.0207sec

0.34 0.34

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 3rd December 2025 - 11:57 AM |