QUOTE(cscheat @ May 11 2019, 12:31 AM)

wonder when OPR reduced by 0.25%.. any impact on ASNB return?

Your note stirred Unker to activate some brain cells this morning, as Auntie n myself was debating on this exact topic some weeks back. Of course, the 2 felines sided her, angrily hissing n showing their backs at Unker when I made my points.

Anyway, as usual Auntie presented a more holistic n probably casestudy. Since Auntie won. Will just share you her major viewpoints.

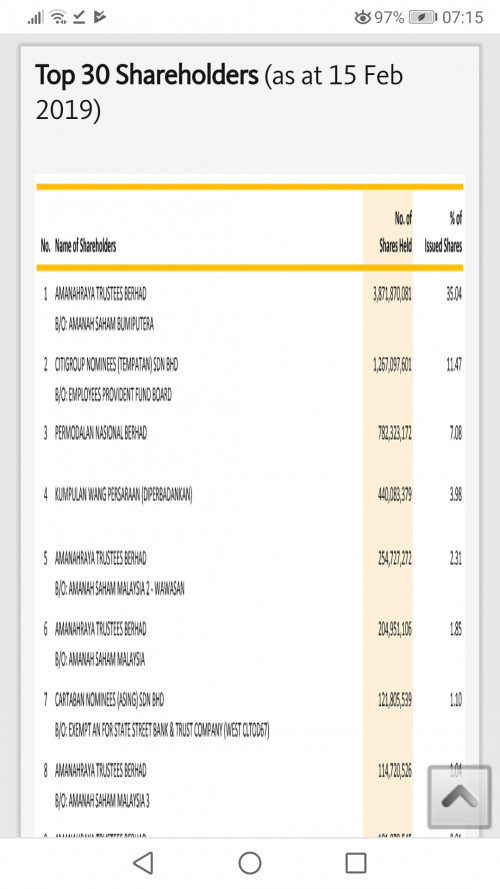

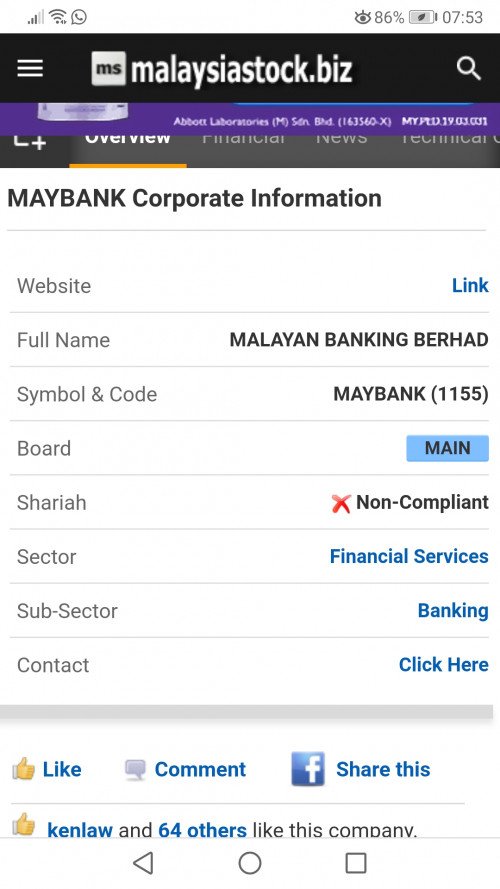

1. Shareholder structure of major KLSE counters. Refer example MBB below. Very low foreign stakeholders n retail, below 20-25%, rest is Khazanah, EPF, PNB, other retirement funds. Interestingly, different % holdings among ASB, ASM, ASW, etc.

2. Over the months, foreign stakeholders have been exiting KLSE. Apr YTD $RM2.0B. Worst within Asia Market.

3. Lower growth, 4.5% compared to last year, disinflation in Q1, slowing economy, PH stopping all major projects (now TM reversing OBOR related decision, but impact will only see 12-15 months time)

4. Worry abt Malaysia Bond thing, Auntie says wait till June to see some light... Some other things, she mention Unker wasn't concentrating, Unker won like $2m in Zynga Poker that time.

In conclusion,...zzzzz, Yawn! Auntie says expect more of the same lah. Hahaha. Zombie banks, property, infra, industrial counters. All goreng, masak n deep fried by same chefs PNB, EPF n the likes.

Don't throw stones at Unker OK? Since you asked, I felt compelled to share personal opinion.

![]() Ultimate Discussions of ASNB Fixed Price UT, Magical UT only in Malaysia

Ultimate Discussions of ASNB Fixed Price UT, Magical UT only in Malaysia

May 9 2019, 08:34 AM

May 9 2019, 08:34 AM

Quote

Quote

0.2818sec

0.2818sec

0.35

0.35

7 queries

7 queries

GZIP Disabled

GZIP Disabled