QUOTE(TheEquatorian @ May 5 2019, 04:34 PM)

I was referring to a risk article I read on a Malaysian blog -

https://mrandmrsmoney.wordpress.com/2019/04...why-it-matters/. FD is guaranteed by government for up 250k and there are offers up to 5% for new money. ASx needs to return more than 1% more to justify the additional risk - otherwise EPF is also better returns for long term.

No luck with new AS units today

Hahaha, cannot stop myself from jumping in. Auntie with family shopping Queensbay Mall, cats at the groomers. Unker gave up on fishing today. Finished all the e-papers n alt media.

Are you having some internal conflict where to invest your $. I thot its very difficult n waiting time to be included into this forum.

Even more difficult for the non-bumi to invest into ASX. Despite any doubts or what we think, the fact is $10Billion??? or so, non-bumi allocation (3 funds) already subscribed.

Risk, is valid. If PNB closes shop due to a repeat of 1mdb magnitude of mismanagement, not many places in Malaysia we can hide n RM$ will be as good as Zimbabwe or Venezuela $.

You undecided among the 3 ASX funds vs FD vs EPF vs Shares? Need to consider your age group, what's your vision n goal, Investment timeline, etc.

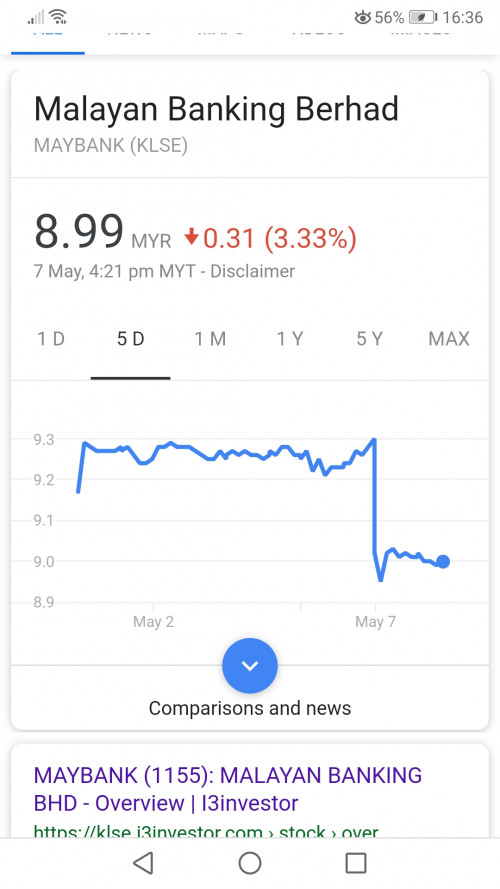

Cimb giving 5%, but only 3 months.. Lepas itu, you go hunting for next Bank promotion. OPR likely down this month, FD will follow.

Let the Elders understand what question or concerns you really have. They will share inputs n you have final decision.

Also, are u read from other bloggers, to have a wider perspective on important subject of $$$. Which other bloggers you following? Allow me to assess....

May 5 2019, 12:57 PM

May 5 2019, 12:57 PM

Quote

Quote

0.2252sec

0.2252sec

0.56

0.56

7 queries

7 queries

GZIP Disabled

GZIP Disabled