these kinda e-commerce sites usually have the same business model. burn money to get volume, then slowly reducing the benefit to buyers and sellers. if you see through the fees and charges, many which are 'waived till further notice'. once they get the volume, don't be surprised if they start to charge. in the meantime, enjoy while you can.

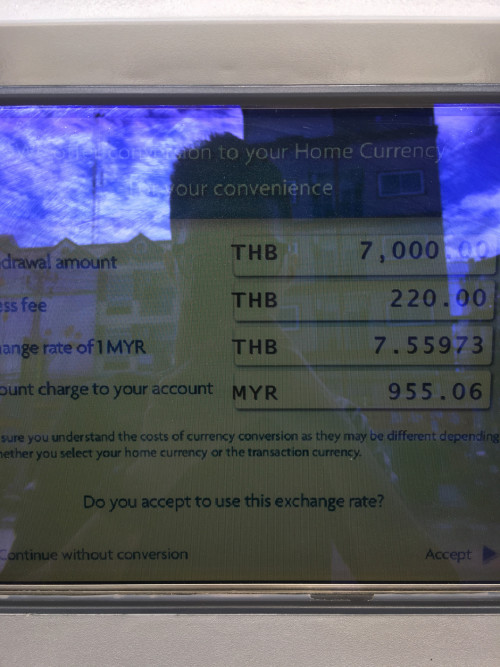

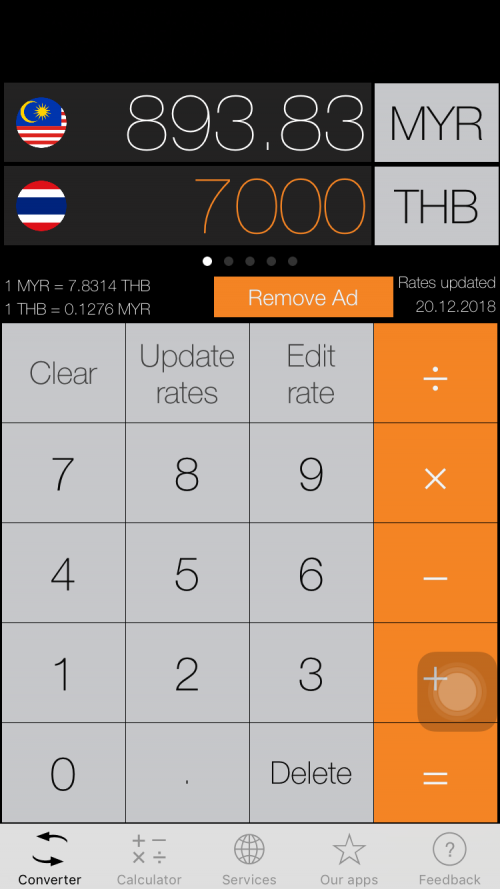

ATM Withdrawal Fee

Local: RM6.00 per transaction

Overseas: RM10.00 per transaction or 2% of withdrawal amount, whichever is higher

(NOTE: For overseas, only RM10.00 will be charged until further notice)

Currency Conversion Fee

(Applied when the purchase is effected in currencies other than Malaysian Ringgit)

1% + network charges

(NOTE: Only charges by the network will be applied until further notice)

Cross-Border Transaction Fee

(Applied when the purchase is through merchant acquired outside of Malaysia but charged in Malaysian Ringgit)

Waived until further notice

https://www.bigpayme.com/fees-chargesJust hope that BNM will give them the go ahead to do micro-lending with less onerous term. This is where they will get the return once the user base become big enough.

From the BFM interview with BigPay CEO last time, BNM still capped the interest rate max at 18% p.a. This means that they can't do very short-term micro-loan that charge with 1% with 1-2 weeks of repayment, for example.

Nov 28 2018, 12:51 AM

Nov 28 2018, 12:51 AM

Quote

Quote

0.0537sec

0.0537sec

0.68

0.68

7 queries

7 queries

GZIP Disabled

GZIP Disabled