QUOTE(Barricade @ Feb 28 2019, 10:20 AM)

So? It's something like cash advance withdrawal. What's the issue? It's withdrawing from CC to cash, with cheaper withdrawal fees. That's all. Please do not use the word "money laundering" like you know what you're talking about. The source of the funds is from CC. Is that dirty fund? It's provided by the bank LMFAO

Not sure if you understand my example or not. And also don't know why you need to be SO defensive about it in a public forum. We know there's nothing illegal in topping up BigPay and then do ATM withdrawal to game the CC reward system. But obviously this will not last forever. Defending it here won't prevent the inevitable outcome

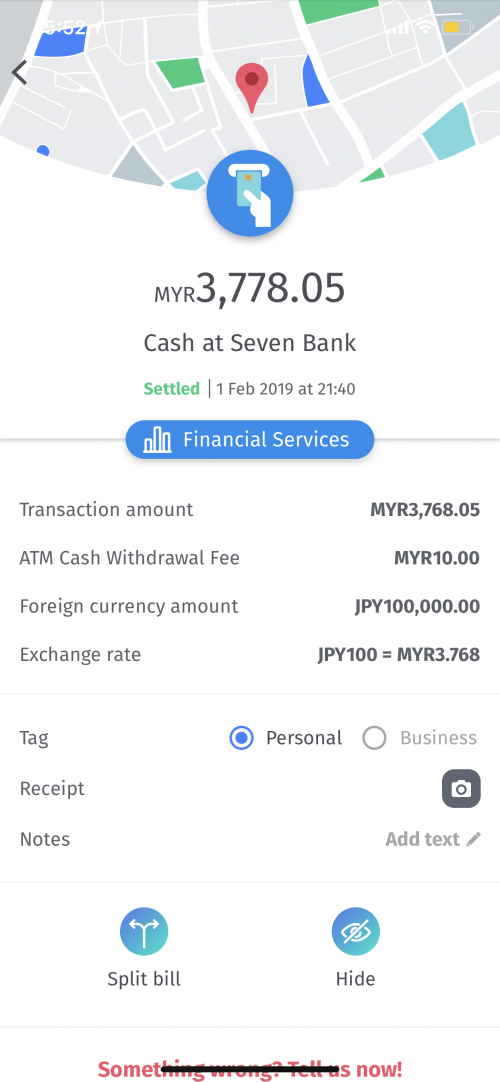

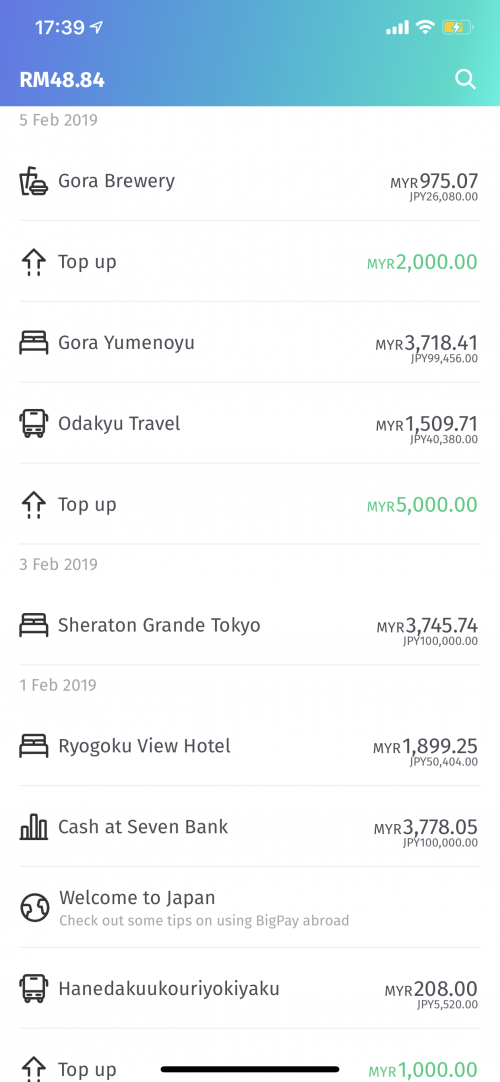

Like I said, BigPay can be less strict because your source of fund is electronically traceable. Only CC or bank transfer, no CDM. But doesn't mean they can just sit on their ass and not need to have some sort of monitoring to detect unusual activity and report to BNM. Anyway, like some forummers pointed out, BigPay will just call you, interview you and ask to show some document as a proof if necessary. Don't need to worry about getting ban/suspended as long as you can give reasonable reason and show document proof.

Real case - in the start when there's is no CC topup limit, my friend did huge $$$ amount with BigPay in 2-3 months (CC points earned enough to redeem flight to London). BP staff called him up and ask for certain documents (salary slips i think). Till this day, he still have his BP card and still churning with the RM10k limit.

That's BP part.

Now comes the bank part. On bank side, they will only see "RMxxxx cash is deposited via CDM" right, they won't know the source of the cash, right?

So, depending on what you do, it could trigger a red flag for potential money laundering activities, and then an investigation/report might need to be done and filed to BNM as part of the process. Obviously, big sum money transfer is already by default need to be reported.

In money laundering, there is a process called 'structuring' - read up on that. This is why small amount transactions can be flagged as well. 1 BigPay card to topup, withdraw, and deposit RM9-10k cash with the CDM 3-4 times might seem 'little' to trigger something - but what if it's more than 1 card feeding deposit into an account?. After-all, everyone can apply for BP - be it for their son, daughter, uncle, auntie, grandma, grandpa

This post has been edited by tohff7: Feb 28 2019, 12:13 PM

This post has been edited by tohff7: Feb 28 2019, 12:13 PM

Feb 12 2019, 09:27 PM

Feb 12 2019, 09:27 PM

Quote

Quote

0.3685sec

0.3685sec

0.43

0.43

7 queries

7 queries

GZIP Disabled

GZIP Disabled