my case

my appendix burst last sunday 8pm as im screaming in agony. Go clinic, get letter to go hospital. Instead of going to gov i went to KPJ Hospital. Went to emergency section, showed my insurance card. The hospital and Insurance (AIA) settle sendiri while i just goyang kaki screaming in emergency bed. Within 1 hour everything settle, room ready, got myself a single room ( very gooding ). Room itself cost 185 pernight. Operate at 9am settle at 12pm Monday

I am writing this post while recovering on my comfortable single bed hospital room.

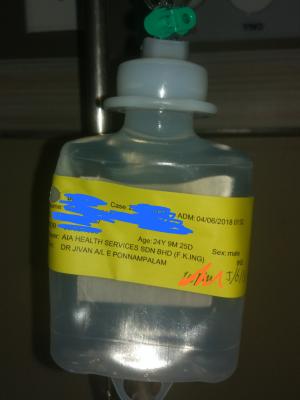

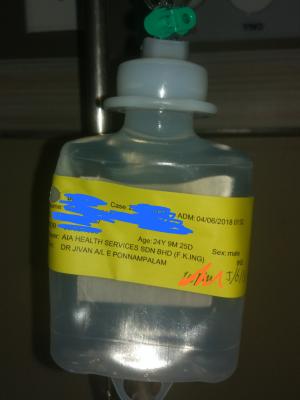

Proof of my admission, Check attachment,

this is the tag from my IV bag

check the tag 4/6/2018

Payer : AIA

other detail censored for obvious reason

I think the whole thing would cost me RM7 to 10K. Obviously i wont be paying that much cuz im insured

Bare in mind that im reasonably healthy 25 years old, Appendix burst out of FUCKING NOWHERE!!,

Night before i was healthy af, chilling with homies and stuff, next day burst

This post has been edited by ZuloPhobia: Jun 6 2018, 01:38 AM Attached thumbnail(s)

Jun 5 2018, 11:44 PM

Jun 5 2018, 11:44 PM

Quote

Quote

0.0479sec

0.0479sec

0.64

0.64

8 queries

8 queries

GZIP Disabled

GZIP Disabled