QUOTE(izwanikhsan @ Sep 26 2025, 02:32 PM)

Astro’s 2Q net profit falls 70% amid decline in subscription, advertising revenue https://www.facebook.com/theedgemalaysia/po...js3cg2Tha3hFvml

https://theedgemalaysia.com/node/771607

» Click to show Spoiler - click again to hide... «

QUOTE

KUALA LUMPUR (Sept 25): Astro Malaysia Holdings Bhd (KL:ASTRO) said its net profit fell 70% in the recently-ended quarter as subscription and advertising revenue declined, while costs rose.

Net profit for the three months ended July 31, 2025 (2QFY2026) was RM16.39 million compared to RM54.71 million over the same quarter last year, the pay-television company said in an exchange filing. Content costs rose and marketing expenses were also higher.

Revenue for the quarter fell 13% year-on-year (y-o-y) to RM683.21 million as sales of programming rights were also lower. The average revenue per user at its mainstay television business fell RM3.5 to RM96.3 per month during the quarter.

“Given the challenging environment, the group continues to maintain a cautious outlook, carefully monitoring business conditions and ensuring effective cost discipline,” Astro said.

Legacy media companies, such as Astro, have been under pressure from a slump in advertising expenditure as brands shift their spending to online and social media where consumers spend most of their time.

Advertising revenue at Astro, including its radio segment, has softened both on a y-o-y and quarter-on-quarter basis. Astro’s radio segment also saw a decline in weekly listeners to 16.3 million in 2QFY2026.

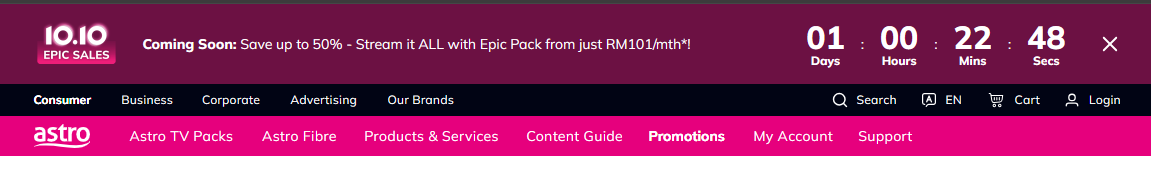

Still, “this quarter has given us more reasons to be encouraged”, chief executive Euan Smith said in a statement. “In August, we also recorded our first positive Pay-TV net add since 2018, a meaningful gain that signals all the hard work is bearing fruit.”

He noted that customers are responding positively to its cheaper packages as well as its newer Ultra and Ulti Boxes, while its fibre service saw net additions in the quarter.

For the first half of FY2026, the increase in costs, coupled with a decrease in revenue from subscription, advertising and sales of programming rights, more than halved its net profit to RM29.87 million from the same six months a year earlier.

Six-month revenue totalled RM1.39 billion, an 11% decline when compared to the same two quarters last year. However, the company grew the number of connected set-top boxes by 5% to 869,000 monthly active users.

“We will keep on growing customers, strengthening the adjacent businesses, and reducing legacy costs,” Smith added.

No dividend was declared for the quarter under review.

Shares of Astro Malaysia closed unchanged at 14 sen on Thursday, valuing the company at about RM680 million.

Net profit for the three months ended July 31, 2025 (2QFY2026) was RM16.39 million compared to RM54.71 million over the same quarter last year, the pay-television company said in an exchange filing. Content costs rose and marketing expenses were also higher.

Revenue for the quarter fell 13% year-on-year (y-o-y) to RM683.21 million as sales of programming rights were also lower. The average revenue per user at its mainstay television business fell RM3.5 to RM96.3 per month during the quarter.

“Given the challenging environment, the group continues to maintain a cautious outlook, carefully monitoring business conditions and ensuring effective cost discipline,” Astro said.

Legacy media companies, such as Astro, have been under pressure from a slump in advertising expenditure as brands shift their spending to online and social media where consumers spend most of their time.

Advertising revenue at Astro, including its radio segment, has softened both on a y-o-y and quarter-on-quarter basis. Astro’s radio segment also saw a decline in weekly listeners to 16.3 million in 2QFY2026.

Still, “this quarter has given us more reasons to be encouraged”, chief executive Euan Smith said in a statement. “In August, we also recorded our first positive Pay-TV net add since 2018, a meaningful gain that signals all the hard work is bearing fruit.”

He noted that customers are responding positively to its cheaper packages as well as its newer Ultra and Ulti Boxes, while its fibre service saw net additions in the quarter.

For the first half of FY2026, the increase in costs, coupled with a decrease in revenue from subscription, advertising and sales of programming rights, more than halved its net profit to RM29.87 million from the same six months a year earlier.

Six-month revenue totalled RM1.39 billion, an 11% decline when compared to the same two quarters last year. However, the company grew the number of connected set-top boxes by 5% to 869,000 monthly active users.

“We will keep on growing customers, strengthening the adjacent businesses, and reducing legacy costs,” Smith added.

No dividend was declared for the quarter under review.

Shares of Astro Malaysia closed unchanged at 14 sen on Thursday, valuing the company at about RM680 million.

Sep 27 2025, 12:13 AM

Sep 27 2025, 12:13 AM

Quote

Quote

0.0489sec

0.0489sec

0.29

0.29

7 queries

7 queries

GZIP Disabled

GZIP Disabled