LOL! Malaysia Boleh

Everyone can rilek now.

KUALA LUMPUR (Nov 20): In an apparent U-turn over a freeze on approvals for luxury property developments, Putrajaya on Monday (Nov 20) said the green light for such projects will still be given but on a case-by-case basis.

Works Minister Datuk Fadillah Yusof said although the decision was taken by the Cabinet following a recent report by Malaysia’s central bank on an oversupply of high-end properties, the freeze does not involve all projects.

“This is not a blanket stop order… The government is (instead) sending a message to developers to study whether there will be (sufficient demand for a project) before they decide (to proceed),” he said.

“If you sell RM1 million (S$326,000) condo (units) located in (unattractive) areas, it may not attract buyers. But if you sell RM4 million condominiums around the Kuala Lumpur Convention Centre (KLCC) area, you will definitely get buyers, especially among expatriates,” he said in reference to the prime real estate area in the middle of the capital city.

Mr Fadhillah believed being selective in approving high-end real estate developments will help address the country’s property glut in the luxury segment.

His comments come a day after his cabinet colleague, Second Finance Minister Datuk Seri Johari Abdul Ghani, said Putrajaya has temporarily frozen approvals for luxury property developments since Nov 1 due to a glut in the sector.

The temporary freeze affects shopping malls as well as commercial and residential developments which sell units at RM1 million (S$326,000) and above.

“This will be in place until we clear all the excess supply,” said Mr Johari on Sunday.

“There is a stark imbalance between supply and demand and we have to review the strategy in terms of real estate development as we do not want such situation to adversely affect the economy.”

In its report, the central bank warned that Malaysia’s property market is facing an oversupply of non-affordable homes and idle commercial space, while demand for affordable housing is not being met.

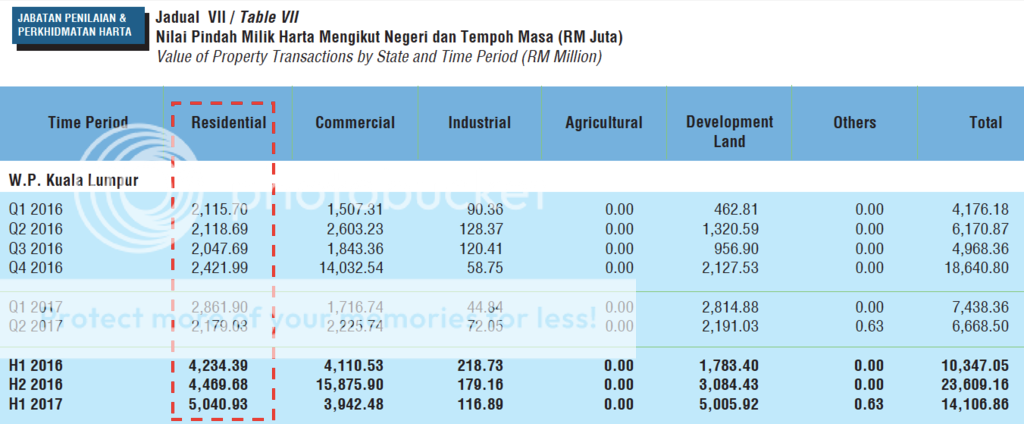

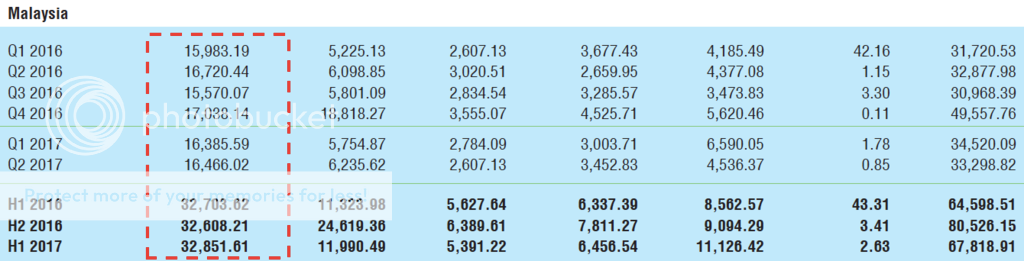

There were 130,690 unsold units at the end of March this year, with 83% priced at above RM250,000. Sixty one percent of the unsold properties comprise of high-rise apartments.

The central bank pointed out Johor has the largest share of unsold residential units, followed by Selangor, Kuala Lumpur and Penang.

“This situation could worsen if the current supply-demand conditions persist. Within the country, Johor is poised to have the largest property market imbalances (highest number of unsold residential properties and potentially the largest excess supply of retail space).

“As such, it is timely for all parties to act now to mitigate any potential risks to macroeconomic and financial stability,” online news portal Malaysiakini quoted the central bank as saying.

Last Friday (Nov 17) central bank governor Tan Sri Muhammad Ibrahim said imbalances in the property market posed significant risks to the country’s economy.

Allaying concerns, Mr Johari said the government will continue to drive the development of affordable homes, specifically those priced below RM300,000 each, which were in short supply.

He said demand for affordable homes stood at 48% while supply is only at 28%.

Following the central bank’s report, the Johor state government is considering to relax restrictions on foreign home ownership to reduce the glut of unsold properties in the state.

Currently, foreigners can only buy houses priced at over RM1 million.The southern state is also mulling giving incentives to developers to encourage them to build properties between RM150,000 and RM400,000, said housing and local government executive councillor Md Jais Sarday.

“Maybe we can look at relaxing the requirements based on the size of the houses. We need to come up with a mechanism to address these issues,” The Star Online quoted him as saying.

Source:

http://www.theedgemarkets.com/article/utur...ls-not-absolute

Nov 20 2017, 12:29 PM

Nov 20 2017, 12:29 PM

Quote

Quote

0.0349sec

0.0349sec

0.49

0.49

6 queries

6 queries

GZIP Disabled

GZIP Disabled