QUOTE(feekle @ Jul 24 2017, 08:37 PM)

hence SKPB changed their name to Sapura Energy kot. heheheheheOil & Gas Careers V12 - Upstream & Downstream, Market still slump, slow, snail pace...

Oil & Gas Careers V12 - Upstream & Downstream, Market still slump, slow, snail pace...

|

|

Jul 25 2017, 02:52 PM Jul 25 2017, 02:52 PM

|

Senior Member

787 posts Joined: Aug 2009 From: Kuala Lumpur, Malaysia |

|

|

|

|

|

|

Jul 25 2017, 04:03 PM Jul 25 2017, 04:03 PM

|

Senior Member

1,551 posts Joined: May 2009 |

|

|

|

Jul 25 2017, 05:49 PM Jul 25 2017, 05:49 PM

Show posts by this member only | IPv6 | Post

#63

|

Senior Member

1,922 posts Joined: Apr 2009 From: Constellation Cygnus |

|

|

|

Jul 25 2017, 06:07 PM Jul 25 2017, 06:07 PM

|

Senior Member

787 posts Joined: Aug 2009 From: Kuala Lumpur, Malaysia |

|

|

|

Jul 26 2017, 03:09 AM Jul 26 2017, 03:09 AM

|

Senior Member

637 posts Joined: Feb 2008 |

|

|

|

Jul 26 2017, 09:12 AM Jul 26 2017, 09:12 AM

|

Senior Member

1,170 posts Joined: Mar 2013 |

|

|

|

|

|

|

Jul 26 2017, 09:47 AM Jul 26 2017, 09:47 AM

|

Junior Member

265 posts Joined: May 2016 |

|

|

|

Jul 26 2017, 09:53 AM Jul 26 2017, 09:53 AM

|

Senior Member

3,491 posts Joined: Jan 2013 |

Malaysian state-owned energy company Petronas will not proceed with a proposed US$29 billion (RM124 billion) liquefied natural gas (LNG) project in western Canada due to weak global prices, dealing a blow to Canada's ambitions to become a global LNG player.

While Petronas' decision is a blow to the regional economy, industry observers said the move was widely expected given years of delay to the huge project near Prince Rupert in the north of the province of British Columbia. It is also the latest setback for the country's energy industry, already bruised by international oil firms selling off around US$23 billion in Canadian energy assets this year alone. Pacific NorthWest LNG was meant to produce 12 megatonnes per year and spur further development of British Columbia's Montney natural gas play in the northeast of the province, Canada's largest shale play. "We have a window of opportunity to develop B.C.'s LNG industry, but the next several years will be critical," said Gillian Robinson, spokeswoman for the BC LNG Alliance. "We risk losing thousands of jobs and billions of dollars in benefits if B.C. does not have diversified access to markets." Pacific NorthWest LNG received approval from the Canadian government last year, but Petronas, which has been going through significant cost-cutting, delayed its final investment decision. The project would have been Petronas' biggest foreign investment and was seen as a sign of Malaysia's global energy ambitions. The US$29 billion price tag included around US$9 billion for the export terminal, US$5 billion in pipelines, the US$4.4 billion Petronas paid for Progress Energy and its natural gas assets and around US$1.6 billion a year expected to be spent on producing natural gas. TransCanada Corp, which was contracted to build the pipeline connecting gas wells to the LNG terminal, said it will be reimbursed for costs associated with the project. It had spent US$400 million as of April, spokesman Shawn Howard said. Petronas had planned to produce its own gas to supply Pacific NorthWest LNG, rather than buying it from other producers, but no LNG demand means firms like Painted Pony Petroleum and Seven Generations Energy will continue to see low gas prices, analysts said. "The demise of the LNG industry in Western Canada means that Western Canadian gas will largely remain captive to the oversupplied North American market," BMO Capital Markets analyst Randy Ollenberger said in a note. Of more than a dozen projects proposed for British Columbia, only the US$1.3 billion privately held Woodfibre project has so far been given the green light by its developers. Last July Royal Dutch Shell and partners pushed back a final investment decision on their proposed LNG Canada project, citing global industry challenges. Michelle Mungall, British Columbia's energy minister, said she will be calling other LNG companies to reassure them her government is ready to work with them, but B.C. Green Party leader Andrew Weaver released a statement saying the future does not lie in "chasing the fossil fuel economy." The ruling New Democratic Party, which formally took power this month, is backed by the environmentalist Green Party. Its rise has fuelled uncertainty about energy development in the province. A spokesman for Canada's Natural Resources Minister Jim Carr, said Petronas' move was a business decision. Petronas and partners will continue to develop natural gas assets in Canada, Anuar Taib, chairperson of the board of Pacific NorthWest LNG, said in a statement. "We are disappointed that the extremely challenging environment brought about by the prolonged depressed prices and shifts in the energy industry have led us to this decision," Anuar said. |

|

|

Jul 26 2017, 06:45 PM Jul 26 2017, 06:45 PM

|

Junior Member

420 posts Joined: Feb 2007 |

not so good news....

QUOTE New diesel and petrol vehicles to be banned from 2040 in UK http://www.bbc.com/news/uk-40723581 France to ban sales of petrol and diesel cars by 2040 https://www.theguardian.com/business/2017/j...el-macron-volvo |

|

|

Jul 26 2017, 06:49 PM Jul 26 2017, 06:49 PM

|

Junior Member

420 posts Joined: Feb 2007 |

|

|

|

Jul 26 2017, 10:49 PM Jul 26 2017, 10:49 PM

|

Junior Member

639 posts Joined: Oct 2007 |

anyone in PCASB TA? U cant miss me, I am with the purging team haha

|

|

|

Jul 27 2017, 10:58 AM Jul 27 2017, 10:58 AM

|

Junior Member

316 posts Joined: Apr 2010 |

|

|

|

Jul 27 2017, 11:20 AM Jul 27 2017, 11:20 AM

|

Junior Member

103 posts Joined: Jun 2007 |

Not a good news. there will be more squeezing to contractor

QUOTE(ZZMsia @ Jul 26 2017, 09:53 AM) Malaysian state-owned energy company Petronas will not proceed with a proposed US$29 billion (RM124 billion) liquefied natural gas (LNG) project in western Canada due to weak global prices, dealing a blow to Canada's ambitions to become a global LNG player. While Petronas' decision is a blow to the regional economy, industry observers said the move was widely expected given years of delay to the huge project near Prince Rupert in the north of the province of British Columbia. It is also the latest setback for the country's energy industry, already bruised by international oil firms selling off around US$23 billion in Canadian energy assets this year alone. Pacific NorthWest LNG was meant to produce 12 megatonnes per year and spur further development of British Columbia's Montney natural gas play in the northeast of the province, Canada's largest shale play. "We have a window of opportunity to develop B.C.'s LNG industry, but the next several years will be critical," said Gillian Robinson, spokeswoman for the BC LNG Alliance. "We risk losing thousands of jobs and billions of dollars in benefits if B.C. does not have diversified access to markets." Pacific NorthWest LNG received approval from the Canadian government last year, but Petronas, which has been going through significant cost-cutting, delayed its final investment decision. The project would have been Petronas' biggest foreign investment and was seen as a sign of Malaysia's global energy ambitions. The US$29 billion price tag included around US$9 billion for the export terminal, US$5 billion in pipelines, the US$4.4 billion Petronas paid for Progress Energy and its natural gas assets and around US$1.6 billion a year expected to be spent on producing natural gas. TransCanada Corp, which was contracted to build the pipeline connecting gas wells to the LNG terminal, said it will be reimbursed for costs associated with the project. It had spent US$400 million as of April, spokesman Shawn Howard said. Petronas had planned to produce its own gas to supply Pacific NorthWest LNG, rather than buying it from other producers, but no LNG demand means firms like Painted Pony Petroleum and Seven Generations Energy will continue to see low gas prices, analysts said. "The demise of the LNG industry in Western Canada means that Western Canadian gas will largely remain captive to the oversupplied North American market," BMO Capital Markets analyst Randy Ollenberger said in a note. Of more than a dozen projects proposed for British Columbia, only the US$1.3 billion privately held Woodfibre project has so far been given the green light by its developers. Last July Royal Dutch Shell and partners pushed back a final investment decision on their proposed LNG Canada project, citing global industry challenges. Michelle Mungall, British Columbia's energy minister, said she will be calling other LNG companies to reassure them her government is ready to work with them, but B.C. Green Party leader Andrew Weaver released a statement saying the future does not lie in "chasing the fossil fuel economy." The ruling New Democratic Party, which formally took power this month, is backed by the environmentalist Green Party. Its rise has fuelled uncertainty about energy development in the province. A spokesman for Canada's Natural Resources Minister Jim Carr, said Petronas' move was a business decision. Petronas and partners will continue to develop natural gas assets in Canada, Anuar Taib, chairperson of the board of Pacific NorthWest LNG, said in a statement. "We are disappointed that the extremely challenging environment brought about by the prolonged depressed prices and shifts in the energy industry have led us to this decision," Anuar said. |

|

|

|

|

|

Jul 27 2017, 02:17 PM Jul 27 2017, 02:17 PM

|

Senior Member

5,464 posts Joined: Mar 2005 |

|

|

|

Jul 27 2017, 09:55 PM Jul 27 2017, 09:55 PM

|

Junior Member

429 posts Joined: Apr 2008 |

KUALA LUMPUR: Petroliam Nasional Bhd (Petronas) has disposed of a 10% stake in Petronas LNG 9 Sdn Bhd (PL9SB) in Malaysia for US$500mil (RM2.14bil) to Thailand's national company and partner.

According to a statement by Thailand's PTT Exploration and Production Public Company Ltd (PTTEP) to the Thailand Stock Exchange on Thursday, it said that its subsidiary's JV had acquired the stake. PL9SB owns the ninth LNG liquefaction train and other related associated facilities located in the Petronas LNG complex in Bintulu, Sarawak with a production capacity of 3.6 million tonnes per annum of LNG. The commercial operations started on Jan 1, 2017. “The acquisition of equity interest in PL9SB is part of PTTEP’s strategy to synergise with PTT in the integrated LNG value chain to meet the country’s growing energy demand,” PTTEP said. The stake was acquired by PTTGL Investment Ltd (PTTGLI) – a company set up PTTEP's subsidiary PTT Global LNG Company Limited (PTTGL). PTTGL is a subsidiary of PTTEP, which is a 50:50 joint venture between PTTEP and PTT plc. PTTEP said on Thursday PTTGLI had signed the share sale and purchase agreement with Petronas to acquire the 10% equity stake in PL9SB. “The total consideration of the acquisition is approximately US$500mil of which PTTEP’s portion is approximately US$250mil,” it said. Then expected closing date would be within September. “With the entrance of PTTGLI, the share proportion in PL9SB shall stand at 80%, 10% and 10% owned respectively by Petronas, JXTG Nippon Oil & Energy Corporation (through its subsidiary, Nippon Oil Finance (Netherlands) B.V.) and PTTGLI. PTTEP said the US$500mil acquisition cost will be funded by 40:60 debt and equity. |

|

|

Jul 27 2017, 11:47 PM Jul 27 2017, 11:47 PM

|

Junior Member

420 posts Joined: Feb 2007 |

QUOTE(engrfeez @ Jul 27 2017, 10:58 AM) Shell's CEO predicts that the future is Gas since it's the cleanest form of fossil energy... that's why they producing more Gas than oil now.... Shell's CEO ditches his diesel powered S500 for a new S500e and the group CFO is driving a BMW I3e... so, when an O&G companies top executive also driving electrical cars; it already telling u something.. |

|

|

Jul 28 2017, 10:09 AM Jul 28 2017, 10:09 AM

|

Senior Member

787 posts Joined: Aug 2009 From: Kuala Lumpur, Malaysia |

QUOTE(sukhoi35mk @ Jul 27 2017, 11:47 PM) Shell's CEO predicts that the future is Gas since it's the cleanest form of fossil energy... that's why they producing more Gas than oil now.... Shell's CEO ditches his diesel powered S500 for a new S500e and the group CFO is driving a BMW I3e... so, when an O&G companies top executive also driving electrical cars; it already telling u something.. hibiscus is taking over shell's asset i heard. |

|

|

Jul 28 2017, 11:23 AM Jul 28 2017, 11:23 AM

|

Junior Member

316 posts Joined: Apr 2010 |

QUOTE(sukhoi35mk @ Jul 27 2017, 11:47 PM) Shell's CEO predicts that the future is Gas since it's the cleanest form of fossil energy... that's why they producing more Gas than oil now.... Shell's CEO ditches his diesel powered S500 for a new S500e and the group CFO is driving a BMW I3e... so, when an O&G companies top executive also driving electrical cars; it already telling u something.. Yes, if not mistaken I saw one presentation from the o&g operator mentioned the trend of world is changing now. there will be more gas to explore rather than oil.However as our side, it still depends between supply and demand. where there is the demand, our business is going well. Otherwise it will be like now where no demand plus the shale oil replacement become more surplus to oil |

|

|

Jul 28 2017, 11:31 AM Jul 28 2017, 11:31 AM

|

Junior Member

420 posts Joined: Feb 2007 |

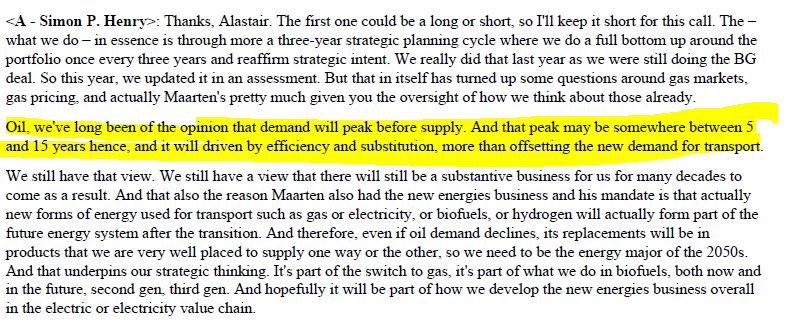

Shell predicted that Oil consumption will peak in 5 to 15 yrs then the demand will going all the way down due to new technology and new transportation system since more and more country will ban fossil fuel vehicles..... oil supply getting more thanks to shale O&G yet more countries moving away from it...

from retired Shell CFO..  |

|

|

Jul 31 2017, 10:17 AM Jul 31 2017, 10:17 AM

|

Junior Member

206 posts Joined: Jun 2016 |

|

|

Topic ClosedOptions

|

| Change to: |  0.0393sec 0.0393sec

0.34 0.34

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 27th November 2025 - 06:12 PM |