QUOTE(hehe86 @ May 31 2017, 07:12 PM)

I cabut because it breaks 3.30 and the 23rd May volume dunno how to interpret. I cabut that time also QR not yet out. After market only it released

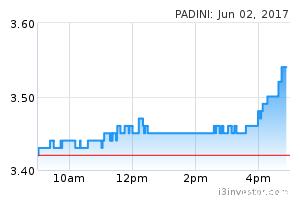

Spiked up again to 3.54 before close

BWC

|

|

Jun 2 2017, 05:21 PM Jun 2 2017, 05:21 PM

|

Junior Member

284 posts Joined: Nov 2016 |

|

|

|

|

|

|

Jun 2 2017, 05:32 PM Jun 2 2017, 05:32 PM

|

Junior Member

284 posts Joined: Nov 2016 |

Trend reversal for karex? Looks like bullish harami QUOTE KUALA LUMPUR (June 2): The world's largest condom maker Karex Bhd saw its share price rebound today on bargain hunting after two consecutive days of falling due to the stock being punished for its weaker financial results for the third quarter ended March 31, 2017 (3QFY17). This post has been edited by Coup De Grace: Jun 2 2017, 05:40 PM |

|

|

Jun 2 2017, 07:58 PM Jun 2 2017, 07:58 PM

|

Senior Member

1,497 posts Joined: Dec 2005 |

|

|

|

Jun 2 2017, 08:04 PM Jun 2 2017, 08:04 PM

|

Senior Member

1,497 posts Joined: Dec 2005 |

Dialog macam ascending triangle wo

|

|

|

Jun 2 2017, 09:41 PM Jun 2 2017, 09:41 PM

Show posts by this member only | IPv6 | Post

#805

|

Senior Member

6,779 posts Joined: Jan 2009 From: SEGI Heaven |

V shape style ar

|

|

|

Jun 2 2017, 09:58 PM Jun 2 2017, 09:58 PM

|

Senior Member

1,497 posts Joined: Dec 2005 |

Ada V ka tak nampak la

|

|

|

|

|

|

Jun 3 2017, 11:24 PM Jun 3 2017, 11:24 PM

Show posts by this member only | IPv6 | Post

#807

|

Senior Member

6,779 posts Joined: Jan 2009 From: SEGI Heaven |

|

|

|

Jun 5 2017, 09:05 PM Jun 5 2017, 09:05 PM

|

Junior Member

284 posts Joined: Nov 2016 |

|

|

|

Jun 5 2017, 11:00 PM Jun 5 2017, 11:00 PM

|

Senior Member

5,569 posts Joined: Aug 2011 |

I love words like harami, doji, sinashobori cloud (or whatever it is)...haha.

|

|

|

Jun 6 2017, 08:48 AM Jun 6 2017, 08:48 AM

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(Coup De Grace @ Jun 5 2017, 09:05 PM) Frankly I don't understand you. Here's why..... 1. What's the 2 vertical line (that has no value) which you have drawn across? 2. Just the other day you wrote: QUOTE Soon will go to 0 cents I think profit growth is what matter. Once the growth ends like Karex, it is time to cabut If time to cabut, why still Karex? Karex is sitting on a 5 consecutive quarters of decline. At this rate, it's trading on a potential yearly EPS of less than 3 sen. We are looking at a stock trading with a pe > 60. With a clear decline in profits, how many other people you think might want to chase the stock up? ( I hear people investing in private companies that are making more and more money but to invest in a company that is losing more and more money? The problem, I understand, in any market, ANY stocks can be fried. ANY. And sometimes, these big name stocks sound sexy. But I reckon it's better you need to understand the risk trading such stocks. 3. Look at the current type of stocks you are/had focused on. Jatuh air stocks. Ok, Karex did well the past 2 days. But your current system picked stocks like Xingquan. When you posted on the 2nd Xingquan closed at 0.045. 2 days later it closed at 0.02 sen. Here's another issue. Such penny stocks. It's extremely hard to line up your sell bids because the Q is usually large in numbers. The only way to sell is that you need to give in and sell to the buyers bid. If the trade buy/sell bid is 1.5 sen and 2 sen, do take into consideration the extra huge losses you have to endure if you were forced to sell at 1.5 sen. So in such trading system, your stock selection focus on stocks allowed you to gain a 20 sen gain on Karex (assuming you got in at 1.67 and sold at 1.87 sen) A 11.97% loss. But in the same system, your stock selection also focused on stock that could lose 2 sen (assuming you buy at 0.045 and sold at 0.02 sen). A loss of 55%! Your trading system has a potential to lose more than you gain! And usually all it takes is one BIG BAD MISTAKE to wipe everything away! So caveat. Ever think of it in this way? Trade wisely dude... always. This post has been edited by Boon3: Jun 6 2017, 08:49 AM |

|

|

Jun 6 2017, 09:22 AM Jun 6 2017, 09:22 AM

|

Junior Member

284 posts Joined: Nov 2016 |

Just papertrading these stocks with my system. These jatuh air stocks got my attention lately so testing if my system can make money from them.

For me, the line below is cut loss, and the line above is buy in after the bullish harami pattern which indicates a trend reversal

Personally, I prefer to trade on longer term stocks with better fundamentals QUOTE(Boon3 @ Jun 6 2017, 08:48 AM) Frankly I don't understand you. Here's why..... 1. What's the 2 vertical line (that has no value) which you have drawn across? 2. Just the other day you wrote: If time to cabut, why still Karex? Karex is sitting on a 5 consecutive quarters of decline. At this rate, it's trading on a potential yearly EPS of less than 3 sen. We are looking at a stock trading with a pe > 60. With a clear decline in profits, how many other people you think might want to chase the stock up? ( I hear people investing in private companies that are making more and more money but to invest in a company that is losing more and more money? The problem, I understand, in any market, ANY stocks can be fried. ANY. And sometimes, these big name stocks sound sexy. But I reckon it's better you need to understand the risk trading such stocks. 3. Look at the current type of stocks you are/had focused on. Jatuh air stocks. Ok, Karex did well the past 2 days. But your current system picked stocks like Xingquan. When you posted on the 2nd Xingquan closed at 0.045. 2 days later it closed at 0.02 sen. Here's another issue. Such penny stocks. It's extremely hard to line up your sell bids because the Q is usually large in numbers. The only way to sell is that you need to give in and sell to the buyers bid. If the trade buy/sell bid is 1.5 sen and 2 sen, do take into consideration the extra huge losses you have to endure if you were forced to sell at 1.5 sen. So in such trading system, your stock selection focus on stocks allowed you to gain a 20 sen gain on Karex (assuming you got in at 1.67 and sold at 1.87 sen) A 11.97% loss. But in the same system, your stock selection also focused on stock that could lose 2 sen (assuming you buy at 0.045 and sold at 0.02 sen). A loss of 55%! Your trading system has a potential to lose more than you gain! And usually all it takes is one BIG BAD MISTAKE to wipe everything away! So caveat. Ever think of it in this way? Trade wisely dude... always. |

|

|

Jun 6 2017, 09:52 AM Jun 6 2017, 09:52 AM

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(Coup De Grace @ Jun 6 2017, 09:22 AM) Just papertrading these stocks with my system. These jatuh air stocks got my attention lately so testing if my system can make money from them. Yes, of course I understand your intention. However, my point to you is that such system tends to generates more risks.For me, the line below is cut loss, and the line above is buy in after the bullish harami pattern which indicates a trend reversal

Personally, I prefer to trade on longer term stocks with better fundamentals Leave charts out. Think for a moment..... Think about the system you are trying to develop. Ok? Now ask yourself.... why do we have such cases? why do we have such cases where stocks suddenly plunges? And when we scalp of the bottom in such scenarios, we are challenging the market that they got it wrong. Yes? Ever think of the flip side? A stock just broke UP STRONGLY instead of breaking down. They go on a 2 or 3 day tear. Creating them long candles. Now would you want to do the opposite by shorting? Yes, an understandable practice cos the stocks could consolidate and perhaps after 2 or 3 days of consolidation or maybe more, the stock would resume its uptrend again. Now the consolidation phase. Sometimes it is short. Sometimes there isn't any meat (hope you understand this).... Agree? If you can understand the risk in shorting in such situations, you would understand the risks in betting for the reversal in a plunging stock. Stocks generally do not fall without a reason. 1. Karex. The profits is CLEARLY going down the drain. 2. Xingquan. DO study the history la. It's a bloody joke. Understand the fuss against Chinese stocks. And when these Chinese stocks can't even produce a financial statement, understand the implication la. 3. Parkson. Ahem. Big name retail company but so what. Look at the books. Look at the numbers. Malaysia losing money. China losing money. It's a bloody joke. 4. AAX and AirAsia. Do read again the earlier postings. 5. Poweroot and Oldtown. Do they deserve the high valuations that they were trading earlier? Several real time postings made last time before. Do search back my postings on SKPet. The warnings I gave on chasing the OnG blue chip stock. The stock fell from 5. How much capital has one got to average all the way down? Vivocom. The 3 billion stock. See how it fell. Xingquan. Posted on it when it was 1++ Parkson. Posted on it when it was 2++ Take care. |

|

|

Jun 6 2017, 12:17 PM Jun 6 2017, 12:17 PM

|

Junior Member

284 posts Joined: Nov 2016 |

This system of buying on downtrend reversal seems quite risky for longer term play. Thanks for your warnings.

In short, what is cheap can get cheaper, what is expensive can get more expensive. Will check your other posts on SK, Vivocom, Parkson, Xingquan QUOTE(Boon3 @ Jun 6 2017, 09:52 AM) Yes, of course I understand your intention. However, my point to you is that such system tends to generates more risks. This post has been edited by Coup De Grace: Jun 6 2017, 12:18 PMLeave charts out. Think for a moment..... Think about the system you are trying to develop. Ok? Now ask yourself.... why do we have such cases? why do we have such cases where stocks suddenly plunges? And when we scalp of the bottom in such scenarios, we are challenging the market that they got it wrong. Yes? Ever think of the flip side? A stock just broke UP STRONGLY instead of breaking down. They go on a 2 or 3 day tear. Creating them long candles. Now would you want to do the opposite by shorting? Yes, an understandable practice cos the stocks could consolidate and perhaps after 2 or 3 days of consolidation or maybe more, the stock would resume its uptrend again. Now the consolidation phase. Sometimes it is short. Sometimes there isn't any meat (hope you understand this).... Agree? If you can understand the risk in shorting in such situations, you would understand the risks in betting for the reversal in a plunging stock. Stocks generally do not fall without a reason. 1. Karex. The profits is CLEARLY going down the drain. 2. Xingquan. DO study the history la. It's a bloody joke. Understand the fuss against Chinese stocks. And when these Chinese stocks can't even produce a financial statement, understand the implication la. 3. Parkson. Ahem. Big name retail company but so what. Look at the books. Look at the numbers. Malaysia losing money. China losing money. It's a bloody joke. 4. AAX and AirAsia. Do read again the earlier postings. 5. Poweroot and Oldtown. Do they deserve the high valuations that they were trading earlier? Several real time postings made last time before. Do search back my postings on SKPet. The warnings I gave on chasing the OnG blue chip stock. The stock fell from 5. How much capital has one got to average all the way down? Vivocom. The 3 billion stock. See how it fell. Xingquan. Posted on it when it was 1++ Parkson. Posted on it when it was 2++ Take care. |

|

|

|

|

|

Jun 6 2017, 12:42 PM Jun 6 2017, 12:42 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(Coup De Grace @ Jun 6 2017, 12:17 PM) This system of buying on downtrend reversal seems quite risky for longer term play. Thanks for your warnings. Run as many trial trades as possible. See the end results. Compare the success rate vs the failures. Most important, gauge if you can contain and limit each lossess cause as far as I know, losses can be extremely humbling. In short, what is cheap can get cheaper, what is expensive can get more expensive. Will check your other posts on SK, Vivocom, Parkson, Xingquan |

|

|

Jun 7 2017, 09:40 AM Jun 7 2017, 09:40 AM

Show posts by this member only | IPv6 | Post

#815

|

Junior Member

284 posts Joined: Nov 2016 |

|

|

|

Jun 7 2017, 09:41 AM Jun 7 2017, 09:41 AM

Show posts by this member only | IPv6 | Post

#816

|

Junior Member

284 posts Joined: Nov 2016 |

Disclaimer: Paper trading

Stock: FGV

May form a morning star by today. Also, selling volume decreasing so a rebound may happen Last Resultwise: QUOTE YoY… 1Q17 returned to the black with core net profit of RM17.7m (from a core net loss of RM60.9m a year ago), boosted mainly by higher palm product prices and CPO production, lower administrative expenses, and better performance at logistics and others sector, but partly offset by losses at sugar division (arising from higher raw sugar cost and weaker MYR). However, longterm outlook: QUOTE While we applaud management’s conscious move to improve FGV’s operations (which include downsizing staff force, embarking on aggressive replanting exercise, and tightening supervision of plantation operations), we believe near-term share price performance will remain weak given the weak near-term earnings outlook at the sugar division. Sugar division aside, we believe a re-rating on the stock would only be justified when core earnings improve.

This post has been edited by Coup De Grace: Jun 7 2017, 09:54 AM |

|

|

Jun 8 2017, 07:21 AM Jun 8 2017, 07:21 AM

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(Coup De Grace @ Jun 7 2017, 09:41 AM) Disclaimer: Paper trading I would have put into consideration the historical earnings track record. Even if they had showed a sign of turnaround, the earnings is really lousy. In short, you are betting on if this lousy horse can turnaround or not.Stock: FGV

May form a morning star by today. Also, selling volume decreasing so a rebound may happen Last Resultwise: However, longterm outlook:

|

|

|

Jun 8 2017, 08:05 AM Jun 8 2017, 08:05 AM

|

All Stars

15,942 posts Joined: Jun 2008 |

Yes, as I have said before, ANY kind of stocks can be goreng UP, which means, sometimes despite our best logical reasoning the stock can still act contrary to our hard work. Yes it happens. It is what it is, the stock market. This is how the game is set up. Should we abandon our logical reasoning and simply bang on?

Use FGV. FGV currently has a trailing eps of only 2.2 sen. What it means is that based on current quarterly trends, at current pace, potentially FGV might only earn 2.2 sen eps for the current fiscal year. At 1.66, we are looking at a stock that is trading with an price earnings multiple of over 75x !!! Yeah. 75x PE. Now let's take a fast look at the quarterlies.

Look at the massive lumpy losses. What does these losses suggest to you? Then we look at the 5 year track record.

Look at how the profits has collapsed. And since its IPO too! Now given such a track record, how would you assume the stock is trading since IPO? Yes, let's use our logical reasoning. See if it works or not.... drums please...........................................

Yes, over time, a lousy company = a lousy stock. Yes, time is the enemy of a lousy company. You cannot escape one. As long as things remain, the lousy company usually perform lousy earnings. Who wants to invest in a company whose earnings is less and less? |

|

|

Jun 8 2017, 08:28 AM Jun 8 2017, 08:28 AM

Show posts by this member only | IPv6 | Post

#819

|

Junior Member

284 posts Joined: Nov 2016 |

Even analysts are pessimistic on this stock's future. Earnings bad, management bad. Only positive is FGV may be in play later during the GE trend or if CPO price shoot up.

QUOTE Analysts downgrade stock on concerns over boardroom rumble PETALING JAYA: The clash in the upper management of Felda Global Ventures Holdings Bhd (FGV), which led to the suspension of its chief executive officer (CEO), has left analysts uncertain about the company’s future direction. Analysts said the suspension of FGV group president and CEO Datuk Zakaria Arshad could impact the company’s earnings, as he had been successful in implementing cost-cutting measures, as well as improving the performance of its core plantation business since taking over the helm in April last year. Read more at http://www.thestar.com.my/business/busines...dJegjzte0QhQ.99 CPO:

QUOTE(Boon3 @ Jun 8 2017, 08:05 AM) Yes, as I have said before, ANY kind of stocks can be goreng UP, which means, sometimes despite our best logical reasoning the stock can still act contrary to our hard work. Yes it happens. It is what it is, the stock market. This is how the game is set up. Should we abandon our logical reasoning and simply bang on? This post has been edited by Coup De Grace: Jun 8 2017, 08:33 AMUse FGV. FGV currently has a trailing eps of only 2.2 sen. What it means is that based on current quarterly trends, at current pace, potentially FGV might only earn 2.2 sen eps for the current fiscal year. At 1.66, we are looking at a stock that is trading with an price earnings multiple of over 75x !!! Yeah. 75x PE. Now let's take a fast look at the quarterlies.

Look at the massive lumpy losses. What does these losses suggest to you? Then we look at the 5 year track record.

Look at how the profits has collapsed. And since its IPO too! Now given such a track record, how would you assume the stock is trading since IPO? Yes, let's use our logical reasoning. See if it works or not.... drums please...........................................

Yes, over time, a lousy company = a lousy stock. Yes, time is the enemy of a lousy company. You cannot escape one. As long as things remain, the lousy company usually perform lousy earnings. Who wants to invest in a company whose earnings is less and less? |

|

|

Jun 8 2017, 08:34 AM Jun 8 2017, 08:34 AM

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(Coup De Grace @ Jun 8 2017, 08:28 AM) Even analysts are pessimistic on this stock's future. Earnings bad, management bad. Only positive is FGV may be in play later during the GE trend or if CPO price shoot up. Election themed stock is way too over rated.Point me, over the past years/elections ..... just one stock that made it great during pre-election |

| Change to: |  0.0319sec 0.0319sec

0.90 0.90

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 17th December 2025 - 03:54 AM |