QUOTE(Boon3 @ Sep 13 2020, 06:52 PM)

Cimb target price is based on fy 21.

Macquarie target price is based on fy 22.

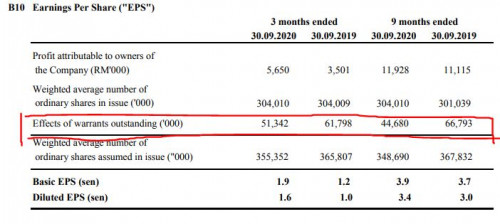

But the important thing is both of them agree that such extraordinary profit cannot be sustainable. And once it declines, the profit decline will be massive.

ChAOoz what's your opinion?

Both have the same direction, but each choose their TP based on different timing.Macquarie target price is based on fy 22.

But the important thing is both of them agree that such extraordinary profit cannot be sustainable. And once it declines, the profit decline will be massive.

ChAOoz what's your opinion?

Cimb choose to go with a TP at the max earning curve, while Big Mac choose to go with an ASP normalized assumption timing.

Both actually have same down direction long run. Not surprise to see CIMB put it from overweight -> Neutral -> Underweight -> Sell in future to come.

Also i know you don't care about their TP, so when you read both report it will look like both telling the same story, but gave different ending conclusion haha.

Sep 13 2020, 07:55 PM

Sep 13 2020, 07:55 PM

Quote

Quote

0.1711sec

0.1711sec

0.38

0.38

7 queries

7 queries

GZIP Disabled

GZIP Disabled