QUOTE(Boon3 @ Jul 8 2020, 02:53 PM)

Cult stock. Even if can short also not good idea. I think their supporter will gladly pay Tony money to buy his debt. Cause you know AA is irreplaceable

BWC

|

|

Jul 8 2020, 03:24 PM Jul 8 2020, 03:24 PM

Return to original view | Post

#21

|

Senior Member

3,496 posts Joined: Dec 2007 |

|

|

|

|

|

|

Jul 14 2020, 02:33 PM Jul 14 2020, 02:33 PM

Return to original view | Post

#22

|

Senior Member

3,496 posts Joined: Dec 2007 |

QUOTE(Boon3 @ Jul 14 2020, 01:05 PM) review... Hahah bookmarked.ok.. got the buy reasoning spot one earlier but the sitting part... could have done it much better. the call that the sector looked as if a climax top might happen... well... it did ... the sector corrected... and on hindsight I discounted a few issues.... a lot of money was made.... I was not the only one... so the hunger for more was there.... the whole setup was there.... the same sexy story could be told sexier.... with the early qr reports... profit estimates got wilder and wilder.. the pandemic clearly wasn't going to end anytime soon, with US clearly had no idea on how to solve it...the opinions were so divided... some till this very day thinks that the C-19 is nothing a political propaganda to promote fear and to bring down Ducky... yeah... in sort.... I underestimated the market frenzy.... lol.. or maybe that tan bugger got it right by saying I am too kiasi... basket.... regrets? well .... it could have been totally unreal.... better bookmark and remember this posting. Greed > Logic as always. When you throw in social media nowadays, it just blow everything out of proportion. The last time i remember such a vertical graph was 97 and dot com. Nobody know when it will pop, but everyone is confident they can run in time. |

|

|

Jul 14 2020, 02:49 PM Jul 14 2020, 02:49 PM

Return to original view | Post

#23

|

Senior Member

3,496 posts Joined: Dec 2007 |

Haha this kind of "Ace" technology counter always like that it seemed.

Loss making, loss making. Then profit, then suddenly goreng all the way. After that many got trap, loss making again. |

|

|

Jul 17 2020, 05:48 PM Jul 17 2020, 05:48 PM

Return to original view | Post

#24

|

Senior Member

3,496 posts Joined: Dec 2007 |

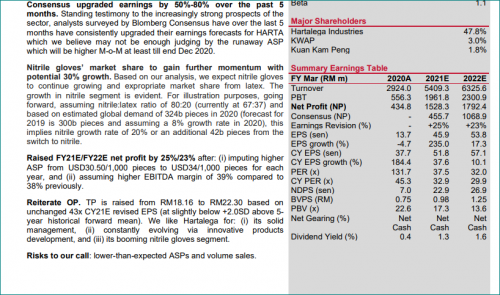

QUOTE(Boon3 @ Jul 17 2020, 12:25 PM) Had some time. Read Kenanga's TopGun report... This has been one hell of a run hahaha. You throw what at the crowd they also take it.[attachmentid=10540873] This is what TopGun has achieved as it is... [attachmentid=10540874] IMO, the following is kinda useful when TopGun reports its next earnings... Cos you wanna get a grasp whether the bar has been set too high or in other words, you do not want to have TopGun release its earnings only to have all these fella saying... below estimates (which realistically should have been the earnings came out okay but we, the scientists, in an effort to BS the target higher, we simply gave chincai sky high rocket estimates.. ) 2020 total net profit estimates is 1402.1 million. currently TopGun has managed 575 net profit for its first 3 quarters. Hence they are suggesting that the net profit for the coming quarter should be 827.1 million. For simple comparison, last year, same quarter, TopGun only managed 80 million profit. (80 million fly to 827.1 million!) For simple comparison, the last reported quarter, ie 2020 Q3, TopGun reported an already very respected 347 million. Which means this scientist is suggesting that TopGun profit increased by 137%. Simple maths... nothing fancy... so the very first part here is to ask... has the bar been set very high for the next coming QR report? But you see, the Target Price was not set based on these number estimates... aha... got some tricks leh... What is CY2021 estimate profit? A cool 3996 million !!! more a less suggesting that TopGun will average ONE BILLION ringgit profit per quarter... and that's how they got the TP (TP tu stand for Toilet Paper ah? *cough* High estimates? or simply chinchai whack sky high profit estimates? you be your judge yourself .... ps... when these scientists come out with new estimates almost every other week, you should know they are frying the stock up! Those analyst are like the moodys of the 08 crisis. We have glove here and then we have tech + EV on US. 2.2K TP Tesla / 1.2k TP shopify P/E is outdated. Now we use P/S |

|

|

Jul 17 2020, 07:05 PM Jul 17 2020, 07:05 PM

Return to original view | Post

#25

|

Senior Member

3,496 posts Joined: Dec 2007 |

Price-to-Sales Ratio. Instead of P/E ratio.

|

|

|

Jul 21 2020, 01:54 PM Jul 21 2020, 01:54 PM

Return to original view | Post

#26

|

Senior Member

3,496 posts Joined: Dec 2007 |

QUOTE(ChAOoz @ Jul 6 2020, 12:37 PM) KYY tends to overheat a stock, and when it drops. It dropped like a rock. Quote myself just for the heck of it. I sold my position blog post out again Some more encourage people to trade on margin. But oh well, that is his style. He clears positions also pretty fast, and once sold there will be a blog post on i clear all my holdings and the reason why. Those clutching the bags, if they kena again this time shame on them. Anyway after so many round, he is still as influential as ever |

|

|

|

|

|

Jul 21 2020, 03:40 PM Jul 21 2020, 03:40 PM

Return to original view | IPv6 | Post

#27

|

Senior Member

3,496 posts Joined: Dec 2007 |

QUOTE(Boon3 @ Jul 21 2020, 03:24 PM) There's a few things I wanna say... again. ..... But this round he moderated slightly. He basically say, i sell cause i feel its expensive but overall i still like the industry. Hence i buy TG. So dont worry ya, TP still intact.1. It's always not about whether the stock goes up as per what he recommends (this is why people are suckered .... ) but people needs to pay attention to his garbage reasoning.... How he got to his target price is BASED ON RIDICULOUS ESTIMATIONS. (ps. he's not even a qualified analyst... is he? lol) 2. ... and how he reasoned out his SELL totally made a mockery out of everything. Where is his integrity? Post after post ... he made one sky high estimation after another. And remember this... 13th July he upgraded his target price for Superman. He buta buta dare say based on his estimations which was safe and conservative... and using his std 20x pe, he said Superman target price should be at least 24.20. If Target price was 24.20, why did he sell out on 20th July. (how many days ah?) at ~18.80. This is the WHAT THE FARK point... one hand calling the stock to be valued at 24... the other hand selling the stock at 18.80... THIS IS MORALLY WRONG! and yeah... his sell reason... that Superman has already gone up how many percent since 2... that was utter shyte. If that reasoning holds true, why on earth did he dare suggest a TP of 24 for Superman? 3. and after so many round.... he is still as influential as ever. LOL! People always want a sifu. Where's that Livermore book? LOL! Yes? anyway... this is how it will always be... suckers will always exist.... punters just want to follow the sifu. What's the stock? What's the TP? thats all they want to know. They do not care about the past. They reckon they will be the smarter sucker.... last time, old uncles kena.. we smarter than them! .... and yet it happens again. .. and again. And this why a KYY will always exist! I buy, I write, They follow, I sell. What a lovely game this stock market is. ... like I said... so rich also need to do such low life stuff meh? cheh. I tell you he rich, but his Dayang suffered. Sure he jackup superman kau kau and rotate from speculative to stable and then finally quietly exit the sector. Confirm this round exceed his previous dayang unrealized gain before the flash crash in O&G. He is big shark, any water he go in sure disrupted. Somemore got blog. |

|

|

Jul 21 2020, 05:08 PM Jul 21 2020, 05:08 PM

Return to original view | Post

#28

|

Senior Member

3,496 posts Joined: Dec 2007 |

QUOTE(Boon3 @ Jul 21 2020, 03:53 PM) slightly is such an understatement here.... 13th July or EXACTLY 5 trading days ago ... He was rich-er before Dayang collasped. So need to make up all the lost profit somewhere. Supermax just came in at the right time. All of the above was HIGHLIGHTED IN BOLD .... 5 trading days.... he spits out..... he sold and he has switched stocks... one hand say buy... one hand say sell.... like I said.... big millionaire... need to do such low life strategy to make money meh? oh... yeah.... he also donates a lot ..... I tell you he sure go TG then quietly disposed and clean his hand of glove sector entirely. After that maybe 1 - 2 month later blogpost about how he sold all glove due to "certain" reason. Nicely offloaded. This time profit fully lock in. |

|

|

Jul 23 2020, 10:37 AM Jul 23 2020, 10:37 AM

Return to original view | IPv6 | Post

#29

|

Senior Member

3,496 posts Joined: Dec 2007 |

Mask, glove, vaccine, vials, packaging, logistics. This is the order i guess. 😋

|

|

|

Aug 3 2020, 11:42 AM Aug 3 2020, 11:42 AM

Return to original view | Post

#30

|

Senior Member

3,496 posts Joined: Dec 2007 |

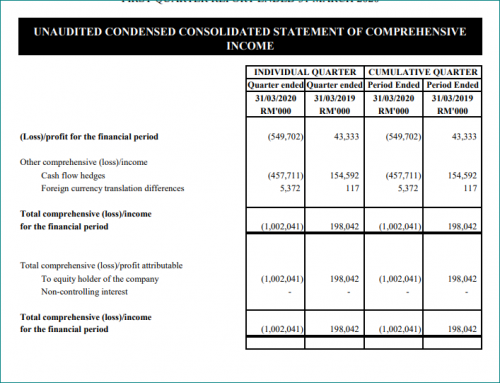

QUOTE(Boon3 @ Aug 1 2020, 10:24 AM) First time ever. Epic! That's why it was strange the other day. AA reported its shyte results but AAX didn't. AA fell but AAX was trading pretty much unchanged at 0.095/0.10. It was a big SHORT on my paper trade book (buku 555 la) ... But anyway... TP zilo is a bit too evil from CIMB la... They could give chance sikit and say 0.005 la.... half sen also can mah.... Anyhow... according to AAX notes, they had applied for a 500 million Danajamin PRIHATIN loan... lifeline depend on the loan... but with such balance sheet... with hardly any asset... percentage of planes flying ( and oh... they had returned one plane back to their lessor!!! epic... and according to the notes...my interpretation is... they want to return more.... WOW!! ini macam also can meh? return to lessor wo... The fuel hedges comparison... AAX remaining hedge is 3.459 million. AirAsia is 5.3 million barrel. Hmmm... AAX still got a lot of fuel hedges left!!! In AirAsia notes, its out of the 5.3 million, 3.1 million is due less than 1 year is carrying a 'paper' loss of 794 million. All AAX wrote is .... "As at 31 March 2020, outstanding number of barrels of Brent and fuel derivative contracts was 3,459,348 barrels" Which means, it's paper loss for the remaining hedges is gonna be huge! And then there is this article... https://www.theedgemarkets.com/article/aax-...udited-net-loss Huge deviation!!! Really huge... Now back to the fuel hedges. Unlike AirAsia, did not write how much its fuel hedges losses were... All I see is....  Did AAX just classified its fuel hedges as CASH FLOW HEDGES???? ChAOoz ... err .... can help see? Am I wrong there.... and also this 'cash flow hedges' loss total is 457 million. How come this 457 million loss not included in AAX profit and loss...link to report I mean did AAX under reported its losses? ie Shouldn't AAX losses be 1 billion. anyway... like half bola.... give chance sikit to AAX la.... half sen TP lo... How they spin it, one thing is clear, AAX & AA financial is really bad. Not worth the debt for their current price. |

|

|

Aug 3 2020, 12:12 PM Aug 3 2020, 12:12 PM

Return to original view | Post

#31

|

Senior Member

3,496 posts Joined: Dec 2007 |

QUOTE(Boon3 @ Aug 3 2020, 11:53 AM) Yeah.. me very confused on this part (since not accountant mah) ... You see it's a 1bil loss for the equity / shareholder. So it's really 1bil, but it's not realized yet, hence not operational.how come those loses not included in their actual p/l statement.... clearly their income statement is saying more than 1 billion in losses. here's another thing I have noticed... them brokerage reports... clearly the head of research is not checking the reports them analysts are spitting out... In the Harta report and in the Inari report... error is seen in the calculation of the TP.... Estimate eps X PE MUltiple also can be wrong.... and hardly anyone is noticing? Really? This is the Quality of the reports? And yeah.. market is so cow cow... no one bothers! LOL! The millennial bull run ! I guess the hedge contract is not close yet or something, maybe this will rebound and it become +500m (wishful thinking) hahah |

|

|

Aug 3 2020, 01:41 PM Aug 3 2020, 01:41 PM

Return to original view | Post

#32

|

Senior Member

3,496 posts Joined: Dec 2007 |

QUOTE(Boon3 @ Aug 3 2020, 01:32 PM) Anyway, just to show you the low quality of the reports.. They use Calendar Year EPS. You see it's slightly higher at 51.8Kenanga own words.. [/b] CY21 EPS from their own table ...  Their CY21E EPS on that table is 45.9 sen. Well 43x45.9 = 19.73 sen mah.... Just how did they get a TP of 22.30 sen? But i have never follow all those analyst guidance. It keep on changing, based on share price and sentiment, so really no value one. I still read all their reports tho, as some contain interviews and internal discussion with the company management or industry observation, those do hold some insight outsider won't get. |

|

|

Aug 3 2020, 06:15 PM Aug 3 2020, 06:15 PM

Return to original view | Post

#33

|

Senior Member

3,496 posts Joined: Dec 2007 |

QUOTE(Boon3 @ Aug 3 2020, 02:20 PM) this is their report... Don't know haha. I guess company financial year and actual calendar year ending different. So they took the higher of those two to calculate their TP.The CY21E eps of 51.8 only appeared on the table.... Why aren't they using the FY21E eps? trying to learn here [attachmentid=10547806] |

|

|

|

|

|

Aug 3 2020, 06:18 PM Aug 3 2020, 06:18 PM

Return to original view | Post

#34

|

Senior Member

3,496 posts Joined: Dec 2007 |

QUOTE(yhtan @ Aug 3 2020, 05:18 PM) Aiya why buku 555, like this see no syiok liao. Last thursday when it move to 80 cents i was freak out, fast fast sell half first, and today it prove me wrong Investing now is as easy as gambling on EPL But well trading u must be discipline, take profit as certain portion. TBH those milennial traders are bunch of mad cow, my remisiers even told me account opening require 3-4 weeks to process I did some small trading on genm as well, bought at 2.29 and thought it will rebound to 2.40, mana tau today market so weak and drop down until 2.23, cut loss and move on. It clearly shown the market strength is not with my side. The reason i bought is because head and shoulder and my experience is it will rebound at this price range. » Click to show Spoiler - click again to hide... « Let's see if construction is the next wave, we need fiscal spending, to keep this house of cards going. |

|

|

Aug 4 2020, 01:13 PM Aug 4 2020, 01:13 PM

Return to original view | Post

#35

|

Senior Member

3,496 posts Joined: Dec 2007 |

QUOTE(Boon3 @ Aug 4 2020, 09:28 AM) Ok. I sort of figured it out....lol .... dunno if correct or not. Result out. Aint no Topglove.The next quarter for Harta is Fy21 Q1 already and at end of the year Harta would be reporting FY21 Q2. So Kenanga Big Scientist is NOT gonna use these two quarters for the TP calculation. The Scientist gonna use FY21 Q3, FY 21 Q4, FY22 Q1 and FY22 Q2 numbers as these quarterly reports will be reported in 2021 calendar year. So this scientist estimate eps for those quarters is 51.8 sen. In their table, had Harta number of shares at 3,380 million shares. Therefor, the estimate profits is 1750 million! (which is obviously gonna be higher than fy 21 estimate profit of 1528 million Which works out on average a profit of 437.5 million per quarter. Errrr..... correct ah? LOL! I am trying so hard to be a scientist too leh... Want to learn how to tipu cow cow la! and the PE multiple used is 43x!!! ** The other Scientist must be so jelly cos his GOLD STANDARD is only 20x PE ** I understand. They used to average median PE or something like that to justify 43x... ** I reckon this is PLATINUM STANDARD lo.... calendar year eps...lol ... for comparison again.... 2019 Q1 124 million 2020 Q1 94 million 2019 Q2 120 million 2020 Q2 103 million 2019 Q3 119 million 2020 Q3 121 million 2019 Q4 113 million 2020 Q4 115 million FY2019 456 million FY2020 435 million Now if Harta reports a 2021 Q1 profit of 230 million... which is doubled its profit reported in Q4 .... which is also its higheest ever profit in its history.... how would the market describe Harta's performance? LOUSY? would anyone dare call out that Harta's performance is actually good but these Scientist in order to ramp up the stock prices is the culprit? They simply tembak here and there to get those high TPs! Let see how fellow analyst gonna write for this one. |

|

|

Aug 4 2020, 01:22 PM Aug 4 2020, 01:22 PM

Return to original view | Post

#36

|

Senior Member

3,496 posts Joined: Dec 2007 |

QUOTE(Boon3 @ Aug 4 2020, 01:17 PM) Lol, totally overvalued. Once peak pandemic over, profit normalized or even deteriorate due to too much extended capacity i wonder what's the P/E gonna be like. This is gonna be like O&G all over again but in a bigger way due to the bubble size and amount in speculations. |

|

|

Aug 6 2020, 07:32 PM Aug 6 2020, 07:32 PM

Return to original view | Post

#37

|

Senior Member

3,496 posts Joined: Dec 2007 |

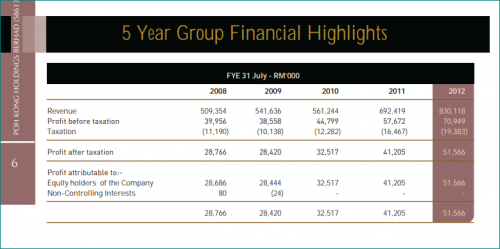

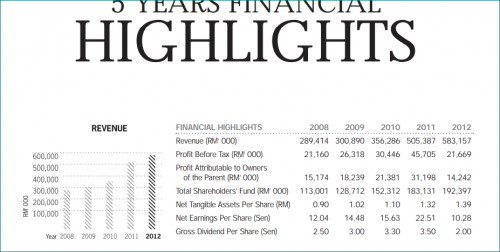

Hehe. Yes gold run. See a good story, camp on it and sell it once its hype.

Jewelry counter Positive Spin: Many gold inventories. Due to low sales during MCO. So old stock = low raw material cost, so with rising gold price you can profit from the difference between cheap raw material and high price finish goods. Tomei vs Poh Kong Poh kong 500+m inventories. Tomei 300+m inventories (as per last QR report) (We assume all their inventories are gold This would mean if all their inventory holdings never sold since pre MCO. Tomei and Poh Kong inventory would now be value at increase 20% = (600m - Poh Kong), (360m - Tomei) Assuming cost structure the same, this would mean next QR, we are expecting Net Profit to increase exponentially. As commodity trading, any small uptick in margin, would translate to big net profit difference. This is the nature of trading business, wont go too deep into this. OK if you read until here, you would think. Wah all good, lets whack jewelry counters. But but but, what "analyst" wont mentioned is: Valuation Assuming today due to rising gold price poh kong earn 100m windfall profit and Tomei earn 60m windfall profit due to the rising gold price. How would it impact their valuation if everything remain the same ? Poh Kong original market cap 200m+. So a 100m windfall profit, would justify a new 300m market cap = 50% increase from RM0.48 to RM0.72 +- share price Tomei original market cap 70m+. So a 60m windfall profit would justify a new 130m market cap = 90% increase from RM0.45 to RM0.85 +- share price But you see how much market value them now. Jewelry counter Risk: Last run on Tomei / Poh Kong was circa 2017, shot up in expectation of rising gold price. Puncture after a few months, trap many bag holders. What people don't realized is Tomei / Poh Kongs are essentially jeweler. They buy gold and manufactured jewelry. So rising gold price is a one time inventory gain effect. As their future buy in raw material price had increased, so essentially if gold were to go down, they would suffer a big one-off as well due to high raw material price and low sell price to customer. Also rising gold price, would mean their future jewelry become expensive, hence with expensive jewelry pieces, this would mean lower sales. So actually a rising gold price is a one off effect and a negative long run effect for business. TLDR: Can trade jewelers counters on sentiment and a good story to spin, but don't invest for long term. It's a shitty business with low margins and cyclical due to gold price. |

|

|

Aug 7 2020, 10:01 AM Aug 7 2020, 10:01 AM

Return to original view | IPv6 | Post

#38

|

Senior Member

3,496 posts Joined: Dec 2007 |

QUOTE(Boon3 @ Aug 7 2020, 09:51 AM) 100m windfall for Poh Kong? 100m windfall is max already. Assuming all inventory since last quarter nvr sold and now only liquidate at current gold price.First GOLD again ...  i think comparison should be made during the 2009 era la... Ok, price of GOLD then and now ... different now .... This is Ah Kong numbers during that period  This is Ah Mei's numbers  This is Ah Lian's numbers ...  (so pixelated so fake ... macam I kedai kopi .... better give link ...lol https://www.bursamalaysia.com/market_inform...?ann_id=1267116 This is Ah Boon's comments.... The jewelry players got enjoy profit la... but definitely don't think can reach 100m windfall for players like Ah Kong la... Also this windfall of 100m is one off not like a continuous profit machine. So max also give it an increase share valuation of 50% from base only, not the now 300% share price increase poh kong is enjoying. |

|

|

Aug 10 2020, 09:57 AM Aug 10 2020, 09:57 AM

Return to original view | Post

#39

|

Senior Member

3,496 posts Joined: Dec 2007 |

QUOTE(Boon3 @ Aug 9 2020, 10:23 AM) Adventa? No lah.... I refuse to look at the stock. Wah seemed like your predicted two tops now for the glove counters. Hahaha too bad not much instrument for you to short in Malaysia.plus... that aspion issue with TopGun.... ok charts... I use them a lot but it has come to a point where I make sure that I am not influenced by the charts to trade the stock... as you know... charts are charts... they can be manipulated.... so if I trade .... there must exist other compelling reason for me to gamble on the stock... I make sure I don't bet just because the chart suggests so. make sense ah? That's me la.... anyway, for me careplus is actually pretty straight forward ... what do you see here?  Me? 1. Clear, clear sign of a climax top happening soon.... 2. How many consecutive gap up was there? Is it 4 or 5? (anything more than 2 ... ahem... better jaga already) 3. The last gap up on the 4th.... Gap up strongly but then ... stock turned weaker.... ***** 4. and if you were using bollinger bands... what do you see? over extended? so many ways the stock is saying it wanna fart.... soon ... but yea .... point 3 was the nail..... and what has happened .... it's not a surprise at all...  my 3 sen la.... Excited to see how it will close today, later is a false negative |

|

|

Aug 10 2020, 04:55 PM Aug 10 2020, 04:55 PM

Return to original view | Post

#40

|

Senior Member

3,496 posts Joined: Dec 2007 |

QUOTE(anakMY @ Aug 10 2020, 02:50 PM) still learning , didnt buy much too. Some wins some looses, very amount. Quite exciting I would say lol. Yeah it's pretty fun but its a sure fire way to lose money this kind of market for me. The more I prone to trade, the higher likelihood I make a mistake and the volatility eats me up. blacky88 liked this post

|

| Change to: |  0.0245sec 0.0245sec

0.45 0.45

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 26th November 2025 - 12:02 AM |