QUOTE(Cubalagi @ Feb 8 2022, 03:58 PM)

Of course!!!Look, I used charts a lot but damn me to hell if I let the charts use me.

BWC

|

|

Feb 8 2022, 04:03 PM Feb 8 2022, 04:03 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

|

|

|

Feb 8 2022, 05:10 PM Feb 8 2022, 05:10 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

and of course .... everyone is different. Esp investors/traders. And traders itself, got many macam...

for example... the flower closed unchanged...  and momentum traders would view it as the there is a strong likelihood that momentum is getting lembik.... hence, for them, given how fast and how strong the stock had progressed, they would more likely exercise their option to sell for a decent chunk of profit. and yet, some other traders might have a different opinion.... and insist on riding the incoming pullback, hoping to profit for a bigger profit. yup... macam macam ada. |

|

|

Feb 9 2022, 01:53 PM Feb 9 2022, 01:53 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

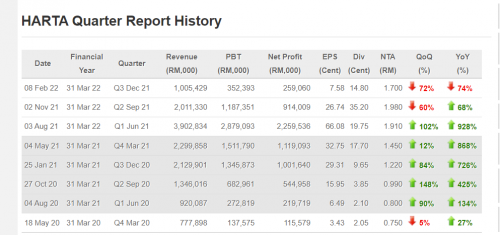

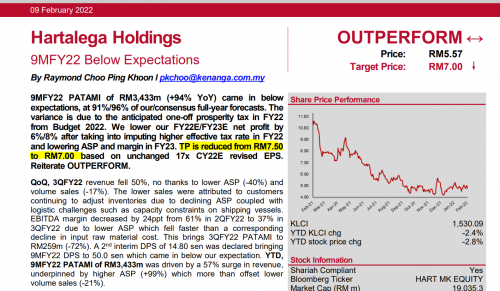

» Click to show Spoiler - click again to hide... « that was from.... post #57664 today... 9/2/2022 Harta's earnings not so ONG!  Amazingly the TP was only cut from 7.50 to 7.00  Unbelievable! LOL!  The highlighted parts are most interesting... 1. Annual capacity to be around 63 Billion...... *cough* 2. The last yellow highlight.... since ASP is no longer lofty, the expectations of disappointments in subsequent quarters is capped!!!! WOW! Can't believe they used that as a point.... 3. the 7.00 TP issue..... *cough* see the curve ball? TP is based on CY22E numbers....!!! Why do they want to make life so difficult. Why can't they base on Harta's FY numbers and not CY numbers? Why la be so sneaky about this? See if they use CY22 numbers it means TP is based on the following quarters... Q3 21, Q4 Q2, Q1 22 and Q2 22. and the CY numbers estimate is not even posted!!!! anyway... look at the FY 23 numbers estimate... their FY 23 estimate profit for Harta is only 696 million!!!! this is a massive lowering of profit estimates!!! Previously their estimates was 1217 million! (can see from the last table inside the spoiler. from 1.217 billion to only 696 million.... and the TP is only lowered by 50 sen? let's see... if the report was based on 17x FY23 numbers and not CY22 numbers, then 17x of an eps of 20 sen = 3.40 ...... correct ma? |

|

|

Feb 11 2022, 09:21 AM Feb 11 2022, 09:21 AM

|

All Stars

15,942 posts Joined: Jun 2008 |

So if Kenanga were to use FY23 earnings and not the nonsensical CY22 earning, 20x FY23, as per their own estimation, would have yielded a TP of rm3.20 instead of rm7.00

compare to that posting in Nov 2021... ... err ..... here we go... https://www.theedgemarkets.com/article/jp-m...underestimation JP Morgan which has been bearish on the glove sector since last year, has once again slashed its target price (TP) for Top Glove Corp Bhd to RM1.50 — a 67.33% discount from its current price of RM2.51 — while maintaining an “underweight” rating.... Notably, these TPs are similar to the glove makers’ share prices before the global Covid-19 outbreak. The note also covered Hartalega Holdings Bhd and Kossan Rubber Industries Bhd. JP Morgan gave an “underweight” rating and a fair value of RM4.00 to Hartalega, 36.25% lower than its current price of RM5.45 while Kossan’s rating was “neutral” and its fair value is pegged at RM2.00, down 3.5% from its current price of RM2.07. ------ be like JP Morgan hor .... if wanna downgrade.... just do it nicely ONE TIME....   =================== I wonder what's JP Morgan estimation for Harta now? rm3.00? |

|

|

Feb 15 2022, 03:44 PM Feb 15 2022, 03:44 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(Cubalagi @ Feb 8 2022, 03:06 PM) Thanks for your insights. If I was in... and had used the 105/1 as the stop profit level and had hanged on to the stock, the stop profit level would have been readjusted to 109/110.Yeah .I confess I used the sell half strategy..in fact I went further n sold 2/3 yesterday. Keeping 1/3 to see how much higher Oil can go. The stop profit is quite helpful idea. Will keep that in mind. and there... |

|

|

Feb 16 2022, 11:31 AM Feb 16 2022, 11:31 AM

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

|

|

|

Feb 16 2022, 11:50 AM Feb 16 2022, 11:50 AM

|

Senior Member

3,373 posts Joined: Nov 2008 |

QUOTE(Boon3 @ Feb 16 2022, 11:31 AM) billy_overheat was keeping on eye on dnex See? See? got ur fav?  this one also they dare goreng... LOL  this one... LOL!  do more homework la... avoid the noise thinking that the recent actions should be good enough but the numbers jialat pbm is another rocket aiyo beginning of the year, not time at all lehhhhh ada 555 mou not forgetting this  strengths are on ong and cpo which both sectors are complicated and too many variables see co, russians go back after 'training' even flb  commodities are strong yo This post has been edited by billy_overheat: Feb 16 2022, 11:55 AM |

|

|

Feb 16 2022, 11:58 AM Feb 16 2022, 11:58 AM

|

All Stars

15,942 posts Joined: Jun 2008 |

Look for strength in a lembik market

|

|

|

Feb 16 2022, 12:07 PM Feb 16 2022, 12:07 PM

|

Senior Member

3,373 posts Joined: Nov 2008 |

|

|

|

Feb 16 2022, 12:25 PM Feb 16 2022, 12:25 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(billy_overheat @ Feb 16 2022, 12:07 PM) some said strength in lembik market is easier to spot Even when there is nothing that suits your style of trading, you can still practice on your trading. cpo, co, and other commodities, finance but once wrong step habis Take Bunga, I don't like the sector but if I had to trade it, it wasn't too difficult was it? the point is... if you want to be really good, you need to put in the extra shift yourself. Quit whining and watch what the market is/isn't saying.... |

|

|

Feb 16 2022, 12:46 PM Feb 16 2022, 12:46 PM

|

Senior Member

3,373 posts Joined: Nov 2008 |

QUOTE(Boon3 @ Feb 16 2022, 12:25 PM) Even when there is nothing that suits your style of trading, you can still practice on your trading. Yupp put in screen time, do some works and voila. Take Bunga, I don't like the sector but if I had to trade it, it wasn't too difficult was it? the point is... if you want to be really good, you need to put in the extra shift yourself. Quit whining and watch what the market is/isn't saying.... Need not to waste time to argue with the market, shoplot exchange la, sc la |

|

|

Feb 16 2022, 12:59 PM Feb 16 2022, 12:59 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

Feb 16 2022, 01:02 PM Feb 16 2022, 01:02 PM

|

Senior Member

3,373 posts Joined: Nov 2008 |

|

|

|

|

|

|

Feb 16 2022, 01:05 PM Feb 16 2022, 01:05 PM

|

Senior Member

3,373 posts Joined: Nov 2008 |

|

|

|

Feb 16 2022, 06:57 PM Feb 16 2022, 06:57 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

Feb 17 2022, 05:13 PM Feb 17 2022, 05:13 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

https://www.theedgemarkets.com/article/ctos...ment-new-shares

KUALA LUMPUR (Feb 17): Credit-reporting agency CTOS Digital Bhd plans to raise RM270 million via a private placement of up to 166.67 million new shares at an indicative RM1.62 each to fund proposed acquisitions and investments to further grow its business. In a Bursa Malaysia filing on Thursday (Feb 17), CTOS said the placement shares are intended to be placed out to third party investors and the corporate exercise is expected to be implemented in a single tranche within six months from the date of approval from the bourse regulator for the listing and quotation of the placement shares on the Main Market of Bursa. "The proposed placement is not expected to have any material effect on the earnings of the CTOS Digital group for the financial year ending Dec 31, 2022, save for the dilution in EPS (earnings per share) as a result of the increase in the number of CTOS Digital shares in issue pursuant to the proposed placement. "As at the LPD (latest practicable date of Jan 31, 2022), there are 2.2 billion (2,200,000,000) CTOS Digital shares in issue. "Barring any unforeseen circumstances, the proposed placement is expected to be completed by the first quarter of 2022,” CTOS said. More to come baru listing.... so fast wanna raise money??? |

|

|

Feb 17 2022, 06:54 PM Feb 17 2022, 06:54 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

Kossan...... in their own words.....

Almost 2 years after WHO declared it a pandemic, COVID-19 continues to impact the world economy. The International Monetary Fund (“IMF”) in its January 2022 World Economic Outlook (“WEO”) report projects global growth to moderate from 5.9 in 2021 to 4.4 percent in 2022. Global growth is expected to slow to 3.8 percent in 2023, according to the IMF. As a result of the pandemic, the demand for protective gloves has increased significantly. In its July 2021 statement, the Malaysian Rubber Glove Manufacturers Association (“MARGMA”) projected global glove demand at 420 billion pieces for 2021 (2020: 360 billion pieces). For 2022 and 2023, MARGMA projected growth to be 10-15% higher than pre-pandemic levels. In the near term, the glove industry remains challenging with the supply and demand imbalance persisting. The Group expects the continued tapering of glove demand and Average Selling Price (“ASP”) from the heights of the pandemic as a result of the rollout of mass vaccinations globally. Even with the Omicron variant, the percentage of Covid-19 cases categorised as severe has declined compared to the earlier stages of the pandemic. As such, the exceptionally high ASPs which were due to the shortage and panic-buying of gloves during the onset of the pandemic, have decreased rapidly leading to inventory adjustments and delayed orders from customers. The glove sector is seeing increased competition and incoming capacity from domestic as well as foreign manufacturers. In addition, the global logistics disruptions and container shipping shortages have continued to affect glove shipments and deliveries. Based on these reasons, the glove sector is expected to face headwinds in the current year 2022. For the Technical Rubber Products (“TRP”) division, the anticipated gradual uptick in economic activity and infrastructure spending domestically and regionally will continue to spur the infrastructure and automotive segments and the Group expects this division to remain profitable in 2022. As we move forward, the Group will continue with its transformation where structural changes have been implemented throughout the organisation, with a focus on operating efficiency which will allow the Group to be resilient even in the face of rising costs and heightened competition. The Group has accelerated reinvestments into digitalisation and automation of its plants to increase productivity and to prepare the Group for its next phase of growth. Post pandemic, the glove industry will continue to experience stable growth underpinned by higher healthcare standards and hygiene awareness in both the medical and non-medical sectors. The Group remains committed to its future growth and is optimistic of the long-term prospects of the glove industry -------------------------------- |

|

|

Feb 18 2022, 09:25 AM Feb 18 2022, 09:25 AM

|

All Stars

15,942 posts Joined: Jun 2008 |

Of course it's not gonna tank with a 12 sen dividend dangled...

the adjusted chart of Kossan (it had a 1 for 1 bonus issue not too long ago) yeah... 12 sen which means a fy dividend of 48 sen. sounds great but if you factor that 48 sen dividen + 14 sen dividen last fiscal year., all the dividends collected won't even cover the drop in share price. |

|

|

Feb 18 2022, 09:38 AM Feb 18 2022, 09:38 AM

|

All Stars

15,942 posts Joined: Jun 2008 |

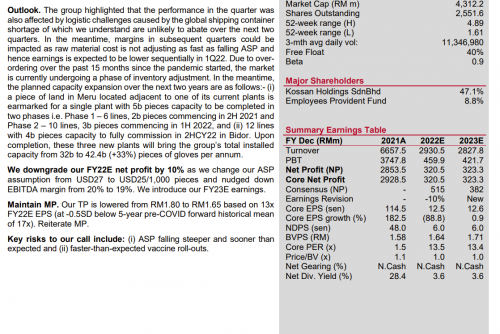

And here is Kossan report from Kenanga...

The inconsistencies is terrible..... As mentioned, for glove companies like Harta and TopGlove and Supermax too, the researcher used CALENDAR YEAR (CY) earning estimates.... and as explained, what is terrible is that the CY estimates are shown, instead they just showed the FY estimates... yup .... WTH !!! and now as one can see, they used FY estimates for Kossan. Why la.... ??? this is rather unacceptable! they cannot blast randomly... suka suka use CY... suka suka use FY.... hey not all the readers are not sleeping la... yup as mentioned... if they had used FY earnings estimates for Harta, then based on their own estimates and PE multiples, Harta's TP should only be around 3.20 and NOT 7.00!!! |

|

|

Feb 25 2022, 01:17 PM Feb 25 2022, 01:17 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

|

| Change to: |  0.0361sec 0.0361sec

1.17 1.17

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 21st December 2025 - 09:46 PM |