QUOTE(johnnyzai89 @ Aug 22 2017, 10:15 AM)

This one also same story and trend... This one also lengchai..

Good spotting.

Which one better Ah Boon?

This post has been edited by gark: Aug 22 2017, 10:42 AM

BWC

|

|

Aug 22 2017, 10:33 AM Aug 22 2017, 10:33 AM

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

|

|

|

|

|

|

Aug 22 2017, 10:46 AM Aug 22 2017, 10:46 AM

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

Aug 22 2017, 11:38 AM Aug 22 2017, 11:38 AM

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

QUOTE(Boon3 @ Aug 22 2017, 10:46 AM) Found a even better related horse .. Up 300% for this year and still only at PE 3+.. This post has been edited by gark: Aug 22 2017, 11:41 AM |

|

|

Aug 22 2017, 11:51 AM Aug 22 2017, 11:51 AM

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(gark @ Aug 22 2017, 11:38 AM) Found a even better related horse .. Up 300% for this year and still only at PE 3+.. Looks good. |

|

|

Aug 22 2017, 12:09 PM Aug 22 2017, 12:09 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

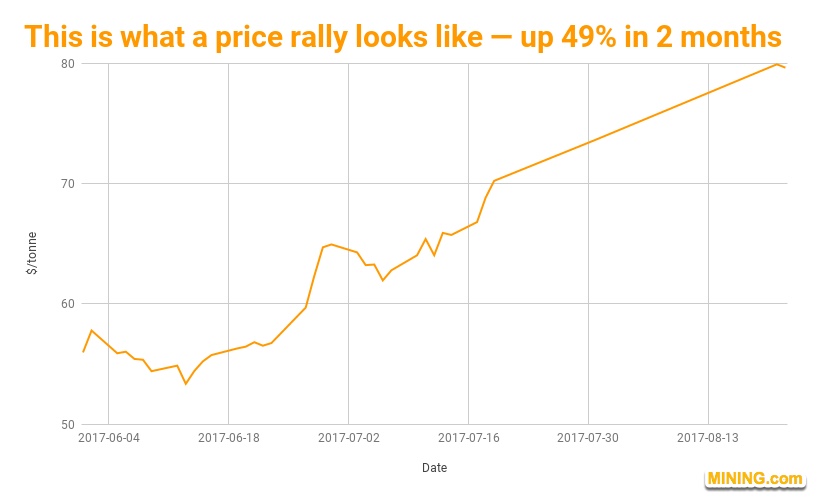

QUOTE(gark @ Aug 22 2017, 10:07 AM) Paper price is going up, so you have contango, raw materials bought cheaper earlier, now can sell for higher price Such jumps ( to be more price.. it jumped from 1.20+ to 1.40 la) are actually normal considering the massive improvement in numbers all around, hence I doubt the gap will be closed for the time being.High demand for box due to more online selling.. Paper and box shortage in China, due to above.. blame alibaba ... Link 1 Link 2 How long this rally will last, no one knows, but china paper producers is already ramping up production Orna buys paper as a raw material and is 60% of cost, so if the paper price downtrend, they can be caught in reverse situation. Jump from RM 1 to RM 1.4X is scary.. Cousins are Muda and boxpak (But Orna have better fundamentals) paper industry is sleepy.. no analyst.. » Click to show Spoiler - click again to hide... « And.....if and if it does closed or attempts to close the gap... then it's really not worth (and if fact, it's usually a 'trap to buy at those levels) fishing for the stock. The preferred entry would be catch the stock if and when it consolidates (higher) .... My 3 Sen This post has been edited by Boon3: Aug 22 2017, 12:11 PM |

|

|

Aug 22 2017, 02:05 PM Aug 22 2017, 02:05 PM

|

Senior Member

567 posts Joined: Feb 2006 |

QUOTE(Boon3 @ Aug 16 2017, 05:41 PM) This always 'sound' logical but ... I am telling you this ain't so. Yup.. I understand what you are trying to tell me.. I am still not disciplined enough to cut loss although I know that is the right thing to do.. Diversifying will never make it safer. When shit happens, like a crash, they will all die... well ... some of the better ones... they just die less or recover faster. And then ... when carries more different stocks... the tendency is that sooner and not later, they will most likely to carry the big G - the goreng stocks... and because of the noob factor...the cutting loss is an art they could never master... and in most failure cases....all it takes is ONE NASTY BAD GORENG STOCK that goes badly wrong . And when this happens....tbe portfolio will turn in huge mega losses. And I will say this.... it's never how many stocks you carry... most important is you carry the right one. And when you carry less different stocks...you force yourself to be damn bloody correct....this is something which I have seen many with multi stocks in their portfolio will fail to do. Most of the time...they carry more just cos of the theory... they carry stocks to fullfil their die hard gambling blood.. they carry more cos they think one bad stock selection is ok. Cos they think the other stocks can take care of one or two lousy picks... And so on and so on..... Ps this issue is subjective. It's always ok for you to disagree. All you need to do is send Gark to kowtim me. |

|

|

|

|

|

Aug 22 2017, 02:32 PM Aug 22 2017, 02:32 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(Suicidal Guy @ Aug 22 2017, 02:05 PM) Yup.. I understand what you are trying to tell me.. I am still not disciplined enough to cut loss although I know that is the right thing to do.. Some stocks... with ... err... fundamentals... when its earnings collapse .... could also see mega mega drop in stock prices. Example? Oil stocks few years back. |

|

|

Aug 22 2017, 04:22 PM Aug 22 2017, 04:22 PM

|

Senior Member

567 posts Joined: Feb 2006 |

|

|

|

Aug 22 2017, 04:34 PM Aug 22 2017, 04:34 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(Suicidal Guy @ Aug 22 2017, 04:22 PM) The ability to ADMIT one is wrong and the ability to rectify the mistake ( and not holding and praying the market will auto correct one one's mistake) is always crucial. How many times you hear the one reason one is holding to Xxx stock is because the stock price is below their cost price? |

|

|

Aug 22 2017, 06:42 PM Aug 22 2017, 06:42 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

....export stocks..... not looking like a sure win play.....

|

|

|

Aug 22 2017, 07:29 PM Aug 22 2017, 07:29 PM

|

Senior Member

1,497 posts Joined: Dec 2005 |

tomypak different than muda/boxpak?

|

|

|

Aug 23 2017, 08:32 AM Aug 23 2017, 08:32 AM

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

|

|

|

Aug 23 2017, 08:34 AM Aug 23 2017, 08:34 AM

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

|

|

|

|

|

|

Aug 23 2017, 09:08 AM Aug 23 2017, 09:08 AM

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(gark @ Aug 23 2017, 08:32 AM) Cos it's not totally reliable to rely on the USD factor as previously.... today no same as yesterday.... 1. Run thru some export stocks. The oomph factor not as solid as before. Example? FLB gave some shitty numbers, no? (was it poor export? where the USD oomph?) 2. Yes, there will be winners (tech sector) but picking these winners is not the same as b4. 3. Growth caused by the USD factor tak cukup. Product itself must be growing... 4. Exporters to US is not necessary a safe bet as b4. Classic example? Classic Scenic (not to say that it was good b4. 5. The recent BNM impact on exporters?? How big is the impact?? ( see http://www.businesstimes.com.sg/government...ort-fx-proceeds ) anymore? |

|

|

Aug 23 2017, 09:17 AM Aug 23 2017, 09:17 AM

|

Senior Member

1,497 posts Joined: Dec 2005 |

FLB huge volume breakout of 1.78 previously turned out to trap traders.... zzzz

Edit: I think it got to do with some error on share buy back from director and the next day amended announcement was sold instead of bought. This post has been edited by hehe86: Aug 23 2017, 09:19 AM |

|

|

Aug 23 2017, 07:03 PM Aug 23 2017, 07:03 PM

|

Senior Member

1,637 posts Joined: Mar 2010 From: Bolehland |

boon3 boon, do you use Moving Average in your trade?

|

|

|

Aug 23 2017, 07:05 PM Aug 23 2017, 07:05 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

Aug 24 2017, 08:39 AM Aug 24 2017, 08:39 AM

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

QUOTE(Boon3 @ Aug 23 2017, 09:08 AM) Cos it's not totally reliable to rely on the USD factor as previously.... today no same as yesterday.... Ok la, not all export counters good, but some keep doing very well, increasing volume sold, not just on forex terms.1. Run thru some export stocks. The oomph factor not as solid as before. Example? FLB gave some shitty numbers, no? (was it poor export? where the USD oomph?) 2. Yes, there will be winners (tech sector) but picking these winners is not the same as b4. 3. Growth caused by the USD factor tak cukup. Product itself must be growing... 4. Exporters to US is not necessary a safe bet as b4. Classic example? Classic Scenic (not to say that it was good b4. 5. The recent BNM impact on exporters?? How big is the impact?? ( see http://www.businesstimes.com.sg/government...ort-fx-proceeds ) anymore? Only export I hold now is Superln and Comfort. This post has been edited by gark: Aug 24 2017, 08:40 AM |

|

|

Aug 24 2017, 08:51 AM Aug 24 2017, 08:51 AM

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

Another potential growth stock for ah boon..

Prestar.. One chart says it all... steel ore price = steel price increase = stock becomes more valuable = higher margins  This post has been edited by gark: Aug 24 2017, 08:52 AM |

|

|

Aug 24 2017, 08:53 AM Aug 24 2017, 08:53 AM

|

Senior Member

6,779 posts Joined: Jan 2009 From: SEGI Heaven |

|

| Change to: |  0.0300sec 0.0300sec

0.74 0.74

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 20th December 2025 - 10:01 PM |