QUOTE(djhenry91 @ Aug 24 2017, 08:53 AM)

The QR has been improving for 6 quarters straight.. BWC

BWC

|

|

Aug 24 2017, 08:55 AM Aug 24 2017, 08:55 AM

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

|

|

|

|

|

|

Aug 24 2017, 08:57 AM Aug 24 2017, 08:57 AM

|

Senior Member

6,779 posts Joined: Jan 2009 From: SEGI Heaven |

|

|

|

Aug 24 2017, 08:58 AM Aug 24 2017, 08:58 AM

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

|

|

|

Aug 24 2017, 09:04 AM Aug 24 2017, 09:04 AM

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

Aug 24 2017, 09:07 AM Aug 24 2017, 09:07 AM

|

All Stars

15,942 posts Joined: Jun 2008 |

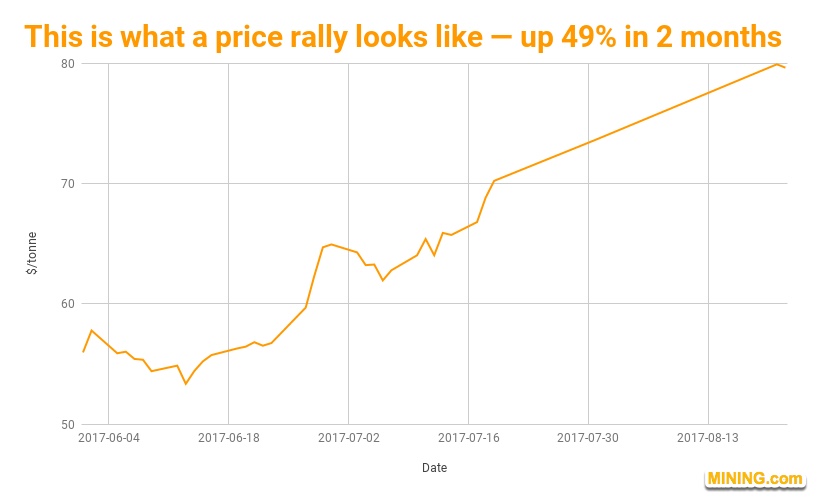

QUOTE(gark @ Aug 24 2017, 08:51 AM) Another potential growth stock for ah boon.. Prestar.. One chart says it all... steel ore price = steel price increase = stock becomes more valuable = higher margins  Impressive but not in. See hor... A company is valuable only if the company's profits keeps improving. Else you can have a company... eat pau, sell pau only..... how to be valuable? |

|

|

Aug 24 2017, 09:13 AM Aug 24 2017, 09:13 AM

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

|

|

|

|

|

|

Aug 24 2017, 09:14 AM Aug 24 2017, 09:14 AM

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

QUOTE(Boon3 @ Aug 24 2017, 09:07 AM) Impressive but not in. See hor... A company is valuable only if the company's profits keeps improving. Else you can have a company... eat pau, sell pau only..... how to be valuable? I also have not gone in yet See the forum view first.. |

|

|

Aug 24 2017, 09:15 AM Aug 24 2017, 09:15 AM

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

|

|

|

Aug 24 2017, 09:23 AM Aug 24 2017, 09:23 AM

|

Senior Member

1,444 posts Joined: Aug 2014 |

|

|

|

Aug 24 2017, 09:24 AM Aug 24 2017, 09:24 AM

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

Aug 24 2017, 09:29 AM Aug 24 2017, 09:29 AM

|

Senior Member

1,444 posts Joined: Aug 2014 |

|

|

|

Aug 24 2017, 09:34 AM Aug 24 2017, 09:34 AM

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

Aug 24 2017, 10:46 AM Aug 24 2017, 10:46 AM

|

Senior Member

4,821 posts Joined: Mar 2009 |

|

|

|

|

|

|

Aug 24 2017, 01:36 PM Aug 24 2017, 01:36 PM

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

|

|

|

Aug 24 2017, 01:38 PM Aug 24 2017, 01:38 PM

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

QUOTE(lowya @ Aug 24 2017, 10:46 AM) Not much value plays out there now.. Margins is expected due to trading business. The profits will come from margin expansion. Debt and cash is not worrying for me as long as their profits can service the interest. Well, not a recom to buy anyway.. see if can dig out more interesting companies.. This post has been edited by gark: Aug 24 2017, 01:39 PM |

|

|

Aug 25 2017, 07:22 PM Aug 25 2017, 07:22 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(Boon3 @ Jun 1 2017, 05:22 PM) » Click to show Spoiler - click again to hide... « Update... Parkson closed at 575. The profits does matter (not difficult to have a quick look see)  * those 3 quarters that shows positive profits? They all include one-off disposals. * By my calculations... we have now seen 19 CONSECUTIVE QUARTERS of losses !! And not looking for the share price.... the share price has broken lower...  * Buy low, sell high? The problem with such strategy is that it is rather very risky if we used this as a one blanket rule. Some stocks are consistently hitting new 56-week lows (another rather pointless yardstick) , The low one buy today could very well turn out to be the highs of the yesterdays. *  The BIG picture is actually highlighted clearly in their performance review in their latest earnings notes.  Look at the cumulative year-to-date review of its retail sections in all countries. THEY ARE ALL LOSING MONEY!! Also, this Parkson business strategy of focusing on new store growth.... well it clearly doesn't seem to be working anymore. Yeah Parkson opened 2 new stores. Parkson MyTown and Parkson Sunway Velocity. Hard to understand. Opening two brand new stores at two NEW MEGA MALL which are located so close to each other. ** Technicals? Chinese Water Torture. Just when you think the stock cannot go down any further, it does! ** NTA. Many have used the NTA as a reason to buy this stock.... and yet Parkson keep falling! Take care. |

|

|

Aug 25 2017, 11:43 PM Aug 25 2017, 11:43 PM

|

Senior Member

6,779 posts Joined: Jan 2009 From: SEGI Heaven |

dah agak la..parkson..laosai FA + TA

|

|

|

Aug 26 2017, 12:10 AM Aug 26 2017, 12:10 AM

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

Aug 27 2017, 12:19 PM Aug 27 2017, 12:19 PM

Show posts by this member only | IPv6 | Post

#1139

|

Senior Member

5,538 posts Joined: Apr 2011 |

Something brewing at TA enterprise? Just announced a net profit jump with one of their highest revenue ever recorded. But why this counter tak laku? Currently at p/e 3 only. I've been hearing people saying how undervalued this company is since years ago, but the price never quite went above RM1. They have made consistent profits over the years except for 2015,2016 (due to securities investment losses and foreign exchange), so still looking quite solid to me.

*stats graph from their annual report |

|

|

Aug 27 2017, 04:20 PM Aug 27 2017, 04:20 PM

|

Senior Member

6,779 posts Joined: Jan 2009 From: SEGI Heaven |

The Group reported revenue of RM312.7 million and profit before tax of RM87.6 million for the

current year’s second quarter, compared to revenue of RM169.5 million and loss before tax of RM20.0 million reported in the previous year’s corresponding quarter. For the current period-to-date, the Group achieved revenue of RM620.0 million and profit before tax of RM201.9 million, as compared to revenue of RM367.8 million and loss before tax of RM90.7 million in the previous corresponding period. Profit before tax for the current year’s second quarter and period-to-date increased as compared to the preceding year’s corresponding period were mainly attributable to better contribution from broking, investment holding, property development and hotel operation divisions. |

| Change to: |  0.0316sec 0.0316sec

0.44 0.44

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 20th December 2025 - 12:55 PM |