QUOTE(sgh @ May 13 2022, 02:26 PM)

When you decide to invest that time you are aware of the risk involved correct? Individual stock has high chance not get back. UT and ETF which is a basket of stocks should in theory get back some maybe not all. Selling now is locking your losses so you need make the decision.

That is why some investors propose invest in different asset classes like some in UT some in ETF some in REIT stock some in stock some in Gold some in endowment insurance etc

Not saying I'm gonna sell. Just keep it there at the moment until it starts to profit again. That is why some investors propose invest in different asset classes like some in UT some in ETF some in REIT stock some in stock some in Gold some in endowment insurance etc

QUOTE(WhitE LighteR @ May 13 2022, 02:41 PM)

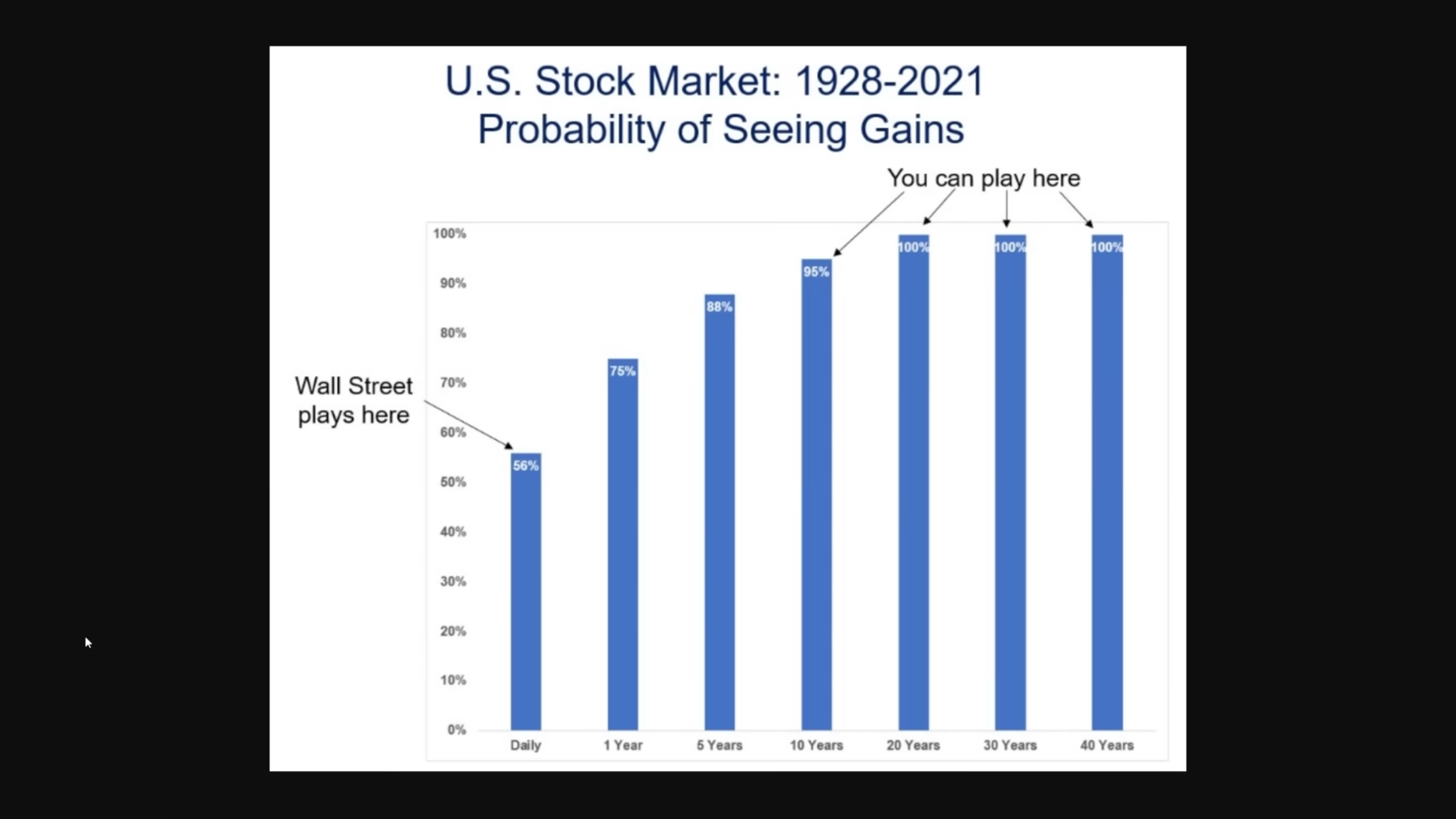

dont be so negative man. history shown us that the market always go up eventually

👌» Click to show Spoiler - click again to hide... «

May 13 2022, 01:45 PM

May 13 2022, 01:45 PM

Quote

Quote 0.0614sec

0.0614sec

0.79

0.79

7 queries

7 queries

GZIP Disabled

GZIP Disabled