QUOTE(MR_alien @ Apr 3 2020, 03:44 PM)

yes, noticed that my moderately aggressive port had moved up from its low too at a "nice pace"....but still negative from its high 2 months ago

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

|

Apr 3 2020, 03:46 PM Apr 3 2020, 03:46 PM

Return to original view | Post

#801

|

Senior Member

8,188 posts Joined: Apr 2013 |

|

|

|

|

|

|

Apr 3 2020, 04:38 PM Apr 3 2020, 04:38 PM

Return to original view | Post

#802

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(MR_alien @ Apr 3 2020, 04:15 PM) Now is definitely better than 2 mths ago But then just not sure if enter now will be better when compared with next month Thus if think of long term, invest with money not gonna touch for few years, select the portfolio level that is true to one's risk appetite...... Now would be better than 2 mtns ago... |

|

|

Apr 5 2020, 04:04 PM Apr 5 2020, 04:04 PM

Return to original view | Post

#803

|

Senior Member

8,188 posts Joined: Apr 2013 |

some reading material during this MCO.....

Impact of Covid-19 on Equity and Bond Markets ....by Public Mutual In the first quarter of 2020, Covid-19 has become a global pandemic and it is expected to have a significant impact on global economic activities. This is due to the disruption to consumption, businesses and production supply chains as a result of the measures taken to combat the pandemic, for example lockdowns and travel restrictions imposed by many countries. What could happen to the equity and bond markets under such situations? Learn more about: • The impact of the Covid-19 outbreak on the global and domestic equity markets • The outlook for the equity markets over the next few months • Investment strategy for equity funds under current market volatility • What caused the volatility in domestic bond market in March 2020 • The outlook for the Malaysian bond market • If you are investing in bond funds, what should you do? Disclaimer: This FAQ is prepared solely for educational and awareness purposes and should not be construed as an offer or a solicitation of an offer to purchase or subscribe to products offered by Public Mutual. No representation or warranty is made by Public Mutual, nor is there acceptance of any responsibility or liability as to the accuracy, completeness or correctness of the information contained herein. Attached File(s)  Impact_of_Coid19_by_PM_5_Apr_2020.pdf ( 400.69k )

Number of downloads: 63

Impact_of_Coid19_by_PM_5_Apr_2020.pdf ( 400.69k )

Number of downloads: 63 |

|

|

Apr 6 2020, 07:33 PM Apr 6 2020, 07:33 PM

Return to original view | Post

#804

|

Senior Member

8,188 posts Joined: Apr 2013 |

|

|

|

Apr 6 2020, 07:54 PM Apr 6 2020, 07:54 PM

Return to original view | Post

#805

|

Senior Member

8,188 posts Joined: Apr 2013 |

|

|

|

Apr 6 2020, 08:04 PM Apr 6 2020, 08:04 PM

Return to original view | Post

#806

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(oldies1950 @ Apr 6 2020, 07:59 PM) Just my 2 cents. a) Will invest into that UT. b) Like the EXPOSURE to Western countries where the Covid has and will continue for sometime until as EFFECTIVE vaccine ( NOT Easy ) is found. Vaccines WILL be pushed into the Market due to Spread BUT dont expecte it to be TOTALLY Effective. Leaway will be GIVEN to reduce infection by Govns. So Health Care will GROW at a SIGNIFICANT rate. c) Target is Drugs and Vaccines. Looks good with the Counters invested in. d) Equipments for treatment . Exposure of 29%. .................................................................... Question for Sifu. 1) Catagories of UT .... MR, MR ( Hedge ), AUS ( Hedge ) , SG (Hedge) and US. If RM continue to DROP against International Curriencies.............. Which would you invest ?? 2) RM dropping againts other International Currencies ? Possible :- YES ; Probability ? .......... > 75% ( My 2 cents )..... Your Comment SIFU ? i only go for MYR funds......thus cannot tell about that 2 othere questions.... |

|

|

|

|

|

Apr 8 2020, 06:15 AM Apr 8 2020, 06:15 AM

Return to original view | IPv6 | Post

#807

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(Drian @ Apr 8 2020, 12:47 AM) Finally, took them so long to do that. I have been saying for so long that their MY exposure is the one limiting their performance for the past 2 years. From 15% to 10% allocation..... Just 5% less.... If exposure to M'sia had been the one limiting the MP performance for the past 2 yrs, then a reduction of 5% allocation to M'sia, will be the turning point of its fortune finally?This post has been edited by yklooi: Apr 8 2020, 06:16 AM |

|

|

Apr 8 2020, 03:26 PM Apr 8 2020, 03:26 PM

Return to original view | Post

#808

|

Senior Member

8,188 posts Joined: Apr 2013 |

|

|

|

Apr 9 2020, 06:31 PM Apr 9 2020, 06:31 PM

Return to original view | Post

#809

|

Senior Member

8,188 posts Joined: Apr 2013 |

|

|

|

Apr 10 2020, 10:37 AM Apr 10 2020, 10:37 AM

Return to original view | Post

#810

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(Fledgeling @ Apr 10 2020, 10:15 AM) Hi there, I noticed quite a few people here mentioned investing into CIMB/Principal Greater China Fund. I have just done a comparison of a few Greater China funds below and I noticed that AmChina A shares has a better performance consistently (look at 5 year, 3 year etc comparison) and less volatility (overall more greens than red). not sure about others, but for me,I think I will put my investment into AmChina A shares. Could those who invest into CIMB/Principal Greater China Fund or any other China-based fund share on why you choose those particular funds instead of AmChina A shares? (somehow this fund hardly gets any mention here in this forum)  I would chose Cimb Greater China over AmChina A share in my core portfolio component funds bcos, it has less initial and subsequence investment amount it has more diversified countries of coverage it has about 25% less 3-Yr Annualised Volatility (%) I would only add in AmChina A share as my commando/striker/supplementary fund for some added kick when and as needed. This post has been edited by yklooi: Apr 10 2020, 10:38 AM |

|

|

Apr 14 2020, 10:22 AM Apr 14 2020, 10:22 AM

Return to original view | Post

#811

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(Avangelice @ Apr 14 2020, 10:08 AM) I got a feeling everything has started to stablize. Thinking of going back into normura I income fund if heart can take it....with the money for > 1 yr no gonna touch...try put 20% of this Nomura I income fund money into China fundthus instead of 100% into Nomura,...place 80% into it and 20% into China??? |

|

|

Apr 14 2020, 10:28 AM Apr 14 2020, 10:28 AM

Return to original view | Post

#812

|

Senior Member

8,188 posts Joined: Apr 2013 |

|

|

|

Apr 15 2020, 05:11 PM Apr 15 2020, 05:11 PM

Return to original view | Post

#813

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(DawnOnYou @ Apr 15 2020, 04:36 PM) May i know why? greater volatility comes with greater rewards..... Because it are holding all Grade A corporate bonds? But i noticed it has a greater volatility compared to AmBond, CIMB Bond, etc No-lah,...i based on its past performance over Ambond, Cimb Bond.... and also, in a mkt rebound, Eq fund would jump faster than Nomura.... so instead of "he" wanted to go ALL in Nomura....i suggested can just try swift 20% to TA to try catch the rebound... if kena bear trap....i think it is also not much impact as it is just 20% of this Nomura This post has been edited by yklooi: Apr 15 2020, 05:30 PM Attached thumbnail(s)

|

|

|

|

|

|

Apr 17 2020, 11:53 AM Apr 17 2020, 11:53 AM

Return to original view | Post

#814

|

Senior Member

8,188 posts Joined: Apr 2013 |

|

|

|

Apr 17 2020, 12:45 PM Apr 17 2020, 12:45 PM

Return to original view | Post

#815

|

Senior Member

8,188 posts Joined: Apr 2013 |

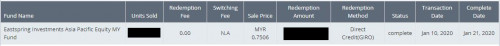

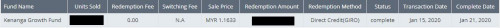

QUOTE(GrumpyNooby @ Apr 17 2020, 12:20 PM) Sorry I'm stupid. I made a "back track" calculation to determine the 'transaction date'....Can explain on this?  NAV on 10/01/2020 is 0.7506 (from Eastspring portal)  NAV on 15/01/2020 is 1.1633 (from Kenanga portal) The transaction date is referring to which transaction date? Date when sales order is placed to FSM? Or date when fund house settled the order (sales NAV has been priced in) with FSM? Attached thumbnail(s)

|

|

|

Apr 17 2020, 01:13 PM Apr 17 2020, 01:13 PM

Return to original view | Post

#816

|

Senior Member

8,188 posts Joined: Apr 2013 |

WUHAN, China: The Chinese city of Wuhan, where the coronavirus first emerged, raised its death toll by 50% on Friday, revealing that the city at ground zero of the global pandemic had been much worse hit than Beijing had previously reported.

https://www.bangkokpost.com/world/1901965/c...plans-reopening |

|

|

Apr 17 2020, 03:23 PM Apr 17 2020, 03:23 PM

Return to original view | Post

#817

|

Senior Member

8,188 posts Joined: Apr 2013 |

|

|

|

Apr 17 2020, 03:34 PM Apr 17 2020, 03:34 PM

Return to original view | Post

#818

|

Senior Member

8,188 posts Joined: Apr 2013 |

still want to heavy "cheong" China?

China suffers historic economic slump with hard recovery ahead published : 17 Apr 2020 https://www.bangkokpost.com/business/190204...-recovery-ahead |

|

|

Apr 17 2020, 03:36 PM Apr 17 2020, 03:36 PM

Return to original view | Post

#819

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(xcxa23 @ Apr 17 2020, 03:32 PM) definitely not doing that I shifted out of India in July 2019, after having recovered all my 2018 losses + some % of 2019 gains.few things i am still worry infrastructure, how long to recover from covid19, trump's trade war how's your allocated india fund performing? from 0% in FI to 50% in Nomura since July 2019 |

|

|

Apr 17 2020, 03:43 PM Apr 17 2020, 03:43 PM

Return to original view | Post

#820

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(GrumpyNooby @ Apr 17 2020, 03:36 PM) I enquired about the RHB Shariah China....was told that due to its Shariah....it did not have finance sector in there...thus wasn't impacted by covid19.. was told that, in the event of mkt bound,...funds with financial sector would bounce faster. |

| Change to: |  0.0573sec 0.0573sec

0.60 0.60

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 14th December 2025 - 06:12 AM |