QUOTE(old_and_slow @ Feb 22 2017, 12:10 AM)

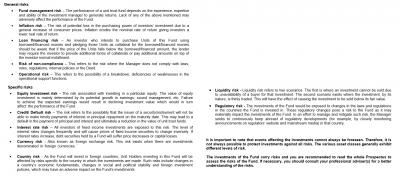

bought some ABERDEEN ISLAMIC WORLD EQUITY FUND - CLASS A last month

seen the performance over last year, compared with mini-recession times in february and october, it seems stable despite rocky market. feel no worry buying. of course there are higher performing but if i want stability then have to sacrifice a bit

good and happy to know that, you found and liked what you wanted to seek. seen the performance over last year, compared with mini-recession times in february and october, it seems stable despite rocky market. feel no worry buying. of course there are higher performing but if i want stability then have to sacrifice a bit

Happy investing and have a nice adventure.

Huat-huat ah.

Attached thumbnail(s)

Feb 22 2017, 07:24 AM

Feb 22 2017, 07:24 AM

Quote

Quote

0.0412sec

0.0412sec

0.54

0.54

7 queries

7 queries

GZIP Disabled

GZIP Disabled