QUOTE(Gatsby IT @ Jan 29 2021, 05:40 PM)

Today NAV b4 3pm ma..... Gonna wait until Nav updated baru u tahu berapa.Today any special? Holiday? Check ur account transaction ma, can see

This post has been edited by ironman16: Jan 29 2021, 05:46 PM

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

|

Jan 29 2021, 05:44 PM Jan 29 2021, 05:44 PM

Return to original view | IPv6 | Post

#401

|

Senior Member

2,437 posts Joined: Sep 2016 |

QUOTE(Gatsby IT @ Jan 29 2021, 05:40 PM) Today NAV b4 3pm ma..... Gonna wait until Nav updated baru u tahu berapa.Today any special? Holiday? Check ur account transaction ma, can see This post has been edited by ironman16: Jan 29 2021, 05:46 PM |

|

|

|

|

|

Jan 31 2021, 04:48 PM Jan 31 2021, 04:48 PM

Return to original view | Post

#402

|

Senior Member

2,437 posts Joined: Sep 2016 |

QUOTE(frostfrench @ Jan 31 2021, 04:33 PM) for now I have 2 funds in FSM, both kinda lesser risk as above said, go for both, different geo allocation , Affin Hwang Select Bond Fund RHB Asian Income Fund Will like to go more into equity this year, am considering these 2 Principal Asia Pacific Dynamic Growth Principal Global Technology Fund Which one should I choose between these 2? anyone holding the above? Thanks budget not enough nvm, just RSP.... just curious only, why u aim for Principal Asia Pacific Dynamic Growth, not Principal Asia Pacific Dynamic Income? but actually im Principal Asia Pacific Dynamic Growth la..... Tech fund i go with United , not Principal This post has been edited by ironman16: Jan 31 2021, 04:49 PM MUM liked this post

|

|

|

Feb 2 2021, 04:52 PM Feb 2 2021, 04:52 PM

Return to original view | IPv6 | Post

#403

|

Senior Member

2,437 posts Joined: Sep 2016 |

QUOTE(xuzen @ Feb 2 2021, 03:59 PM) Another new month another blow-water session. 😅 4%My Dec 2020 statement of account just in. Dec 2020 was a good month. Got a 1.6% gain. Total One year gain = 4% My investment gung-fu is worse than KWSP manager Xuzen Which fund drag u? This post has been edited by ironman16: Feb 2 2021, 04:53 PM |

|

|

Feb 2 2021, 06:01 PM Feb 2 2021, 06:01 PM

Return to original view | IPv6 | Post

#404

|

Senior Member

2,437 posts Joined: Sep 2016 |

QUOTE(yklooi @ Feb 2 2021, 03:31 PM) can try compare it with this? United ASEAN Discovery Fund https://www.fsmone.com.my/funds/tools/facts...c=fund-selector in my radar oledi ..... |

|

|

Feb 3 2021, 11:34 AM Feb 3 2021, 11:34 AM

Return to original view | IPv6 | Post

#405

|

Senior Member

2,437 posts Joined: Sep 2016 |

QUOTE(LoTek @ Feb 3 2021, 11:24 AM) Correct me if I'm wrong...I'm thinking that, if a same fund is listed in both fsm my and sg: clever The platform fees will be based on the current value, not the initial investment. So, it is impossible to calculate accurately the difference in cost between the initial sales charge vs platform fees as we do not know how the fund will perform in future. Assuming the fund was stagnant, fsm sg would be cheaper than fsm my up to 17+ quarters. Highly unlikely that a fund does not grow, and we still keep it so maybe with growth, ballpark, 12 quarters, or 3 years. Most people (I hope) keep their units way longer than 3 years, so, the initial sales charge method still seems more worth it? *This of course does not take into account the fact that some (many) people might wish to keep their assets in Sg rather than My, hence the appeal of Fsm Sg. **Disclaimer: I have both fsm my and sg accounts. at least u try planning for ur future moves oledi.... i will try to hold my investment with fsm , until fsm "lesap" or i "lesap" This post has been edited by ironman16: Feb 3 2021, 11:36 AM |

|

|

Feb 5 2021, 08:28 AM Feb 5 2021, 08:28 AM

Return to original view | IPv6 | Post

#406

|

Senior Member

2,437 posts Joined: Sep 2016 |

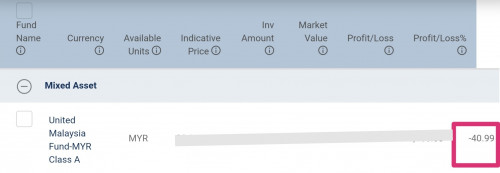

QUOTE(ganesh1696 @ Feb 5 2021, 07:13 AM) Hi guys, Yesterday oledi update in my holding,Does anyone have invested in UNITED MALAYSIA FUND? Did your fund's unit split (distribution) have executed? I do notice the pricefall in my fund's NAV price, and overall profit is about ( - 40%). When will they split units as the price already adjusted? If anyone have invested in it via FSMONE, please let me know if the split units has updated & displayed in your funds holdings. Because my holdings in "EUNITTRUST" haven't update. Kinda worry.  |

|

|

|

|

|

Feb 6 2021, 04:05 PM Feb 6 2021, 04:05 PM

Return to original view | IPv6 | Post

#407

|

Senior Member

2,437 posts Joined: Sep 2016 |

QUOTE(yycclin @ Feb 6 2021, 01:29 PM) Btw, these my allocation for discussion purposes. Assume that ur global is tech fund, i will increase Asia or ASEAN, decrease USNeed any improvement ? All comments are welcome Allocation. ■Asia ex Japan 2.84% ■US 10.03% ■China 16.17% ■Malaysia 0.56% ■Greater China 20.25% ■China India 6.55% ■Global 43.60% |

|

|

Feb 7 2021, 09:29 PM Feb 7 2021, 09:29 PM

Return to original view | IPv6 | Post

#408

|

Senior Member

2,437 posts Joined: Sep 2016 |

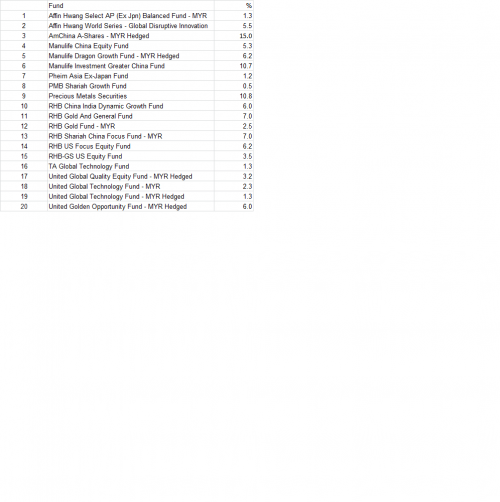

QUOTE(yycclin @ Feb 7 2021, 09:12 PM) Hi all, i attached my portfolio here for discussion, do i need to adjust any percentage ? Any possible improvement ? Tks. 😵 So many fund. Fund % 1 Affin Hwang Select AP (Ex Jpn) Balanced Fund - MYR 1.3 2 Affin Hwang World Series - Global Disruptive 5.5 3 Innovation Fund - MYR Hedged 15.0 4 AmChina A-Shares - MYR Hedged 5.3 5 Manulife China Equity Fund 6.2 6 Manulife Dragon Growth Fund - MYR Hedged 10.7 7 Manulife Investment Greater China Fund 1.2 8 Pheim Asia Ex-Japan Fund 1.2 9 PMB Shariah Growth Fund 10.8 10 Precious Metals Securities 6.0 11 RHB China India Dynamic Growth Fund 7.0 12 RHB Gold And General Fund 2.5 13 RHB Gold Fund - MYR 7.0 14 RHB Shariah China Focus Fund - MYR 6.2 15 RHB-GS US Equity Fund 3.5 16 TA Global Technology Fund 1.3 17 United Global Quality Equity Fund - MYR Hedged 3.2 18 United Global Technology Fund - MYR 2.3 19 United Global Technology Fund - MYR Hedged 1.3 20 United Golden Opportunity Fund - MYR Hedged 6.0 |

|

|

Feb 7 2021, 10:13 PM Feb 7 2021, 10:13 PM

Return to original view | IPv6 | Post

#409

|

||||||||||

Senior Member

2,437 posts Joined: Sep 2016 |

QUOTE(poooky @ Feb 7 2021, 09:41 PM) Any experienced investors care to rate my portfolio, advise on the next steps, and comment on my plan below? planning to be in it for the long game. My personal view ony.Current Porfolio:

Plan: I'm thinking of increasing proportion of 1. `Affin Hwang Select Asia Pacific (Ex Japan) Balanced Fund - MYR ` to 40% of holdings, and 2. Fixed Income / Bonds / Etc 20% Any recommendations on Fixed Income funds / Bonds or other lower risk investments to diversify and balance my portfolio? If u plan to add in Bond fund , not need balanced fund any more, can switch to others affin fund OR can intra swtich to affin bond fund to get ur credit (so u can use it to purchase others equity fund with 0% sales charge) OR maintan the balanced fund and just add in some others equity fund that u like i dun like this bcoz cant adjust my bond allocation. can try China A share/ Affin Distruptive or RHB AI/ ASEAN/ small cap/.... can limit ur fund below 10 fund so that easy to manage not a cert financial planner, follow at ur own risk.... |

||||||||||

|

|

Feb 7 2021, 10:29 PM Feb 7 2021, 10:29 PM

Return to original view | IPv6 | Post

#410

|

||||||||||

Senior Member

2,437 posts Joined: Sep 2016 |

QUOTE(poooky @ Feb 7 2021, 09:41 PM) Any experienced investors care to rate my portfolio, advise on the next steps, and comment on my plan below? planning to be in it for the long game. Affin Hwang Select Asia (Ex Japan) Opportunity Fund - MYR/Affin Hwang Select Asia Pacific (Ex Japan) Dividend Fund - MYRCurrent Porfolio:

Plan: I'm thinking of increasing proportion of 1. `Affin Hwang Select Asia Pacific (Ex Japan) Balanced Fund - MYR ` to 40% of holdings, and 2. Fixed Income / Bonds / Etc 20% Any recommendations on Fixed Income funds / Bonds or other lower risk investments to diversify and balance my portfolio? Affin Hwang World Series - Global Disruptive Innovation Fund - MYR Hedged/ Affin Hwang World Series - Next Generation Technology Fund - MYR Hedged/ RHB Global Artificial Intelligence Fund - MYR Hedged/ United Global Technology Fund - MYR AmChina A-Shares - MYR/ RHB Shariah China Focus Fund - MYR Principal ASEAN Dynamic Fund - MYR/ United ASEAN Discovery Fund (small cap) give u some suggest, do ur home work first but normally China fund will overlap with asia ex japan or Tech fund.... This post has been edited by ironman16: Feb 7 2021, 10:30 PM |

||||||||||

|

|

Feb 7 2021, 10:42 PM Feb 7 2021, 10:42 PM

Return to original view | IPv6 | Post

#411

|

Senior Member

2,437 posts Joined: Sep 2016 |

|

|

|

Feb 8 2021, 07:39 AM Feb 8 2021, 07:39 AM

Return to original view | IPv6 | Post

#412

|

Senior Member

2,437 posts Joined: Sep 2016 |

QUOTE(poooky @ Feb 8 2021, 07:09 AM) Hello, thanks for the suggestions, but I can't find the Fund Selector is unable to find the `RHB China Bond Fund`. Or am I looking in the wrong place. It's OK, ur choice. As long as u know what r u doing. Also, please do share your concerns with the TA Technology Fund. At a glance, it appears to offer greater diversity in Tech related equities on a global scale compared to `Principal Greater China Fund – MYR` or `Affin Hwang -Ex Japan` funds which are more focused on China. Thanks for the suggestions. I thinking to pull out of 1. TA Global Technology Fund 2. Affin Hwang AIIMAN Asia (Ex Japan) Growth Fund - MYR and go more into: 1. Affin Hwang Select Asia Pacific (Ex Japan) Balanced Fund - MYR 2. Principal Greater China Fund – MYR + 1 more FI/Bond fund. Another note, the Fund Selector is not able to find a number of the suggested funds. Only one that I can find that is similar is RHB i-Global Sustainable Disruptors - MYR Hedged, and this looks to be a new fund started from this year. If u r using Web page, fund selector is under UNIT TRUST / FUND selection. |

|

|

Feb 8 2021, 08:56 AM Feb 8 2021, 08:56 AM

Return to original view | IPv6 | Post

#413

|

Senior Member

2,437 posts Joined: Sep 2016 |

QUOTE(yycclin @ Feb 8 2021, 08:50 AM) Sorry, yesterday reached my daily post quota ( 3/day ) not able to update in time.. ;( boss, ur fund too many oledi n some just overlap .Here is the updated data, pls comment for improvement  example : United Globa tech u choose MYR and MYR hedged....>>> same fund . u try trim ur fund into Geo/Sector allocation, after that choose which one u wanna keep.... normally 1 or 2 fund in each geo or sector allocation, u punya Based on the latest event, now ppl favor in asia ex japan, China, Tech..........may b can add some ASEAN? This post has been edited by ironman16: Feb 8 2021, 08:57 AM yycclin liked this post

|

|

|

|

|

|

Feb 8 2021, 12:55 PM Feb 8 2021, 12:55 PM

Return to original view | IPv6 | Post

#414

|

Senior Member

2,437 posts Joined: Sep 2016 |

QUOTE(donhay @ Feb 8 2021, 12:43 PM) FD matured today, not putting back into FD, will put in Franklin U.S. Opportunities salute u ..... https://www.fsmone.com.my/funds/tools/facts...c=global-search US equities FTW donhay liked this post

|

|

|

Feb 8 2021, 05:20 PM Feb 8 2021, 05:20 PM

Return to original view | IPv6 | Post

#415

|

Senior Member

2,437 posts Joined: Sep 2016 |

QUOTE(donhay @ Feb 8 2021, 04:54 PM) No need to salute me 👍👍👍I have 2 funds already in China since Sept 2020, just diversifying my money Stay confident with ur decisions. donhay liked this post

|

|

|

Feb 9 2021, 09:01 AM Feb 9 2021, 09:01 AM

Return to original view | IPv6 | Post

#416

|

Senior Member

2,437 posts Joined: Sep 2016 |

|

|

|

Feb 13 2021, 12:33 AM Feb 13 2021, 12:33 AM

Return to original view | IPv6 | Post

#417

|

Senior Member

2,437 posts Joined: Sep 2016 |

|

|

|

Feb 13 2021, 10:43 PM Feb 13 2021, 10:43 PM

Return to original view | IPv6 | Post

#418

|

Senior Member

2,437 posts Joined: Sep 2016 |

Nine Common Mistakes Investors Make Mistake #1 Crowd support indicates a sure thing Mistake #2 Current returns are a guide to the future Mistake #3 “Experts” show the way Mistake #4 Shares can’t go up in a recession... Mistake #5 Letting a strongly held view get in the way Mistake #6 Looking at your investments too much Mistake #7 Making investing too complex Mistake #8 Too conservative early in life Mistake #9 Trying to time the market https://www.fsmone.com.my/funds/research/ar...eb%5D?src=funds sohailili, wongmunkeong, and 1 other liked this post

|

|

|

Feb 13 2021, 11:11 PM Feb 13 2021, 11:11 PM

Return to original view | IPv6 | Post

#419

|

Senior Member

2,437 posts Joined: Sep 2016 |

QUOTE(wongmunkeong @ Feb 13 2021, 10:55 PM) reverse all the above and U get a good repeatable simplified process focus on plan-able & execute-able, track track track XD QUOTE(lee82gx @ Feb 13 2021, 10:59 PM) 6, 7, 9 i always do..... i force myself every a few day to monitor my portfolio so that i can keep my momentum to top up monthly.....afraid if i didnt monitor so frequent, i will skip the monthly dca. bcoz i start my investment too late (around 35), so now i make my investment too complicated + timing market (some times) so that i can save my money (even single cent i oso want kabal82 and WhitE LighteR liked this post

|

|

|

Feb 13 2021, 11:22 PM Feb 13 2021, 11:22 PM

Return to original view | IPv6 | Post

#420

|

Senior Member

2,437 posts Joined: Sep 2016 |

QUOTE(wongmunkeong @ Feb 13 2021, 11:20 PM) I'm guilty of ALL of the above except item 8 Mistake #8 Too conservative early in life - may be too aggressive XD 👍👍😎😎😎well i was updating and calculating /trading DAILY (on top of passive investing) till 2018 - sometimes up to 5am+/- coz of US daylight saving time, thus welcome! misery loves company or fools flock together - take your pick XD dont worry about being late to the game - hell, i rebooted everything in 2008, started from near $0 cash due 1 major bad life's decision. learn the proper game, use the rules to your advantage where possible note - i'm just a worker / salaried slave & have kids +from a Gov servant father & home maker mum (ie. no silver spoon) |

| Change to: |  0.0689sec 0.0689sec

0.46 0.46

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 8th December 2025 - 10:09 AM |