Outline ·

[ Standard ] ·

Linear+

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

xuzen

|

Jun 21 2017, 11:23 AM Jun 21 2017, 11:23 AM

|

|

ASX FP UTF... ah, the enigma, the enigma...

This product does not comply with any FRS. It is more like a suka - suka type "my way or the highway " type product. Enjoy it while it last. When one day, the shit hits the fan, and those "privileged" must then need to come down back to face reality and participate in real open market / economy. In the mean time, enjoy the wine, song and dance.

BTW, you will not get any info on these ASX FP UTF on Morningstar website, and why? Coz they are not real funds. They are created in a microcosmo la la land.

p/s Oh I forget to add... Bernie Madoff's fund also have almost zero volatility. Long Term Capital Management bond fund too was having almost risk-free behavior. Google them and read about it.

This post has been edited by xuzen: Jun 21 2017, 11:26 AM

|

|

|

|

|

|

xuzen

|

Jun 22 2017, 10:21 AM Jun 22 2017, 10:21 AM

|

|

QUOTE(wonghs @ Jun 22 2017, 09:37 AM) Thx. Any thoughts of investing in the european funds now? There is no buy call on TA Europe fund from Algozen™ ver four. Xuzen » Click to show Spoiler - click again to hide... « Investors seeking higher equity market returns can consider our preferred region of Asia ex Japan, which at this current moment, still offer compelling value and higher expected upside as compared to the developed markets. The above is an extract from FSM article on Europe. This post has been edited by xuzen: Jun 22 2017, 10:24 AM |

|

|

|

|

|

xuzen

|

Jun 22 2017, 11:47 PM Jun 22 2017, 11:47 PM

|

|

QUOTE(Nom-el @ Jun 22 2017, 06:52 PM) Based on the latest data, Manulife AP REIT has higher 3 Year RRR & Sharpe Ratio compared to AmAsia AP REIT although the volatility is higher. I think it's worth taking the risk for the higher returns. Between the two REITs UTF, it is difficult to call who is the winner or loser in terms of Sharpe Ratio. I do track both and both of them takes turn to be number one and two ranking alternately. The only thing I can think of is, for alpha (ROI seeking), go ManuReits. For beta (stability seeking) go for AmReits. For me, since I use TA - GTF and KGF for generating alpha, I use AmReits for beta purpose. Xuzen p/s Case in point; when TA - GTF dropped 3% very recently, my AMReits actually went up to cushion my port's negativity. This post has been edited by xuzen: Jun 23 2017, 12:07 AM |

|

|

|

|

|

xuzen

|

Jun 29 2017, 11:14 AM Jun 29 2017, 11:14 AM

|

|

QUOTE(Msxxyy @ Jun 29 2017, 08:17 AM) Hi, I'm hoping for more than 10 percent. Thank you. Optimal port for 11% ROI are made up of: 1) Lee Sook Yee   UTF = 10% 2) Selina's  Reits UTF = 15% 3) TA - GTF = 15% 4) Esther's bond    UTF = 50% 5) RHB - EMB UTF = 10% Total = 100% 3 years historical annualized return is 11% 3 Years annualized volatility is 3.52% Risk to reward ratio = 3.125 Happy or not? Xuzen This post has been edited by xuzen: Jun 29 2017, 03:53 PM |

|

|

|

|

|

xuzen

|

Jun 29 2017, 12:33 PM Jun 29 2017, 12:33 PM

|

|

QUOTE(dasecret @ Jun 29 2017, 11:47 AM) So bond heavy? Anticipating a correction? One is a port for 13% ROI with optimized volatility. Another is a port for 11% ROI with optimized volatility. The inquirer asked for a port with above 10% ROI, so 11% is also > 10%. 11% is a moderate risk port. Xuzen p/s I ran many simulation from 8% to 20% ROI.... Which port is depend on your risk profile. My personal preference is a high moderate profil 13 to 14% port. This post has been edited by xuzen: Jun 29 2017, 12:35 PM |

|

|

|

|

|

xuzen

|

Jun 29 2017, 03:47 PM Jun 29 2017, 03:47 PM

|

|

QUOTE(Ancient-XinG- @ Jun 29 2017, 03:05 PM) FI 50% because this is a moderate / balanced port mah! BTW, you go and look high and low and see which balanced fund in FSM UTF list can give you a ROI of 11% with risk ratio of above 3 punya! Xuzen P/s : Paiseh paiseh, what does this symbol " <3 " mean? This post has been edited by xuzen: Jun 29 2017, 03:51 PM |

|

|

|

|

|

xuzen

|

Jul 1 2017, 12:15 PM Jul 1 2017, 12:15 PM

|

|

Today is the 1st of July 2017. Time for my port monthly review: Port made a low four digit gain, which translate to a below one percent gain. Gain is made up of small contribution from RHB - EMB and Esther bond (both half a percent each). The other gain came from surprise surprise Selina Reits (close to one percent gain) and Eastspring Asia Select Income which is a balanced fund, also a one percent gain in one month period. ES ASI UTF is actually from my KWSP - MIS port and I seldom talk about it because my KWSP - MIS is a very long term investment and is put on auto pilot. TA - GTF made a loss of half a percent in June 2017 period. My portfolio transaction for July 2017 is: a) Add MYR 500.00 to TA - GTF b) Add MYR 500.00 to Selina Reits  c) Add MYR 1,000.00 to Lee Sook Yee's   UTF d) Take profit of MYR 450.00 from Esther Bond    UTF My non Pokémon - Go port is made up of five UTFs and only one out of four UTFs made a loss   Xuzen p/s : BTW apa itu sales charge at? It sounds sooooooo alien to me  This post has been edited by xuzen: Jul 1 2017, 12:17 PM This post has been edited by xuzen: Jul 1 2017, 12:17 PM |

|

|

|

|

|

xuzen

|

Jul 4 2017, 12:42 PM Jul 4 2017, 12:42 PM

|

|

QUOTE(Msxxyy @ Jul 3 2017, 04:16 PM) Lol. So sexism. Gal cannot invest one? Good sister, On the contrary, a lot of our beloved Unit Trust Fund are managed by female fund managers. We are not gender bias, we are gender blind. All we care are her figures  Xuzen |

|

|

|

|

|

xuzen

|

Jul 4 2017, 12:46 PM Jul 4 2017, 12:46 PM

|

|

QUOTE(Msxxyy @ Jul 3 2017, 08:52 PM) But I realised we won't be better than guys in investing. A number of article that I have come across randomly have stated women makes better investors. Guys " think" they are better investors. On the other hand perhaps guys are better trader and there is a confusion between trader and investor. Xuzen |

|

|

|

|

|

xuzen

|

Jul 5 2017, 11:16 AM Jul 5 2017, 11:16 AM

|

|

QUOTE(HahaCat @ Jul 4 2017, 07:56 PM) [....Went home switched large chunk of portfolio to affin hwang ex japan. Then also donno why, first 3 month of this year shot up until fund close. Then went to bangsar one, affin was trying to promote absolute return fund 2. But this guy kept on saying china is good, china is good china is good, so i shift part of portfolio to china, also shot up. Recently, i went to (not by invitation) but by purchasing ticket, also another talk by affin, the MD reaffirm malaysia has more leg to go. So I also look around, and shifted chunk of portfolio to interpac, also went up. I switch here and there base on fund manager view and my personal research, in large chunk. And portfolio is not balanced, unlike what others would recommend. But I am confident in my own observation. Not possible to go to a talk where ppl tell u this FUND will shoot up. They can only give general view and region to recommend. Whether to place large chunk of ur portfolio into one region in a "high risk" bet and win, really depends on the person. Some ppl r not passionate about fund flow, I recommend they do DCA and be happy with double digit returns. Play like me will get burn they say. But I have no patience to save sex for retirement. I have the balls to borrow money from the bank and invest. Others dont. So we each get what we deserve base on our risk reward. Fair? I never state how much i invest in UT la, I juz state my FSM membership eligibility. Don't too excited. 12% per annum return, 30 years later is also a lot.  And this is exactly what I meant when I say male investor "thinks" that they are good investor. They tend to confuse investing with trading. Let's say a Platinum holder status gets a 0.75% discount, that means the transactional cost becomes 2.00 less 0.75 equals to 1.25% For normal stock trading, your transaction cost is only less than 0.5% for both sell and buy activity. Which is more efficient? UTF is a very poor tool for trading purpose. There exist better tools for trading if trading is your preferred choice of activity for making passive income. Xuzen This post has been edited by xuzen: Jul 5 2017, 11:50 AM |

|

|

|

|

|

xuzen

|

Jul 6 2017, 02:08 PM Jul 6 2017, 02:08 PM

|

|

QUOTE(wongmunkeong @ Jul 5 2017, 01:12 PM) bwhahaah eh, sifu, oxymoron leh - " trading activity for making passive income" trading is work, continuous work - buy/sell (or vice-versa), rinse, repeat Vs investing programmatically (DCA, VCA, asset allocation rebalancing, value, etc) - buy "right", zzz, wake up see see, zzz - or is that just me?  Paiseh paiseh.... sorry. |

|

|

|

|

|

xuzen

|

Jul 6 2017, 02:19 PM Jul 6 2017, 02:19 PM

|

|

QUOTE(T231H @ Jul 6 2017, 08:21 AM)  if the fund that you wanted to buy is not on the discounted SC list but other funds from that FH are? can try this.....?? same asset class ex...EQ ex.....I wanted to buy TA GTF but it does not have discounted SC but TA European has discounted SC buy TA European, then later switch to TA GTF.... this trick suggested by others many months ago worked. But do take note of switching fees if any...    Super clever.... I award you "Most Kiamsiap Investor" award!  Xuzen |

|

|

|

|

|

xuzen

|

Jul 6 2017, 02:21 PM Jul 6 2017, 02:21 PM

|

|

QUOTE(nvk @ Jul 6 2017, 08:40 AM) Thanks! ya becos that was one of the earliest fund i bought so now slowly buying others to lower the % i would also like to diversify my portfolio Does Affin Hwang Select Asia (ex Japan) Opportunity Fund correlate with CIMB Asia Pac Dynamic Income Fund? There is no data on Ponzi Two found inside Morningstar corr-matrix table. Hence you cannot get a definite answer. However, our educated guess is they are most like highly correlated (> 70%) Xuzen |

|

|

|

|

|

xuzen

|

Jul 7 2017, 11:38 AM Jul 7 2017, 11:38 AM

|

|

Friend Avangelice stated that he is going to sai lang into KGF. From my reading of the various local fund house media statement, they are bullish on KLSE stock market stating the main driver of uptrend being the impending GE-14 event. Personally I concur with their views and am also DCA'ing into KGF to take advantage of the momentum. However, unlike Avangelice, I do not have balls of titanium hence I will only slow poke into Lee Sook Yee   UTF up until the GE event. Regarding TA - GTF., for those who have been following my writing, recall that since Qtr four of year 2016, I have been skimming profit from TA - GTF until the most recent Algozen™ version four reading. Meaning, in plain English, I have been taking profit from TA - GTF since nine months ago when she was at her best performance. Now I am buying in again when it is low. Hmmmm.... Algozen™ version four do seem to be able to crystal - ball buy low sell high after all....    Xuzen |

|

|

|

|

|

xuzen

|

Jul 8 2017, 11:48 AM Jul 8 2017, 11:48 AM

|

|

My equity portion dropped! Time to sell some of my bonds to top up on equity aka rebalancing. Sell Esther Bond    (RM 500) and RHB - EMB (RM 500.00) to top up on Selina Reit  (RM 500.00) and TA - GTF (RM 500.00) and additional RM 500.00 (additional out of pocket top up) into Lee Sook Yee   UTF Xuzen This post has been edited by xuzen: Jul 8 2017, 11:51 AM |

|

|

|

|

|

xuzen

|

Jul 9 2017, 08:41 AM Jul 9 2017, 08:41 AM

|

|

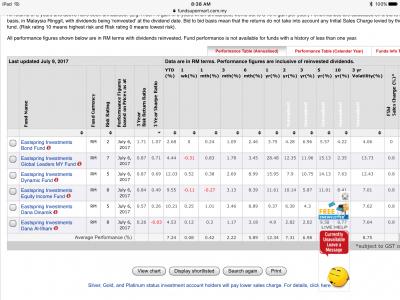

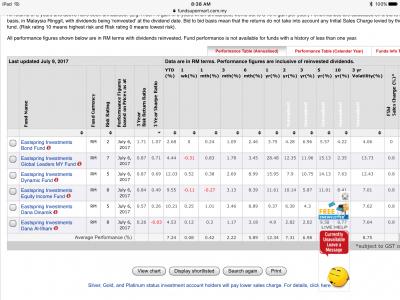

QUOTE(Kaka23 @ Jul 9 2017, 08:33 AM) any good epf fund to invest? my current EI Small cap already tutup..

Eastspring Investment UTF that are eligible for EPF - MIS withdrawal and also part of FSM's recommended UTF list. Xuzen |

|

|

|

|

|

xuzen

|

Jul 9 2017, 08:44 AM Jul 9 2017, 08:44 AM

|

|

QUOTE(2387581 @ Jul 8 2017, 06:19 PM) Feeling Super Macho! |

|

|

|

|

|

xuzen

|

Jul 9 2017, 11:34 PM Jul 9 2017, 11:34 PM

|

|

QUOTE(Kaka23 @ Jul 9 2017, 08:56 AM) I am thinking of EI MY FOCUS FUND.. but not in FSM recomended list  What a coincidence, I too, regularly do not give a two hoot about FSM's recommeded fund list myself. I did it MY WAYYYYYYYYYYYYY ! Xuzen |

|

|

|

|

|

xuzen

|

Jul 9 2017, 11:53 PM Jul 9 2017, 11:53 PM

|

|

QUOTE(skynode @ Jul 9 2017, 11:45 AM) This just struck my mind. I wonder what age groups are the current FSM investors in this forum? Can we create a poll like this? A. 21-30yo (the Gen Z) B. 31-40yo (the Gen Y) C. 41-50yo D. 51-60yo If you are a 11-20yo millennial and already saving up and investing, Kudos to you. It's just interesting to know what age groups do the people like Xuzen, Ramjade and Avangelice belong to. So that you can compare this to yourself at your current age and get a grasp at whether you are ahead or behind your peers. Much like comparing the performance of a UTF to another of the same market segment. What do you all think? Proud Gen X'er! This post has been edited by xuzen: Jul 10 2017, 12:11 AM |

|

|

|

|

|

xuzen

|

Jul 9 2017, 11:55 PM Jul 9 2017, 11:55 PM

|

|

QUOTE(David3700 @ Jul 9 2017, 11:36 PM) Group C. Started 2015, 2 years return 15.5% Amount invested 200k+ Before all in FD If the fund had remained 100% in FD, the ROI would have been a max = 8.5%. Congrats you have made additional 7% ROI and that is despite already paid sales charge. Xuzen This post has been edited by xuzen: Jul 9 2017, 11:58 PM |

|

|

|

|

Jun 21 2017, 11:23 AM

Jun 21 2017, 11:23 AM

Quote

Quote

0.0433sec

0.0433sec

0.36

0.36

7 queries

7 queries

GZIP Disabled

GZIP Disabled