QUOTE(encikbuta @ Jan 13 2021, 02:42 PM)

It's looking good. As some have pointed out, the Asia ex Jap may overlap a bit with Greater China & Emerging Markets. So if you're looking for more diversity, you could reduce them and put more into Global (US Focus). But if your intention is to really bet on Asia/China this year, then I'm all for it.

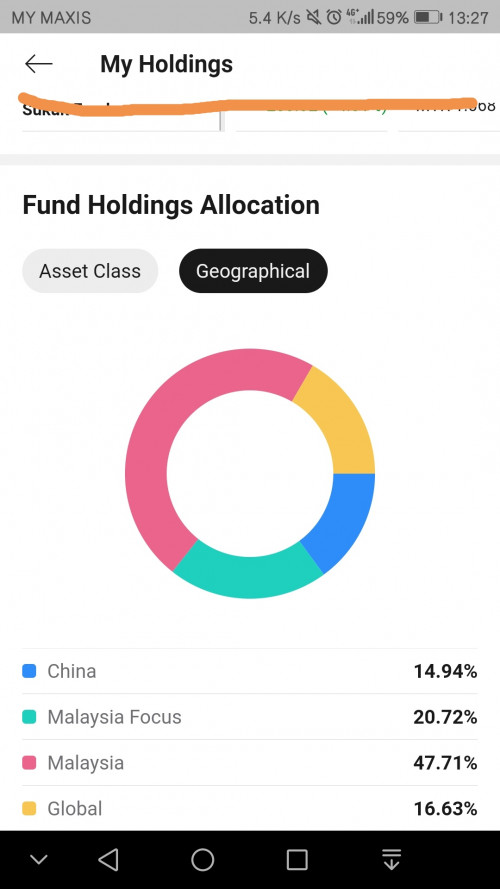

Below is mine for reference, no change to my 2020 allocation (for now). My only sector funds are US/China big tech, APAC REITS & ASEAN small caps. Others two funds (UGQEF & PGCF) are more geographical:

1. United Global Quality Equity Fund - 28%

2. TA Global Technology Fund - 25%

3. United ASEAN Discovery Fund - 19%

4. Principal Greater China Fund - 15%

5. Manulife Investment APAC REIT Fund - 14%

Am still very tempted to put 5 - 10% into Affin Disruptive

Too bad most of my funds in epf-mis. No tech funds but REITS looks interesting.

QUOTE(LoTek @ Jan 13 2021, 03:14 PM)

1. China (and Greater China) 35%

2. Tech (US and China heavy) 20%

3. Asia ex Japan 15%

4. Singapore (Equity & Reits) 10%

5. Emerging Markets 5%

Don't hold any malaysian equities as most of my "cash" is in asm, which already gives exposure to My, and personally am bearish about our long term prospects.

I also don’t see long term prospect for Malaysia sector at the moment. As mentioned before, planning to divert Malaysia allocation to others, REITS maybe

QUOTE(ironman16 @ Jan 13 2021, 03:24 PM)

Asia 44%

Tech 25%

Global 14%

Msia 4%

Gold 4%

This year planning : may b pump lagi China (A share) + Global + Msia

havent decide.......wait msia event habis baru decide.....

If based on Polar punya excel :

US

China

Taiwan

S korea

Hong Kong

Japan

After pumping A share, your China will be no 1

Malaysia up up 🙏

Jan 7 2021, 11:22 AM

Jan 7 2021, 11:22 AM

Quote

Quote

0.0642sec

0.0642sec

0.59

0.59

7 queries

7 queries

GZIP Disabled

GZIP Disabled