QUOTE(ChipZ @ Jun 9 2020, 10:58 PM)

My KGF +12%FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

|

Jun 9 2020, 10:59 PM Jun 9 2020, 10:59 PM

Return to original view | IPv6 | Post

#21

|

Senior Member

5,596 posts Joined: Apr 2011 From: Kuala Lumpur |

|

|

|

|

|

|

Jun 29 2020, 06:47 PM Jun 29 2020, 06:47 PM

Return to original view | IPv6 | Post

#22

|

Senior Member

5,596 posts Joined: Apr 2011 From: Kuala Lumpur |

Compared to StashAway, can I say that FSM is less suitable for active trading?

Since you will be charged a one time sales charge by FSM when you enter, while for StashAway you will only be charged the annual fee as a percentage of your holding (less holding less annual fee) If I realize my gain from FSM today, I will need to pay the sales charge again when I enter. This post has been edited by victorian: Jun 29 2020, 06:48 PM |

|

|

Jun 29 2020, 06:58 PM Jun 29 2020, 06:58 PM

Return to original view | IPv6 | Post

#23

|

Senior Member

5,596 posts Joined: Apr 2011 From: Kuala Lumpur |

QUOTE(MUM @ Jun 29 2020, 06:52 PM) if you wanted to switch frequently in FSM, Yea UTs are never meant for active trading, but just wondering since many posters are taking their gains today. FSM has credit point system, try to use that to offset the sales charges can that reduce/solve your concern? anyway, i think FSM never advocate active trading of UTs Wouldn’t that incur extra cost when you want to enter again? |

|

|

Jul 3 2020, 06:16 PM Jul 3 2020, 06:16 PM

Return to original view | Post

#24

|

Senior Member

5,596 posts Joined: Apr 2011 From: Kuala Lumpur |

QUOTE(joeaverage @ Jul 3 2020, 05:36 PM) If someone is doing DCA and has been topping up consistently on a fixed day in the week (for weekly) or particular date (in a month) - would it still be considered DCA if they defer the topping up on a day which is 'super good' for the market as it is akin to timing.. but here the defer is just a day or 2 when there is profit taking or a dip.. and then top up then. DCA should be automated and does not require any manual intervention from the user. i guess in the long run - it doesnt really matter but wonder what do you guys practice? But hey if you are free to do that just go ahead. |

|

|

Jul 7 2020, 11:43 AM Jul 7 2020, 11:43 AM

Return to original view | IPv6 | Post

#25

|

Senior Member

5,596 posts Joined: Apr 2011 From: Kuala Lumpur |

Cashed out some of my principal greater China and Asia pacific just to lock some profit

|

|

|

Jul 7 2020, 11:47 AM Jul 7 2020, 11:47 AM

Return to original view | Post

#26

|

Senior Member

5,596 posts Joined: Apr 2011 From: Kuala Lumpur |

Double post

This post has been edited by victorian: Jul 7 2020, 11:47 AM |

|

|

|

|

|

Jul 7 2020, 11:58 AM Jul 7 2020, 11:58 AM

Return to original view | IPv6 | Post

#27

|

Senior Member

5,596 posts Joined: Apr 2011 From: Kuala Lumpur |

QUOTE(yklooi @ Jul 7 2020, 11:52 AM) Haha no la If I withdraw profit only It’s too little.I cashed out half of my greater China and 20% of my principal Asia Pacific dynamic. Profit for greater China is 15% (DCA after COVID) and 5% for principal Asia pacific dynamic (DCA for one year already, hence it was greatly impacted by the March crash). It’s very hard to decide whether to sell now or keep holding, but my house will be done end of this year and I need some cash, hence it helped me in the decision. |

|

|

Jul 7 2020, 12:02 PM Jul 7 2020, 12:02 PM

Return to original view | Post

#28

|

Senior Member

5,596 posts Joined: Apr 2011 From: Kuala Lumpur |

QUOTE(yklooi @ Jul 7 2020, 11:52 AM) cash out just the profits only? I really do not want to over analyze the market. btw, how many % is the profits earned? Are you expecting some markets corrections to be coming soon? if YES, then what is your expected % of markets "pull back"? For me the decision is simple, I need the cash in few months time and the profit is good. Take out some and leave some inside, continue to DCA. PrintHelloWorld, cempedaklife, and 1 other liked this post

|

|

|

Jul 9 2020, 08:42 AM Jul 9 2020, 08:42 AM

Return to original view | IPv6 | Post

#29

|

Senior Member

5,596 posts Joined: Apr 2011 From: Kuala Lumpur |

If I sold my holdings on Tuesday morning, when will the price be locked in ya? I just checked and the units are still inside my account, does it mean that the price is not locked yet?

It’s really giving me a rollercoaster ride, seeing my current holdings fluctuating and my sale order still in process. |

|

|

Jul 9 2020, 08:44 AM Jul 9 2020, 08:44 AM

Return to original view | IPv6 | Post

#30

|

Senior Member

5,596 posts Joined: Apr 2011 From: Kuala Lumpur |

|

|

|

Jul 9 2020, 08:48 AM Jul 9 2020, 08:48 AM

Return to original view | IPv6 | Post

#31

|

Senior Member

5,596 posts Joined: Apr 2011 From: Kuala Lumpur |

|

|

|

Jul 9 2020, 11:40 PM Jul 9 2020, 11:40 PM

Return to original view | IPv6 | Post

#32

|

Senior Member

5,596 posts Joined: Apr 2011 From: Kuala Lumpur |

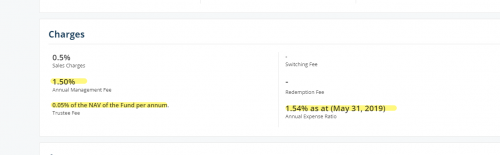

Early this year there was a Managed Portfolio promotion by FSM, if you subscribe to their MP you’ll get lifetime 0% subscription fee.

I just confirmed with FSM that I can change the RSP amount and I can still enjoy the 0% subscription fee.

This means that the only fee that I have to pay is 0.50% management fee per annum.

For the MP one of the fund is KGF, if I want to enter KGF normally I’ll have to pay 1.75% sales charge. It also comes with 1.50% annual management fee.

If I were to invest through MP, I can bypass all that and only pay 0.50% annual management fee. Is there anything I’m missing? |

|

|

Jul 9 2020, 11:58 PM Jul 9 2020, 11:58 PM

Return to original view | Post

#33

|

Senior Member

5,596 posts Joined: Apr 2011 From: Kuala Lumpur |

QUOTE(tadashi987 @ Jul 9 2020, 11:48 PM)  yes and no yes because u indeed dont need to pay for subscription fee for ur MP no because in fact you are still paying the highlighted, but for UT, the highlighted usually doesnt matter because it is absorded and reflected in the NAV, which means the NAV and performance you saw on FSM is already considered and included with the highlighted. |

|

|

|

|

|

Jul 10 2020, 08:36 AM Jul 10 2020, 08:36 AM

Return to original view | IPv6 | Post

#34

|

Senior Member

5,596 posts Joined: Apr 2011 From: Kuala Lumpur |

QUOTE(yklooi @ Jul 10 2020, 08:32 AM) other than those mentioned by tadashi987, KGF is just my example to illustrate the scenario, I do not have any preference on the portfolio allocation.this is what i thought too.... if you wanted KGF and think that KGF (or any other funds) is going to be great in the coming future.... if you buy your self, you can buy a much as you like to suit your % of allocation... but if you rely on MP to buy, you cannot control the % of allocation. look at the % of KGF being allocated in the MP,....is that % allocated in the MP is of the same desire as yours? |

|

|

Jul 10 2020, 01:10 PM Jul 10 2020, 01:10 PM

Return to original view | IPv6 | Post

#35

|

Senior Member

5,596 posts Joined: Apr 2011 From: Kuala Lumpur |

|

|

|

Jul 19 2020, 09:08 AM Jul 19 2020, 09:08 AM

Return to original view | IPv6 | Post

#36

|

Senior Member

5,596 posts Joined: Apr 2011 From: Kuala Lumpur |

I still use the web FSM because it allows me to login using touchid.

|

|

|

Jul 19 2020, 09:16 AM Jul 19 2020, 09:16 AM

Return to original view | IPv6 | Post

#37

|

Senior Member

5,596 posts Joined: Apr 2011 From: Kuala Lumpur |

|

|

|

Aug 12 2020, 09:59 AM Aug 12 2020, 09:59 AM

Return to original view | Post

#38

|

Senior Member

5,596 posts Joined: Apr 2011 From: Kuala Lumpur |

What happened to principal greater China fund ya? Suddenly drop 8%, is it because of income distribution ?

|

|

|

Aug 12 2020, 10:19 AM Aug 12 2020, 10:19 AM

Return to original view | Post

#39

|

Senior Member

5,596 posts Joined: Apr 2011 From: Kuala Lumpur |

|

|

|

Aug 16 2020, 11:18 PM Aug 16 2020, 11:18 PM

Return to original view | Post

#40

|

Senior Member

5,596 posts Joined: Apr 2011 From: Kuala Lumpur |

|

| Change to: |  0.0565sec 0.0565sec

0.27 0.27

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 5th December 2025 - 09:41 PM |