QUOTE(rojakwhacker @ Aug 17 2020, 09:24 PM)

If top up a fund during Merdeka Sales, will be eligible for lesser sales % charge when sell it in any other day?

There’s no charges when exiting.FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

|

Aug 17 2020, 09:30 PM Aug 17 2020, 09:30 PM

Return to original view | Post

#41

|

Senior Member

5,602 posts Joined: Apr 2011 From: Kuala Lumpur |

|

|

|

|

|

|

Aug 17 2020, 09:53 PM Aug 17 2020, 09:53 PM

Return to original view | IPv6 | Post

#42

|

Senior Member

5,602 posts Joined: Apr 2011 From: Kuala Lumpur |

QUOTE(rojakwhacker @ Aug 17 2020, 09:49 PM) I understand the part on promotion period, get lower % sales charge. Sales charge is only charged when u buy, you can sell it anytime without any feeThen it means when first brought a fund, it had already defined how many % sales charge are applied to the fund? Like for my new account, i invest in the Principal Greater China Equity MYR fund, it says 1% sales charge. So when i sell it after few months/years, i get 1% sales charge, correct? |

|

|

Aug 18 2020, 05:49 PM Aug 18 2020, 05:49 PM

Return to original view | Post

#43

|

Senior Member

5,602 posts Joined: Apr 2011 From: Kuala Lumpur |

QUOTE(whirlwind @ Aug 18 2020, 05:46 PM) I’m new to UT. Around 2 months old only I think your mistake is playing UT like stocks. Bought Precious Metal Securities early August and the price of gold and NAV went sliding down. Panicked and switch it to Ambond immediately. Lost few hundred there. Anyway, it’s my mistake for investing in it in the first place when I’m not prepared with the volatility Just hold and keep buying |

|

|

Sep 22 2020, 09:12 AM Sep 22 2020, 09:12 AM

Return to original view | IPv6 | Post

#44

|

Senior Member

5,602 posts Joined: Apr 2011 From: Kuala Lumpur |

QUOTE(coo|dude @ Sep 22 2020, 08:46 AM) Anyone here had opened an account and purchased from Prudential Eastspring? Can you confirm if they really accept GrabPay? I passed by their investment office yesterday and when asked, they said Boost is the only ewallet they support at the moment. GrabPay channel closed already |

|

|

Sep 25 2020, 06:46 PM Sep 25 2020, 06:46 PM

Return to original view | IPv6 | Post

#45

|

Senior Member

5,602 posts Joined: Apr 2011 From: Kuala Lumpur |

lets say you have 4 funds that you are DCAing monthly in equal amount each, and you are planning to cash in and stop 2 of them in order to accumulate more liquid cash, which 2 will you stop and why. The funds in question are:

1. Principal Asia Pacific Dynamic 2. Principal Greater China 3. Kenanga Growth Fund 3. TA Global Tech |

|

|

Oct 21 2020, 11:27 AM Oct 21 2020, 11:27 AM

Return to original view | Post

#46

|

Senior Member

5,602 posts Joined: Apr 2011 From: Kuala Lumpur |

QUOTE(Mr.Beanster @ Oct 21 2020, 10:58 AM) Anyone using managed portfolios? What do you think of the performance of the funds? Using since March 2020, got the 0% subscription fee promo. I signed up FSM 1 month ago but haven't buy into any funds yet. Still researching but seems like the fund like Principle Greater China in my watch list is at all time high now. As of now already 13% return |

|

|

|

|

|

Oct 21 2020, 02:29 PM Oct 21 2020, 02:29 PM

Return to original view | IPv6 | Post

#47

|

Senior Member

5,602 posts Joined: Apr 2011 From: Kuala Lumpur |

|

|

|

Jan 27 2021, 11:38 PM Jan 27 2021, 11:38 PM

Return to original view | IPv6 | Post

#48

|

Senior Member

5,602 posts Joined: Apr 2011 From: Kuala Lumpur |

0% SC cut off date is 3 pm on Friday. If I pay by FPX tomorrow can I still make it ?

|

|

|

Feb 3 2021, 03:11 PM Feb 3 2021, 03:11 PM

Return to original view | IPv6 | Post

#49

|

Senior Member

5,602 posts Joined: Apr 2011 From: Kuala Lumpur |

This is FSM MY thread. If you are keen on FSM SG may I suggest you to open a separate thread? Not all of us are interested in going the extra miles just to save a few pennies.

|

|

|

Mar 11 2021, 08:46 PM Mar 11 2021, 08:46 PM

Return to original view | IPv6 | Post

#50

|

Senior Member

5,602 posts Joined: Apr 2011 From: Kuala Lumpur |

QUOTE(Yenshefu @ Mar 11 2021, 08:41 PM) Hi guys, I have bought PRS Fund via FSM just wondering if we can Sell the fund using FSM web, as I couldn’t find this Option. Thank you. Do you know what PRS funds are for? Why are you selling them. kabal82 liked this post

|

|

|

Mar 13 2021, 11:33 AM Mar 13 2021, 11:33 AM

Return to original view | Post

#51

|

Senior Member

5,602 posts Joined: Apr 2011 From: Kuala Lumpur |

|

|

|

Mar 19 2021, 09:09 AM Mar 19 2021, 09:09 AM

Return to original view | IPv6 | Post

#52

|

Senior Member

5,602 posts Joined: Apr 2011 From: Kuala Lumpur |

What is the charge for etf? Any recommendations? Feel like dumping into etf just for the campaign

|

|

|

Mar 19 2021, 10:23 AM Mar 19 2021, 10:23 AM

Return to original view | IPv6 | Post

#53

|

Senior Member

5,602 posts Joined: Apr 2011 From: Kuala Lumpur |

QUOTE(T231H @ Mar 19 2021, 10:19 AM) as per posted in post 27335 ETFs also can ah, but no one knows what is the fee..5. The first 1,000 eligible investors who invested a successful trade in any stock or ETF within the campaign period and fulfilled T&C 4 will enjoy RM100 worth of Cash Management Fund 2. |

|

|

|

|

|

Mar 19 2021, 10:35 AM Mar 19 2021, 10:35 AM

Return to original view | IPv6 | Post

#54

|

Senior Member

5,602 posts Joined: Apr 2011 From: Kuala Lumpur |

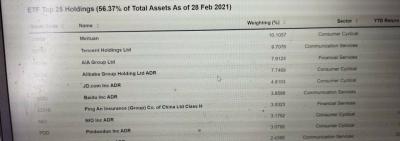

CDS account approved and I immediately bought 2 lots of China etf. Rm875 per lot. Total is RM 1760 with RM10+ fees.

|

|

|

Mar 19 2021, 10:40 AM Mar 19 2021, 10:40 AM

Return to original view | IPv6 | Post

#55

|

Senior Member

5,602 posts Joined: Apr 2011 From: Kuala Lumpur |

|

|

|

Mar 19 2021, 10:57 AM Mar 19 2021, 10:57 AM

Return to original view | IPv6 | Post

#56

|

Senior Member

5,602 posts Joined: Apr 2011 From: Kuala Lumpur |

QUOTE(victorian @ Mar 19 2021, 10:40 AM) The name is China etf, a bit hard to navigate the etf list so I just picked the only china etf on the list. I forgot to adjust the bid price just now, and my order was matched shortly.

Any sifu can advice, will it be better for me to lower the bid price or maintain the default price? |

|

|

Mar 19 2021, 11:02 AM Mar 19 2021, 11:02 AM

Return to original view | IPv6 | Post

#57

|

Senior Member

5,602 posts Joined: Apr 2011 From: Kuala Lumpur |

|

|

|

Mar 19 2021, 11:23 AM Mar 19 2021, 11:23 AM

Return to original view | IPv6 | Post

#58

|

Senior Member

5,602 posts Joined: Apr 2011 From: Kuala Lumpur |

|

|

|

Mar 19 2021, 11:42 AM Mar 19 2021, 11:42 AM

Return to original view | IPv6 | Post

#59

|

Senior Member

5,602 posts Joined: Apr 2011 From: Kuala Lumpur |

|

|

|

Mar 19 2021, 12:38 PM Mar 19 2021, 12:38 PM

Return to original view | IPv6 | Post

#60

|

Senior Member

5,602 posts Joined: Apr 2011 From: Kuala Lumpur |

QUOTE(lee82gx @ Mar 19 2021, 12:32 PM) All I know is sure Rakuten / M+ etc getting less business. UT vs Shares, I think has been on going for a long time.... For small fish like me, I still prefer UT as it does not have a minimum charge. Investing 1k in UT = 1.75% sales charge = RM17.5 Investing 1k in share = RM10 X 2 = RM 20 If you invest lump sum share is cheaper but if you want to DCA small amount, UT is still cheaper extinct_83 and yklooi liked this post

|

| Change to: |  0.0655sec 0.0655sec

0.78 0.78

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 9th December 2025 - 01:21 PM |