QUOTE(wongmunkeong @ Mar 29 2017, 08:43 AM)

bro - what U see MORE in forums are usually the "fast twitch" ones.

most of us "slow twitch" ones do not REACT to these "stuff", we RESPOND to value changes or % deviation from our planned portfolio.

As can be seen from the prior responses to your post - these fellow forumers are responding to your example Q (last sentence), instead of the bigger picture.

Same post (from U), Different focus (from us), Different reaction/response (from us)

It's a good thing - else all become lemmings / sheeples, right?

In reference to US exposure:

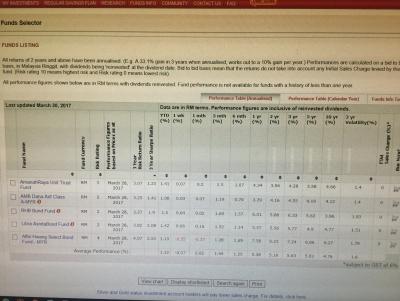

I used TA GTF as my proxy to US equity exposure.

I entered in Qtr 2 of Yr 2016 and started to skim profit from it starting in Nov 2016 until now.

Why do I start to skim profit way starting back in four months ago?

Because Algozen™ ver 3.0 says so! The fact of the matter is, its risk to reward ratio was beginning to drop and the similar parameter, that is, risk to reward for Asia-Pac ex Japan region was beginning to improve. Hence, Algozen™ told me to shift more towards Asia-Pac ex-Japan in lieu of US. That is why since Nov 2016, I have been skimming the profit made from US exposure and placing them into Asia Pac ex-Japan.

Is Algozen™ able to predict the future? I don't know. Is it a coincidence that it knows that US will be volatile? I don't know.... but for version three = so far so good lar!

This is why veterans do not over react to these small little noises here and there. We have already an custom in-built filter to these noises.

Less Noise; More Zen™!

Xuzen

p/s I bet for the next few days some noobs unheard before will post question like, I have US UTF, should I sell?

This post has been edited by xuzen: Mar 29 2017, 11:54 AM

This post has been edited by xuzen: Mar 29 2017, 11:54 AM

Mar 26 2017, 08:44 PM

Mar 26 2017, 08:44 PM

Quote

Quote

0.0471sec

0.0471sec

0.68

0.68

7 queries

7 queries

GZIP Disabled

GZIP Disabled