QUOTE(Tongny @ Feb 26 2018, 09:31 PM)

Yes, cash investment and EPF investment have the same sales charges at FSM.FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

|

Feb 26 2018, 10:18 PM Feb 26 2018, 10:18 PM

Return to original view | Post

#141

|

Junior Member

225 posts Joined: Jul 2017 |

|

|

|

|

|

|

Feb 28 2018, 05:05 PM Feb 28 2018, 05:05 PM

Return to original view | Post

#142

|

Junior Member

225 posts Joined: Jul 2017 |

QUOTE(T231H @ Feb 28 2018, 04:35 PM) if i am not mistaken....i1899 did mentioned United Global Quality Equity fd sometime back....... United Global Quality Equity doesn't disappoint me so far.. can try to have a look then tell us what you think... But, just as reminder, Before step into United Funds, please take note below points: 1) 1% (intra fund house) switching fee for almost all united funds. 2) Minimum redeem units : 1000 units. |

|

|

Feb 28 2018, 05:54 PM Feb 28 2018, 05:54 PM

Return to original view | Post

#143

|

Junior Member

225 posts Joined: Jul 2017 |

QUOTE(funnyface @ Feb 28 2018, 05:10 PM) EQ to FI should be still FOC right? Not, switching fee cannot be offset by credit, only the sales charge can be waived using credit.If we use ninja trick (EQ to FI to EQ), should be still free.... if perform INTRA swiching among UNITED funds, need to pay 1% as switching fee. 1% is quite high for me, is higher than my entitled sales charges. So, Ninja trick is not good for united funds switching The only way to not pay the switching fee is directly sell to bank account or CMF. Refer to : https://www.fundsupermart.com.my/main/buyse...svdo?code=MYUOB |

|

|

Feb 28 2018, 06:18 PM Feb 28 2018, 06:18 PM

Return to original view | Post

#144

|

Junior Member

225 posts Joined: Jul 2017 |

QUOTE(funnyface @ Feb 28 2018, 06:00 PM) u can try to get a special offer, but i can confirm u that UNITED 1% switching fee cannot be waived, at this moment. Manulife waive only 6 switching / year , max amount/ year is RM25x6 = RM150. it is waived by Manulife, not FSM. pls refer to: https://www.fundsupermart.com.my/main/buyse...do?code=MYMLIFE Remark : Manulife Asset Management Services Berhad will waive the switching fee for the first 6 switching in a calendar year for each unit holder. Switching fee on RHB is also RM25 and it also cannot be waived. RM25/ switching is nothing, is not same story with UNITED 1% switching fee. |

|

|

Feb 28 2018, 10:57 PM Feb 28 2018, 10:57 PM

Return to original view | Post

#145

|

Junior Member

225 posts Joined: Jul 2017 |

QUOTE(5p3ak @ Feb 28 2018, 09:41 PM) I don't quite get the 1% switching fee, does that mean if I wanna switch I need to switch RM1060 worth if the other fund investment amount is RM1000? United's 1% switching fee is applicable to INTRA fund house switching only.For example, when u want to switch RM100K from United Global Quality to United Japan Discovery. - RM1K will be deducted from United Global Quality, as switching fee, and then RM99K will be switched to United Japan Discovery. No credit is utilized in this case because no sales charges. 1 year later, the RM99K grows to RM120K.. u decided to switch United Japan to United Income Plus Fund. Then, the other RM1.2K will be deducted from United Japan Fund. So, total paid switching fee is RM2.2K, and snow ball will be bigger and bigger if always doing intra switching among UNITED Funds. |

|

|

Mar 1 2018, 01:33 PM Mar 1 2018, 01:33 PM

Return to original view | Post

#146

|

Junior Member

225 posts Joined: Jul 2017 |

QUOTE(ben3003 @ Mar 1 2018, 11:02 AM) of course MYR Hedged, becoz hedged currency fund can reduce currency risk significantly.QUOTE(ehwee @ Mar 1 2018, 12:52 PM) anyone know as CIMB bond fund require min subsequent top up of RM500.00, can I switch some amount less than that say RM300.00 from my other CIMB equity fund to CIMB bond fund, will FSM accept the transaction? not, u cannot. |

|

|

|

|

|

Mar 1 2018, 09:14 PM Mar 1 2018, 09:14 PM

Return to original view | Post

#147

|

Junior Member

225 posts Joined: Jul 2017 |

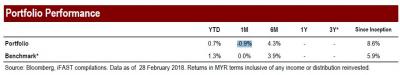

February not so bad lah.

MoM : -1.44%, YTD +0.65% |

|

|

Mar 2 2018, 12:16 AM Mar 2 2018, 12:16 AM

Return to original view | Post

#148

|

Junior Member

225 posts Joined: Jul 2017 |

|

|

|

Mar 5 2018, 06:05 PM Mar 5 2018, 06:05 PM

Return to original view | Post

#149

|

Junior Member

225 posts Joined: Jul 2017 |

The outlook of bond/bond funds are not good since early of 2017, EMB / High Yield bond even worse.

But, FSM HK & FSM MY still overweight EMB now (refer to FSM DPMS Portfolio Strategy table in FSM monthly commentary of MP). Looking at conservative managed portfolio's latest factsheet, i noticed 6M ROI is -0.1%... ppl bought it must be very very disappointed now. ROI of Aggressive Portfolio (90% EQ) is worse than my 75% EQ DIY portfolio. In the other words, MP 's risk is higher but with lower ROI. |

|

|

Mar 6 2018, 05:07 PM Mar 6 2018, 05:07 PM

Return to original view | Post

#150

|

Junior Member

225 posts Joined: Jul 2017 |

QUOTE(yageosamsung @ Mar 6 2018, 04:06 PM) Hello guys, how do you think about the FSM Fund Choice March 2018- Manulife Asia Pacific Growth Fund? FSM Fund Choice March 2018 is Manulife Asia Pacific Income and Growth Fund.TQ. It is a Balanced Fund invested to Asia Pacific Ex Japan (Pacific means Australia is included). Factsheet is not available at FSM, but it can be found at below link: http://www.manulifefunds.com.hk/pwsdfp/man...-spc/mapi2u.pdf |

|

|

Mar 7 2018, 10:19 PM Mar 7 2018, 10:19 PM

Return to original view | Post

#151

|

Junior Member

225 posts Joined: Jul 2017 |

QUOTE(Ancient-XinG- @ Mar 7 2018, 05:59 PM) Please don't get me wrong guys. Personally, i think below reason is very weird reason for selling UT.I intend to do this because I want to -lock profit (miss many times to lock already) -I need money now -to cut lost. I did rebal last august and yea, that's the time most fund fly high and now drop deep and I cant afford to lost it after my managed port bleed real bad. However, those who see this as an opportunity, the coming drop is really good time to buy in. "I need money now" - if u need BIG money NOW, u should know earlier, right? A better way is sell gradually since at least 6 months ago. - And, don't use emergency fund/ saving for wedding/ house down-payment for investment, so that u not need to sell with loss when u need them. - if u r a retiree, u just need to sell "a bit" every month for ur expenses, not ALL... So, i need money now, then i sell ALL now, sounds no sense. |

|

|

Mar 8 2018, 04:31 PM Mar 8 2018, 04:31 PM

Return to original view | Post

#152

|

Junior Member

225 posts Joined: Jul 2017 |

|

|

|

Mar 8 2018, 04:44 PM Mar 8 2018, 04:44 PM

Return to original view | Post

#153

|

Junior Member

225 posts Joined: Jul 2017 |

QUOTE(Ancient-XinG- @ Mar 8 2018, 09:07 AM) Its for my education. I planned all already to gain as much as possible. Suddenly my uni close down the 6 month grace period for paying. Or else I will only pay last minute and the money in FSM can gain some petrol for me. Too bad, the uni so cruel... Pay them earlier they gain a lot and I gain nothing.... Managed port I wont touch. It hold 60% of the FSM port. My DIY port is small enough. "Emergency fund" is expenses reserved for next 6 months, includes education fee, normal living expenses, renovation of house etc etc, in upcoming months . Invest in stock/UT using money that u won't need for at least 2-3 years. If that money can stay inside market for at least 1 full cycle (10 years) is the best lah. Good luck and happy investing. |

|

|

|

|

|

Mar 8 2018, 09:56 PM Mar 8 2018, 09:56 PM

Return to original view | Post

#154

|

Junior Member

225 posts Joined: Jul 2017 |

QUOTE(xcxa23 @ Mar 8 2018, 08:27 PM) not surprising.. giving so much market volatility Buy-the-dip-believers-rejoice-as-white-house-eases-trade-tensionimo, still more to come.. brave urself for the ride yo DIY -2.40 MP -1.85 QUOTE(WhitE LighteR @ Mar 8 2018, 07:10 PM) Another disappointing fund recently is Manulife REIT. As expected. 3y years chart n below all show crossover to downtrend. [attachmentid=9642353] Interest rate hike is not good for REIT. I removed REIT fund from my portfolio since second half of 2016. This post has been edited by i1899: Mar 8 2018, 10:03 PM |

|

|

Mar 9 2018, 04:23 PM Mar 9 2018, 04:23 PM

Return to original view | Post

#155

|

Junior Member

225 posts Joined: Jul 2017 |

QUOTE(Cactus89 @ Mar 9 2018, 02:54 PM) If u checked their factsheet the reported MoM lost is merely -0.5% for February. They calculation is very misleading. My managed moderate aggresive recorded -2% .. I am sure they did the calculation wrong! If you calculated the "weighted average of ROI" using the data in their performance table, MoM ROI for Aggressive is -2.1% and M.Aggressive is -1.8%.

For aggressive portfolio, they reported MoM ROI is -0.9%, but 90% of the portfolio (equity portion) having -2.33%, so the reported value makes no sense, and logically wrong. FSM oh FSM... what happened to u, not able to perform a simple calculation ? How can i have confidence on your research article? |

|

|

Mar 9 2018, 04:44 PM Mar 9 2018, 04:44 PM

Return to original view | Post

#156

|

Junior Member

225 posts Joined: Jul 2017 |

QUOTE(funnyface @ Mar 9 2018, 04:29 PM) the -0.9% is with respect to their original portfolio value (10k). Your calculation is with respect to previous month (31 Jan). So no, they are not wrong, you just comparing apple to orange i am not understand what u were trying to clarrify?

The -0.9% is 1 month ROI intable above. Everyone knows 1M ROI is respect to previous month (31 Jan), not to the original portfolio value. |

|

|

Mar 9 2018, 06:05 PM Mar 9 2018, 06:05 PM

Return to original view | Post

#157

|

Junior Member

225 posts Joined: Jul 2017 |

QUOTE(5p3ak @ Mar 8 2018, 10:13 PM) Invest in stock/UT using money that u won't need for at least 2-3 years. If that money can stay inside market for at least 1 full cycle (10 years) is the best lah. The important point here is not how long is the full stock market cycle, but the main point here is that stay LONGER in market for AT LEAST the WHOLE cycle. Anyway, historically, stock market's crash* MOSTLY happens every 10 years***. * In economic terminology (i studied Engineering, info below are from my side readings), - crash :>20% drops in relatively short period (around 1 week). - bearish/recession : >20% drops from the peak, and stays for > 2months - correction: 10% to 20% drops from the recent peak. *** Recent market crash events: - 2008 Global Financial Crisis - 1997 Asian Financial Crisis - 1987 October 19: Black Monday QUOTE(ssl_lim @ Mar 8 2018, 11:42 PM) Don't misunderstand...In long term, market performs as big up-trending sinusoidal wave. The reason to stay LONGER in market for AT LEAST the WHOLE cycle is: - if u bought near peak, u can sell near the NEXT peak which u will have chance to meet if stay in the whole cycle. Imagine the up-trending sinusoidal wave.... |

|

|

Mar 9 2018, 09:20 PM Mar 9 2018, 09:20 PM

Return to original view | Post

#158

|

Junior Member

225 posts Joined: Jul 2017 |

QUOTE(Ancient-XinG- @ Mar 9 2018, 04:46 PM) The performance of managed portfolio is not guaranteed, so not need to get angry when it does not perform. The charges of managed portfolio is black and white written when you bought, so not need to get angry when paying. But, IF "MoM ROI" reported in the official monthly factsheet is not the real one, or had been modified to lure more investor or to keep existing investor inside the game , then it is quite serious problem... u should get frustrated and get an explanation from them. MA: reported -0.5% vs real -1.8% Agg: reported -0.9% vs real -2.1% not understand.. |

|

|

Mar 10 2018, 02:47 PM Mar 10 2018, 02:47 PM

Return to original view | Post

#159

|

Junior Member

225 posts Joined: Jul 2017 |

QUOTE(rapple @ Mar 10 2018, 10:22 AM) That statement is dated 8th March. I am sure that they did the calculation wrong, reported the misleading/wrong "MoM ROI" and "ROI since reception" in their "monthly factsheet" (not monthly statement, as i am not investing to their managed portfolio & did not receive it). The "1 month" is referring to Feb 2018. calm down and re-calculate see if is still wrong Now, i just want to know it is a problem of ability of calculation or problem of integrity. QUOTE(Ramjade @ Mar 10 2018, 10:23 AM) What's related to statement date? In any February MONTHLY factsheet, MoM ROI is calculated from 01 Feb to 28 Feb 18. It is common sense, everyone should know before step into investment. If dont know, better go back to school. QUOTE(Cactus89 @ Mar 10 2018, 11:15 AM) it is stated clearly in the factsheet that data used is up till 28 February 2018. although the released date is 8 of march. New investor please do take notes of this discrepancy in the MoM RoI before u signed up. Precisely.QUOTE(yklooi @ Mar 10 2018, 11:23 AM) Since inception roi and YTD are wrong as well. Beware and happy investing. |

|

|

Mar 12 2018, 02:05 PM Mar 12 2018, 02:05 PM

Return to original view | Post

#160

|

Junior Member

225 posts Joined: Jul 2017 |

|

| Change to: |  0.9056sec 0.9056sec

0.46 0.46

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 3rd December 2025 - 06:26 PM |