QUOTE(jutamind @ Mar 12 2018, 02:58 PM)

since Eastspring Smallcap is soft closed now, if i were to switch out from this fund, can i switch in again some weeks/months later?

it reopened again now.FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

|

Mar 12 2018, 03:40 PM Mar 12 2018, 03:40 PM

Return to original view | Post

#161

|

Junior Member

225 posts Joined: Jul 2017 |

|

|

|

|

|

|

Mar 12 2018, 07:05 PM Mar 12 2018, 07:05 PM

Return to original view | Post

#162

|

Junior Member

225 posts Joined: Jul 2017 |

QUOTE(yklooi @ Mar 12 2018, 03:46 PM) fyi...this is the reply I gets when I directed this LYN subject and post to them... I admit that their customer service team really nice and tried their best to give an explanation. "Thanks for your email. Kindly be informed that in the event of portfolio adjustment/rebalancing, the weighted return of performance of individual funds will not tie with the returns of the portfolio. This is due to the fact that the underlying funds reported in factsheets are reflective of positions of the portfolio at the end of the month. In general during portfolio adjustments, the positions of underlying funds change over the period of the month as funds are switched out first then subsequently new funds are switched in. For instance, new underlying funds’ 1-month return is not accurate attribution to portfolios’ 1-month return as these new funds may be included in the portfolio mid-month. Below is the series of events that took place during Feb’s portfolio adjustment for your reference: 8th Feb – switch sell Eastspring Investments Global Leaders MY Fund {“EIGL”); 14th Feb – switch buy United Global Quality Equity Fund – MYR Hedged (“UGQE”); 28th Feb – reporting date for month of Feb. Underlying funds reported in factsheets is reflective of positions at 28th Feb. The model portfolio(excluding cost) return calculation includes the benefit gained during the rebalancing process as the transaction of selling EIGL took place when it was at a relatively high value and buying of UGQE took place at a dip as markets were experiencing volatility due to sell-offs. In this particular change, we missed out on market downturn during selling. This benefit of rebalancing would not be captured when one performs a quick return attribution on an individual fund basis for a given time period due the different time periods of entry and exit of funds within the month. We hope this clarifies. Thank you". anyway.... looking at the variance of ROI results between them and us, and looking at the % of the funds that are involved in the change for the month..... I still have doubt But, to me, their explanation doesnt clarify the doubts : "the variance of ROI results between them *-0.6% and the investors *-1.8%". In fact, from 31 Jan to 8 Feb, EIGL loss -4.79%. from 14 Feb to 28 Feb, UGQE gain 1.77%. So, for that portion of funds *15%?, still encounter loss of -3.10%=1- (1-.0479)*1.0177, worse than the value reported in the factsheet, for UGQE from 31/01 to 28/02 -0.99%. Therefore, their 1M ROI should be worse than -1.8%, not better. Ok, made my mind : i wont touch their managed portfolio. |

|

|

Mar 12 2018, 09:27 PM Mar 12 2018, 09:27 PM

Return to original view | Post

#163

|

Junior Member

225 posts Joined: Jul 2017 |

QUOTE(idyllrain @ Mar 12 2018, 08:01 PM) Here's a table of all their factsheets: The "reported portfolio value" for February is wrong. Therefore, if u calculate the 1M ROI using it, u will get the numbers same as the reported ROI, which is wrong.  Most of the time, the reported 1M return ROI matches the calculation formula (I'm including the 0.1% differences as being the "same" since I don't have data from the actual start of the reporting period); however there are some big discrepancies that I cannot account for. Anyways, Investor of MP without topup, can give a correct portfolio value as at 28 Feb 2018, by looking at their monthly statement. QUOTE(yklooi @ Mar 12 2018, 08:34 PM) but my profit/loss % of end Feb 2018 vs end Jan 2018 is > - 2.5% variance to me that is definitely more than the published 1month ROI value...that really puzzle me.... the variance of profit/loss % of my port is not the same as variance of ROI? if i m u, i will ask for further explanation until my doubts is cleared loh. QUOTE(MUM @ Mar 12 2018, 08:48 PM) I think it is not the same.... I think i1899 did mentioned something like that a few weeks back when a forummers mentioned that his port lost > 10% have to really dig up that posts....I think should be from 8 Feb postings.... But, for yklooi's case, profit/loss % of end Feb 2018 vs end Jan 2018 is same as 1 month ROI value. This post has been edited by i1899: Mar 12 2018, 09:28 PM |

|

|

Mar 12 2018, 09:55 PM Mar 12 2018, 09:55 PM

Return to original view | Post

#164

|

Junior Member

225 posts Joined: Jul 2017 |

QUOTE(David83 @ Mar 12 2018, 09:26 PM) What is GE14 effect u all r expecting?Do u think Government or Gov agency like PNB, KWSP still having tons of money to buy back GLC stocks in bulk to push up the price? if they have money, they need to give as high as possible for dividend of EPF, ASNB Fixed Price, to make ppl happy. Our Gov cannot issue more bond to get money for Election, like 5 years ago, because not so good reputation & credit. So, where is the money for election come from? Of course, from GLC, and gov agency. So, do u think Gov agency still having tons of money? What do u think Foreigner will do if Government had been changed? See this: Malaysia held her general elections on 8 March 2008 and the results shocked the market. The Kuala Lumpur Composite Index (KLCI) corrected by 9.5% on 10th March, which was the first trading day right after the election. Refer to : https://www.fundsupermart.com.my/main/resea...What-s-Next--33 On 308, we only changed a few state government and BN lost 2/3 majority ONLY, but KLCI lost 9.5% in a single day. So, if we change government and the transition of change is not smooth or somebody don't happy with the result, i can tell u KLCI drops 20% in a single day is not impossible. Beware beware. |

|

|

Mar 12 2018, 10:01 PM Mar 12 2018, 10:01 PM

Return to original view | Post

#165

|

Junior Member

225 posts Joined: Jul 2017 |

QUOTE(idyllrain @ Mar 12 2018, 09:38 PM) Could that be due to the effect of investment timing/top-ups and subscription and management fees? see below posts.In the absence of daily data and information about switch dates it is impossible to calculate actual ROI by using NAV values from the individual funds themselves. My calculation was based on the reported MOM growth of a RM10k portfolio which (I assume) is post-subscription fee and has no management fees deducted from it (should be a very small effect). Even using this calculation you can see there are discrepancies in the reported 1M ROI: the biggest of which is the September and October factsheets where the portfolio value has dropped BUT the reported ROI was a positive. So it is likely that the factsheets contain mistakes. Not the first time from FSM. QUOTE(yklooi @ Mar 12 2018, 03:46 PM) fyi...this is the reply I gets when I directed this LYN subject and post to them... "Thanks for your email. Kindly be informed that in the event of portfolio adjustment/rebalancing, the weighted return of performance of individual funds will not tie with the returns of the portfolio. This is due to the fact that the underlying funds reported in factsheets are reflective of positions of the portfolio at the end of the month. In general during portfolio adjustments, the positions of underlying funds change over the period of the month as funds are switched out first then subsequently new funds are switched in. For instance, new underlying funds’ 1-month return is not accurate attribution to portfolios’ 1-month return as these new funds may be included in the portfolio mid-month. Below is the series of events that took place during Feb’s portfolio adjustment for your reference: 8th Feb – switch sell Eastspring Investments Global Leaders MY Fund {“EIGL”); 14th Feb – switch buy United Global Quality Equity Fund – MYR Hedged (“UGQE”); 28th Feb – reporting date for month of Feb. Underlying funds reported in factsheets is reflective of positions at 28th Feb. The model portfolio(excluding cost) return calculation includes the benefit gained during the rebalancing process as the transaction of selling EIGL took place when it was at a relatively high value and buying of UGQE took place at a dip as markets were experiencing volatility due to sell-offs. In this particular change, we missed out on market downturn during selling. This benefit of rebalancing would not be captured when one performs a quick return attribution on an individual fund basis for a given time period due the different time periods of entry and exit of funds within the month. We hope this clarifies. Thank you". anyway.... looking at the variance of ROI results between them and us, and looking at the % of the funds that are involved in the change for the month..... I still have doubt QUOTE(i1899 @ Mar 12 2018, 07:05 PM) I admit that their customer service team really nice and tried their best to give an explanation. But, to me, their explanation doesnt clarify the doubts : "the variance of ROI results between them *-0.6% and the investors *-1.8%". In fact, from 31 Jan to 8 Feb, EIGL loss -4.79%. from 14 Feb to 28 Feb, UGQE gain 1.77%. So, for that portion of funds *15%?, still encounter loss of -3.10%=1- (1-.0479)*1.0177, worse than the value reported in the factsheet, for UGQE from 31/01 to 28/02 -0.99%. Therefore, their 1M ROI should be worse than -1.8%, not better. Ok, made my mind : i wont touch their managed portfolio. |

|

|

Mar 13 2018, 09:45 PM Mar 13 2018, 09:45 PM

Return to original view | Post

#166

|

Junior Member

225 posts Joined: Jul 2017 |

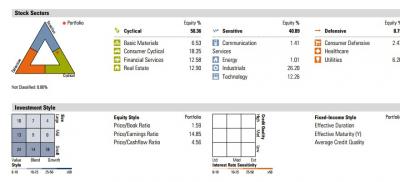

QUOTE(MUM @ Mar 13 2018, 03:06 PM) from the KGF fund 's semi annual reports.... https://www.fundsupermart.com.my/main/admin...ortsMYKNGGF.pdf can see KGF did holds many stocks from The Components of the FTSE Bursa Malaysia KLCI Index http://topforeignstocks.com/indices/the-co...sia-klci-index/ You will find out that KGF is mainly a mid-small malaysia equity fund, while the KLSE is 30 biggest stocks in M'sia. see the "investment style" of below picture.

|

|

|

|

|

|

Mar 13 2018, 10:02 PM Mar 13 2018, 10:02 PM

Return to original view | Post

#167

|

Junior Member

225 posts Joined: Jul 2017 |

QUOTE(Ancient-XinG- @ Mar 13 2018, 08:03 PM) anyone have good exp with their CIS? like they really good in advice instead of following the SOP when recommend customer go into fund. I ask my CIS for portfolio health check, twice before.because most of them tend to bring you merry go round balik balik recommended fund. lol His answer was not different with the recommendation list provided by Fundsupermart. Most of the time, u ask the way to the east, they show u the way to the west because the way to the west is their SOP. Their professional level is so so only. |

|

|

Mar 14 2018, 02:54 PM Mar 14 2018, 02:54 PM

Return to original view | Post

#168

|

Junior Member

225 posts Joined: Jul 2017 |

QUOTE(besiegetank @ Mar 14 2018, 02:40 PM) Anyone else notice TAGT has been rising a lot recently? It has hit my ceiling price and I'm considering if the rise is sustainable or not. Which good bond I can intra-switch to later? Any recommendations? If i remember well, only one bond fund in Ta Invest : ta dana arif.Buying UT is also so troublesome...if drop we will worry, if rise also will worry...zzz TAGT performs well because NASDAQ returned to its recent peak already. United global technology also rise a lot recently. |

|

|

Mar 14 2018, 10:57 PM Mar 14 2018, 10:57 PM

Return to original view | Post

#169

|

Junior Member

225 posts Joined: Jul 2017 |

QUOTE(jfleong @ Mar 14 2018, 01:48 PM) Hang Seng dropped quite a bit today, any predictions for tomorrow ? why not extend to wholesale fund?!Also I tried to switch to FSM by selling my eUT units, because I wanna buy Dragon fund at 0% Turns out this offer does not extend to wholesale fund ....backfired ! Below are FSM reply to me about the step of Transfer In: " You may follow the steps below : 1. First, you are required send us the redemption slip as supporting document for record purpose. 2. We will offer you 0% sales charge for the same redemption amount. 3. We will offer you 1 month buffer period (from the redemption date) to move in the funds. 4. This offer is applicable to all funds except for All Affin Hwang Asset Management Berhad wholesales funds. 5. When you want to utilize the offer, kindly send email to notify us to adjust sales charge manually after placing order online before 2:30pm. " |

|

|

Mar 16 2018, 12:52 AM Mar 16 2018, 12:52 AM

Return to original view | Post

#170

|

Junior Member

225 posts Joined: Jul 2017 |

QUOTE(yklooi @ Mar 15 2018, 07:28 PM) idyllrain, i1899 looks funny for me...here is the latest update.... "Pertaining to your previous query. We wish to update you on our new findings. We would like to sincerely apologise for the inaccuracy in calculation due to the mistake in recognition of dates. The on-going rebalancing and portfolio adjustment during the end-of month (reporting date) has caused this inaccuracy. Please find below the calculations that we have worked out accounting for the rebalancing period. (see attached table and note) *Please take note that last row in above table is the inaccurate return in factsheet (2/2/18 – 28/2/18). This error occur due to previous round rebalancing was still on-going from 25 Jan 2018 to 2 Feb 2018. As such, system mistakenly capture 2 Feb data instead of 31 Jan data to calculate for overall portfolio return in Feb. (1 Feb 2018 is Federal Territory Day, holiday) We will re-upload the factsheets soonest possible and rectify the inaccuracy. Thank you". A big company dont have an auditor to check the factsheet before release. All account works depends to so called "system"? I hope they will hire more researcher and accountant. |

|

|

Mar 16 2018, 12:10 PM Mar 16 2018, 12:10 PM

Return to original view | Post

#171

|

Junior Member

225 posts Joined: Jul 2017 |

|

|

|

Mar 19 2018, 10:40 PM Mar 19 2018, 10:40 PM

Return to original view | Post

#172

|

Junior Member

225 posts Joined: Jul 2017 |

|

|

|

Mar 20 2018, 01:53 PM Mar 20 2018, 01:53 PM

Return to original view | Post

#173

|

Junior Member

225 posts Joined: Jul 2017 |

QUOTE(kenny79 @ Mar 20 2018, 01:34 PM) Did u know what is unlimited money sir. Mean when u full port is 1000 u are able to top up more the. 1000 in once time. Same theory as blackjack.. last rm10 next bet will be rm20. Third round is rm40 i seems read this strategy before. when dip, double up ur bet (EQ portfolio): -10% , +100% of ur portfolio. -20% , +200% of ur portfolio. * can do by top up if u have infinite money. Tentatively, can be done by rebalancing portfolio aka moving from FI to EQ. Then, when up, minus ur EQ portfolio: +10%, -50% of ur portfolio +20%, -75% of ur portfolio Theoretically, it works. But, i think it is very hard to implement for most of people here. |

|

|

|

|

|

Mar 20 2018, 03:13 PM Mar 20 2018, 03:13 PM

Return to original view | Post

#174

|

Junior Member

225 posts Joined: Jul 2017 |

QUOTE(Ancient-XinG- @ Mar 20 2018, 10:53 AM) actually a lot dilemma can occur in UT. some people say cut lost. some people invest more. if market perform worst. the cut lost people is at winning part. and the vca people at lost. but if the market bounce back, the opposite happen. and there are also people saying invest 3 to years across the horizon... there will be some fund perform bad or so so even lower than fd across 3 to 5 years..... so how. is it long term investing really making out? easier example will be IDS or Ponzi 1. even with mandate chage also very doubtly will rise back. take IDS as example. people hoo haa say when dip is time to top up provided you have confidence in the fund. looks like the dip never stop... back to reality. you still need to monitor your fund time to time. interest hike. reits also fall. how much will fall? no one know. currency instability also affect. see Esther and RHB EMB also know. 1 year return -1.8 lol. my saving accont also perform better...... to cut lose or chipped in.... that's a million dollar question... To cut loss or to invest more in a dipping market depends on the 1) potential of the market and 2) performance of the the fund itself. 1) If the market drops, it is common that the fund invest in the market drops also. But if the potential of the market in the future is still bright and the valuation (PER) is still cheap (such as China, Asia Ex Japan), invest more loh. If no potential (such as REIT) in the near future or the valuation (PER) looks expensive (like Msia, India), dont invest more . 2) if the market did not drop significantly or "flat", but the fund dropped significantly lets say 5% drops more than its peers/ index, it is the time to CUT LOST before it getting worse. Get IDS as example, compare with Eastspring Small Cap or CIMB Small Cap, FBM Small Cap, IDS drops of -27.4% from the peak is unacceptable, incompatible with its peers, should CUT LOSS before it reach -10%. It is true that Unit trust is long term investment, but it doesn't mean you buy and hold without monitor or transaction. When it is time to switch out or switch in, please do so to avoid any further loss or to take profit. ============= I invested in UT ~10 years, with IRR as 11.4% Over these years, value of my UT investment had reached 105 months of my current salary. With 12% p.a., i am earning 1 full month salary from my UT Investment alone, every month. I would like to say UT is an easy and convenient tools for saving ur monthly salary for retirement purpose/ financial freedom. Dont give up. |

|

|

Mar 20 2018, 04:32 PM Mar 20 2018, 04:32 PM

Return to original view | Post

#175

|

Junior Member

225 posts Joined: Jul 2017 |

QUOTE(Streetrat @ Mar 20 2018, 03:31 PM) QUOTE(ehwee @ Mar 20 2018, 03:39 PM) U can find latest PER of any Index/ individual stock at BLOOMBERG apps. FSM updates PER and estimated growth of every market weekly. U can find the link at FSM main page. At fund level, you can find the PER/volatility/alpha/ beta of the fund (the mother fund's ) by looking at the mother fund factsheet. All oversea fund except S'pore, state fund PER etc in their monthly factsheet. For Example, - CIMB Greater China is at PER 20.2 - Eastspring GEM is at PER 15.2 - Am GEM Opportunities is at PER 15.5 more factsheet of Schroder ISF are available : http://www.schroders.com/en/sg/private-inv...isf-literature/ |

|

|

Mar 20 2018, 08:05 PM Mar 20 2018, 08:05 PM

Return to original view | Post

#176

|

Junior Member

225 posts Joined: Jul 2017 |

|

|

|

Mar 20 2018, 09:30 PM Mar 20 2018, 09:30 PM

Return to original view | Post

#177

|

Junior Member

225 posts Joined: Jul 2017 |

QUOTE(Ancient-XinG- @ Mar 20 2018, 08:30 PM) Nice one! Same channel with me. No. No. No. Exactly my point... Because when every dip, many here will just say "another great chance to in" but, if we really buta buta trust the wrong fund then how? Isn't it.. But reality is that we cant really predict what will happen in the coming weeks. And to look further, IDS is really special case, it shoot up too fast, way too fast. And with speculation and others, all people all in to this so called goose that lays golden eggs... Then... shit happen. Look at Tech stock now... TA Global Tech hit really hard. And no one see that coming.... But still, we need to learn it in a hard way anyway. IMHO, 2018 market = FI market. Now already into Q2, still not stable... Aduiii Very miss 2017 haha.. Its good to bring up this issue. And its a new milestone for a newbie like me. Happy investing! 2018 market IS NOT FI market definitely, esp those Foreign bond funds. I have moved out all my bond funds with FSM, buying ASNB FP slowly / worse case buy Msia Bond Fund at eUT. I think I will === I do strongly agree to buy in dip, but you should buy into the CORRECT MARKET and RIGHT FUND during dip. CORRECT MARKET is more important to RIGHT FUND. Fyi, my portfolio had been up >3% YTD (>3 months salary) because i bought during recent dip. My profit is very close to the peak on 24/01. I switched in around 10% of my UT portfolio from FI to EQ on 06 Feb, 09 Feb, 28 Feb and 02 March. And, i switched out from EQ on 26/01 and 26/02 with around 7% profit in 1 or 2 months. ** look at the date above ==> i bought near the bottom/ lowest of month, and sold at the peak of month. I would like to say that it is REBALANCING. Many people here forgot about REBALANCE : always hoo ray hoo ray when market is up, then cry dad cry mum during dip. When market is up, u should take out some portion of EQ and put it to FI. When market is down, u should take out some portion of FI and put it to EQ. ===== The other obvious problem that i observed here is: don't know how to sell. They buy during the dips, they buy with DCA or VCA or advanced tenique, buy, buy and buy, BUT don't bother to sell or lock profit in FI. They only sell when they need money. it will be a problem. many more... Investment is an art... not engineering.. so there is NO 1 formula for all people... but there is some common sense we should follow. Happy investing. |

| Change to: |  0.0738sec 0.0738sec

0.48 0.48

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 2nd December 2025 - 02:06 PM |