FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

|

Jun 28 2018, 12:08 PM Jun 28 2018, 12:08 PM

Return to original view | Post

#101

|

Junior Member

309 posts Joined: Nov 2011 |

|

|

|

|

|

|

Jun 28 2018, 01:15 PM Jun 28 2018, 01:15 PM

Return to original view | Post

#102

|

Junior Member

309 posts Joined: Nov 2011 |

QUOTE(Ancient-XinG- @ Jun 28 2018, 01:06 PM) QUOTE(funnyface @ Jun 28 2018, 01:10 PM) Actually there is a trick minimum rm1k for topup... still manageable.1st purchase RM10k only, after bought you can immediately sell until minimum of 1000 units left (around RM 1000+ based on today NAV). You do not need to hold RM10k in the fund. Subsequent purchase needs to be minimum RM1k though. besides...i'm not exactly young.. |

|

|

Jul 7 2018, 08:45 PM Jul 7 2018, 08:45 PM

Return to original view | IPv6 | Post

#103

|

Junior Member

309 posts Joined: Nov 2011 |

QUOTE(lcs89 @ Jul 7 2018, 12:28 PM) holding this 3 ... If you need to cash out everything in 6mo, maybe should put in CMF or FD instead? Equity fund seems quite volatile lately.need some advise ... need to cash out end of this year ... CIMB-Principal Asia Pacific Dynamic Income Fund (+11.49) Kenanga Growth Fund (+7.5) Manulife India Equity (-3.66) shld I let go of MIE .. and use the money to top up either KGF or CPAPDIF ? or shld I just wait ... profit kecut nearly 35% since this few weeks ... any advise to readjust ? |

|

|

Aug 1 2018, 09:20 PM Aug 1 2018, 09:20 PM

Return to original view | IPv6 | Post

#104

|

Junior Member

309 posts Joined: Nov 2011 |

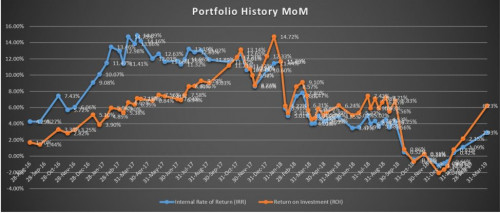

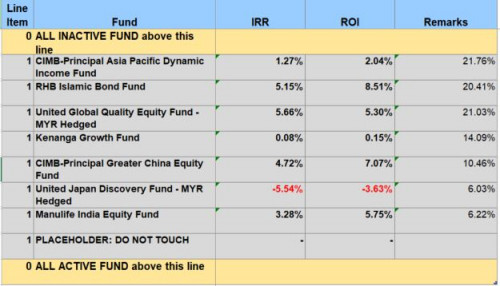

QUOTE(yklooi @ Aug 1 2018, 06:10 PM) Yes, July had been good to me... Would you comment a little about your portfolio size changes? Are you still adding money to it, taking money out from it, or just rebalancing?August?......my bet is on GOOD too . just planning...planning yeah... next year would like go like tis.... Manu Reits 5% Manu India 5% Ta Global 5% EI Dinasti 5% Nikko Spore 6% United Global Quality 15% Titan 16% KGF 20% AH Asia Pac 22% any ideas for improvement? Your irr and roi are both quite consistent...I can't understand I'm still in acquisition mode..adding more and more money into portfolio. When my irr flat, my roi goes up. When roi flat, irr falls down |

|

|

Aug 2 2018, 09:27 AM Aug 2 2018, 09:27 AM

Return to original view | IPv6 | Post

#105

|

Junior Member

309 posts Joined: Nov 2011 |

QUOTE(yklooi @ Aug 1 2018, 09:29 PM) for the past few years, I lump summed, i am mostly relocating it previuos years....next January, will start to take out about 6~10% out per year. Thanks for clarifying.my IRR is quite constant because i beliefs after some years,....it will need a drastic movement of ROI to have an impact on the IRR...(it is all due to the working of the maths i think) This post has been edited by spiderman17: Aug 2 2018, 09:27 AM |

|

|

Aug 24 2018, 09:41 PM Aug 24 2018, 09:41 PM

Return to original view | IPv6 | Post

#106

|

Junior Member

309 posts Joined: Nov 2011 |

|

|

|

|

|

|

Aug 28 2018, 03:06 PM Aug 28 2018, 03:06 PM

Return to original view | Post

#107

|

Junior Member

309 posts Joined: Nov 2011 |

QUOTE(T231H @ Aug 28 2018, 12:39 PM) You asked for it... Happy Merdeka! All Unit Trusts At 0.57% Sales Charge For 4 Days (28 till 31 Aug 2018) https://www.fundsupermart.com.my/main/resea...or-4-Days-10118 buy buy buy !

|

|

|

Aug 30 2018, 04:30 PM Aug 30 2018, 04:30 PM

Return to original view | Post

#108

|

Junior Member

309 posts Joined: Nov 2011 |

|

|

|

Aug 30 2018, 11:13 PM Aug 30 2018, 11:13 PM

Return to original view | IPv6 | Post

#109

|

Junior Member

309 posts Joined: Nov 2011 |

QUOTE(Ancient-XinG- @ Aug 30 2018, 05:45 PM) Wah, u so smart!QUOTE(MUM @ Aug 30 2018, 05:54 PM) for others...maybe it is like that after RM10000 entry ...sell till maintain 1000 minimum units 1000 x 0.542 = RM 542 QUOTE(funnyface @ Aug 30 2018, 10:54 PM) But they are smarter |

|

|

Oct 12 2018, 05:26 PM Oct 12 2018, 05:26 PM

Return to original view | Post

#110

|

Junior Member

309 posts Joined: Nov 2011 |

QUOTE(MUM @ Oct 12 2018, 04:37 PM) today is a good day to track and update your ROI..... took up your advise:keep it and paste in on the wall......as a reminder of what can happens without warning in a span of few days..... btw....have you guys checked your managed ports ROI...... you will be amazed....

my managed port (balanced) is at -2.98% ROI. |

|

|

Nov 1 2018, 04:33 PM Nov 1 2018, 04:33 PM

Return to original view | Post

#111

|

Junior Member

309 posts Joined: Nov 2011 |

|

|

|

Jan 3 2019, 10:33 AM Jan 3 2019, 10:33 AM

Return to original view | Post

#112

|

Junior Member

309 posts Joined: Nov 2011 |

QUOTE(idyllrain @ Dec 21 2018, 05:11 PM) Thanks yklooi. That’s good to know. It gives us some tome to incorporate changes to accommodate the new site. I’ll discuss with polarzbearz to see if we can make this transition as smooth as possible for everyone using the spreadsheet. Great job!! -- EDIT -- As of 8:30PM, we can no longer get NAV prices from the old link at https://www.fundsupermart.com.my/main/fundi....tpl?id=MYKNGGF This means that if you're using the old Windows or Mac versions of this spreadsheet, it will no longer retrieve the latest prices since that page is no longer there. -- EDIT2 -- I have a working solution ready for Windows. If you're feeling adventurous or impatient, below are the steps to modify your own copy of the Excel Spreadsheet to cater for changes in the new FSMOne site. By doing this yourself, you won't have to deal with migrating your existing data into a new updated file. It's pretty straightforward: MAKE A COPY OF YOUR FILE BEFORE YOU DO THIS! Just in case... » Click to show Spoiler - click again to hide... « Attached is an updated base file for Excel 2016 for Windows. Note that this file does not contain functionality that polarzbearz added when she published her beta version a while ago. This is merely the previous spreadsheet with the FSM retrieval code updated. If you do not want to start afresh, I would recommend following the instructions above to update your own file. [attachmentid=10144384] -- EDIT3 -- Instructions for Mac version are available here: https://forum.lowyat.net/index.php?showtopi...post&p=91308800 -- EDIT4 -- I updated the instructions and base file above. Changes - Switched to using a different date value in the API response. - Fixed timezone issues in date calculation - Optimized regular expressions - Removed TLS1.2 connection setting Thanks to yklooi for discovering these issues. I should've been more careful. Those who followed my instructions above will have to redo them again. I'm terribly sorry for the trouble; please forgive me. Just wanna mention that the new code doesn't update the "portfolio summary" date. I copy and add "WS.Range("portfolioLastUpdate").Value = Date" just before Exit Sub based on old version. |

|

|

Jan 3 2019, 10:39 AM Jan 3 2019, 10:39 AM

Return to original view | Post

#113

|

Junior Member

309 posts Joined: Nov 2011 |

|

|

|

|

|

|

Mar 18 2019, 11:11 AM Mar 18 2019, 11:11 AM

Return to original view | Post

#114

|

Junior Member

309 posts Joined: Nov 2011 |

Anyone here attended FSM event last week in Penang? Can share brief summary?

|

|

|

Apr 2 2019, 02:44 PM Apr 2 2019, 02:44 PM

Return to original view | Post

#115

|

Junior Member

309 posts Joined: Nov 2011 |

QUOTE(yklooi @ Apr 1 2019, 07:40 PM) mine is YTD ROI 11.07% MoM +2.18% Change moved United Jpn to United Global moved Cimb Asean to Cimb Greater China hope the rest of the forummers are already in the Green now  port unchanged:  Hope for another good quarter |

|

|

Apr 2 2019, 06:33 PM Apr 2 2019, 06:33 PM

Return to original view | Post

#116

|

Junior Member

309 posts Joined: Nov 2011 |

|

|

|

Apr 24 2019, 05:03 PM Apr 24 2019, 05:03 PM

Return to original view | Post

#117

|

Junior Member

309 posts Joined: Nov 2011 |

Good discussion

A bond fund holding shorter term bonds inherently have higher PTR, compared to another found holding longer term bonds. It's not always due to itchy fingers trading. Then we have to consider long term vs short term bond...which is likely to be more stable, lower default risk? Nothing is ever absolute, always relative. |

|

|

May 3 2019, 05:08 PM May 3 2019, 05:08 PM

Return to original view | Post

#118

|

Junior Member

309 posts Joined: Nov 2011 |

|

|

|

May 5 2019, 01:48 AM May 5 2019, 01:48 AM

Return to original view | IPv6 | Post

#119

|

Junior Member

309 posts Joined: Nov 2011 |

|

|

|

Jul 1 2019, 06:45 PM Jul 1 2019, 06:45 PM

Return to original view | Post

#120

|

Junior Member

309 posts Joined: Nov 2011 |

|

| Change to: |  1.2486sec 1.2486sec

0.63 0.63

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 1st December 2025 - 03:30 PM |