QUOTE(renodiy @ Dec 10 2024, 09:22 AM)

With current inflation, maintaining a property is becoming a burden. Ownstay or rented out units need maintenance. Selling it could sometimes only breakeven or even occur losses for properties purchased mid 2015 onwards

For properties purchased mid 2015 onwards -

Is it better to hold and collect rent vs sell at breakeven price and have a more stress free life? If hold for another 10 years and price remained stagnant, it would actually be bad investment/ losses.

Historical price analysis

Condo 2002- Rm 169K 2007 sold rm365K

Condo 2005 - Rm 200k 2010 sold rm400k

House 2009-Rm 575K. 2015 sold Rm1M ( reno 80K)

House 2010 Rm 410K. 2017 sold Rm680K (reno 70k)

Condo 2017 Rm 660k. 2024 sold Rm700K (negative gains/ reno 60k)

I am sure many of us/ some of us know and have gone through the above property scenario.

For investment units/ ownstay purchased 2015 onwards, i will be 10 years next year, yet the price have not appreciated or only gone up a bit making it a bad choice of investment..

Eg Eco botanic

2016/17 Rm 1Mil. Now rm1.1-1.2m - losses

Ideal condos bayan lepas

2013 launch rm475k. now rm515k - losses

Setia houses

subsale 2017 rm 1.1mil. now rm 1.1mil

Hope others can input some data here too....

For properties purchased mid 2015 onwards -

Is it better to hold and collect rent vs sell at breakeven price and have a more stress free life? If hold for another 10 years and price remained stagnant, it would actually be bad investment/ losses.

Historical price analysis

Condo 2002- Rm 169K 2007 sold rm365K

Condo 2005 - Rm 200k 2010 sold rm400k

House 2009-Rm 575K. 2015 sold Rm1M ( reno 80K)

House 2010 Rm 410K. 2017 sold Rm680K (reno 70k)

Condo 2017 Rm 660k. 2024 sold Rm700K (negative gains/ reno 60k)

I am sure many of us/ some of us know and have gone through the above property scenario.

For investment units/ ownstay purchased 2015 onwards, i will be 10 years next year, yet the price have not appreciated or only gone up a bit making it a bad choice of investment..

Eg Eco botanic

2016/17 Rm 1Mil. Now rm1.1-1.2m - losses

Ideal condos bayan lepas

2013 launch rm475k. now rm515k - losses

Setia houses

subsale 2017 rm 1.1mil. now rm 1.1mil

Hope others can input some data here too....

QUOTE(MishimaZ @ Dec 10 2024, 09:51 AM)

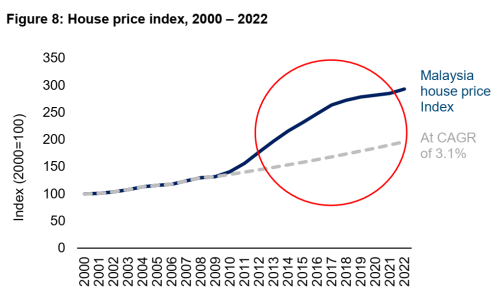

The property 'inflation' was basically driven by ease of credit during Bijan's time, where most of the property buyers, flippers and drivers are mostly from the Chinese community.... even prices of subsales shot up from 10-30% yearly. If you see prices today and 7 years ago do not hold much difference, it easily understood that 7 years ago the property prices were priced to much advanced years.

The only denominator of how long more the property is going to stay stagnant depends on how fast salary grows or how easy money can be obtained - which is not the case in Malaysia.

But who knows, maybe TarzanX can create another round bullrun with fake middle east investments like Bijan used China before people starts complaining that property prices need two term loan as being push by most developers and housing board. Its just a matter of time only wat.

The only denominator of how long more the property is going to stay stagnant depends on how fast salary grows or how easy money can be obtained - which is not the case in Malaysia.

But who knows, maybe TarzanX can create another round bullrun with fake middle east investments like Bijan used China before people starts complaining that property prices need two term loan as being push by most developers and housing board. Its just a matter of time only wat.

QUOTE(homicidal85 @ Dec 10 2024, 12:46 PM)

you didnt see this coming?

back in 2012-2020 era my friends were buying multiple properties and they were in their own mindbubble. in their mind, buying property is a no brainer because property price will always go up! i held back because i saw it was a bubble. but then again, a lot of them made big gains and lost only a little bit so i think i rugi in that sense. but i invested elsewhere which is giving me more profit than my property flipper friends. the real people who rugi are those that never invest anywhere.

back in 2012-2020 era my friends were buying multiple properties and they were in their own mindbubble. in their mind, buying property is a no brainer because property price will always go up! i held back because i saw it was a bubble. but then again, a lot of them made big gains and lost only a little bit so i think i rugi in that sense. but i invested elsewhere which is giving me more profit than my property flipper friends. the real people who rugi are those that never invest anywhere.

QUOTE(Sihambodoh @ Dec 10 2024, 01:31 PM)

QUOTE(cloudwan0 @ Dec 10 2024, 10:14 PM)

luckily i sell before it become stagnant, agent still sms me and the price still same as 8 years ago i sold my unit...

QUOTE(Skylinestar @ Dec 11 2024, 03:03 PM)

my property already stagnant for 10 years. probably will remain so. selling it is a lost because of how much loan interest that I have paid.

This post has been edited by icemanfx: Dec 11 2024, 03:08 PM

Dec 10 2024, 09:30 AM

Dec 10 2024, 09:30 AM

Quote

Quote

0.0184sec

0.0184sec

0.48

0.48

6 queries

6 queries

GZIP Disabled

GZIP Disabled