Bubble? Good, if prices drop I will buy more.

Multiple Signs of Malaysia Property Bubble V20

Multiple Signs of Malaysia Property Bubble V20

|

|

Feb 13 2019, 12:39 AM Feb 13 2019, 12:39 AM

|

Junior Member

44 posts Joined: Oct 2016 |

Bubble? Good, if prices drop I will buy more.

|

|

|

|

|

|

Feb 13 2019, 12:43 AM Feb 13 2019, 12:43 AM

|

Junior Member

72 posts Joined: Apr 2015 |

keep on saying bubble.. bubble burst also nobody will sell below purchase price. mana ada bubble lidis? only got lelong but that only rare to see.

|

|

|

Feb 13 2019, 04:49 PM Feb 13 2019, 04:49 PM

Show posts by this member only | IPv6 | Post

#2083

|

All Stars

21,457 posts Joined: Jul 2012 |

QUOTE(keelovesjie1314 @ Feb 13 2019, 12:39 AM) Current property market need people like you to support else "for sale" duration is getting longer and some vendors may not able to sustain.QUOTE(cant think of a username @ Feb 13 2019, 12:43 AM) keep on saying bubble.. bubble burst also nobody will sell below purchase price. mana ada bubble lidis? only got lelong but that only rare to see. No vendor is willing to sell below cost or perceived market price. price is dropped through foreclosure auction and number of foreclosure sale is on uptrend.This post has been edited by icemanfx: Feb 13 2019, 08:20 PM |

|

|

Feb 13 2019, 08:17 PM Feb 13 2019, 08:17 PM

|

All Stars

21,457 posts Joined: Jul 2012 |

https://asia.nikkei.com/Spotlight/Cover-Sto...ver-the-economy

If china housing glut is any indication; the % of housing loan in malaysia tied to housing assets that are neither being lived in nor churning out rental income could be double digits. This post has been edited by icemanfx: Feb 13 2019, 08:48 PM |

|

|

Feb 16 2019, 01:56 AM Feb 16 2019, 01:56 AM

Show posts by this member only | IPv6 | Post

#2085

|

Junior Member

91 posts Joined: Jan 2003 |

All data is about apartment buildings, how about price data on landed houses or even non build-up empty land?

|

|

|

Feb 18 2019, 11:57 PM Feb 18 2019, 11:57 PM

|

All Stars

21,457 posts Joined: Jul 2012 |

QUOTE(AskarPerang @ Feb 18 2019, 10:23 PM) No bidder. Another 10% price drop. New price as below: B- 10-06, Magna Ville Condominium, Lebuhraya Selayang -Kepong, Reserve price 🔥🔥RM230,850🔥🔥 1001 sqft, 1 car park slot Leasehold until 2107 Auction: Mid/End of Mac 2019 *Vacant unit *Non bumi lot Actual unit pics: » Click to show Spoiler - click again to hide... « |

|

|

|

|

|

Feb 19 2019, 02:05 PM Feb 19 2019, 02:05 PM

Show posts by this member only | IPv6 | Post

#2087

|

All Stars

21,457 posts Joined: Jul 2012 |

Malaysia’s unsold homes are estimated to reach a staggering RM20 billion and the government is pushing to mop these units out of the developers’ books to prevent a rising bubble. .... The banking sector is already shouldering more than RM500 billion in property loans, the biggest segment of consumer lending. .... From the total 30,115 units of unsold properties, 17,971 units are priced below RM500,000, while the remaining 12,144 are units between RM500,000 and RM1 million. https://themalaysianreserve.com/2019/02/19/...t-resolve-glut/ It is estimated property remain vacant and not tenanted in subsale market is about 3 times of developers overhang i.e over RM60b. Of these, RM6b or 9,000 units may end up in foreclosure in next few years. ManutdGiggs remember you read these numbers here |

|

|

Feb 19 2019, 02:05 PM Feb 19 2019, 02:05 PM

|

All Stars

13,761 posts Joined: Jun 2011 |

QUOTE(icemanfx @ Feb 19 2019, 02:05 PM) Malaysia’s unsold homes are estimated to reach a staggering RM20 billion and the government is pushing to mop these units out of the developers’ books to prevent a rising bubble. Take note of the asset class 👌.... The banking sector is already shouldering more than RM500 billion in property loans, the biggest segment of consumer lending. .... From the total 30,115 units of unsold properties, 17,971 units are priced below RM500,000, while the remaining 12,144 are units between RM500,000 and RM1 million. https://themalaysianreserve.com/2019/02/19/...t-resolve-glut/ It is estimated property remain vacant and not tenanted in subsale market is about 3 times of developers overhang i.e over RM60b. Of these, RM6b or 9,000 units may end up in foreclosure in next few years. ManutdGiggs remember you read these numbers here |

|

|

Feb 19 2019, 02:10 PM Feb 19 2019, 02:10 PM

|

Junior Member

615 posts Joined: Feb 2018 |

|

|

|

Feb 19 2019, 03:53 PM Feb 19 2019, 03:53 PM

|

All Stars

13,761 posts Joined: Jun 2011 |

QUOTE(koja6049 @ Feb 19 2019, 02:10 PM) Property developers made a wrong judgment, they think many people in the middle class. Turns out alot are actually B40 people and cannot afford 300k housing also But some extremists ll use tis specific overstock asset class to cheat market with the numbers regardless valid or invalid.The truth is one should b neutral n highlight the shortage of certain assets too. Anw v must agree to disagreement. |

|

|

Feb 19 2019, 04:28 PM Feb 19 2019, 04:28 PM

|

Junior Member

615 posts Joined: Feb 2018 |

QUOTE(ManutdGiggs @ Feb 19 2019, 03:53 PM) But some extremists ll use tis specific overstock asset class to cheat market with the numbers regardless valid or invalid. One of the weirdest asset class is the soho unit. These units priced between 100k - 200k. Most Malaysians will not buy these units for their residential purpose because of their size (and doesn't make sense if buy solely for an office). Many foreigners wanted to buy (especially single expatriates or those who come without family) but are shut out due to the RM 1 mil requirement. Ends up most are Malaysian investors buying for AirBNB, but nowadays such businesses are tanking also. That's why many of the soho units are left unsold.The truth is one should b neutral n highlight the shortage of certain assets too. Anw v must agree to disagreement. I'm not sure whether they also lump this asset class into the below 500k list, but sure it will distort the overall picture. The govt must come up with more sensible rules like relaxing the quantum requirement for foreigners. At least for those foreigners working and staying in Malaysia, permit them to buy one residential unit without the RM 1 mil requirement. |

|

|

Feb 22 2019, 01:56 AM Feb 22 2019, 01:56 AM

|

All Stars

21,457 posts Joined: Jul 2012 |

QUOTE(AskarPerang @ Feb 21 2019, 11:23 PM) If you think the above biggest size unit at 706k is cheap, now you got an even cheaper lelong unit in the market. However, this unit view is facing KLCC but possible block by Arte plus in front. A-38-01, Block A, The Elements @ Ampang, Reserve price 🔥RM 661,349 🔥 Freehold 1572sqft, Corner unit, 2 car park slots Facing KLCC (view possible block by Arte+) Auction: 28-Feb-2019 (Thu) » Click to show Spoiler - click again to hide... « |

|

|

Feb 23 2019, 10:24 AM Feb 23 2019, 10:24 AM

|

All Stars

21,457 posts Joined: Jul 2012 |

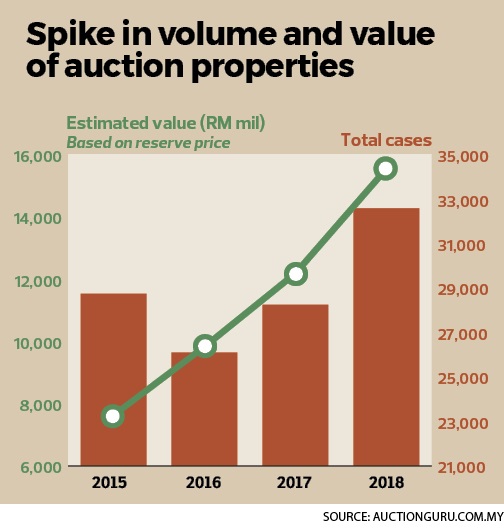

The number of properties put up for auction is rising. Data collated by online auctions listings platform AuctionGuru.com.my showed that there was a total of 32,611 properties worth RM15.56 billion that went under the hammer in 2018, an increase of 15.4% year-on-year (y-o-y) in volume and 27.6% in total value. AuctionGuru.com.my executive director Gary Chia has observed that the number of newly completed properties put up for auction rose last year. “These new [foreclosure] properties were handed over to owners less than three years or five years ago, some are completed units that were sold previously under the Developer’s Interest Bearing Scheme (DIBS). There were also more foreclosure properties in new developments such as in Semenyih and Ampang,” he tells EdgeProp.my. Introduced by property developers in 2009, DIBS allowed buyers to purchase a property with almost zero entry cost, no down payment and no bank loan, until the property is built and handed over to the buyer. The easy homeownership scheme spurred many to jump on the property investment bandwagon. It was abolished in 2014. Among the properties which went under the hammer last year (2018), 85.5% of them were residential properties (27,877 units worth RM10 billion), according to AuctionGuru.com.my data. About 11% or 3,663 cases were commercial properties worth RM4 billion while there were 1,071 land plots worth RM1.5 billion, making up around 3.3% of total cases. https://www.edgeprop.my/content/1480406/mor...der-hammer-2018 Number of foreclosure is as many as number of developers overhang units. given most investors financial is weaker than developers, mean many are in financial distressed. This post has been edited by icemanfx: Feb 23 2019, 10:40 AM |

|

|

|

|

|

Feb 23 2019, 01:59 PM Feb 23 2019, 01:59 PM

|

All Stars

23,688 posts Joined: Aug 2007 From: Outer Space |

|

|

|

Feb 27 2019, 06:02 PM Feb 27 2019, 06:02 PM

|

All Stars

23,688 posts Joined: Aug 2007 From: Outer Space |

No taker again. Hard to believe this. Is now 50% off S&P price. Non bumi unit. Owner bought the unit from developer, in 2018. Bought after project completion. Developer units. Less than 1 year ago. J-21-10, 21st Floor, Block J, Boulevard Serviced Apartment Reserve price 🔥🔥RM355,500🔥🔥 1137 sqft Freehold Auction: End of Mac 2019 S&P price for this unit: RM724,300 Refer: http://www.summerfield.com.my/wp-content/u...-05-05-2017.pdf |

|

|

Mar 1 2019, 03:00 PM Mar 1 2019, 03:00 PM

|

All Stars

21,457 posts Joined: Jul 2012 |

|

|

|

Mar 1 2019, 06:06 PM Mar 1 2019, 06:06 PM

|

All Stars

21,457 posts Joined: Jul 2012 |

QUOTE(cliffekent @ Mar 1 2019, 05:24 PM) Housing Ownership Campaign 1- 3 March KLCC 2019 by KK List of overhang developments.1. Mah sing M centura, M vertical, lakeville residences, sensory southville city, cerrrado, m aruna, the loft, ferringhi residence 2, meridin, covil 2. Jkp Arora 1, sarra, vezzara, alia 3. Ioi properties Palmyra, the strata, ayden, 16 sierra, muse, skyz residences 4. Osk Iringan bayu, windmill, ryan n miho 5. Ijm Alam suria enclave, suria pantai, sofira, swans rimbayu, ara impian, pantai sentral park, savio, 6. Glomac Saujana perdana, plaza kelana jaya, camellia, acadian 7. Ancubic group Cubic botanical 8. Zikay grouo Bangi sekyen 3, brisdale kl 9. Land n general berhad Astoria, seresta 10. Pv Pv9, splendor, teratai, platinium OUG 11. Hap seng Akasa 12. Dmia land Fifty 9 emerald 13. Tanming berhad The pearls 14. Eco world Eco horizon, eco grandeur, eco sky, eco majestic, eco forest, eco sanctuary 15. TH properties Enstek, pristine 2, hundred 16. Worldwide Azalea, amber, halya, sg purun 17. Sin hee yang Seri changgang, dataran abadi 3, desa salak bakti 18. Naza ttdi Met 1, ascencia, the valley, 19. Must ehsan development Dahlia, encorp cahaya alam 20. Ayer holding Ayer bukit puchong, epic 21. Kueen lai Tiara south 22. Selayang18 Selayang.18, univ369 place 23. Symphony life Tijani ukay, elevia puchong 24. Ecofirst hartz Liberty ampang 25. Matrix Chambers, ara sendayan, residensi sigc, cadena, bandar sri sendayan 26. Sunway Velocity 2, serene, citrine, onsen suites 27. Um land Viridea 28. Aspen group Aspen vision city 29. Mkh Mkh boulevard 2, inspirasi, nexus kajang station, tr residence, prima kajang, 30. Bukit kiara Verve suites 31. Tropicana Paisley, triana, dahlia, arnica, 32. LBS Sky villa, skylake, bsp21, kita, desiran bayu, alam perdana 33. Sime darby Serenia city, serini, anggerik, the alcove, elmina green 34. Mitraland Gravit8, upperville 35. Guocoland Emerald hills 36. Uem Eugenia, broadhill, verdi, radia, dahlia 37. Setia Trio, avis 2, setia eco templer, setia city, alam damai, setia seraya, setia alamsari, setia sky, setia eco hill, setia eco glades, sky oasis 38. Astaka 39. Beverly grp Henna, equine 40. Gamuda land Gamuda garden, gamuda cove, twentyfive 7, highpark, the robertson, jade hill, 41. Prima Residensi pd, Residensi brickfields, Residensi seremban sentral, Residensi kajang utama, Residensi kajang, Residensi alam damai 42. Uda property Legasi jubilee, legasi sepang, 38 bangsar, dedaun height, legasi kampung bahru, 43. Putrajaya holding Duta villa, flora rosa, wetlands 43. Mayland Dorsett, hampton 44. Skyworld Bennington, sky meridien, sky luxe, |

|

|

Mar 2 2019, 03:59 PM Mar 2 2019, 03:59 PM

|

All Stars

21,457 posts Joined: Jul 2012 |

|

|

|

Mar 2 2019, 04:12 PM Mar 2 2019, 04:12 PM

|

Junior Member

458 posts Joined: Mar 2010 |

|

|

|

Mar 5 2019, 03:58 AM Mar 5 2019, 03:58 AM

|

All Stars

21,457 posts Joined: Jul 2012 |

The Upside of a Global Downturn? Juicy Real Estate Deals

To lure house hunters, sellers of high-end homes are slashing prices by as much as 30 percent. Many metro areas are succumbing to downward pressure from the U.S.-China trade war, uncertainty in Europe, rising interest rates, or a combination of all three. Of course, all real estate is local, so some discounts are better than others. Here’s where policymakers, central bankers, and developers are creating an environment for juicy deals today—or even better bargains tomorrow. https://www.bloomberg.com/news/articles/201...global-downturn A peek outside the kampung for property investors. it seems qt is affecting property price world wide. if price could dropped substantially in cosmopolitan cities, property price could similarly drop in kv. This post has been edited by icemanfx: Mar 5 2019, 10:59 AM |

| Change to: |  0.0375sec 0.0375sec

0.60 0.60

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 19th December 2025 - 03:47 PM |