So is it a good time to buy now? When should be a good time to buy?

Multiple Signs of Malaysia Property Bubble V20

Multiple Signs of Malaysia Property Bubble V20

|

|

Jul 27 2018, 12:14 AM Jul 27 2018, 12:14 AM

|

Senior Member

4,720 posts Joined: Jan 2003 |

So is it a good time to buy now? When should be a good time to buy?

|

|

|

|

|

|

Jul 27 2018, 12:24 AM Jul 27 2018, 12:24 AM

|

All Stars

23,688 posts Joined: Aug 2007 From: Outer Space |

|

|

|

Jul 27 2018, 12:25 AM Jul 27 2018, 12:25 AM

|

Senior Member

1,244 posts Joined: Jul 2005 |

|

|

|

Jul 27 2018, 10:41 AM Jul 27 2018, 10:41 AM

|

Senior Member

6,562 posts Joined: Jan 2003 From: Kuala Lumpur |

QUOTE(kevyeoh @ Jul 27 2018, 12:14 AM) Just buy anytime you are ready, with the right "boosters" you will never go wrong. The problem with people that bought properties "wrongly" was that they bought because of other factors such as peer-pressure and deceitful marketing. If you can pass through all that, then you are good to go. |

|

|

Jul 28 2018, 05:03 PM Jul 28 2018, 05:03 PM

|

All Stars

21,456 posts Joined: Jul 2012 |

QUOTE(agentjoel @ Jul 28 2018, 04:08 PM) I've special deals with rebates from 10% to even 30%. Cash rebate up to 150k. Undercons, near VP, or developer units available. Drop me a message if interested. Thanks. What is true market value? 30% or $150k below list/ask/spa price?This post has been edited by icemanfx: Jul 28 2018, 05:04 PM |

|

|

Jul 28 2018, 05:15 PM Jul 28 2018, 05:15 PM

Show posts by this member only | IPv6 | Post

#1526

|

Senior Member

725 posts Joined: Apr 2008 From: Kuala Lumpur |

they didnt really define burst properly.

|

|

|

|

|

|

Jul 29 2018, 06:44 PM Jul 29 2018, 06:44 PM

Show posts by this member only | IPv6 | Post

#1527

|

Junior Member

297 posts Joined: Sep 2006 |

I'm planning to buy for investment pro purposes. Grand Ss15. But having second doubts now. Also read that the bubble is gonna burst. Reading this thread reminded me of lelong properties. Should look into it. 🤔 Anyways should I or shouldnt I buy the property. Thanks in advance for reply

|

|

|

Jul 29 2018, 06:46 PM Jul 29 2018, 06:46 PM

|

Junior Member

230 posts Joined: Mar 2008 |

QUOTE(icemanfx @ Jul 25 2018, 01:56 PM) In 2008, property price rise was caused by commodities price increased e.g oil, steel, etc. Then price continue to climb with low interest rate and easy credit, a fallout of u.s qe. Where got so long ???Many bought off plan and take 3 to 4 years to deliver, foreclosure could take up to 2 years. Hence, foreclosure i.e price drop is delayed and slow. Been told 2 months in default, they will rampas. |

|

|

Jul 29 2018, 06:49 PM Jul 29 2018, 06:49 PM

|

Junior Member

124 posts Joined: Apr 2013 |

time to buy!

|

|

|

Jul 29 2018, 06:54 PM Jul 29 2018, 06:54 PM

|

All Stars

21,456 posts Joined: Jul 2012 |

|

|

|

Jul 29 2018, 06:54 PM Jul 29 2018, 06:54 PM

Show posts by this member only | IPv6 | Post

#1531

|

Senior Member

700 posts Joined: Nov 2009 |

QUOTE(overthemoon @ Jul 29 2018, 06:46 PM) You been lied to, where got so fast. Minimum also 3 months, that also not immediately after 3 months they auction your house, just blacklist you and keep chasing you to pay then issue auction notice etc.There’s also no such thing as “rampas” your house. You think like tow truck can kena tow ah? They will just issue notice of auction and ask you to vacate the property but if no on e buys from auction, you can still stay there, bank won’t chase you out also. |

|

|

Jul 29 2018, 09:07 PM Jul 29 2018, 09:07 PM

|

Junior Member

230 posts Joined: Mar 2008 |

My goodness. Thought they kejar like mad after one, two months delay.

No wonder so many NPLs in the country. Sigh. What if there’s a winning bidder and the occupier refuses to move out ???? This post has been edited by overthemoon: Jul 29 2018, 09:27 PM |

|

|

Jul 30 2018, 12:15 AM Jul 30 2018, 12:15 AM

|

Junior Member

176 posts Joined: Dec 2016 |

|

|

|

|

|

|

Aug 5 2018, 03:34 AM Aug 5 2018, 03:34 AM

|

Junior Member

139 posts Joined: Jun 2008 |

I don't think there will be a "Property Bubble Burst" anytime or at all.. Cause our NPL ratio is relatively low compared to previous years. Even the number of auction cases drop year on year. Trust me those people who bought 4 years ago with zero interest can afford those property because banks do credit screening before lending them the money.

I am no kidding our NPL is really low...

|

|

|

Aug 5 2018, 04:19 AM Aug 5 2018, 04:19 AM

|

All Stars

21,456 posts Joined: Jul 2012 |

QUOTE(vinkon @ Aug 5 2018, 03:34 AM) I don't think there will be a "Property Bubble Burst" anytime or at all.. Cause our NPL ratio is relatively low compared to previous years. Even the number of auction cases drop year on year. Trust me those people who bought 4 years ago with zero interest can afford those property because banks do credit screening before lending them the money. Amidst the soft residential property market, more houses were foreclosed by financial institutions and sold via auctions in the first quarter of this year, reported Free Malaysia Today.I am no kidding our NPL is really low...

In May, AuctionGuru.com revealed that about 6,225 homes were disposed through this method in Q1 2017, up from the 5,442 units recorded in the same period in the previous year. https://www.propertyguru.com.my/property-ne...rending-upwards AuctionGuru’s Chia says about 5% to 7% of residential properties under auction are new. The number will continue to grow due to the lacklustre secondary property market and abundant supply. Residential properties made up the bulk — about 86% — of auctioned properties in 2017, says Loh of Property Auction House. He anticipates an increase in the number of foreclosed properties due to the many high-rise projects built in the past few years, especially those under the developer interest-bearing scheme. Many of these new projects, which were recently handed over, usually required a low initial capital outlay or whose buyers were given rebates. “Problems arise when loan repayment commences and the borrowers are unable to meet their financial commitment or rent out the property. Many bought the properties to flip them but in the current market, they are unable to sell them for a higher price,” says Loh. http://www.theedgemarkets.com/article/cove...s-fewer-bidders KUALA LUMPUR: Malaysian banks may see an uptick in non-performing loan (NPL) ratio as Bank Negara Malaysia (BNM) is expected to raise its overnight policy rate (OPR) twice by end-2018. Furthermore, the likelihood of a higher unemployment rate may result in more loan defaults, according to S&P Global Ratings. http://www.theedgemarkets.com/article/nonp...ans-rise-—-sp Why 94% of Malaysians are six months from a financial crisis Three out of four Malaysians are unable to raise RM1000 (US $235) in an emergency, a 2015 survey by Bank Negara Malaysia (BNM) revealed. Only 6% of respondents were confident about meeting their financial obligations for at least six months if they lost their income, the same survey showed. Such dismal figures highlight a worrying trend. https://www.aseantoday.com/2017/06/why-94-o...nancial-crisis/ This post has been edited by icemanfx: Aug 5 2018, 04:50 AM |

|

|

Aug 6 2018, 02:55 AM Aug 6 2018, 02:55 AM

|

All Stars

21,456 posts Joined: Jul 2012 |

The End of the Global Housing Boom

From London to Sydney and Beijing to New York, house prices in some of the world’s most sought-after cities are heading south. Tax changes to damp demand, values out of kilter with affordability and tougher lending standards have combined to undermine the market. That could have wider implications because the world’s wealthy have been buying homes on multiple continents, meaning a downturn in one country could now pose more of a threat to markets elsewhere, according to the International Monetary Fund. https://www.bloomberg.com/news/articles/201...ney-to-new-york |

|

|

Aug 6 2018, 11:38 PM Aug 6 2018, 11:38 PM

|

All Stars

21,456 posts Joined: Jul 2012 |

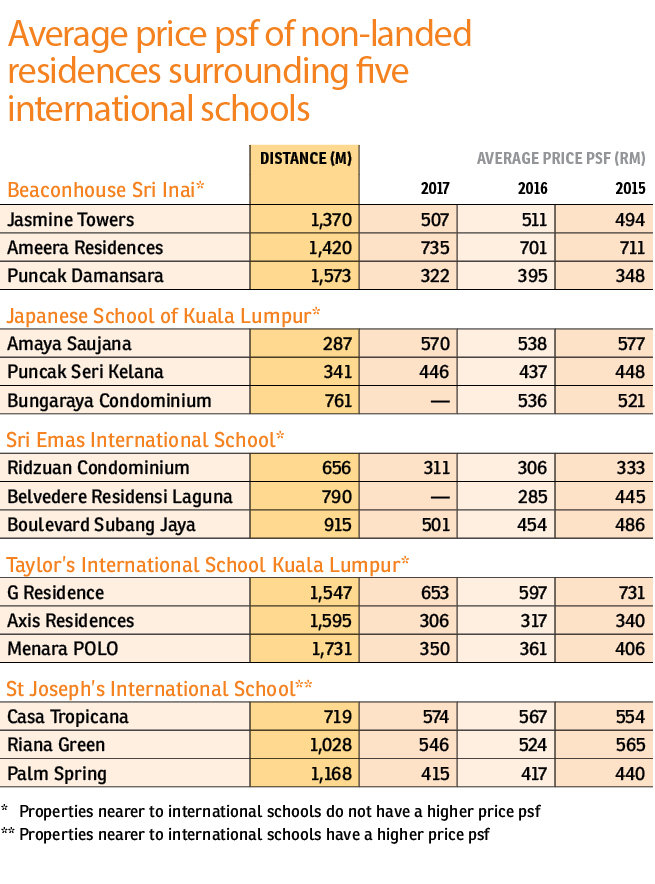

https://www.edgeprop.my/content/1411137/do-...property-values A snapshot of property price trend. International school is supposed to enhanced property value. |

|

|

Aug 6 2018, 11:47 PM Aug 6 2018, 11:47 PM

|

All Stars

21,456 posts Joined: Jul 2012 |

In Selangor, home ownership is at 70.2%.

https://www.edgeprop.my/content/1411263/aff...-complex-matter For comment. |

|

|

Aug 8 2018, 09:27 AM Aug 8 2018, 09:27 AM

|

All Stars

23,688 posts Joined: Aug 2007 From: Outer Space |

QUOTE(AskarPerang @ Jul 23 2018, 04:01 PM) No taker this unit. Now at even cheaper price. No taker. Cheaper price than ever now. For bumi buyer only. B-05-02, Kondo Villa Pantai @ Saville , No. 1, Jalan Pantai Murni 8 Reserve price: 🔥🔥RM 510,300🔥🔥 Freehold 1646 sqft Auction : 07-Aug-2018 QUOTE(scorptim @ Jul 23 2018, 05:54 PM) If only this was 2 months earlier...damn la. Already bought another unit in nearby area and out of funds now 😭 Sold at 585k. 8 bidders. Depends on how many units on lelong for that particular development. Most of the time it won’t impact much because you don’t get that many lelong units for the same development. I love buying these type of units coz the market price usually still maintains. Of course there are exceptions when a development got too many lelong units like M city *cough**cough* too many lelong units confirm market price will come down. If you scroll above, can actually win without fight at 567k back in Jul last month. Haha. |

|

|

Aug 8 2018, 09:36 AM Aug 8 2018, 09:36 AM

|

Senior Member

3,180 posts Joined: Jun 2009 From: Borlänge |

I dont care about price of house. I care more on euro. I plan to study in europe next year.

|

| Change to: |  0.0206sec 0.0206sec

0.95 0.95

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 11th December 2025 - 01:34 PM |