QUOTE(jonoave @ Jan 5 2023, 03:56 PM)

Even newer promo from HLB?

4.18% for 6 months, eFD. Min RM1000

https://www.hlb.com.my/en/personal-banking/...promo-2023.htmlHigher than the 4.13% promo, which required min RM10k.

Edit; oh missed the fine detail. Only for new customers. So 4.13% is for existing customers.

QUOTE(jonoave @ Jan 5 2023, 05:38 PM)

I believe almost everyone who browse this forum is aware of that, and there's already been numerous posts asking and clarifying the difference.

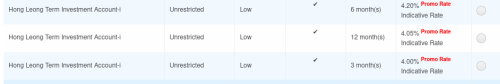

And TIA rates have been mentioned often alongside FD rates.

HLB right? Yeah, not sure what's going on but for some reason 6 months has the highest rate.

Ok cool. No worries. I am relatively new to this thread and thought it was purely about FD only, and your TIA post was the first time I've come across it since I started following this thread. Also, you had just posted about the eFD promo from HLB just 1-2 posts earlier, so as I was reading and scrolling the page, I thought it was a continuation on the same topic.

Personally I don't go for TIAs as the non-guaranteed projected rates are basically their cap on your profit, and it may end up being lower, so there is a potential downside with no potential for an upside, and no PIDM protection. Anyway, I'm sure this has been discussed in detail in earlier threads. Good luck though.

On the 6-month placements having the higher rate than longer term placements, it's not a mistake. It's a targeted FD campaign looking to attract RM350 million in funds, intended to be subsequently invested by the bank based on that time window.

Feb 12 2022, 07:56 PM

Feb 12 2022, 07:56 PM

Quote

Quote

0.0604sec

0.0604sec

0.47

0.47

7 queries

7 queries

GZIP Disabled

GZIP Disabled