QUOTE(faradie @ Jan 12 2021, 12:52 PM)

This is over the counter rate right?Fixed Deposit Rates In Malaysia V. No.15, Strictly for FD Discussion Only

Fixed Deposit Rates In Malaysia V. No.15, Strictly for FD Discussion Only

|

|

Jan 12 2021, 12:58 PM Jan 12 2021, 12:58 PM

Return to original view | IPv6 | Post

#81

|

Senior Member

1,628 posts Joined: May 2013 |

|

|

|

|

|

|

Jan 20 2021, 04:42 PM Jan 20 2021, 04:42 PM

Return to original view | IPv6 | Post

#82

|

Senior Member

1,628 posts Joined: May 2013 |

|

|

|

Jan 20 2021, 05:57 PM Jan 20 2021, 05:57 PM

Return to original view | IPv6 | Post

#83

|

Senior Member

1,628 posts Joined: May 2013 |

Anyone know whether I can press on the withdraw button on the OTC FD in my Hong Leong online account on the maturity date (today), without forfeited my interest?

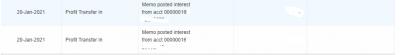

I saw the interest already label as Posted memo as of maturity date and the OTC FD is certless. |

|

|

Jan 20 2021, 07:56 PM Jan 20 2021, 07:56 PM

Return to original view | IPv6 | Post

#84

|

Senior Member

1,628 posts Joined: May 2013 |

QUOTE(Deal Hunter @ Jan 20 2021, 08:07 PM) Don't understand why forummers like placing at lower uncompetitive rates so much or what they are doing about getting best available rates. Can you suggest what are the few better offers that can help each forumer and let us decide.I just take the best rates all the time, never even below 2.4 %, so why all this talk of 2.35 %, and 2 %. Is this a forum for people to choose and promote savings rates, board rates or second or third rate promo rates? Do you have so much money or so rich that already too much at 2.4 % and need to place at no 3 or no 4 or lower ranked rates as safety diversification or seeking PIDM protection? Or have some problems making a switch? Maybe don't like or mistrust some banks? Or maybe caught unready without prior bank arrangements? |

|

|

Jan 20 2021, 10:41 PM Jan 20 2021, 10:41 PM

Return to original view | IPv6 | Post

#85

|

Senior Member

1,628 posts Joined: May 2013 |

QUOTE(cybpsych @ Jan 20 2021, 09:22 PM) iirc, can do. try check the amount at the final confirmation page. Set to no auto renew during the online FD placement. The interest already posted to my saving account just the principal. I chat with the CS, they reply need to wait the next day of the maturity date. Thanks for the info btw.btw, you should set the instruction to Credit to Account upon maturity (no renewal) . both principal + profit would auto credit to SA upon maturity. QUOTE(??!! @ Jan 20 2021, 09:40 PM) ok, thanks for the reply. Appreciate you guys. |

|

|

Jan 20 2021, 11:59 PM Jan 20 2021, 11:59 PM

Return to original view | IPv6 | Post

#86

|

Senior Member

1,628 posts Joined: May 2013 |

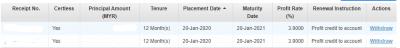

QUOTE(??!! @ Jan 21 2021, 12:16 AM) The online system will only show the 'renewed/withdrawn FD next day. It's stated as such on hong leong website. ok, not sure whether we are talking in the same boat. Sorry for long winded.However for withdrawal purposes, it's 'due ' on stated date as per placement. You can see that the withdrawal amount is in full before you hit 'confirm' Same process for RHB eFD as well. This is my OTC FD in Hong Leong Connect. There is a withdraw function.

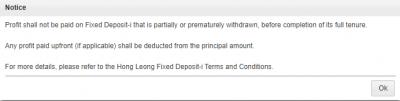

When I click on the withdraw and then to Confirmation page. The Principal amount and Net Withdrawal amount are the same. At the same time a notice pop out. I am not sure whether if I proceed to withdrawal, will my interest that already posted to my saving account will be deducted back(reverse).

Saving account already have the interest.

I understand for the withdrawal for RHB bank can be done on the maturity date. It is my first time for Hong Leong. Another problem for RHB bank is that I have to fund transfer to another bank in less than 10k as there securesign is not support FPX more than 10k to other bank. DO you encounter this problem? |

|

|

|

|

|

Jan 21 2021, 02:18 AM Jan 21 2021, 02:18 AM

Return to original view | IPv6 | Post

#87

|

Senior Member

1,628 posts Joined: May 2013 |

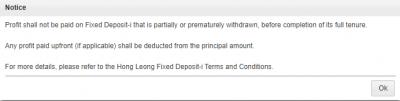

QUOTE(??!! @ Jan 21 2021, 03:14 AM) From my experience, No deduction/claw back of interest (which was already credited into CASA) Thank you for the reply and advise. Good night/good morning bro.Where I had placements that are "renew with principle and interest" the withdrawal amount will show the principle + interest calculated to full term.

This notice macam default keluar when i do any withdrawal online..also see it on CIMB clicks on withdrawal on maturity date. I just ignore it. Didn't do FPX from RHB before, so can't comment |

|

|

Feb 2 2021, 07:44 PM Feb 2 2021, 07:44 PM

Return to original view | IPv6 | Post

#88

|

Senior Member

1,628 posts Joined: May 2013 |

QUOTE(David_Yang @ Feb 2 2021, 01:04 AM) OCBC Take advantage of this Fixed Deposit promotion Currency Malaysian Ringgit Tenure 12 months Interest rate 2.38% p.a. Min. Placement Amount RM1,000 This promotion is only valid from 3 February 2021 – 5 February 2021 between 9am to 9pm daily for online placement and 9.30am to 3pm daily for placement at the branch. QUOTE(bbgoat @ Feb 2 2021, 11:42 AM) Better OCBC promo Why the same bank has 2 promo with different rate with the same tenure?Good morning 🌻 *OCBC FD Promotional Rate February 2021:* 🔸*6 Months FD*🔸 💰 1.85% p.a. - *Fresh/ Existing funds* 💰1.9% p.a. - *Convert from existing FD with 12months tenure/ FULL Fresh Funds* 💰Minimum Placement RM1,000 🔹*12 Months FD*🔹 💰1.85% p.a - *Fresh Funds ONLY* 💰Minimum Placement RM10,000 Applicable for *BOTH Conventional & Islamic FD* *All promotion are subject to availability* I like the online placement one. |

|

|

Feb 2 2021, 10:56 PM Feb 2 2021, 10:56 PM

Return to original view | IPv6 | Post

#89

|

Senior Member

1,628 posts Joined: May 2013 |

|

|

|

Feb 3 2021, 12:22 PM Feb 3 2021, 12:22 PM

Return to original view | IPv6 | Post

#90

|

Senior Member

1,628 posts Joined: May 2013 |

QUOTE(bbgoat @ Feb 3 2021, 09:51 AM) This one is good offer ! But last week I have already run out of juice. Refer to the T&C, online FD does not qualify for monthly interest. Only branch FD is qualified, probably is a Mi FD account.Monthly interest, minimum 1k, online or OTC, good deal. Except short term, but the OCBC lady who called said so far is until this Friday only. |

|

|

Feb 3 2021, 08:09 PM Feb 3 2021, 08:09 PM

Return to original view | IPv6 | Post

#91

|

Senior Member

1,628 posts Joined: May 2013 |

|

|

|

Feb 3 2021, 08:10 PM Feb 3 2021, 08:10 PM

Return to original view | IPv6 | Post

#92

|

Senior Member

1,628 posts Joined: May 2013 |

QUOTE(chiwawa10 @ Feb 3 2021, 08:50 PM) After login, I can only see the scammer alert pop-up. After clicking away that one, nothing to see except for my dashboard. Just found out. You click on the arrow icon at your right side below the menu row. Then there is a list of running advertisement. chiwawa10 liked this post

|

|

|

Feb 15 2021, 09:41 AM Feb 15 2021, 09:41 AM

Return to original view | IPv6 | Post

#93

|

Senior Member

1,628 posts Joined: May 2013 |

QUOTE(Deal Hunter @ Feb 12 2021, 11:04 PM) Yes so far I got the HL TIA rates as stated for the various TIA offers matured. I put some into 2.4 % TIA and the remainder into Affin 2.45 %. Too bad HL TIA did not have the 2.45 % then or even move back to 2.5 %. Just to confirm the OPR rate will affect the return rate for the TIA. The TIA return is calculated per month or at the end of TIA maturity date? |

|

|

|

|

|

Feb 19 2021, 03:51 PM Feb 19 2021, 03:51 PM

Return to original view | IPv6 | Post

#94

|

Senior Member

1,628 posts Joined: May 2013 |

|

|

|

Feb 22 2021, 04:53 PM Feb 22 2021, 04:53 PM

Return to original view | IPv6 | Post

#95

|

Senior Member

1,628 posts Joined: May 2013 |

QUOTE(Human Nature @ Feb 22 2021, 04:59 PM) The 12m 2.28% OCBC is for OTC only or eFD too? It is online FD.The rate shown at online portal is just board rate and every time I click next to proceed, the portal goes offline. So unable to test to confirm the promo rate. Once you login to your ocbc online account, you need to click on the advertisement of the promo. If you did not see the advertisement, click on the triangle on your right side top part to expand it. |

|

|

Feb 23 2021, 12:46 AM Feb 23 2021, 12:46 AM

Return to original view | IPv6 | Post

#96

|

Senior Member

1,628 posts Joined: May 2013 |

QUOTE(Human Nature @ Feb 22 2021, 06:05 PM) Thanks mate, been searching high and low for the banner. Found it! No issue for me to click on the adv, what is the error message?------------------------ add: alas, the portal has some issue - This content is blocked. Contact the site owner to fix the issue. Anyone facing the same problem? |

|

|

Feb 23 2021, 12:58 AM Feb 23 2021, 12:58 AM

Return to original view | IPv6 | Post

#97

|

Senior Member

1,628 posts Joined: May 2013 |

QUOTE(Human Nature @ Feb 23 2021, 01:50 AM) This Try use another browser on tomorrow 9am onwards. Now cannot place online FDAppears after I clicked the banner, enter all the details and at the last step to trigger the FPX Human Nature liked this post

|

|

|

Feb 23 2021, 11:04 AM Feb 23 2021, 11:04 AM

Return to original view | IPv6 | Post

#98

|

Senior Member

1,628 posts Joined: May 2013 |

|

|

|

Feb 23 2021, 12:21 PM Feb 23 2021, 12:21 PM

Return to original view | IPv6 | Post

#99

|

Senior Member

1,628 posts Joined: May 2013 |

QUOTE(LoTek @ Feb 23 2021, 01:11 PM) They come to your home to open a saving account? Is it limit to customer that have account with Affin or completely new customer also entitle for this service? Its website does not mention and ask in chat also need to walk in to branch to open saving account for completely new customer to the bank. |

|

|

Feb 28 2021, 03:19 PM Feb 28 2021, 03:19 PM

Return to original view | IPv6 | Post

#100

|

Senior Member

1,628 posts Joined: May 2013 |

QUOTE(Junichiro Tanizaki @ Feb 28 2021, 03:08 PM) instant transfer or GIRO limit for online transfer is 50k maximum. I reported this to them via facebook but they could not fix the problem. If fpx limit is 200000-00 maximum, what is the use if it is still subject to the daily transfer limit of RM50000-00 ? Thanks for yr suggestion. Do you mean you want to place the online fixed deposit in Public bank and the PFX is from RHB to PBB? |

| Change to: |  0.0690sec 0.0690sec

0.78 0.78

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 13th December 2025 - 07:15 PM |