Outline ·

[ Standard ] ·

Linear+

Fixed Deposit Rates In Malaysia V. No.15, Strictly for FD Discussion Only

|

rocketm

|

Sep 2 2021, 02:37 PM Sep 2 2021, 02:37 PM

|

|

I just chat with Affin bank CS.

The current eFD promo is:

Kindly be inform, this promotion period is from 1 September 2021 to 8 September 2021

The promotion rates are as per below:

Branch FD/TD-i (NON-INVIKTA)

Min Placement RM10,000

Promotion rate per annum:

3 months @ 2.25% p.a

6 months @ 2.30% p.a

9 months @ 2.40% p.a

12 months @ 2.50% p.a

18 months @ 2.50% p.a

24 months @ 2.55% p.a

Branch FD/TD-i (INVIKTA)

Min Placement RM 50,000

Promotion rate per annum:

3 months @ 2.30% p.a

6 months @ 2.35% p.a

9 months @ 2.45% p.a

12 months @ 2.55% p.a

18 months @ 2.55% p.a

24 months @ 2.60% p.a

AffinOnline eFD/eTD-i

Min Placement RM10,000

Max Placement RM200,000

Promotion rate per annum:

3 months @ 2.25% p.a.

6 months @ 2.30% p.a.

9 months @ 2.40% p.a

12 months @ 2.50% p.a

=========================

Need to have saving/current account to open saving account in branch only

RM12 annual fee for debit card

=========================

Operation hour:

NRP - Phase 1

FMCO - 09.15 a.m. to 2.00 p.m.

MCO - 09.15 a.m. to 4.00 p.m.

EMCO - 9.30 am to 1.00 pm

|

|

|

|

|

|

rocketm

|

Sep 2 2021, 04:58 PM Sep 2 2021, 04:58 PM

|

|

QUOTE(mrhseinpingq @ Sep 2 2021, 05:37 PM) Yes |

|

|

|

|

|

rocketm

|

Sep 2 2021, 07:31 PM Sep 2 2021, 07:31 PM

|

|

QUOTE(cute_boboi @ Sep 2 2021, 07:53 PM) Your FD is similiar to the earlier calculation few posts above. 2.40% you will get 59.50684932 2.45% you will get 60.74657534 So, it looks like HLBB has erred in first calculation by giving you 2.40%, then add back the missing 1.239726027 for the 0.05%  Just to confirm when calculate the effective rate for FD/TIA-i, we are using the formula below (publish rate in p.a / 365 x number of tenure in calendar day For my case, (2.45/365) x 182 days = 1.221% |

|

|

|

|

|

rocketm

|

Nov 8 2021, 04:59 PM Nov 8 2021, 04:59 PM

|

|

|

|

|

|

|

|

rocketm

|

Dec 27 2021, 07:46 AM Dec 27 2021, 07:46 AM

|

|

Anyone try place an online FD that the fund is from RHB amount RM10K and above using FPX that require SecureSign? (FPX from RHB to other bank)

The CS told me that the SecureSign is function on their mobile banking app.

Is their SecureSign function as I do normal transfer using SecureSign is not working but not sure on FPX.

|

|

|

|

|

|

rocketm

|

Dec 29 2021, 06:18 PM Dec 29 2021, 06:18 PM

|

|

QUOTE(Junichiro Tanizaki @ Dec 27 2021, 09:00 PM) Quote : Anyone try place an online FD that the fund is from RHB amount RM10K and above using FPX that require SecureSign? (FPX from RHB to other bank) The CS told me that the SecureSign is function on their mobile banking app. Is their SecureSign function as I do normal transfer using SecureSign is not working but not sure on FPX. unquote Their mobile banking app is a lousy app. My wife has the app on her mobile phone but I cannot find SecureSign on the app. QUOTE(cybpsych @ Dec 27 2021, 10:56 PM) I put >10k few days back. didn't ask for securesign thingy. using desktop rhbnow (classic) portal. RHB only has 1 website. I only use this every time, is this classical portal? https://logon.rhb.com.my/?_ga=2.70624211.21...4251.1640772920@cybpsych, are you placing RHB efd or placing other bank (non-RHB)'s efd when you are not prompt to use SecureSign when the efd is more than 10k in single placement. |

|

|

|

|

|

rocketm

|

Dec 29 2021, 07:59 PM Dec 29 2021, 07:59 PM

|

|

QUOTE(cybpsych @ Dec 29 2021, 08:41 PM) I placed to rhb efd source fund from Maybank Noted. SecureSign needed when money goes out from RHB. |

|

|

|

|

|

rocketm

|

Dec 29 2021, 08:51 PM Dec 29 2021, 08:51 PM

|

|

QUOTE(jack2 @ Dec 29 2021, 09:47 PM) This issue has been 1 year plus that their securesign is not working at all and they asked you to use mobile app instead. What a louzy bank.... He was referring to rhb desktop transfer from, not from others to RHB. When you use RHB mobile app, does the SecureSign work for placing efd on another bank that require FPX from RHB bank more than 10K. The fund is with RHB so need FPX to another bank's efd. |

|

|

|

|

|

rocketm

|

Dec 29 2021, 09:08 PM Dec 29 2021, 09:08 PM

|

|

QUOTE(jack2 @ Dec 29 2021, 10:04 PM) I didn't test that before but I remembered did not work too. All the while I am using desktop to make transfer from RHB but their cacat securesign doesn't work one so I use rhb mobile app to do all transactions ok, when you use Mobile app can you successful transfer out RM10k and above? Do you need SecureSign with mobile app? |

|

|

|

|

|

rocketm

|

Dec 29 2021, 09:17 PM Dec 29 2021, 09:17 PM

|

|

QUOTE(jack2 @ Dec 29 2021, 10:13 PM) Can. Mobile App doesn't need any SecureSign approval. Just transfer like usual. Is the RHB app that you are using now is called RHB mobile banking? |

|

|

|

|

|

rocketm

|

Apr 2 2022, 11:57 AM Apr 2 2022, 11:57 AM

|

|

QUOTE(Afterburner1.0 @ Mar 31 2022, 03:21 PM) yeah 3.5% but capped at max RM3K only Do you mean Tng Go+ for the 3.5%? |

|

|

|

|

|

rocketm

|

Apr 9 2022, 10:42 AM Apr 9 2022, 10:42 AM

|

|

QUOTE(Ryaness @ Apr 9 2022, 10:52 AM) Need some help. I just put the efd in rhb via online. But I found out there's no option for uplift or withdrawal. Does it means I need to visit nearby branch to withdraw after it matured? If not mistaken, efd placed cannot withdraw/uplift on the same day. Wait for tomorrow. No interest will be given for early withdraw/uplift. |

|

|

|

|

|

rocketm

|

Oct 5 2022, 11:10 AM Oct 5 2022, 11:10 AM

|

|

Anyone placed CIMB Tia before?

Does the return calculation same as Hong Leong bank Tia?

|

|

|

|

|

|

rocketm

|

Oct 11 2022, 07:56 PM Oct 11 2022, 07:56 PM

|

|

QUOTE(Lazygenes @ Oct 9 2022, 10:58 PM) Thanks, managed to uplift the FDs through RHB's new online banking site and it works, got the interest. Old internet banking website did not have the uplift button. Appreciate the info. I recently encountered that we have to uplift the matured efd by ourself on the maturity date. Then the principal and interest will be credited to our saving account. |

|

|

|

|

|

rocketm

|

Oct 24 2022, 10:43 AM Oct 24 2022, 10:43 AM

|

|

QUOTE(cybpsych @ Oct 24 2022, 11:33 AM) Grow more wealth with our e-Term Deposit* promotion. Enjoy 3.60% p.a. with 12 months tenure when you make a minimum placement of RM10,000. Deposit via RHB Online Banking now! Hurry, promotion ends on 31st October 2022. Find out more: https://rhbgroup.com/flashdeal/index.htmlT&C Apply. *Protected by PIDM up to RM250,000 for each depositor. Member of PIDM.  Why this is not reflect in RHB online account. Also unable to pop out this promo rate when I inserted RM10k and 12 months tenure. |

|

|

|

|

|

rocketm

|

Oct 24 2022, 11:08 AM Oct 24 2022, 11:08 AM

|

|

QUOTE(New2LYN @ Oct 24 2022, 11:59 AM) The e-FD offer is to be placed via FPX. After inserted RM10k and 12 months, I selected the 3.40% promo banner then chosen non-RHB bank for deposit then it will display 3.60% on the placement details page. |

|

|

|

|

|

rocketm

|

Nov 10 2022, 01:11 PM Nov 10 2022, 01:11 PM

|

|

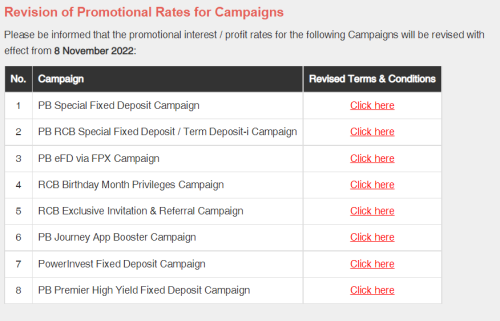

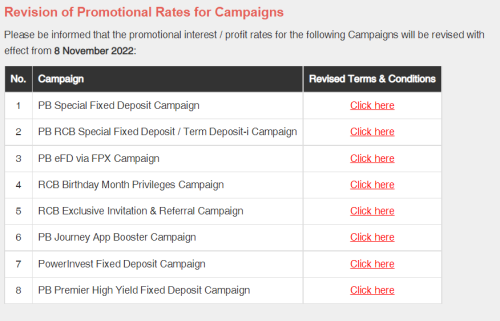

QUOTE(woowoo1 @ Nov 10 2022, 11:44 AM) BTW this can be done online fpx by choosing term deposit-i promo. For those lazy to go bank counter Why this document is not available in their official website? Only have update for these FD  |

|

|

|

|

|

rocketm

|

Nov 10 2022, 01:20 PM Nov 10 2022, 01:20 PM

|

|

QUOTE(Human Nature @ Nov 10 2022, 02:16 PM) OCBC 90th Anniversary FD Rate 10 Nov 22 to 31 Jan 23 9M 3.69% 13M 3.79% Top up FRESH FUND with min RM10K ---- OCBC FD Rate for PB 10 Nov till further notice 6M 3.05% 12M 3.25% Fully fresh fund with min RM1K Existing fund with min RM50K These promo is OTC or online? |

|

|

|

|

|

rocketm

|

Nov 10 2022, 02:18 PM Nov 10 2022, 02:18 PM

|

|

How likely will OPR rise again in next year? I am in doubt whether to put 3, 6, 9 or 12 months of efd.

|

|

|

|

|

|

rocketm

|

Nov 10 2022, 03:08 PM Nov 10 2022, 03:08 PM

|

|

QUOTE(Cookie101 @ Nov 10 2022, 04:03 PM) Can place online. Or any public bank can do. can place online based on the TnC |

|

|

|

|

Sep 2 2021, 02:37 PM

Sep 2 2021, 02:37 PM

Quote

Quote

0.0628sec

0.0628sec

0.73

0.73

7 queries

7 queries

GZIP Disabled

GZIP Disabled