Outline ·

[ Standard ] ·

Linear+

Fixed Deposit Rates In Malaysia V. No.15, Strictly for FD Discussion Only

|

rocketm

|

Feb 28 2021, 04:11 PM Feb 28 2021, 04:11 PM

|

|

QUOTE(Junichiro Tanizaki @ Feb 28 2021, 05:08 PM) RHB is having problem for FPX and any fund transfer more than RM10k in a single transaction. This happens long time ago yet they are unable to fix/improve their app. So you need to transfer out to not more than 10k to other bank. |

|

|

|

|

|

rocketm

|

Mar 1 2021, 12:02 PM Mar 1 2021, 12:02 PM

|

|

QUOTE(Sky.Live @ Mar 1 2021, 11:21 AM) Need to tfx 9999 each time because their app cannot do secure plus authorisation yes. I kena many times already. Alternatively, you can go to the branch to transfer to other bank. |

|

|

|

|

|

rocketm

|

Mar 8 2021, 11:50 AM Mar 8 2021, 11:50 AM

|

|

QUOTE(alvinfks78 @ Mar 8 2021, 10:44 AM) Hi Lowyat, Is commodity-murabahah-deposit-i a "INVESTMENT linked FD"? or just ilke conventional FD but Islamic? TQ I saw commodity-murabahah-deposit-i for RHB Islamic FD. The operation is similar to conventional FD. |

|

|

|

|

|

rocketm

|

Mar 8 2021, 05:03 PM Mar 8 2021, 05:03 PM

|

|

QUOTE(alvinfks78 @ Mar 8 2021, 04:03 PM) Nice Thx. I read RHB got 2.35 per annum for it. if same can go for it. Yes, you can choose conventional and islamic. Both are having the same rate and tenure. Just an remainder that when you want to withdraw money out from RHB either by FPX/IBG/Instant Transfer, you need to transfer less than RM10k per transfer due to their Secure sign function is not support for transaction more than RM10k. |

|

|

|

|

|

rocketm

|

Mar 11 2021, 12:46 PM Mar 11 2021, 12:46 PM

|

|

QUOTE(gsc @ Mar 10 2021, 03:07 PM) anyone heard of this UBB Amanah. Projected profit share 1st - 4th Year: 6.0% - 8.0% per annum (Net of all fees) 5th Year: 7.0% - 9.0% per annum (Net of all fees) It is a trust fund thingy if not mistaken. For me, I will stay away as a bit fishy to me. |

|

|

|

|

|

rocketm

|

Apr 5 2021, 07:34 PM Apr 5 2021, 07:34 PM

|

|

QUOTE(??!! @ Apr 5 2021, 07:28 PM) RHB 12 MONTHS 2.35% AMbank existing fund 12 MONTHS 2.35%(subject HO approval) RHB FD is online or otc? |

|

|

|

|

|

rocketm

|

Apr 7 2021, 10:17 AM Apr 7 2021, 10:17 AM

|

|

QUOTE(Cookie101 @ Apr 6 2021, 07:40 PM) It’s definitely fpx issue. I tried multiple times and only one transaction failed. Just have to wait fpx to sort it out and refund. Usually 2nd working day will see the money back in the account. Just to confirm whether you have tried from RHB FPX to other bank? RHB cannot transfer more than 10k as their secure sign is not function. I experience this last time. Same with their Instant transfer (DuitNow) or IBG. The CS advised me to transfer less than 10k per transfer to other bank and use that to FPX to the bank that you want to place FD. |

|

|

|

|

|

rocketm

|

Apr 16 2021, 10:28 PM Apr 16 2021, 10:28 PM

|

|

Anyone will choose HLBB online 24months at 2.40%pa or 12months at 2.35%?

My main concern is that will FD rate increase this year?

|

|

|

|

|

|

rocketm

|

Apr 17 2021, 02:42 PM Apr 17 2021, 02:42 PM

|

|

QUOTE(cclim2011 @ Apr 17 2021, 01:38 PM) i thought got 2.4 18mth? Still there? Should be still available. I just selecting which tenure is suitable for my next placement. |

|

|

|

|

|

rocketm

|

Apr 24 2021, 11:14 PM Apr 24 2021, 11:14 PM

|

|

Anyone can confirm on PBB otc and online fd rate?

For online FD is

1mth - 2%

2mth - 2.10%

3mth - 2.20%

The fund need from other bank or from own PBB saving account?

This post has been edited by rocketm: Apr 24 2021, 11:30 PM

|

|

|

|

|

|

rocketm

|

Aug 16 2021, 10:35 PM Aug 16 2021, 10:35 PM

|

|

QUOTE(yongs90 @ Aug 16 2021, 10:05 PM) Anybody able to post in hong leong bank investment account Are you looking for this one? https://www.hlisb.com.my/en/personal-i/prom...2021-promo.html |

|

|

|

|

|

rocketm

|

Aug 16 2021, 10:39 PM Aug 16 2021, 10:39 PM

|

|

When Hong Leong bank TIA matured, does the principal and interest will still keep in TIA account (just like FD) after passing the maturity date or both will credit to our saving account on the maturity date?

If TIA need to manually withdraw then are we allow to withdraw on the maturity date without forfeit our interest?

|

|

|

|

|

|

rocketm

|

Aug 17 2021, 11:23 PM Aug 17 2021, 11:23 PM

|

|

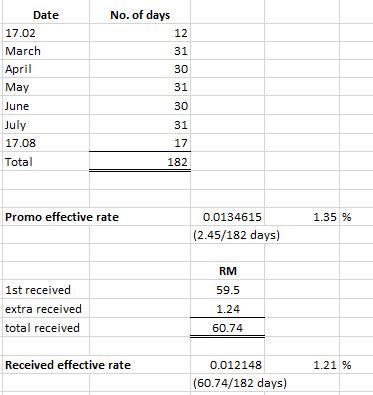

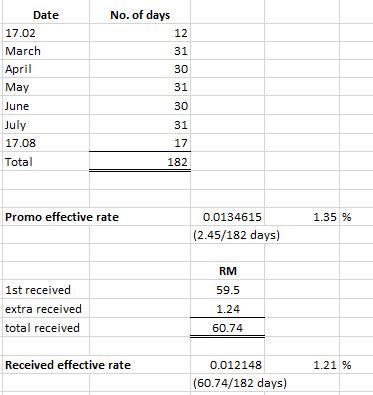

Hi all, my Hong Leong bank TIA matured today.

It is 6 months 2.45%, the effective rate is 1.225% (correct me if I am wrong)

I deposited RM5k and received interest of RM59.50. So, my return is 1.19%.

Based on your experience, does the differences between the actual rate and effective rate is acceptable?

|

|

|

|

|

|

rocketm

|

Aug 20 2021, 09:09 AM Aug 20 2021, 09:09 AM

|

|

QUOTE(mamamia @ Aug 19 2021, 12:14 PM) i think i have also get "cheated" by the 2.45%, as based on my statement, i still see it shown the rate as 2.45% instead of 2.40%, it seem like my other placement on 25 Feb will only get 2.40% instead of 2.45% if what u mentioned is true.. [attachmentid=10952364] Can we complaint this to the bank? |

|

|

|

|

|

rocketm

|

Aug 20 2021, 09:12 AM Aug 20 2021, 09:12 AM

|

|

QUOTE(mamamia @ Aug 20 2021, 10:11 AM) I lodge case via live chat, the CS said wait for the branch to cal me back within 3-5 working days Let me know the outcome. Thanks |

|

|

|

|

|

rocketm

|

Sep 2 2021, 09:47 AM Sep 2 2021, 09:47 AM

|

|

QUOTE(steadypong @ Sep 2 2021, 03:45 AM) They would ask u to open a saving account 1st. To have online banking ,u must get a debit card RM12 per annum. To put eFD, they will ask you to bank in the money to your saving account 1st, from that then you can proceed to put eFD. Can I open an account with Bank Mualamat online without going to the branch? |

|

|

|

|

|

rocketm

|

Sep 2 2021, 10:43 AM Sep 2 2021, 10:43 AM

|

|

Hi guys, just want to confirm on HLBB TIA-i calculation. I chat with them and got my refund for the shortage of profit amount. Promo rate: 2.45% p.a Tenure: 6 months Principal: RM 5k Placement tenure: 17.02.21 - 17.08.21 Total profit received RM59.50 + RM1.24 = RM60.74 =================================== [url=https://pictr.com/image/B66QC2]  Does the amount that I received is still not based on the promo rate? This post has been edited by rocketm: Sep 2 2021, 10:43 AM |

|

|

|

|

|

rocketm

|

Sep 2 2021, 10:57 AM Sep 2 2021, 10:57 AM

|

|

QUOTE(Human Nature @ Sep 2 2021, 11:54 AM) Then go to other banks. Simple, no need to curse I notice that BR, BM, AB maybe others are consistently having promo on eFD higher than PBB and HLBB. I only have MBB, RHB, PBB and HLBB. Which one worth to open an online saving account to get better eFD rate? TIA. |

|

|

|

|

|

rocketm

|

Sep 2 2021, 11:09 AM Sep 2 2021, 11:09 AM

|

|

QUOTE(Human Nature @ Sep 2 2021, 12:04 PM) You can forego MBB as they seldom come out with promo. The other 3 banks have eFD promo here and then, but I think currently HLBB has a better offer. Check it out. Yup, HLBB has 12, 18, 24 months for 2.40%. Other banks seem like having higher rate and always. Just want to know if able to open an online saving which one will be the next choice. |

|

|

|

|

|

rocketm

|

Sep 2 2021, 02:14 PM Sep 2 2021, 02:14 PM

|

|

QUOTE(cclim2011 @ Sep 2 2021, 02:51 PM) the most consistent is affin for the past one year or so. 😁 What is the current promo as there is no info on its website. Seem like no saving account able to open online without visit to their branch. Just to confirm. |

|

|

|

|

Feb 28 2021, 04:11 PM

Feb 28 2021, 04:11 PM

Quote

Quote

0.0928sec

0.0928sec

1.11

1.11

7 queries

7 queries

GZIP Disabled

GZIP Disabled