Outline ·

[ Standard ] ·

Linear+

Fixed Deposit Rates In Malaysia V. No.15, Strictly for FD Discussion Only

|

joeblow

|

Feb 11 2022, 12:13 PM Feb 11 2022, 12:13 PM

|

|

QUOTE(hychoo @ Feb 10 2022, 06:50 PM) From my example above: RM 10000 @ 2.45 per annum for 12 months What interest amount people expected upon maturity? The testing of interest calculation should be done by bank IT department, not consumer As a consumer, i only point out the inaccuracy of the interest calculation by bank, doesn't matter if it occurred only on certain amount/rate/tenure. Hi I have affin bank fd also gives ending 0.99 which is kind of strange. But me lazy to argue. One thing is not all banks go by the formula of exact days for interest. Eg citibank will show you the resulting fd interest when mature, they just use the basic principal x interest rate. No number of days for that 12 months. Best if you need to abide by principle is to ask everytime you place the fd for them to tell you the total interest rate. Rather than waste your time to go argue especially if you have taken the interest already when matured. |

|

|

|

|

|

joeblow

|

Apr 12 2022, 07:11 PM Apr 12 2022, 07:11 PM

|

|

I am a long time citibank customer, tbh 3.5% sounds too good to be true. I managed to get 2.7% for 1 year fresh fund FD via approval, I thought that was the best rate in Feb 2022?

Anyway the process of converting to UOB is lengthy, that said even if converted it should not have any changes to your current credit card or bank account. I suspect those existing products will be phased into UOB products and slowly transit from there. A few years process that should not have any inconvenience to the customer. That said don't bomb me if this is not the case.

|

|

|

|

|

|

joeblow

|

May 10 2022, 10:07 PM May 10 2022, 10:07 PM

|

|

QUOTE(guy3288 @ May 10 2022, 09:59 PM) 300k ada but must consider the hassle. also not yet read T&C..If say that rate for 1year sure must go I calculated if going for this hassle can gain extra RM307 in 2 months compared to KDI extra RM307 not bad ,but would SCB be so generous throwing that at us without strings...... Max placement only 50k... |

|

|

|

|

|

joeblow

|

Jul 8 2022, 11:54 AM Jul 8 2022, 11:54 AM

|

|

QUOTE(Dyson Jin @ Jul 8 2022, 09:06 AM) Affin eFD Promo sudah out 1 Month 2.0% 3 Months 2.48% 6 Months 2.73% 9 Months 2.75% 12 Months 3.05% 18 Months 3.05% 24 Months 3.15% For PBB eFD campaign [attachmentid=11195428] Invita a bit higher. 3 years 3.5%, I am very tempted. 19 to 24 months 3.25%. 12 months 3.15%. OTC. |

|

|

|

|

|

joeblow

|

Jul 13 2022, 05:17 PM Jul 13 2022, 05:17 PM

|

|

QUOTE(bbgoat @ Jul 13 2022, 08:20 AM) AmBank 12 mth 3.2% is for sure. Yesterday just fwd the CIMB rate from my RM, which stated effective yesterday. Looks like 18 mth 3.2% is new, not in what u received ????? Your RM did not send u the FD update yesterday ? My RM did not send me FD update last week. He seems to be more busy in selling Klibor, retail bonds, structured products than FD, hahaha. He got more commissions from there......... Hi my CIMB RM is on leave. The cimb 3.25% you posted for 18 months, any hidden clause or pure Fresh Fund big amount can get 3.25%? Currently this cimb 3.25% looks best. Citibank 12 months 2.8%. |

|

|

|

|

|

joeblow

|

Jul 14 2022, 03:27 PM Jul 14 2022, 03:27 PM

|

|

QUOTE(jusjul @ Jul 14 2022, 03:04 PM) My RM told me Cixx bank offering 3.55% 12 month pure fd premium banking customer with min 400k and 10k in casa. You may contact my RM at 017-2346138 Sounds too good to be true for pure FD even with min 400k FF. I just contacted my RM and no such deal. Perhaps your RM got special approval for you, ie branch specific. |

|

|

|

|

|

joeblow

|

Jul 17 2022, 12:36 PM Jul 17 2022, 12:36 PM

|

|

I put in lately big amount into cimb preferred 2.6% for 3 months. Seeing how interest rate going up, will only lock down after the next opr rate.

Also seems bond rates going up, but I still stick to FD for now first. Citibank can give special rate if amount high for 6 months. Please request if you need it.

|

|

|

|

|

|

joeblow

|

Aug 2 2022, 12:28 AM Aug 2 2022, 12:28 AM

|

|

QUOTE(BoomChaCha @ Aug 1 2022, 12:12 PM) If place Affin 3 months FD today, the maturity day will fall into Saturday (1 Oct, 2022), will Afiin auto adjust the FD maturity day to next Monday (3 Oct, 2022)? The answer is no. But there's a way around it. I can't remember exactly the method but I think is auto renew instructions (please check with affin) for the FD, then Mon you go take it out you will get the interest for Sat and Sun too. |

|

|

|

|

|

joeblow

|

Sep 12 2022, 12:42 PM Sep 12 2022, 12:42 PM

|

|

QUOTE(frozz@holic @ Sep 12 2022, 11:33 AM) side track, going from normal to invikta what are the extra you get/forced onto ? (besides the better FD rates) any extra charges/fees you have to pay ? I was offered a year++ back, I rejected when they say need to open invikta CA & take the invikta CC. (RM25 for CC I don't need) The FD rates are nice though. AFAIK,for my case only rm10 every 6 months for admin fee. Other than that nothing. I did not even take the debit card. And definitely no need to take the credit card. |

|

|

|

|

|

joeblow

|

Sep 15 2022, 02:48 PM Sep 15 2022, 02:48 PM

|

|

QUOTE(??!! @ Sep 14 2022, 11:08 PM) A little bird told me Cimb TIA 3.55% 12 months starting next week. Fixed rate for Preferred customers. Also, expecting upwards adjustment to FD promotion rates, by same date CIMB TERM INVESTMENT ACCOUNT-I (TIA) Offering Period: Starting from 19 Sept 2022Minimum: RM10k Tenor: 3M 💰 2.85% p.a. Tenor: 6M 💰 3.05% p.a. Tenor: 12M 💰 3.55% p.a. |

|

|

|

|

|

joeblow

|

Sep 18 2022, 12:48 PM Sep 18 2022, 12:48 PM

|

|

SCB now (few weeks ago started) have Priority banking promotion, 6 months 4%. New to bank only.

Actually a lot of debate on 60 months FD. In the past I may put that. Now with the interest rate ALL taken back if you make early withdrawal, I might as well go for A grade corporate bond at 4% and above of 3 to 5 years.

|

|

|

|

|

|

joeblow

|

Sep 19 2022, 08:44 PM Sep 19 2022, 08:44 PM

|

|

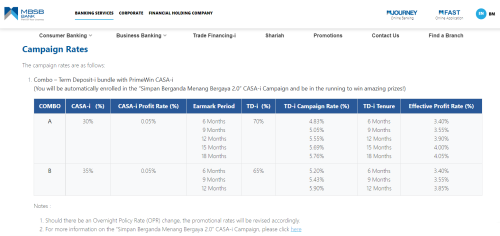

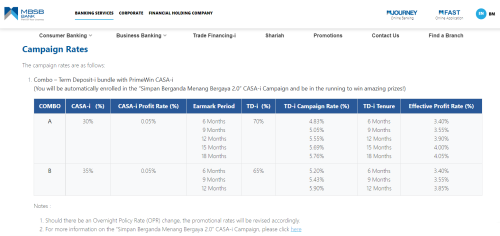

QUOTE(voc8888 @ Sep 19 2022, 07:31 PM) I guess u r referring to this   Wow this promotion is simply amazing. But anyone checked with MBSB on this promotion? I would assume the deposit in CASA PrimeWin account cannot be taken out, ie locked in, for the FD period. Kind of strange to see 12 months for Combo A and B there's a difference of 0.05% despite being same thing? This 18 months 4.05% effective rate look too good. Can people who opened MBSB account before share their experience? I will go down next week to find out more. Crazy MBSB, promotion started 1st Sep meaning even before the OPR hike. I wonder any catch in this promotion... |

|

|

|

|

|

joeblow

|

Sep 21 2022, 07:40 PM Sep 21 2022, 07:40 PM

|

|

Kind of strange.

Normally the new FD rates will come up very fast especially now year end. They need the money to make paper position looks good. But this time round seems quite slow.

MBSB rate looks best, but given the feedback plus 2 days cheque clearance plus even have to go back again, I might give it a miss. Go all in shares.... Oct then see what's the rate.

|

|

|

|

|

|

joeblow

|

Sep 29 2022, 03:52 PM Sep 29 2022, 03:52 PM

|

|

Wanted to post my experience in MBSB.

Like what folks posted here, the guy says the whole account creation process takes 1 to 2 hours and cheque clearance/transfer etc you have to be present to make withdrawal then make FD. A bit strict on the rules. As my place to the nearest branch is almost 50 mins drive, I decided to move my money to stock market for now. Hope the rest of the banks catch up with FD soon, if not I may eventually have to apply for account online then go down twice. The branch I went to even has two reserved parking space for ALL MBSB customers lol.

For those interested, Citibank now offering 6 months 3.1%.

|

|

|

|

|

|

joeblow

|

Oct 13 2022, 02:38 PM Oct 13 2022, 02:38 PM

|

|

QUOTE(guy3288 @ Oct 13 2022, 01:23 PM) must go read the T&C. so far he said only need lock RM10k in savings account yeah 4.8% really tempting but mainland no branch quite a hassle that guy also could not give clear answers said must go read the documents there at 3)Asked if bring cheque FD starts same day? he is unsure said may need to get approval first? May be you can help find out? Seems like this 4.8% need to be new customer with referral, at least this is what my rm said. If you deposit cheque etc, they can backdate for you. ie once cheque cleared they issue the fd on the day you deposit. |

|

|

|

|

|

joeblow

|

Oct 17 2022, 08:07 PM Oct 17 2022, 08:07 PM

|

|

QUOTE(guy3288 @ Oct 17 2022, 06:45 PM) yeah we all have read so many just juggle around., open many accounts just to be each within RM250k cover. i wont sacrifice returns just to get PIDM. too cumbersome also. Case in point now is this CitiGold FD promo 1+1 Effective FD rate 4.8% monthly interest somemore Min RM500k x 2 takkan PIDM cant cover all , we avoid it? Not for me This 4.8% is too good. Too bad I am current Citigold and my RM refuses to apply for waiver to get 4.8%... |

|

|

|

|

|

joeblow

|

Oct 17 2022, 08:25 PM Oct 17 2022, 08:25 PM

|

|

QUOTE(sweetpea123 @ Oct 17 2022, 08:12 PM) when does promo end ? Irresistible offer... I don't know, don't bother to ask once I know I can't qualify. I put my FDs into 1 month CIMB at 2.25% waiting for the Nov BNM decision... Will apply online for the MBSB account... 4.05% too hard to resist despite needing to go two times. |

|

|

|

|

|

joeblow

|

Oct 17 2022, 11:27 PM Oct 17 2022, 11:27 PM

|

|

QUOTE(guy3288 @ Oct 17 2022, 10:57 PM) i am surprised you go for 2.25% when we have KDI upto 3.5% 1st 50k, even lowest i get beyond 200k is still 2.5% dont like KDI still got Versa 3.2% or more soon That MBSB 4.05% is for 18 months.. too long with now interest keep going up.. I placed the 12 month @ 3.9% but few weeks back now better keep in KDi wait.. I am putting only 1 month and lazy to move fund around, previous FD is CIMB. And I don't have KDI account. |

|

|

|

|

|

joeblow

|

Oct 18 2022, 02:09 PM Oct 18 2022, 02:09 PM

|

|

QUOTE(AVFAN @ Oct 18 2022, 09:00 AM) i hope u already know this: usual clicks, u get 2.25% 1m, 2.45% 3m, etc. clicks via this link, u get 2.65% 3m, 3.05% 6m... but no 1m. https://www.cimb.com.my/en/personal/promoti...imb-clicks.htmlyes, i think so too... nov, dec... more hikes coming. Yeah man, thanks I know. Been putting in there previous 3 months. Need to put 1 month and amount is rather large. Now thinking to go stocks or FD, still have money in brokerage haven't pull the trigger. Waiting... Once Nov BNM decision out I will put in for a long while... |

|

|

|

|

|

joeblow

|

Oct 18 2022, 07:02 PM Oct 18 2022, 07:02 PM

|

|

What do you guys think about this? From CIMB

‼️ *Foreign Currency Fixed Deposit: 外汇定期* !!

*12M Interest 12个月利息*

📊 *USD美金*: 4.75%💰

📊 *SGD新币* :3.80%💰

📊 *AUD澳币* :3.75%💰

*Why FCFD? 原因*

📌 have multiple currency as hedge of country risk 拥有多元化货币以便分散

📌Malaysian Ringgit long trend depreciation 马币长期贬值

📌 Flexible choice of tenure 多选择时长

Looks like rates very good. Though the exchange rate sucks, but ringgit indeed on downtrend and if there's a recovery, aussie looks good considering their natural resources.

|

|

|

|

|

Feb 11 2022, 12:13 PM

Feb 11 2022, 12:13 PM

Quote

Quote

0.0615sec

0.0615sec

0.46

0.46

7 queries

7 queries

GZIP Disabled

GZIP Disabled