QUOTE(pundi @ Jan 12 2021, 06:44 AM)

I'm not sure about you but I already have several saving accounts from several banks. So no concern for me.This post has been edited by GrumpyNooby: Jan 12 2021, 06:46 AM

Fixed Deposit Rates In Malaysia V. No.15, Strictly for FD Discussion Only

|

|

Jan 12 2021, 06:46 AM Jan 12 2021, 06:46 AM

Return to original view | Post

#541

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

|

|

|

Jan 12 2021, 06:50 AM Jan 12 2021, 06:50 AM

Return to original view | Post

#542

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(pundi @ Jan 12 2021, 06:47 AM) Both you and I will be subjected to suspicious transactions and AMLATFA 2001.Alternatively you may try to nego for the same rate at the branch over the counter. This post has been edited by GrumpyNooby: Jan 12 2021, 06:50 AM |

|

|

Jan 12 2021, 04:31 PM Jan 12 2021, 04:31 PM

Return to original view | IPv6 | Post

#543

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(CoronaV @ Jan 12 2021, 01:42 PM) Bank Negara may cut OPR at Jan 20 meeting. OCBC Bank Research saysKUALA LUMPUR: OCBC Bank Research expects Bank Negara Malaysia to likely reduce the Overnight Policy Rate (OPR) by 25 basis points to 1.50% at its Jan 20 monetary policy committee meeting due to the weaker economic outlook. Its global treasury – research & strategy economist Wellian Wiranto said on Tuesday there could be another rate cut to 1.25% in the March meeting as well. He said Malaysia's move to reimpose the Movement Control Order's (MCO) restrictions and state of emergency could impact the economic growth as the government steps up its measures to bring the Covid-19 pandemic under control. The MCO will come into effect on Wednesday and it covers the most economically active regions which contribute more than two-thirds of Malaysia’s GDP. https://www.thestar.com.my/business/busines...k-research-says |

|

|

Jan 15 2021, 12:01 PM Jan 15 2021, 12:01 PM

Return to original view | Post

#544

|

All Stars

12,387 posts Joined: Feb 2020 |

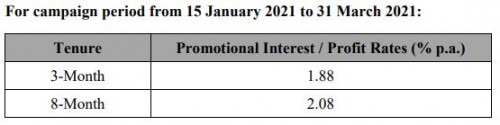

Revision of Promotional Rates for Campaigns

Please be informed that the promotional interest / profit rates for the following Campaigns will be revised with effect from 15 January 2021: PB Fixed Deposit / Term Deposit-i Campaign  Click here for the revised T&C https://www.pbebank.com/pdf/Promotions/pb-f...0121-tc-en.aspx |

|

|

Jan 15 2021, 12:58 PM Jan 15 2021, 12:58 PM

Return to original view | Post

#545

|

All Stars

12,387 posts Joined: Feb 2020 |

BNM expected to cut OPR to new low of 1.5% — DBS Group Research

KUALA LUMPUR (Jan 15): DBS Group Research is predicting Bank Negara Malaysia (BNM) to cut the overnight policy rate (OPR) by another 25 basis points (bps), which would bring the interest rate to a new low of 1.5%, in the forthcoming monetary policy meeting scheduled for next Wednesday (Jan 20). https://www.theedgemarkets.com/article/bnm-...-group-research First it was OCBC, now it's DBS. |

|

|

Jan 18 2021, 05:04 PM Jan 18 2021, 05:04 PM

Return to original view | IPv6 | Post

#546

|

All Stars

12,387 posts Joined: Feb 2020 |

Malaysia's central bank seen cutting key rate as coronavirus forces fresh lockdowns

KUALA LUMPUR (Jan 18): Malaysia's central bank is expected to cut key interest rates to historic lows on Wednesday, according to a Reuters poll, after surging coronavirus infections led the government to impose fresh lockdowns, further curbing economic activity. Nine out of 15 economists expected Bank Negara Malaysia (BNM) to cut its overnight policy rate to a record low of 1.50%, according to the poll on Monday, with another analyst betting on a bigger 50 basis point cut. The remaining five expected the central bank to stay put. https://www.theedgemarkets.com/article/mala...fresh-lockdowns Tough decision ahead for Bank Negara on OPR PETALING JAYA: Malaysia’s overnight policy rate (OPR) has been at its all-time low at 1.75% since July last year as Bank Negara’s Monetary Policy Committee (MPC) sought to accelerate economic recovery post movement control order (MCO). Ahead of the MPC's first two-day meeting this year starting on Wednesday, economists are quite divided this time around as Malaysia is placed under a second round of MCO, with both sides of the fence having strong views on why the central bank should maintain or cut the OPR. A Bloomberg poll of 24 economists was equally divided between a retention of 1.75% and a reduction to a new low of 1.5%. Reuters’ polled a more pessimistic view with nine out of 15 economists expecting a cut to 1.5%, five expecting the rate to be maintained while another expected a 50 basis points (bps) cut to 1.25%. UOB Malaysia senior economist Julia Goh was one of them who projected a 25bps cut to 1.50% in view of the worsening pandemic, tighter containment measures and weaker growth outlook. https://www.thestar.com.my/business/busines...k-negara-on-opr This post has been edited by GrumpyNooby: Jan 18 2021, 06:27 PM |

|

|

|

|

|

Jan 19 2021, 12:41 PM Jan 19 2021, 12:41 PM

Return to original view | Post

#547

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Jan 19 2021, 01:19 PM Jan 19 2021, 01:19 PM

Return to original view | Post

#548

|

All Stars

12,387 posts Joined: Feb 2020 |

Seems like no cutting anymore:

Economists expect BNM to maintain OPR tomorrow after govt deployed fiscal resources KUALA LUMPUR (Jan 19): With the RM15 billion Perlindungan Ekonomi dan Rakyat Malaysia (PERMAI) stimulus package deployed, economists now expect Bank Negara Malaysia (BNM) to maintain its overnight policy rate (OPR) at the Monetary Policy Committee (MPC) meeting tomorrow. JP Morgan economist Milo Gunasinghe said in a note today that while the risk of a cut had increased, he expects BNM to remain on hold this week given the relief measures announced, the short duration of movement control order (MCO) restrictions and a limited policy rate transmission mechanism. “We think BNM will keep the OPR on hold at 1.75% this week, following the 125 basis points (bps) in cumulative cuts in 2020,” he said. https://www.theedgemarkets.com/article/econ...ources-deployed |

|

|

Jan 19 2021, 01:48 PM Jan 19 2021, 01:48 PM

Return to original view | Post

#549

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Jan 19 2021, 05:16 PM Jan 19 2021, 05:16 PM

Return to original view | IPv6 | Post

#550

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Jan 20 2021, 02:01 PM Jan 20 2021, 02:01 PM

Return to original view | Post

#551

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(eujin @ Jan 20 2021, 02:00 PM) CIMB eFD will end by today.https://www.cimbclicks.com.my/efd-nov20.html This post has been edited by GrumpyNooby: Jan 20 2021, 02:02 PM |

|

|

Jan 20 2021, 03:11 PM Jan 20 2021, 03:11 PM

Return to original view | Post

#552

|

All Stars

12,387 posts Joined: Feb 2020 |

OPR maintains at 1.75% Monetary Policy Statement At its meeting today, the Monetary Policy Committee (MPC) of Bank Negara Malaysia decided to maintain the Overnight Policy Rate (OPR) at 1.75 percent. The global economy continues to recover, led by improvements in manufacturing and export activity. However, the recent resurgences of COVID-19 cases and the subsequent containment measures have affected economic activity in several major economies. The expedited roll-out of mass vaccination programmes, together with ongoing policy support, are expected to lift global growth prospects going forward. Financial conditions also remain supportive. The overall outlook remains subject to downside risks, primarily if there is further resurgence of COVID-19 infections and delays in mass inoculation against COVID-19. For Malaysia, the resurgence in COVID-19 cases and the introduction of targeted containment measures has affected the recovery momentum in the fourth quarter of 2020. As a result, growth for 2020 is expected to be near the lower end of the earlier forecasted range. For 2021, while near-term growth will be affected by the re-introduction of stricter containment measures, the impact will be less severe than that experienced in 2020. The growth trajectory is projected to improve from the second quarter onwards. The improvement will be driven by the recovery in global demand, turnaround in public and private sector expenditure amid continued support from policy measures, and higher production from existing and new manufacturing and mining facilities. The roll-out of vaccines in the coming months will also lift sentiments. Downside risks to the outlook remain, stemming mainly from ongoing uncertainties surrounding the dynamics of the pandemic and potential challenges that might affect the roll-out of vaccines both globally and domestically. https://www.bnm.gov.my/-/monetary-policy-statement-8 This post has been edited by GrumpyNooby: Jan 20 2021, 03:12 PM TaiGoh and Human Nature liked this post

|

|

|

Jan 20 2021, 03:31 PM Jan 20 2021, 03:31 PM

Return to original view | Post

#553

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

|

|

|

Jan 20 2021, 06:21 PM Jan 20 2021, 06:21 PM

Return to original view | IPv6 | Post

#554

|

All Stars

12,387 posts Joined: Feb 2020 |

Prediction wrong few days ago!

OCBC Bank sees further OPR easing in 2Q21 KUALA LUMPUR (Jan 20): OCBC Bank sees further easing in the overnight policy rate (OPR) by Bank Negara Malaysia (BNM), likely in the second quarter of 2021 (2Q21), when economic prints start to shift less decisively upward than anticipated. Its economist Wellian Wiranto said an economic recovery is coming, in large part driven by the start of vaccination efforts, especially in major economies. “But we see the ongoing challenges of Covid-19 case resurgence hurting things more — even if a lot less than in 2020 — and we have probably attached a lower probability of a smooth vaccine rollout,” he said in a note today. https://www.theedgemarkets.com/article/ocbc...opr-easing-2q21 |

|

|

Jan 20 2021, 07:08 PM Jan 20 2021, 07:08 PM

Return to original view | IPv6 | Post

#555

|

All Stars

12,387 posts Joined: Feb 2020 |

Even without OPR cut, real rates will turn negative this year, says Maybank IB chief economist

KUALA LUMPUR (Jan 20): A passive easing in interest rates in the country will be seen, even without making any changes to the overnight policy rate (OPR), according to Maybank Investment Bank (Maybank IB) chief economist Suhaimi Ilias. Today, Bank Negara Malaysia decided to maintain the already record low OPR at 1.75% — as anticipated by Maybank IB. “We are looking at inflation to make a comeback this year by 2%, after a deflation of -1% last year,” said Suhaimi, during the webinar session today, titled "Market Outlook 2021: Steering through Volatility". https://www.theedgemarkets.com/article/even...chief-economist |

|

|

Jan 20 2021, 10:02 PM Jan 20 2021, 10:02 PM

Return to original view | IPv6 | Post

#556

|

All Stars

12,387 posts Joined: Feb 2020 |

Economists see likelihood of OPR cut in 1H2021 after BNM keeps the rate this round

KUALA LUMPUR (Jan 20): Despite the decision to maintain the overnight policy rate at 1.75%, economists noted Bank Negara Malaysia (BNM)’s cautious tone in its monetary policy statement, with several expecting there to be another 25bps cut within the first half of the year. In its statement, the Central Bank cited uncertainties surrounding the further resurgence of infections as well as “delays in mass inoculation against Covid-19”. Given the uncertainties, it said the “stance of monetary policy going forward will be determined by new data and information, and their implications on the overall outlook for inflation and domestic growth”. https://www.theedgemarkets.com/article/econ...keep-rate-round |

|

|

Jan 21 2021, 09:11 AM Jan 21 2021, 09:11 AM

Return to original view | Post

#557

|

All Stars

12,387 posts Joined: Feb 2020 |

Possible rate cut by 25bps in March or 2Q2021 cannot be ruled out — AmBank Research

KUALA LUMPUR (Jan 21): AmBank Group Research said that a possible rate cut by 25 basis points (bps) in March or 2Q2021 cannot be ruled out. In a note today, AmBank chief economist and head of research Dr Anthony Dass said this after Bank Negara Malaysia (BNM) decided to leave the overnight policy rate (OPR) unchanged at 1.75%. “This can happen should the downside risk accelerates on the global front and/or domestic driven by the Covid cases, roll-out and effectiveness of the vaccine, and the impact from the stimulus measures,”he said. Dass said that as expected, in the monetary policy commitee (MPC) meeting, BNM extended the 2% Statutory Reserve Requirement (SRR) flexibility which ends on May 31, 2021 to Dec 31, 2022. “Extension of SRR measure is part of BNM’s continuous efforts to ensure sufficient liquidity to support financial intermediation activity. “The banking institution can substitute MGS and MGII papers to meet the SRR compliance,” he said. Dass said the latest MPC tone is seen as “Neutral”. https://www.theedgemarkets.com/article/poss...ambank-research |

|

|

Jan 21 2021, 11:44 AM Jan 21 2021, 11:44 AM

Return to original view | Post

#558

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(digidigi @ Jan 21 2021, 11:41 AM) SC promo is usually attached with Banca products.https://av.sc.com/my/content/docs/my-banca-...ersonal-tcs.pdf |

|

|

Jan 24 2021, 08:47 PM Jan 24 2021, 08:47 PM

Return to original view | IPv6 | Post

#559

|

All Stars

12,387 posts Joined: Feb 2020 |

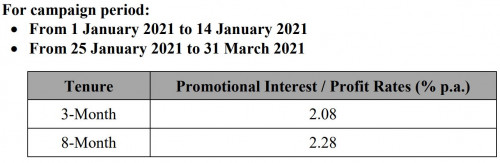

Revision of Promotional Rates for Campaigns

Please be informed that the promotional interest / profit rates for the following Campaigns will be revised with effect from 25 January 2021: PB Fixed Deposit / Term Deposit-i Campaign  Click here for the revised T&C https://www.pbebank.com/pdf/Promotions/tc-f...i-en250121.aspx |

|

|

Jan 25 2021, 07:07 AM Jan 25 2021, 07:07 AM

Return to original view | Post

#560

|

All Stars

12,387 posts Joined: Feb 2020 |

|

| Change to: |  0.0548sec 0.0548sec

0.98 0.98

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 15th December 2025 - 08:07 PM |