Outline ·

[ Standard ] ·

Linear+

Fixed Deposit Rates In Malaysia V. No.15, Strictly for FD Discussion Only

|

GrumpyNooby

|

Nov 16 2020, 05:04 PM Nov 16 2020, 05:04 PM

|

|

QUOTE(??!! @ Nov 16 2020, 04:57 PM) RM told me same thing for USD FD placement which I wanted to transfer (before maturity) to a USD call account . No forex loss as both account denominated in USD. This is not UOB. Pre-mature withdrawal no penalty for FCFD?  |

|

|

|

|

|

GrumpyNooby

|

Nov 16 2020, 05:19 PM Nov 16 2020, 05:19 PM

|

|

QUOTE(??!! @ Nov 16 2020, 05:16 PM) Pre maturity withdrawal --- forfeits whatever accrued interest to date + fees ( in my case it was USD 84...not sure how they arrive at the figure) Not sure what is the description of this USD 84 fee-- penalty or ??? , saya tak tahu. It cannot be forex loss as the transfer is between same denominated currency But FCFD tenure is very flexible right? From 1-day or 1-week to 12-months? |

|

|

|

|

|

GrumpyNooby

|

Nov 21 2020, 04:51 PM Nov 21 2020, 04:51 PM

|

|

QUOTE(David_Yang @ Nov 21 2020, 04:38 PM) Ugly. Because this means that Affin researchers expect another rate cut mid 2021  I have a same thought as you too. |

|

|

|

|

|

GrumpyNooby

|

Nov 25 2020, 04:59 PM Nov 25 2020, 04:59 PM

|

|

QUOTE(eugenetwh @ Nov 25 2020, 04:55 PM) where did u find this info ya? i can't seems to get it on their website His CIMB RM. |

|

|

|

|

|

GrumpyNooby

|

Nov 26 2020, 07:57 AM Nov 26 2020, 07:57 AM

|

|

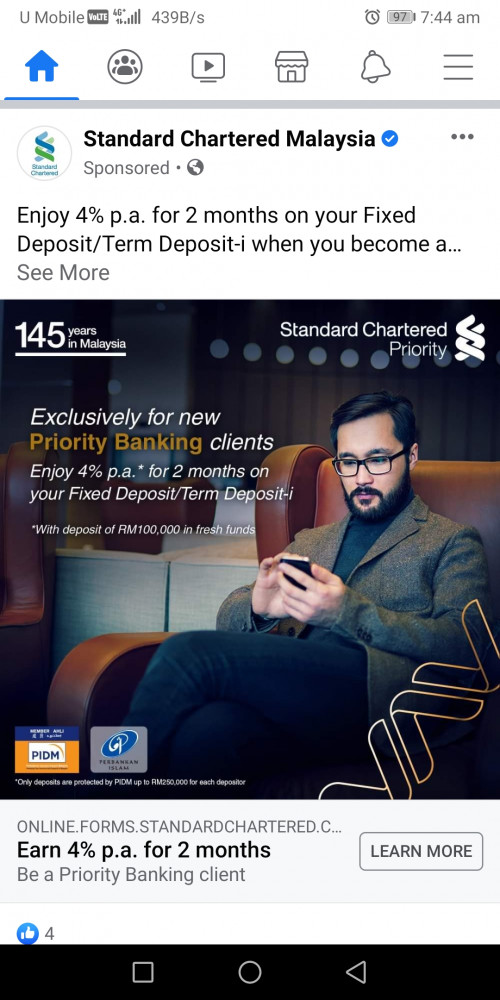

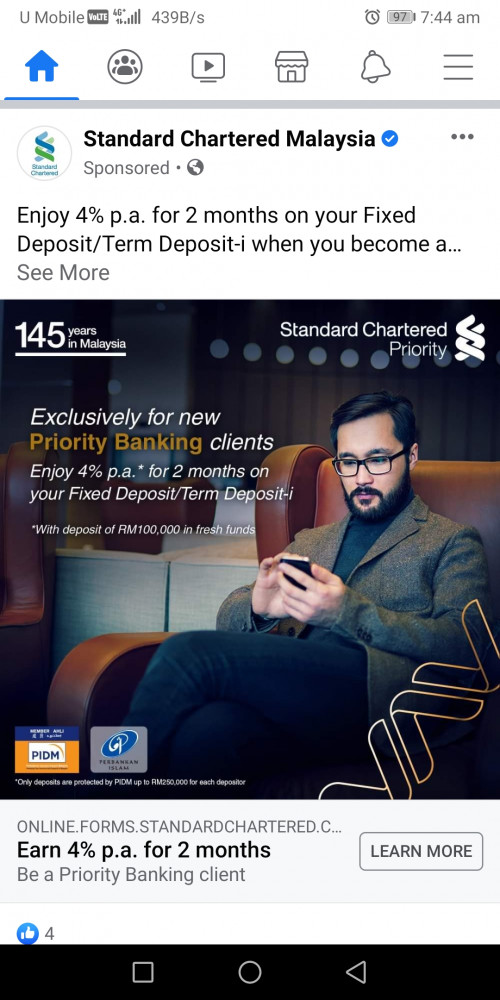

QUOTE(Leroi2x @ Nov 26 2020, 07:46 AM)  Hi guy ,any1 have more info about this? Saw on fb ad Here's the campaign T&C: https://av.sc.com/my/content/docs/my-fixed-deposit-tc.pdf |

|

|

|

|

|

GrumpyNooby

|

Nov 26 2020, 10:12 AM Nov 26 2020, 10:12 AM

|

|

Economists see no further OPR easing in next MPC meet after October’s 1.5% CPI dropUALA LUMPUR (Nov 25): Economists are keeping their target of a 1% contraction in inflation for 2020, after consumer prices in October fell for the eighth straight month — which was largely expected — with no further overnight policy rate (OPR) cuts expected at the next Monetary Policy Committee meeting scheduled for January next year. October's consumer price index dropped 1.5% in October from a year earlier, according to the Department of Statistics Malaysia (DOSM) today, dragged by a decline in transport (-10.2%), housing, water, electricity, gas and other fuels (-3%), and clothing and footwear (-0.4%). Deflationary pressure is likely to persist in November, CGS-CIMB economist Michelle Chia said in a note, as an appreciating ringgit against the US dollar helped to mitigate higher oil prices to result in a further 2.5% to 2.9% decline in petrol prices month to date, while retail price for diesel only rose 1%. https://www.theedgemarkets.com/article/econ...ers-15-cpi-dropGood news?

|

|

|

|

|

|

GrumpyNooby

|

Nov 26 2020, 05:23 PM Nov 26 2020, 05:23 PM

|

|

QUOTE(??!! @ Nov 26 2020, 05:19 PM) No need . While you are at it, ask for monthly crediting of interest  If amount like > 200K + , rate can go higher than 2.45% pa. Asking is " free"...apa salah tanya je?  How higher are we looking to see? Let's say for amount of RM 500k or RM 1mil. |

|

|

|

|

|

GrumpyNooby

|

Dec 1 2020, 11:30 AM Dec 1 2020, 11:30 AM

|

|

|

|

|

|

|

|

GrumpyNooby

|

Dec 1 2020, 12:51 PM Dec 1 2020, 12:51 PM

|

|

Affin eFD [Extended to 31/12/2020] Promotion Rate: 1. 6 months @ 2.36% p.a 2. 9 months @ 2.38% p.a 3. 12 months @ 2.25% p.a Promotion Period: 1 December 2020 to 31 December 2020 Minimum Placement Amount For Each Certificate RM10,000 Maximum Placement Amount For Each Certificate RM200,000 Campaign T&C: https://www.affinonline.com/AFFINONLINE/med...paignTnCEng.pdfThis post has been edited by GrumpyNooby: Dec 1 2020, 12:51 PM

|

|

|

|

|

|

GrumpyNooby

|

Dec 1 2020, 01:59 PM Dec 1 2020, 01:59 PM

|

|

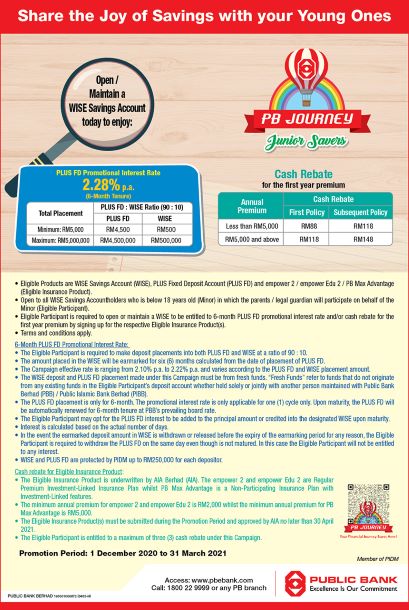

Anybody got info for this?  |

|

|

|

|

|

GrumpyNooby

|

Dec 2 2020, 01:56 PM Dec 2 2020, 01:56 PM

|

|

Best Fixed Deposit Promos – December 2020Monthly UpdateHere’s a roundup of this month’s updates to the best fixed deposit accounts in Malaysia: 1. Overall, Islamic FD products continue to offer higher interest rates compared to conventional FD products. 2. Bank Rakyat offers the best rate for most FD products this month (1, 3, 6 and 9-month tenure). However, do take note that Bank Rakyat’s FD products are not protected by PIDM. 3. The highest interest rate recorded in this month’s round-up is 2.40% (KFH Malaysia; 12-month FD), whereas the lowest stood at 1.60% (AmBank; 1-month FD). Article link by RP: https://ringgitplus.com/en/blog/fixed-depos...nt2nfMLr_SHk7Bg

|

|

|

|

|

|

GrumpyNooby

|

Dec 2 2020, 07:23 PM Dec 2 2020, 07:23 PM

|

|

QUOTE(rocketm @ Dec 2 2020, 07:15 PM) Yes, I just saw it. Commodity Murabahah Deposit-i and e-Term Deposit account 6 months 2.35% Min RM 10k per FD placement Valid from 11.11.2020 - 31.12.2020 Can make placement over the counter or using internet banking Got link? |

|

|

|

|

|

GrumpyNooby

|

Dec 3 2020, 08:23 AM Dec 3 2020, 08:23 AM

|

|

QUOTE(mavistan89 @ Dec 3 2020, 12:37 AM) When is the next meeting to decide OPR rate? What is the interval per year? QUOTE(Human Nature @ Dec 3 2020, 01:19 AM) The frequency and the month it is going to be held are roughly fixed. Just the date could be moving around. |

|

|

|

|

|

GrumpyNooby

|

Dec 4 2020, 10:15 AM Dec 4 2020, 10:15 AM

|

|

Should be the 2nd bank after Maybank. RHB launches mobile e-ticketing services, same-day appointmentsKUALA LUMPUR (Dec 4): RHB Banking Group has launched mobile e-ticketing services and same-day appointments at 50 selected RHB Bank and RHB Islamic Bank branches in Malaysia, with the help of the Queue Management System (QMS) app. https://www.theedgemarkets.com/article/rhb-...ay-appointments |

|

|

|

|

|

GrumpyNooby

|

Dec 4 2020, 08:08 PM Dec 4 2020, 08:08 PM

|

|

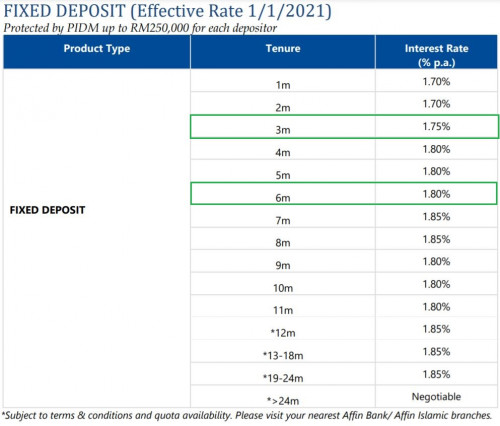

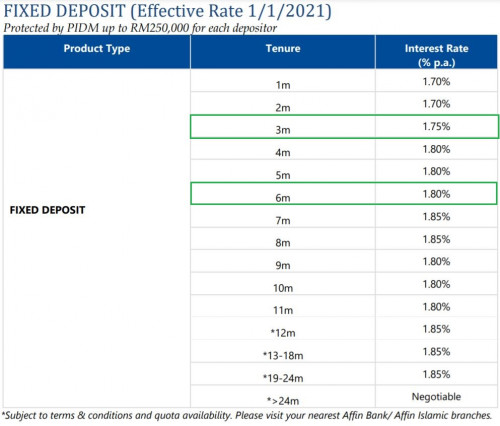

Revision of Deposit Rates Effective 1 January 2021-4 December 2020 We wish to inform that effective 1 January 2021, the revised deposit rates are as follows: - Revision of Deposits Rates Effective 1 January 2021 (Link:https://www.affinonline.com/AFFINONLINE/media/assets/announcement/BI_ConventionalInterestRate04122020.pdf)  For more information, contact our Call Centre at 03-8230 2222, visit your nearest AFFINBANK branch.

|

|

|

|

|

|

GrumpyNooby

|

Dec 10 2020, 12:11 PM Dec 10 2020, 12:11 PM

|

|

QUOTE(arisu85 @ Dec 10 2020, 12:10 PM) Did fresh fund policy change? Previously I can transfer fresh fund and the existing fund in bank can lump together to get promo rate. I don't think so. Better check with the bank; different bank has different policy. |

|

|

|

|

|

GrumpyNooby

|

Dec 10 2020, 12:15 PM Dec 10 2020, 12:15 PM

|

|

QUOTE(arisu85 @ Dec 10 2020, 12:13 PM) I checked with Public Bank and they don't let me lump fresh and existing fund together  Which makes sense as they can track the date of the inward transfer of the fund. |

|

|

|

|

|

GrumpyNooby

|

Dec 10 2020, 12:19 PM Dec 10 2020, 12:19 PM

|

|

QUOTE(arisu85 @ Dec 10 2020, 12:17 PM) Last time can ge wo   So they advice to put in Money Market, after 1 week take it out then will consider as fresh fund wo. You can make it out to another and then move it back. Fresh fund policy usually has number of days to consider as fresh fund; 5 working days for example. As said policy varies from bank to bank and could be from branch to branch too. |

|

|

|

|

|

GrumpyNooby

|

Dec 11 2020, 08:36 AM Dec 11 2020, 08:36 AM

|

|

QUOTE(??!! @ Dec 11 2020, 01:07 AM) That's good news. Currently , CIMB seems hungry for fresh funds. 1st time, have other officers besides RM calling to offer FD promo Can get higher than 2.4% pa for 12m? |

|

|

|

|

|

GrumpyNooby

|

Dec 15 2020, 12:20 PM Dec 15 2020, 12:20 PM

|

|

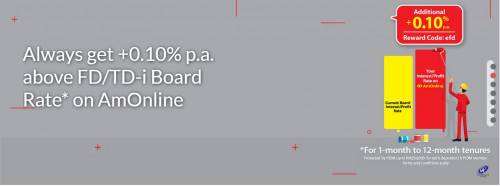

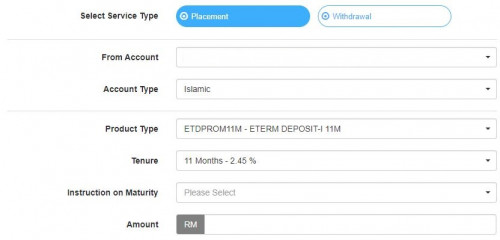

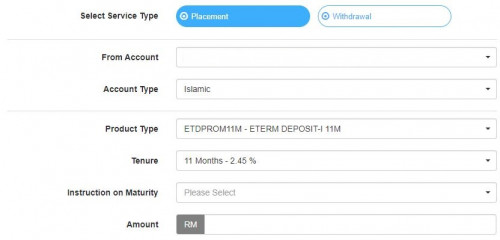

QUOTE(??!! @ Dec 15 2020, 12:02 PM) * new Affin FD Promo *Fresh / existing Fund *3 months: 2.36%* *6 months: 2.38%* *11 months: 2.45%* Minimum 10k otc... not sure if available for eFd. Yes, available for eFD:  QUOTE eFD/eTD-i Campaign

Promotion Period: 15 December 2020 to 31 December 2020

a) 6 months - 2.36%

b) 9 months - 2.38%

c) 11 months - 2.45%

Minimum Placement Amount For Each Certificate RM10,000

Maximum Placement Amount For Each Certificate RM200,000 T&C link: https://www.affinonline.com/AFFINONLINE/med...paignTnCEng.pdf This post has been edited by GrumpyNooby: Dec 17 2020, 08:39 AM This post has been edited by GrumpyNooby: Dec 17 2020, 08:39 AM |

|

|

|

|

Nov 16 2020, 05:04 PM

Nov 16 2020, 05:04 PM

Quote

Quote

0.0609sec

0.0609sec

0.65

0.65

7 queries

7 queries

GZIP Disabled

GZIP Disabled